Intro on Casual Vacancy of Auditor

First Auditor is generally appointed by the Board of Directors within 30 days of registration of company. Whereas a subsequent auditor is appointed by the members in the Annual General Meeting of the Company who shall hold office from the conclusion of that meeting till the conclusion of its sixth annual general meeting i.e. for a period of five years.

A contingency may occur in the office of the auditor due to death, resignation, insolvency, disqualification, etc. Vacancies arising out of these reasons are called casual vacancies. The term “casual vacancy” is not explicitly defined in the Companies Act, 2013.”Casual” typically refers to something happening unexpectedly or by chance, not by the normal passage of time.

In common understanding, it refers to a vacancy arising from events such as the death, disqualification, or resignation of an auditor who had previously accepted a valid appointment, leading to the cessation of their role as auditor for the company before the expiry of the term of office. It’s important to note that if an auditor is not appointed or reappointed, this situation does not constitute a casual vacancy.

As per Section 139 (8) of the Companies Act, 2013, when a casual vacancy arises in companies other than Government companies, it is the responsibility of the Board of Directors to fill the vacancy within 30 days of its occurrence. However, if a vacancy arises due to the resignation of an auditor, the process differs. In such cases, the shareholders of the company must appoint a new auditor within three months from the date of the Board of Directors’ recommendation. The newly appointed auditor will serve until the conclusion of the next annual general meeting.

In cases of government companies or those owned or controlled by the Central Government, State Government, or both, a casual vacancy in the auditor position shall be filled by the Comptroller and Auditor-General of India (CAG) within 30 days, failing which the responsibility shifts to the Board of Directors to fill the vacancy within the subsequent 30 days.

Let’s understand in this Article in what situations a casual vacancy of Auditor may arise, compliance checklist, and procedural aspects for Other than Govt. Companies, Govt. Companies, OPC’s, Documents Checklist, Applicable forms and fees with respect to Appointment of Auditor in casual vacancy.

How does the casual vacancy of auditor arise?

A casual vacancy of an auditor may arise due to various reasons such as the auditor’s death, resignation, disqualification, incapacitation, removal, or bankruptcy, leading to the need for a replacement to ensure continuous oversight of the company’s financial affairs. Following are the reasons outlining how a casual vacancy of an auditor may arise:

Death

If the appointed auditor passes away during their term of office, it creates a vacancy that needs to be filled.

Resignation

When an auditor voluntarily resigns from their position before the completion of its term, it results in a casual vacancy.

Disqualification

A person appointed as an auditor of a company incurs any of the disqualifications specified under the Companies Act, 2013 subsequent to their appointment, they are required to vacate their office as an auditor. This vacation of office is considered a casual vacancy in the auditor position.

For more information on disqualification, kindly read: Who can become an Auditor

Incapacity

In situations where the auditor becomes incapacitated or unable to perform their duties effectively, leading to their removal from office, a casual vacancy arises.

Bankruptcy

If the auditor becomes bankrupt or insolvent, rendering them ineligible to continue serving as the company’s auditor, it creates a casual vacancy.

These circumstances necessitate the appointment of a new auditor to ensure the company’s compliance with regulatory requirements and the integrity of its financial reporting.

