MSMEs are one of the driving forces of the economy. Privately held businesses create jobs and result in the mobilization of resources. They contribute to the development of the society and the nation as a whole. Realizing their importance and also to incentivize people to start businesses, the government on 1st July 2020 launched Udyam Registration. Udyam Registration deals with the classification of MSMEs and streamlines the procedure for their registration. In this article, we explain Udyam Registration and the process pertaining to its registration.

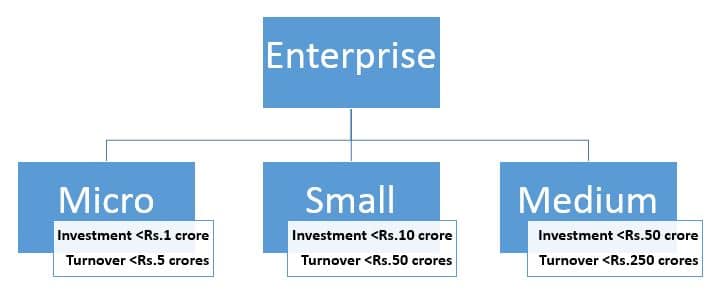

Classification of MSMEs

In accordance with the regulations laid out by the government:

- A Micro Enterprise is one where the investment in plant machinery or equipment is not over 1 crore and the turnover of the Enterprise does not exceed Rs.5 crores.

- A Small Enterprise is one where the investment in plant machinery or equipment does not exceed 10 crore and the turnover for which is less than or equal to Rs.50 crore.

- A Medium Enterprise is defined as the one where the investment in plant and machinery or equipment does not exceed 50 crore and the turnover for the same is not more than Rs.250 crore.

An enterprise is classified into any one of the three categories as mentioned above. It must fulfill both the criteria of the class it seeks its registration in. If any enterprise crosses the specified limits for the class it is in, then it would cease to exist in that category as soon as it crosses the threshold of any of the Criterion. It would then be shifted towards the upper category. Note that an enterprise will not be put into a lower class if it falls below any one of the mentioned criterion. It would only be put in a lower category if it falls below the threshold in both the criteria. (Both investment & turn over).

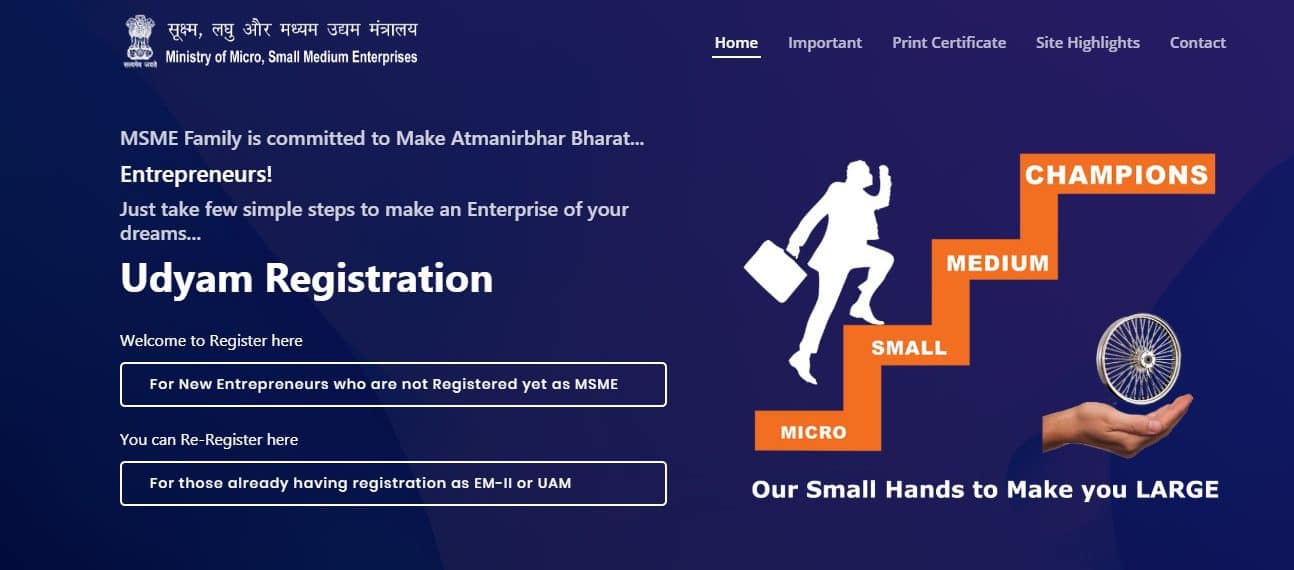

What is Udyam Registration?

Any person intending to commence business and establish a Micro, Small or Medium Enterprise needs to file for Udyam registration online on the Udyam registration portal. The process relies on self-declaration and does not require the applicant to upload or attach documents certificates papers for any valid proof.

