Startup India Scheme – Eligibility, Benefits and How to Apply

The Startup India Scheme is an initiative by the Government of India to support the people who want to start their own business. Under this program, the Government of India provides benefits to all those people who have an idea in their mind and want to implement the same. The scheme was launched by Prime Minister Narendra Modi on 16 August, 2016. The main motive of introducing the scheme was to push the accelerator of sustainable development and implementation of ideas through innovation.

The other motive of the implementation of the scheme is the generation of new employment opportunities. The initiative was taken by The Department for Promotion of Industry and Internal Trade (DPI&IT). The success of the scheme will eventually make India economically strong and one of the most powerful countries in the world.

What is a Startup

Any legal entity, headquartered in India, will be known as a startup due to following reasons :

- The entity should be incorporated either as

– Private Limited under the Companies Act, 2013

– Partnership Firm under section 59 of Partnership Act, 1932

– Limited Liability Partnership under Limited Liability Partnership Act, 2008

- An entity shall be considered as a startup up to 10 years from the date of its incorporation.

- It is working towards the aim of innovation, development, improvement of existing products, services and processes or if it is a scalable business model and should have the potential to generate employment or creation of wealth.

- The startup would cease to be called one if the turnover exceeds more than 100 crore

An entity formed by splitting up or reconstruction of an existing business shall not be considered a ‘Startup’.

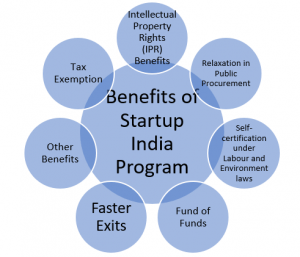

The Benefits of Startup India Scheme

The Government tries its best in order to give people employment, good services and quality goods. The scheme is aimed to do all the following and at the same time, helping manufacturers to flourish. The government plans on building a startup ecosystem which enables the network of all the startup in the country.

The various benefits are :

1) Intellectual Property Rights (IPR) Benefits

2) Relaxation in Public Procurement

3) Self-certification under Labour and Environment laws

4) Faster Exits

5) Fund of Funds for startups

6) Tax Exemption

7) Other Miscellaneous Benefits

Intellectual Property Rights Benefits :

Startup India Program promises to provide high quality Intellectual Property resources and facilities. The Government plans to do this in order to encourage the startups to avail the benefits of IPR and commercialize the same.

The government provides facilities like fast track startup applications, panel to aware the owners regarding the benefits and the process of applying etc. The government promises to bear the facilitation costs and in addition to that it offers a, 80% rebate on filing a patent and 50% rebate on filing the application on Trademark.

Relaxation in Public Procurement:

If the startups meet the needed quality specifications, The government offers them a relaxation on Public Procurement policies. All the establishments under the Government of India, the Ministries, Public Departments and Public Sector Undertakings (PSU) have been asked to relax the norms on the procurement process. This acts as a catalyst in the production of goods and services of the startups.

The registered startups can avail the following benefits :

1) A beforehand experience and turnover is not required

2) Initialized Money Deposit.

3) Information regarding the government tenders

To know more about the public procurement facilities, visit

https://www.startupindia.gov.in/content/sih/en/public_procurement.html

Self-certification under Labour and Environment laws :

The laws and taxation policies might prove to be very time consuming and act as a barrier between the growth and development of the startup. The government has pull off the restrictions on the labor and environment laws to certain extent.

Labour laws :

The government has given an option to the startups to self-certify their compliance for 6 Labour Laws. The startup had to avail the “Shram Suvidha Portal”.

Environmental laws :

The environmental laws include those laws that are implemented in order to maintain the sanctity of nature and that the establishments do not take the environment for granted. However, considering the small turnover of a startup, the Government has exempted the levy of 3 environmental laws as well. The startups, once registered, will only fall under the category of ‘white category’ of Central Pollution Control Board (CPCB) which do not require environmental clearance for a period of 3 years.

Faster Exits :

The government of India promises to provide the provision of submitting an application regarding winding up of the business within 90 days while it is 180 days for other companies. The same will also provide the startup with an insolvency professional who will help the startup in liquidating all its assets and paying the creditors within 6 months of filing the application.

Fund of Funds :

The most intriguing part of running or starting a startup is to search and collect for funding. Every other company requires money to make money from. The government has initiatives according to what they offer a great deal of corpus to the startups. The registered startups are from the Fund of Funds of 10,000 crore rupees.

The same will be managed by SIDBI. The government participates in the capital of SEBI registered Venture Funds, who further invest in Startups.

Tax Exemption :

- The Inter-Ministerial Board also aids the innovation driven startups by granting them the tax related benefits. The profits of startups which are certified by Inter-Ministerial Board are free from paying the taxes for a period of 3 years out of 7 years of incorporation. These benefits are provided in order to ensure the growth and development of the startups.

- A DPIIT recognized Startup is eligible for exemption from the provisions of section 56(2)(viib) of the Income Tax Act by filing a duly signed declaration in Form 2 to DPIIT.

Other Benefits of The Scheme

The government gives Pro Bono services free of cost while collaborating with huge companies like Amazon and Microsoft. Along with that, the government offers programs that will definitely bring small startups closer and work together to build up a ground for innovation.

Startup India Hub

The startups that are registered under Government of India, come under one roof known as the startup ecosystem. The government provides the facility of connecting all the startups together in a network.

The part with Research and Development is one of the most important parts of a company and there are many resources involved in the same. The government of India promises to provide all the necessary resources as far as incubation of startups are concerned. It helps in initiating a collaboration platform known as startup hub. It helps the startup creators to harness private sector for gathering incubation. Also, the Government has displayed its R&D efforts by building up new and successful innovation centers across the country.

Process of applying to the Startup India Program

As notified by The Government of India that the startups need to register themselves as a legal entity and as Private Limited and Limited Liability of Partnership of Partnership Firm and then only they can move forward with applying to the program.

The application can be put forward through the mobile application offered by the scheme or through the portal supplied by DIPP(Department of Policy and Promotion). In addition, a toll free number and an email address is also provided for customer enquiry.

Documents required

The following are the documents required for successful submission in the startup India program :

** The Startup should prove that it is working towards innovation or improvement of a product, process or service and/or have scalable business model with high potential for creation of wealth & employment

The Registration Process Does not Require

Problems faced by the Startup India Program

Execution

Although the instructions in the manual or the Startup India kit are quite clear, but people do mess up the applications when they try and submit with half knowledge. This is a major problem as the government could only help those who help themselves. There are still many loopholes which need to be kept in mind before moving forward with this program.

Customer Retention

The government can only provide the catalyst to start the experiment. But, it is up to you how you manage to retain your customers and how you will be able to provide them with continued services. It is seen that the startups do sometimes forget that they have to maintain their standard of working.

Fundraising

All the funds that are supposed to be a part of the Fund of Funds, must come from somewhere. Well, they are compensated while cutting off the expenses on other governmental projects. It is also important to understand that the money that government offers in this policy, comes from the taxes that they collect from us. It is important that these recourses are utilized in a manner such that it is not misused.

Human Resource

While we are talking about Research and Development, it is important for us to measure the amount of human resource we have left to our dispatch. Not only quantity, but also the quality. It is important for the government to spend a calculated amount of time on the same problem.