Compliance Checklist for Auditor appointment in casual vacancy

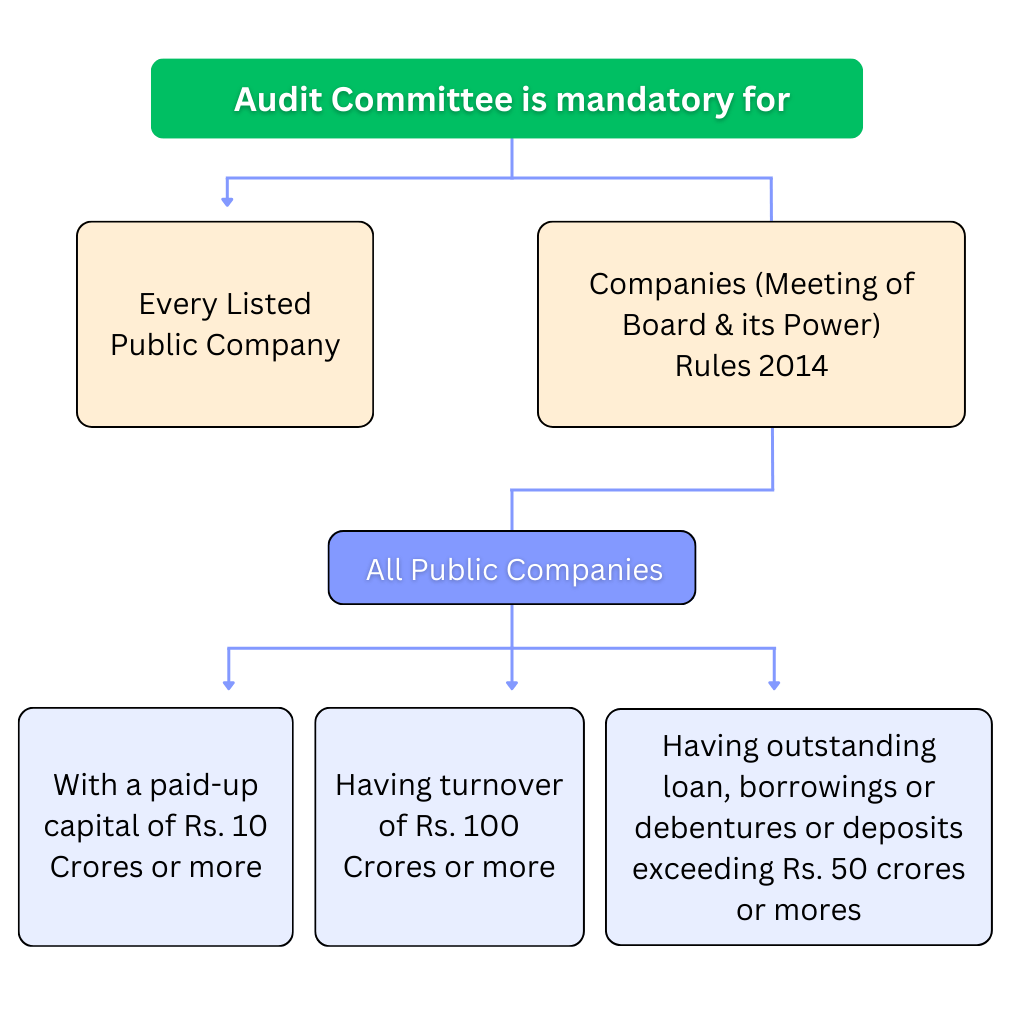

Recommendation of Audit Committee

When a company is obligated to form an Audit Committee according to Section 177, appointment of auditors to fill the casual vacancy of an auditor must be made with due consideration of the recommendations put forth by the said committee.

Consideration of Qualifications and Experience

If a company is required to constitute an Audit Committee under Section 177, the committee (or the Board if no such committee is required) shall assess the qualifications and experience of the individual or firm proposed for appointment as auditor. The suitability of these qualifications and experience to the company’s size and needs must be evaluated.

Additionally, any professional misconduct proceedings against the proposed auditor before the Institute of Chartered Accountants of India or any competent authority must be taken into account.

Obtain consent and Certificate from the proposed Auditor

Prior to appointing the auditor, the company must secure written consent from the proposed auditor for the appointment. Additionally, the company is obligated to obtain a certificate from the proposed auditor, ensuring that the appointment, if executed, will comply with the conditions specified in Rule 4 of the Companies (Audit and Auditors) Rules, 2014 as follows:

(a) The individual or firm is eligible for appointment and not disqualified under the Act, the Chartered Accountants Act, 1949, and related rules or regulations.

(b) The proposed appointment complies with the term provided under the Act.

(c) The proposed appointment falls within the limits prescribed by or under the authority of the Act.

(d) The list of proceedings against the auditor, audit firm, or any partner of the audit firm related to professional conduct matters, as disclosed in the certificate, is accurate and truthful.

Additionally, the certificate should indicate whether the auditor meets the criteria outlined in Section 141 of the Companies Act, 2013, regarding eligibility, qualifications, and disqualifications of auditors.

