How much time is needed for setting up a Nidhi company in India?

On average it takes 7-12 days for completion of registration, 2 different approvals (Name Approval & Final Approval) are required from government bodies. However, this is dependent on the workload of the Central Registration Centre (CRC), MCA.

Do I need to be physically present during this process?

No, Nidhi company registration is a completely online process. All the required documents are filed electronically, so you would not need to be physically present at all. You would just need to send us scanned copies of all the required documents & forms.

Who can be a member of a Nidhi Company?

Any individual can become a member/shareholder of a Nidhi limited company including foreigners/NRI. However, such a person must be 18+ above in terms of age and should have a valid PAN card.

What is the status of Nidhi Company, is it a Private Limited Company or a Public Limited Company?

A Nidhi Company shall be a public limited company and registered under Section 406 of Companies Act 2013 read with Nidhi Rules 2014.

How many directors are required for the formation of a Nidhi Company?

There should be a minimum of 3 directors to form a Nidhi Limited Company, out of which at least 1 director should be a permanent resident of India.

Does a Nidhi Limited Company have continuous existence?

Yes, Nidhi limited company shall have perpetual succession as per law. However, it is pertinent to note that statutory annual compliances are required to be completed by company mandatorily. In case of non-compliance Registrar of Companies (ROC) shall be bound to struck off the name of company.

Why is a Nidhi Limited Company is called a separate legal entity?

A Nidhi Limited company is a legal entity and is established as distinct person under the Act. It is treated as a different person which can own a property and have debts or creditors. The members, directors, shareholders of a company have no liability to creditors of a company in case the company is unable to pay the debts.

How should I choose a name for a Nidhi Company?

For incorporation of a company, a unique name of a company must be reserved with the Ministry of Corporate Affairs (MCA). The name should qualify guidelines as prescribed by MCA. Read to know more about name approval guidelines.

What are factors one should consider in selecting the company name?

- It must be short & simple – The name must be concise and not be too long. People should be able to say it easily and they should be able to recollect your company’s name the first time they read it or hear it.

- It must be meaningful – The name of the company should be related to the business. It must fit the company’s branding.

- It must be unique – The name of the company mustn’t be the same or identical to an already existing company or a trademark. One must preferably avoid the plural version.

- Add Suffix – The name of the company must end with the suffix “Private Ltd” in a case of a Private limited company and “Nidhi Limited” in case of a Nidhi Company.

- It shouldn’t be illegal / offensive – The name of the company shouldn’t be against the law. It shouldn’t be abusive or against customs and the beliefs of any religion.

How many names can I submit for approval?

Initially, you can submit 2 names for name reservation to MCA out of which 1 name will be approved based on availability. If the initial 2 names are rejected then one more chance of re-submission for applying fresh 2 names is provided. So, in total 4 names can be applied in a single application.

What is the minimum capital needed to form a Nidhi Company?

The minimum capital required to form a Nidhi Company is Rs. 5 lakhs. Further, within 1 year of Incorporation the Net Owned Fund shall be increased to Rs. 10 lakhs.

I am the only director and shareholder; can I form a Nidhi Company alone?

No, there should be at least 3 directors and 7 shareholders for incorporation of Nidhi Company.

Can a salaried person or a person in employment become director of a Nidhi Company?

Yes, a salaried person or person in employment can become director of a private limited, LLP, or OPC. However, one needs to check the employment agreement if that allows for such provisions. In a lot of cases, the employers are quite comfortable with the fact that their employee is a director in another company. However, if there’s a restriction in becoming a director of a company, one can hold shares in a company and become a shareholder alternatively.

Can a person under employment or a government servant or a professional carrying on his practice be a member/shareholder in a Nidhi Company?

Yes, a person under employment or a government servant, or a professional carrying on his practice can be a member/shareholder in a Nidhi Company. However, one needs to check if there’s any restriction from governing body, authority or ministry.

What is the difference between a director and a shareholder?

A shareholder or member is an owner of a company who holds certain shares in the company and his name is entered in the register of members of the company. Whereas Director is a person who manages the day-to-day function of a business. Director and shareholder may or may not be the same person in a company.

Can a minor person become a director or shareholder of a Nidhi Company?

No, a minor cannot become a director or shareholder in a Nidhi Company. However, deposits may be accepted in the name of a minor, if they are made by the natural or legal guardian who is a member of Nidhi.

What is Memorandum of Association (MoA) and Articles of Association (AoA)?

