Online Sole Proprietorship Registration

Our Top Clients

Simplifying the Process

Learn how our streamlined system makes it easy to navigate

your business needs from start to finish.

Sole Proprietorship Registration

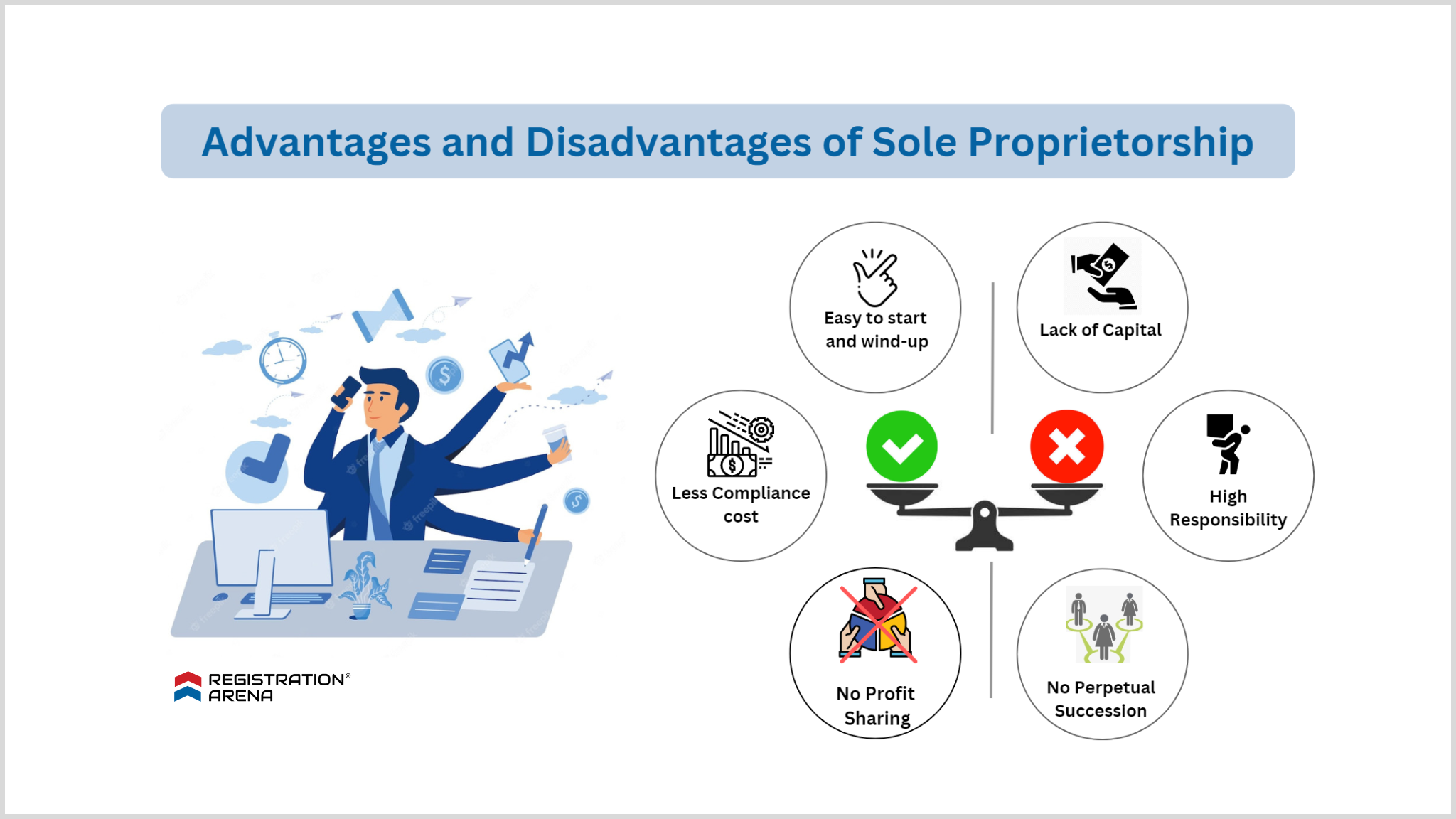

An individual person owns, manages, and controls a sole proprietorship or sole proprietorship firm. Furthermore, this person is solely responsible for the day-to-day management of the business and the capital arrangement. Moreover, he/she has full entitlement to the profits and losses of the business.

The sole proprietor completely owns all the assets and resources of the business, and he is entirely responsible for the firm’s liabilities and debts. The sole proprietor’s liability is unlimited which implies that in case of any default in payment of dues or loans, creditors can use his personal property to recover their debt.

Further, it does not create a separate legal entity from the owner, i.e. the business and the owner are one and the same.

Moreover, a sole proprietorship does not have any specific government registration in India. However, one can opt for various registrations such as Shops and Establishment registration, GST registrations, MSME (Udyam) registrations, etc. Basically, any person willing to start a grocery store, retail store, boutique, shop, small factory, household shop, etc. can go for a proprietorship firm.

Various Registrations for Opting Sole Proprietorship

- Shops and Establishment Act Registration

A sole proprietor can register his business under the Shops and Establishment Act (also known as the Shop Act License) of the respective state in which he is carrying out business. Every shop, office, godown, restaurant, cafe, factory, any other establishment, etc. has to obtain this registration from the respective State Labour Department. Also, the procedure for obtaining the Shop and Establishment Registration Certificate differs from state to state.

- MSME Registration

MSME registration also known as Udyam Registration recognizes business enterprises as micro, small, and medium enterprises under MSME Act. Accordingly, a sole proprietor may register his business under the MSME Act, which would help him recognize his business and avail various benefits and subsidies under government programs and schemes.

- GST Registration

A sole proprietor is recognized as a Supplier under GST. It enables him to collect taxes from customers and issue a GST invoice in return. Registration under GST laws is mandatory for specific suppliers, whereas it is optional and voluntary for others. Altogether, without GST registration, a sole proprietor can neither collect tax from his customers nor claim any input tax credit of tax paid by him.