India’s Best Rated Professional Services Platform !

From Registration to Compliance, We’ve Got You Covered

Kickstart Your Business Journey Today!

Our Top Clients

Explore the esteemed brands who have chosen to collaborate with

us on their business journey.

On a Mission to Empower India’s Startup Ecosystem!

We believe that every entrepreneurial journey deserves the right support and resources. Our mission is to simplify the complexities of business registration, compliance, and growth, enabling startups to thrive in a competitive landscape. Together, we can build a brighter future for Businesses in India.

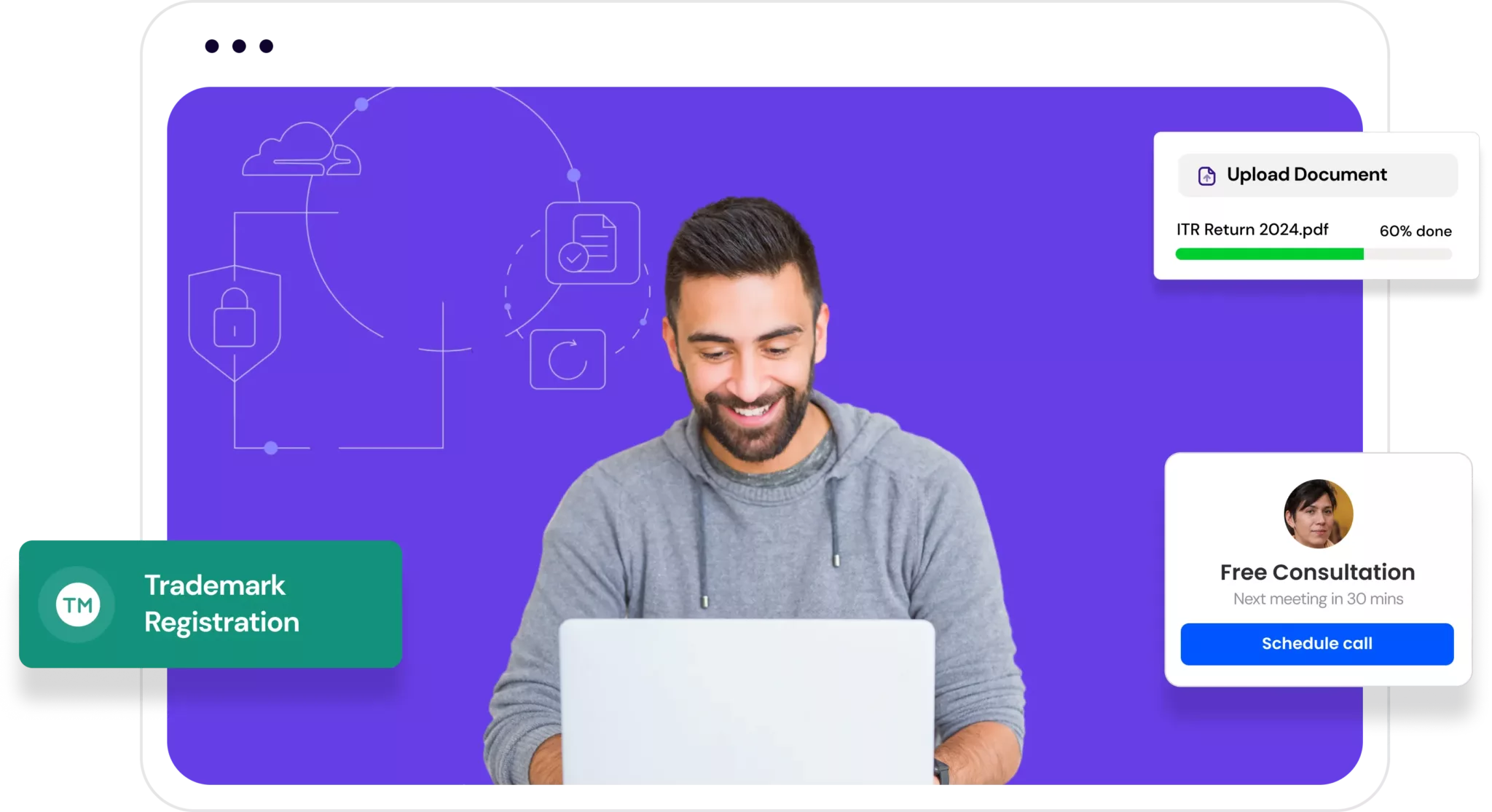

Simplifying the Process

Learn how our streamlined system makes it easy to navigate your

business needs from start to finish.