The Memorandum of Association is a document that sets out the constitution of a company and is therefore the foundation on which the structure of the company is built. It defines the scope of the company’s activities and its relations with the outside world.

The articles are its bye-laws or rules and regulations that govern the management and internal affairs and the conduct of its business. Both the documents are required to be registered with the Registrar of Companies at the stage of incorporation of the company.

While incorporating a Nidhi Company, what is the maximum number of shareholders and directors that I can keep?

There is no upper limit on the number of shareholders/members for incorporation of a public limited company but there can be a maximum of 15 directors at the time of incorporation. However, only 3 DIN’s can be obtained through SPICE+ forms, so if the remaining directors are not having DIN they shall be admitted as directors after the company is incorporated.

Is there any kind of approval required from the Reserve Bank of India (RBI) for Nidhi Company registration?

No, there is no kind of approval required from RBI for Nidhi Company registration.

Is it required to have a Nidhi company’s books audited?

Yes, a Nidhi Company should get its book audited and file the same with the Registrar of Companies (ROC) every year.

Can I register a Nidhi Company at my home or residential address?

Yes, you can register the company at their residential address. You need to submit the utility bill copy of your home address along with the No Objection Certificate from the owner of the premises.

Can NRIs/Foreign Nationals become Director and Shareholder in a Nidhi Company?

Yes, NRIs and Foreign National can become directors and shareholders in a Nidhi Company along with the required documents, also they can hold majority shares in the company. However, at least one Director on the Board of Directors should be a permanent resident of India.

What if there are no partners available, can I register a company with my family members as director and shareholder?

Yes, it is good to register a family member as a partner i.e., shareholder/director in a private limited company. After registration of company, shareholding or directorship can be changed at any point of time as per convenience and requirement.

Can directors and shareholders be the same person in the company?

Yes, directors and shareholders can be the same person in a company. But if you want to have separation in ownership and management then you can appoint a different individual as shareholder and director.

What is the tenure of a Director in a Nidhi Company?

The tenure of the Director shall be for a term up to 10 consecutive years. He shall be eligible for re-appointment only after the expiration of 2 years ceasing to be a director.

Can I induct any other Company or LLP as a member/shareholder in Nidhi Company?

No, you cannot induct or allot shares to any Private Limited Company, Public Company, LLP, and Registered Society, etc. Only an Individual member can be admitted as a member in Nidhi Company.

What is SPICe+ Form?

SPICe+ is an integrated Web form for incorporation of a company simultaneously offering 10 services by 3 Central Govt Ministries & Departments. (Ministry of Corporate Affairs, Ministry of Labour & Department of Revenue in the Ministry of Finance) and Two-State Government (Maharashtra & Karnataka), thereby saving as many procedures, time, and cost for Starting a Business in India. SPICe+ is a part of various initiatives and commitments of the Government of India towards Ease of Doing Business (EODB).

What is the minimum number of directors required to form a company?

Minimum no. of directors for One Person Company: 1, Private Limited Company: 2, for Nidhi/Public Limited Company: 3 and, for producer company: 5.

What is the minimum number of shareholders/subscribers required for the registration of a company?

Minimum no. of subscribers for One Person Company: 1, Private Limited Company: 2, for Nidhi/Public Limited Company: 7, and for Producer company: 10.

What is Director Identification Number (DIN)?

DIN is a unique Identification Number allotted to an individual who is appointed as a director of a company, in respect of a new company an application for allotment of a maximum of 3 DIN’s shall be made through SPICe+ form at the time of its incorporation

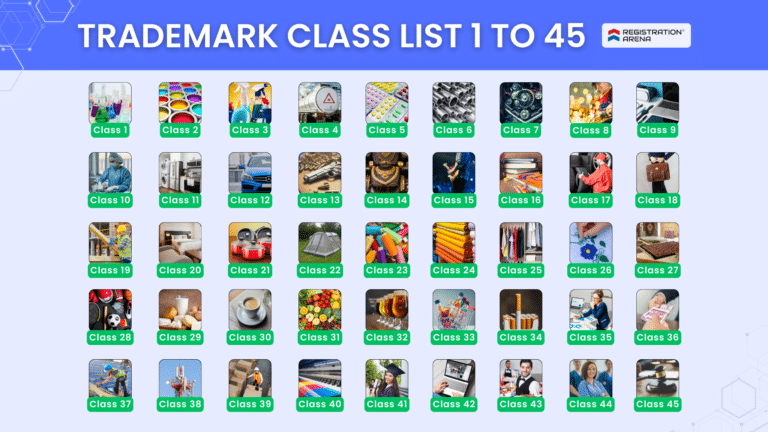

How do I apply for a name if the name of a Trade Mark is included in the proposed name?