Procedure for filling Casual Vacancy of Auditor

a. In cases other than resignation:

In the event that a casual vacancy arises due to reasons other than resignation, the Board is mandated to fill the vacancy within 30 days. The procedure to be followed is as follows:

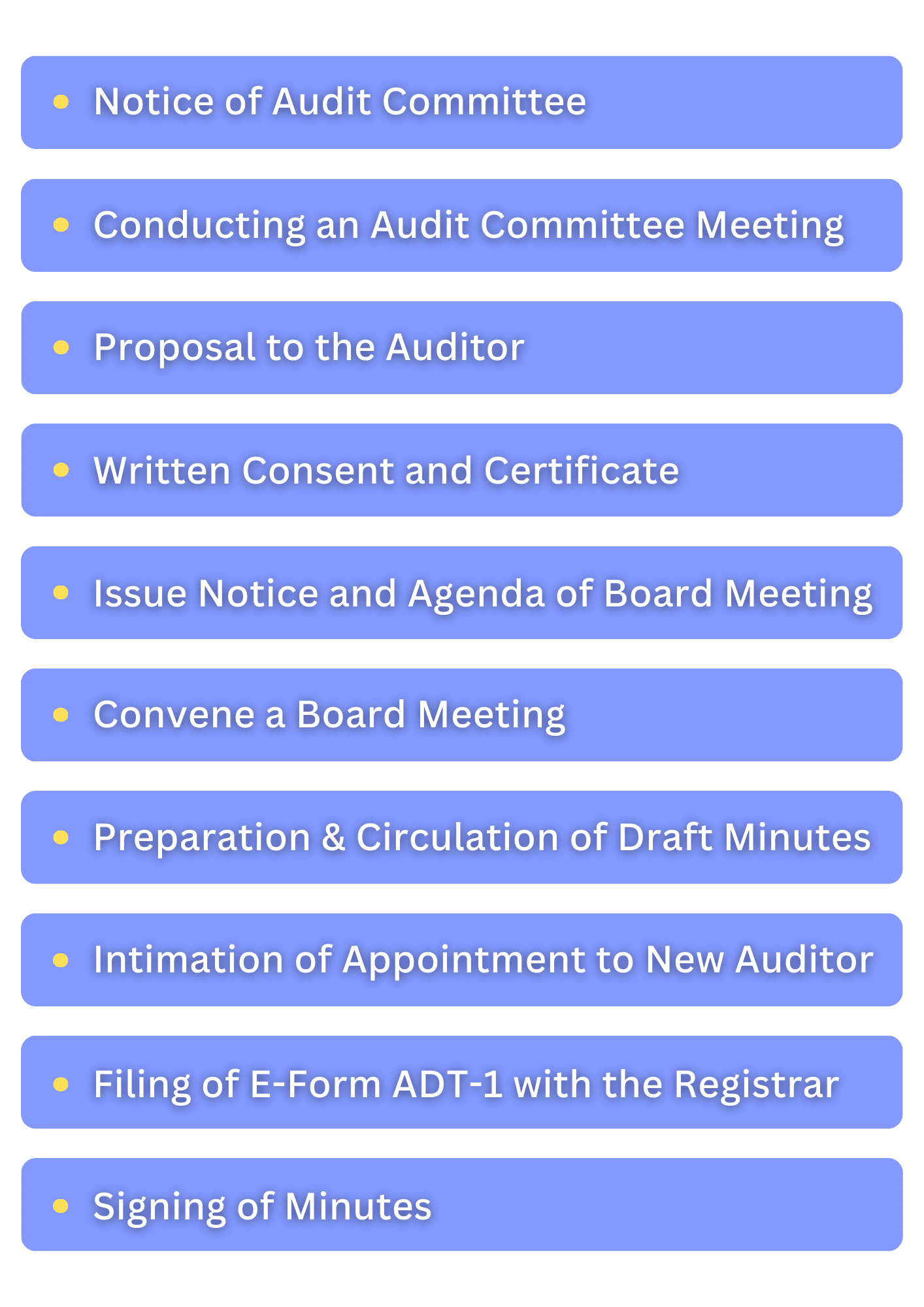

Notice of Audit Committee

Draft and issue notice calling Audit Committee meeting in such manner as prescribed in Section 177 of the Companies Act 2013 and Secretarial Standard

Conducting an Audit Committee Meeting

Convene a meeting of the Audit Committee for making recommendations to the Board the name of an individual auditor or of an audit firm who may fill the casual vacancy in the office of Auditors. If the Board agrees with the recommendation of the audit committee, it shall fill the casual vacancy within 30 days. Wherein the audit committee is not applicable the Board shall fill the casual vacancy in 30 days.

Proposal to the Auditor

The Company shall send a proposal to the proposed auditor to be appointed in case of Casual Vacancy.

Written Consent and Certificate

Obtain a written certificate from the proposed auditor confirming their eligibility for appointment.