On registration the concerned enterprise (which is referred to as Udyam on the portal) will be assigned a Permanent Identity Number. This number is referred to as Udyam registration number. An e-certificate will be issued upon the completion of the registration process. This is referred to as registration certificate.

All business units having the same Goods and Services Tax Identification Number (GSTIN) and the Permanent Account Number (PAN) will be collectively treated. They will be classified as one Enterprise. They will be classified into the relevant MSME category basis the aggregate values of the investment and turnover.

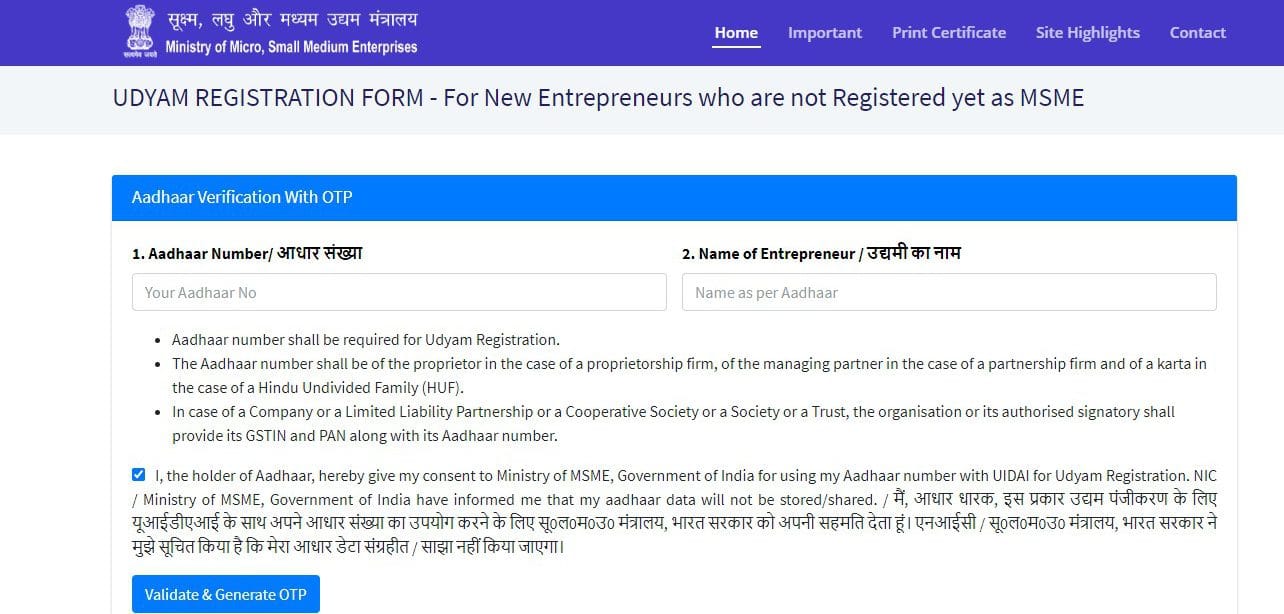

Udyam Registration process

- Open the Udyam Registration website

- Choose the first option: ‘For new Entrepreneurs who are not Registered yet as MSME’.

- Enter Aadhaar number and the name of Entrepreneur

- Click on the checkbox below. Be sure to read any terms before agreeing.

- Click on Validate & Generate OTP

- Following this, an OTP will arrive on the phone number linked to your Aadhaar.

- Enter the OTP on the next page.

- Click on Submit. The request is now underway

Calculation of turnover

- While calculating the turnover, Exports of goods or services or both shall be excluded regardless of the class that the enterprise falls in. This is done for the purpose of classification

- The figures relating to the turnover of an enterprise which does not have its permanent account number will be considered on the basis of self-declaration for a period ending 31st March 2021. Following this pan and GSTIN shall be made mandatory

Calculation of Investment

To ascertain the value of investment in Plant Machinery and Equipment (PME), the purchase receipt or invoice of the same will be considered. This will be done excluding Goods and Services Tax (GST). This will also be done on self-disclosure basis; if the enterprise is newly formed without any Income Tax Return (ITR). Note that the consideration of the assets will be regardless of the fact whether or not It is a first-hand sale. Since a new enterprise would not have any prior income tax return information the promoter(s) will self-declare. This Relaxation however will end after the 31st March of the financial year the enterprise files its first ITR in.

- For other Enterprises, the calculation of investment in PME shall be linked to the income tax return of the previous years filed under the Income Tax Act of 1961

- The expression plant and machinery or equipment has this same meaning as mentioned in the Income Tax rules, 1962 which has been framed under the Income Tax Act 1961. It shall include all tangible assets apart from land & building and furniture & fittings.