In case the proposed name includes a reference to a Trademark name, the applicant must ensure that he has attached the No objection certificate (NOC) from the owner of the trademark.

Is registration for Profession Tax through SPICe+ mandatory all over India?

No. Registration for Profession Tax shall be mandatory through SPICe+ only in respect of new companies incorporated in the State of Maharashtra and Karnataka.

Is it mandatory for all new companies incorporated all over India to get Registration for EPFO and ESIC through SPICe+?

Yes. Registration for EPFO and ESIC shall be mandatory for all new companies incorporated w.e.f 23rd February 2020 through SPICe+ webform and EPFO & ESIC registration numbers shall not be separately issued by the respective agencies. However, in case the company is being incorporated in an area that falls under ‘no implemented area’ for ESIC, ESIC registration shall not be applicable.

However, compliances are not required to be carried out in respect of EPFO and ESIC provisions until the company surpasses the threshold limit provided in EPFO and ESIC provisions.

How will I get my Incorporation documents like Certificate of Incorporation, MoA, AoA, PAN, TAN, etc.?

You will receive these documents in soft copy via email as well as we shall send you a printout of these documents at your address.

Can I do Nidhi Company registration myself?

No, you have to take help from a Professional CS/CA/CMA/Advocate/Consulting Firm for registration of the company as it will require certification from these professionals.

How can I verify whether my Company is registered or not?

You will receive a certificate of Incorporation of Company approved by Government, alternatively, you can also check Corporate Identification Number (CIN) and the name of the company on the Ministry of Corporate Affairs (MCA) portal under “View Company/LLP Master Data” option.

What are the Authorised capital and paid-up capital of the company?

The authorised capital is the maximum limit of capital that a company may raise through the issue of shares to the shareholders. On the other hand, paid-up capital is the amount that is actually paid and subscribed by the shareholders of the company. The Paid-up capital of a company cannot exceed authorise capital of a company. Stamp duty is paid on the authorised capital of a company.

Do I need to hold my equity shares of a Nidhi Company in dematerialized form?

No, you are not required to hold the equity share of Nidhi Company in dematerialized form.

Is GST mandatory for a Nidhi Company?

GST registration is required for those businesses whose aggregate turnover crosses the prescribed limit or such business that does the inter-state supply of goods/services. So, every company has to check whether it supplies goods to different states or qualifies for the prescribed turnover limit or any such other conditions as specified under GST laws.

Can I do any other business in Nidhi Company apart from lending and borrowing?

No, you cannot do any other businesses in Nidhi Company. The sole objective of Nidhi Company shall be cultivating the habit of thrift and savings amongst its members, receiving deposits from, and lending to, its members.

Do I need to invest any paid-up capital before or at the time of incorporation of the company?

No, you don’t need to invest any capital before or at the time of incorporation of a company.

When do I need to invest paid-up capital into the company?

Paid-up capital which was subscribed in the MOA at the time of incorporation has to be deposited by all shareholders into the bank account of the company within a period of 180 days from the date of incorporation.

How is a public limited company different from a private limited company?

A public limited company is a company that is not a private limited company and can be formed for any lawful purpose by 7 or more persons. The securities of a public company may be quoted on a Stock Exchange. Its number of members is not limited to 200 and can induct unlimited members.

Is there any renewal process or charge for Nidhi Company?

No, there is no renewal of Nidhi Company, once it’s registered it will be valid for a lifetime. However, you have to do mandatory compliance and file statutory returns every year.

Can I change the registered office address of the company later on?

Yes, you can change the registered office address of the company after the company is registered, by following the prescribed procedure as per law.

Can I keep the virtual office or Co-working space as the registered office address of my company?

Yes, you can keep the virtual office or co-working space as registered office address of the company by providing utility bill of such office premises along with No Objection Certificate (NOC) from the owner. However, you have to make sure that you have the facility to receive and acknowledge letters, notices, and documents from various authorities at that address. Also, you have to paint or affix the company’s name and address outside every office.

Will there be any physical verification of the registered office address by the Registrar of Companies (ROC)?

There is no physical verification of the registered office but if the Registrar has reasonable cause to believe that the company is not carrying on any business or operations, he may cause a physical verification of the registered office of the company.

Is there any stamp duty required for the incorporation of a company and how it is paid?