Issue Notice and Agenda of Board Meeting

Prepare and issue notice and agenda calling Board Meeting to all the directors at least seven days before the date of the Meeting.

Convene a Board Meeting

Hold a Board meeting within 30 days of the casual vacancy and pass a resolution to appoint a new auditor to replace the previous one.

Preparation and Circulation of Draft Minutes

The minutes should be drafted and circulated within 15 days from the conclusion of a board meeting to all directors so that they can provide their comments, if any, within 7 days from the date of circulation of the draft minutes.

Intimation of Appointment to New Auditor

The Newly appointed Auditor must be intimated of his appointment at the Board Meeting by providing a formal appointment letter signed by any one director authorized.

Filing of E-Form ADT-1 with the Registrar

Notify the Registrar of Companies by submitting the prescribed form i.e E-Form ADT-1 by paying the requisite filing fee within 15 days of the meeting.

Signing of Minutes

The minutes of the Board meeting must be signed and dated by either the Chairman of the meeting at any time before the next Meeting is held or by the Chairman of the subsequent meeting.

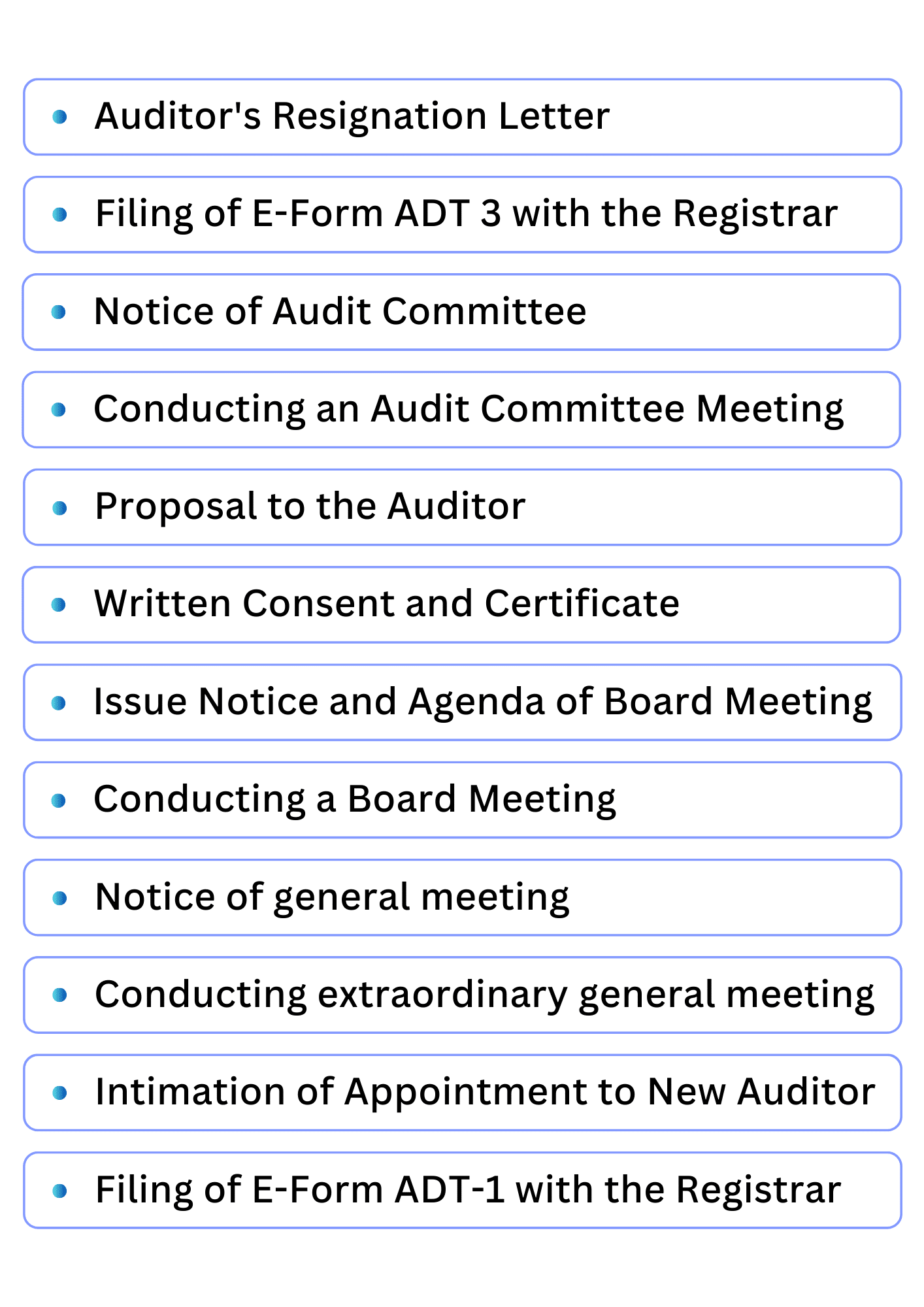

b. In case of resignation:

If a casual vacancy occurs due to the resignation of an auditor, the Board of Directors must fill it within 30 days. The appointment made by the Board needs to be approved in a general meeting convened within three months from the date of the Board’s recommendation.

Auditor’s Resignation Letter

The auditor will submit a resignation letter to the company, stating the exact specific reasons for resignation.

It is important to note that as per the Implementation Guide on Withdrawal / Resignation from an Engagement to Perform Audit of Financial Statements issued by ICAI), the auditor should describe the circumstances while giving the reasons for resignation suitably, instead of mentioning ambiguous reasons such as other pre-occupation or personal reasons or administrative reasons or health reasons or mutual consent or unavoidable reasons. The auditor should give valid reasons like pending/ non-payment of audit fees is a valid reason for resignation.

Filing of E-Form ADT 3 with the Registrar

The Auditor who has resigned shall file a statement in E-Form ADT 3 within 30 days from the date of resignation with the Company as well as the Registrar of Companies.

Notice of Audit Committee

Draft and issue notice calling Audit Committee meeting in such manner as prescribed in Section 177 of the Companies Act 2013 and Secretarial Standard

Conducting an Audit Committee Meeting

Convene a meeting of the Audit Committee for making recommendations to the Board the name of an individual auditor or of an audit firm who may fill the casual vacancy in the office of Auditors. If the Board agrees with the recommendation of the audit committee, it shall fill the casual vacancy within 30 days. Wherein the audit committee is not applicable the Board shall fill the casual vacancy in 30 days.

Proposal to the Auditor

The Company shall send a proposal to the proposed auditor to be appointed in case of Casual Vacancy caused due to resignation.

Written Consent and Certificate

The new auditor shall provide written consent and certificate confirming eligibility under Section 141 of the Companies Act, 2013.

Issue Notice and Agenda of Board Meeting

Prepare and issue notice and agenda calling Board Meeting to all the directors at least seven days before the date of the Meeting.

Conducting a Board Meeting

Convene a Board Meeting to discuss the following:

- Taking Note of the Resignation of Auditor

- Consideration of the recommendation of the Audit Committee for appointment of Auditor, if any

- Appointment of Auditor in case of casual vacancy due to resignation

- Convening extraordinary general meeting

Notice of general meeting

Draft and issue notice calling extraordinary general meeting along with the explanatory statement as required under Section 102 and in such manner as prescribed in Section 100 and Secretarial Standard 2 (within a period of 3 months of the recommendation of the Board) to obtain the approval of members. The mode of sending the Notice of the meeting shall be by hand or ordinary post or by speed post or by registered post or by courier or by facsimile or by e-mail or any other electronic means.

Conducting extraordinary general meeting

Convene extraordinary general meeting and pass an ordinary resolution for appointment of an individual/firm as auditor who shall hold office till the conclusion of the next annual general meeting.

Intimation of Appointment to New Auditor

The Newly appointed Auditor must be intimated of his appointment at the Extra-Ordinary General Meeting by providing a formal appointment letter signed by any one director authorized.

Filing of E-Form ADT-1 with the Registrar

Notify the Registrar of Companies by submitting the prescribed form i.e E-Form ADT-1 by paying the requisite filing fee within 15 days of the meeting. Following mandatory attachments are to be made in E-Form ADT 1:

- Consent Letter and Eligibility Certificate from Auditor.

- Letter of intimation to the auditor from the company.

- Resolution passed for appointment of Auditor.