- The cost of certain items as specified in the ‘explanation 1 to subsection 1 of section 7 of the Income Tax Act’ shall be excluded while calculating the amount of investment in plant and machinery.

Guidelines for Udyam Registration

Guidelines For registration of new partners

The registration form is provided on the Udyam Registration Portal. Note that the applicant can file the Udyam Registration form for free. Udyam Registration requires the applicant’s aadhaar number. The aadhar number must be of the proprietor in case of a sole proprietorship firm, managing partner in the case of a Partnership firm, and Karta when a Hindu Undivided Family or Joint Hindu Family Business is concerned.

- When a Company/LLP/Society/Trust is concerned, the organization or the person acting on behalf of the latter as an authorized signatory shall provide its GSTIN and PAN along with its Aadhaar number.

- If the enterprise is registered as an Udyam with PAN, it can fill in the information left out (if any) for years it did not have a PAN, on self-declaration basis.

- An Enterprise cannot file for more than one Udyam Registration. Keeping in mind that any number of activities may be specified in one Udyam Registration.

- Whoever intentionally misrepresents or attempts to hide information or suppress facts and figures that were self-declared by the same appearing in the Udyam registration or updation process shall be liable to such penalty as prescribed under Section 27 of the Act.

Guidelines for registration of Existing Partners

- All existing enterprises that are registered under EM-Part-II or UAM will have to register yet again on the Udyam Registration portal on or after 1 July, 2020.

- All the enterprises registered till 30 June, 2020 shall be reclassified on the lines of this notification.

- The existing enterprises registered prior to 30 June, 2020 shall be valid until 31 March, 2021.

Any enterprise which is registered with any other organization under the Ministry of MSMEs, shall register itself under Udyam Registration.

Relating to assessment and classification

An enterprise having Udyam Registration Number must update its information online. This must be done on the Udyam Registration portal. The update shall include the details of the Income Tax Return and the GST Return for the previous financial year. It should also include other additional information as may be required, on self-declaration basis.

If the concerned enterprise fails to update the relevant information within the time period specified on the Udyam Registration portal, it will be rendered liable for suspension of its status.

Basis the information furnished or gathered from Government’s sources, the enterprise will be reclassified. If the classification changes, the same will be communicated to the enterprise. In case of an upward change in investment or turnover or both, and consequent reclassification, an enterprise will maintain its current status till expiry of one year from the close of the year of registration. If the enterprise is reclassified into a lower class whether as a result of re-classification of limits or due to actual changes in investment or turnover or both, and whether the enterprise is registered under the Act or not, the enterprise will continue in its present category till the closure of the financial year. The benefits resulting from the changed status would come into effect from 1st April of the financial year following the year in which such change took place.

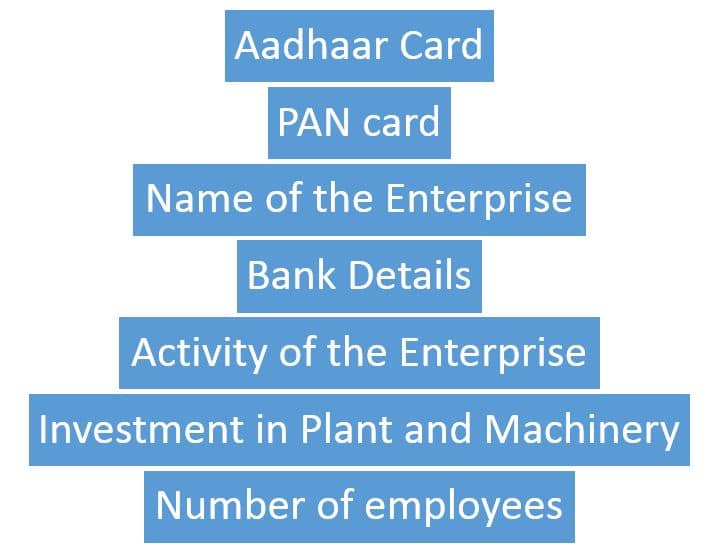

Documents

- Aadhar Card of Proprietor.

- Pan Card of Proprietor.

- Name of the Enterprise

- Bank details of the Enterprise

- Activity of the Enterprise

- Investment in plant and Machinery

- Number of Employees

Note that the documents differ on the basis of business type.

Conclusion

The government has taken various initiatives in recent years to incentivize people to start businesses. Startup India Scheme, reforms to Company Registration and the introduction of the One Person Company concept are a few examples of it. Udyam Registration comes across as a reform intended for the MSMEs. Though Udyam Registration is simple, MSME Registration is not. It is a long and winding process. Why not leave the hassle to us? At Registration Arena, We help people incorporate their business and grow. While they focus on the growth, we look at their registrations and compliance. Reach out to us for hassle-free MSME Registration.