Yes, there is a stamp duty to be paid during incorporation. The stamp duty depends on authorised capital and it is different for each state. The stamp duty is generally paid online during the incorporation processh.

What is Digital Signature Certificate (DSC)?

Digital Signature Certificates (DSC) are the digital/electronic format of physical or paper certificates. Few Examples of physical certificates are drivers’ licenses, passports, or membership cards. Certificates serve as proof of identity of an individual for a certain purpose; for example, a driver’s license identifies someone who can legally drive in a particular country. Likewise, a digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet, or to sign certain documents digitally.

Why is Digital Signature Certificate (DSC) required?

Physical documents are signed manually, similarly, electronic documents, for example, e-forms are required to be signed digitally using a Digital Signature Certificate.

Who issues the Digital Signature Certificate?

A licensed Certifying Authority (CA) issues the digital signature. Certifying Authority (CA) means a person who has been granted a license to issue a digital signature certificate under Section 24 of the Indian IT-Act 2000.

Whether every subscriber and/or director must obtain DSC at the time of incorporation?

Yes, in case the number of subscribers and/or directors to eMoA and eAoA is up to 20 and all such subscribers and/or directors have DIN/PAN, it shall be mandatory for each one of them to obtain a DSC.

Whether Nidhi Company can accept deposits or lend loans to non-members?

No, a Nidhi company cannot accept deposits or lend loans to non-members. It has to induct such person as a member in order to accept deposits or lend loans to such person.

Which returns and forms are required to be filed by Nidhi Company?

- NDH-1: Nidhi Company shall file a return of statutory compliances in Form NDH-1 along with such fee as prescribed with the Registrar within 90 days from the closure of the first financial year after its incorporation

- NDH-2: Nidhi Company, if required has to file form NDH-2 along with the prescribed fees with the regional director for an Extension of time in case of non-compliance with Rule 5(1)

- NDH-3: Nidhi Company is required to File NDH-3 Half Yearly Return with prescribed fees within 30 days from the conclusion of each half year.

- AOC-4: Form AOC 4 is used to file the financial statements for each financial year with the Registrar of Companies (ROC) The Form has to be filed within a period of 30 days from the date of the Annual General Meeting of the company

- MGT-7: Form MGT-7 is used by companies to file their annual return details for each financial year with the Registrar of Companies (ROC). The Form has to be filed within a period of 60 days from the date of the Annual General Meeting of the company.

- INC 20A: After incorporation, a Declaration is filed by the director that every shareholder (member) of the company has paid the value of shares (paid-up capital) agreed to be taken by him/her during incorporation within a period of 180 days from the date of incorporation.

- NDH-4: A Nidhi Company incorporated under the Act on or after the commencement of the Nidhi (Amendment) Rules, 2019 shall file Form NDH-4 within sixty days from the date of expiry of one year from the date of its incorporation or the period up to which extension of time has been granted by the Regional Director.

What are the limits on lending loans to a member of Nidhi Company?

The loans given by a Nidhi Company to a member shall be subject to the following limits-

If the total amount of deposits of such Nidhi from its members is less than 2 crore rupees -Rs. 2 lakhs

- If the total amount of deposits of such Nidhi from its members is more than 2 crore rupees but less than 20 crore rupees – Rs. 7 lakhs

- If the total amount of deposits of such Nidhi from its members is more than 20 crore rupees but less than 50 crore rupees – Rs. 12 lakhs

- If the total amount of deposits of such Nidhi from its members is more than 50 crore rupees – Rs. 15 lakhs

- In a case, where Nidhi has not made profits continuously in the 3 preceding financial years, it shall not make any fresh loans exceeding 50% of the maximum amounts of loans specified above

If a member of Nidhi has previously defaulted in repaying loans, can he still get a loan from Nidhi?

A member shall not be eligible for any further loan if he has borrowed any earlier loan from the Nidhi and has defaulted in repayment of such loan.

Can a Nidhi Company open a current account for its members?

No, as per Rule 6 of Nidhi Rules 2014, Nidhi Company cannot open a current account with its members.

Can a Nidhi Company issue preference shares or issue debentures to its members?

No, as per Rule 6 of Nidhi Rules 2014, Nidhi Company cannot issue or raise money through preference shares, debentures, or any other debt instruments.

Can Nidhi Company lend money to Body Corporate or Big Corporate businesses?

No, as per Rule 6 of Nidhi Rules 2014, Nidhi Company cannot lend money to any body corporate. There is a prohibition to induct body corporate and trust as a member of Nidhi Company.

Can Nidhi Company do an advertisement for soliciting deposits?

No, as per Rule 6 of Nidhi Rules 2014, Nidhi Company cannot issue or cause to be issued any advertisement in any form for soliciting deposit. However, private circulation of the details of fixed deposit Schemes among the members of the Nidhi carrying the words “for private circulation to members only” shall be allowed.

What is the minimum value of shares to be issued to members of Nidhi Company?

Nidhi Company shall issue at least 1 equity share of Rs. 10 each to its members. However, a minimum of 10 equity shares or shares equivalent to Rs. 100 shall be issued to a fixed deposit holder.

Can Nidhi Company levy service charges on the issue of shares?

No, service charges cannot be levied for the issue of shares by Nidhi Company.

Can a Nidhi Company open branches without earning any net profits?

No, A Nidhi may open branches only if it has earned net profits after tax continuously during the preceding 3 financial years.

How many branches can a Nidhi Company open?

A Nidhi Company may open up to 3 branches within the district if it has earned net profits after tax continuously during the preceding 3 financial years. If it wants to open more than 3 branches within the district it has to obtain the prior permission of the Regional Director and intimation is to be given to the Registrar about the opening of every branch within 30 days of such opening.

Can a Nidhi Company open branches outside the state of Registration?

Yes, Nidhi company may open branches outside the state of Registration, if it has earned net profits after tax continuously during the preceding 3 financial years and obtained the prior permission of the Regional Director and intimation is to be given to the Registrar about the opening of every branch within 30 days of such opening.

How much amount should a Nidhi Company keep as un-encumbered term deposits?

Nidhi Company has to invest in unencumbered term deposits with a scheduled commercial bank or post office deposits (other than a co-operative bank or regional rural bank) at least 10 percent. of the deposits outstanding at the close of business on the last working day of the second preceding month.

However, in case of unforeseen commitments, temporary withdrawal may be permitted with the prior approval of the Regional Director for the purpose of repayment to depositors, subject to such conditions and time limit which may be specified by the Regional Director to ensure restoration of the prescribed limit of 10 percent.

Can a Nidhi Company give a loan against moveable property?

No, as per Rule 15 of Nidhi Rules 2014, Nidhi Company cannot lend money against a moveable property, vehicles, or personal loan. It is allowed to provide secured loans against jewellery, immovable property, fixed deposit receipts, National Savings Certificates, Government Securities, and insurance policies to its members.

Are Nidhi Companies required to follow prudential norms and classify the assets into non-performing assets (NPA)?

Yes, Nidhi Companies are required to adhere to the prudential norms for revenue recognition and classification of assets in respect of mortgage loans or jewel loans.

What is the maximum limit up to which a Nidhi Company can declare a dividend?

Nidhi Company shall not declare dividends exceeding 25% or such a higher amount as may be specifically approved by the Regional Director.

Can Nidhi Companies provide locker facilities to its members?

Yes, A compliant Nidhi Company may provide locker facilities on rent to its members, but rental income from such facilities shall not exceed 20% of the gross income of the Nidhi at any point of time during a financial year

Is Nidhi company required to appoint an auditor?

Yes, Nidhi Company is required to mandatorily appoint a statutory auditor.

What is the difference between Nidhi Company and Chit Fund Business?

Nidhi Company can accept deposits or lend money to its members, whereas Chit Fund Companies can accept fixed Instalments over a certain period of time by its members and they can neither lend nor accept the amount as a lumpsum amount.

What is the difference between Nidhi Company and NBFC?

Nidhi Company is regulated by the Ministry of Corporate Affairs (MCA) and can accept deposits or lend money to its members, it cannot carry the business related to hire purchase finance, leasing finance, insurance, or acquisition of securities issued by anybody corporate. On the other hand, NBFC is granted a license by the Reserve Bank of India (RBI) and is engaged in the business of granting loans/advances, acquisition of shares and securities issued by Government or local authority, leasing, hire‐purchase, insurance business, chit business, etc. as per the category of NBFC license.

What is the difference between Nidhi Company and Banks?

Nidhi Company can accept deposits or lend money only to its members, it cannot deal with a non-member. Whereas Banks can deal with members and non-members, they also offer a wide range of deposit and loan facilities. However, the capital requirement and regulation are much higher for banks as compared to Nidhi Companies.

Registration Arena is the expert hub that can assist you with your business requirements. For more details, call us at 8600544411 / 8600544422.