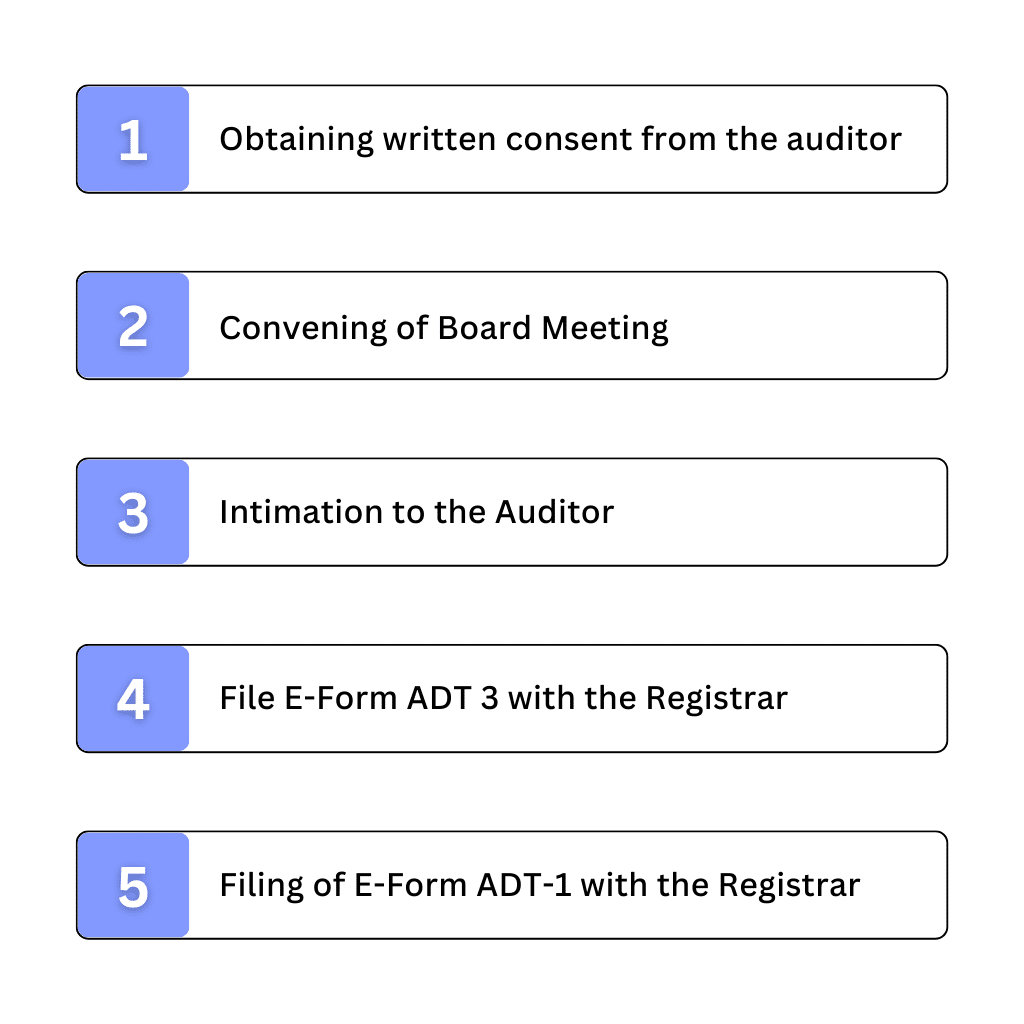

c. In case of Government Companies:

In case of a casual vacancy, the Comptroller and Auditor General (CAG) is tasked with filling the vacancy within 30 days. If the CAG fails to do so within this timeframe, the following steps are required to be taken:

Obtaining written consent from the auditor

The company must obtain a written certificate from the proposed auditor, affirming their eligibility and consent to be appointed as the company’s auditor.

Convening of Board Meeting

The company must call for a Board meeting within 30 days of receiving information about the failure of the Comptroller and Auditor General (CAG) to appoint an auditor to fill the casual vacancy. Notice must be provided to all directors. During this meeting, a resolution should be passed to appoint a new auditor in place of the previous one.

Intimation to the Auditor

The company then informs the first auditor of their appointment, providing them with a certified copy of the resolution passed by the Board.

File E-Form ADT 3 with the Registrar

In case of resignation, the Auditor who has resigned shall file a statement in E-Form ADT 3 within 30 days from the date of resignation with the Company, Registrar of Companies and also with Comptroller and Auditor-General of India, indicating the reasons and other facts as may be relevant with regard to his resignation.

Filing of E-Form ADT-1 with the Registrar

Notify the Registrar of Companies by submitting the prescribed form i.e E-Form ADT-1 by paying the requisite filing fee within 15 days of the meeting.

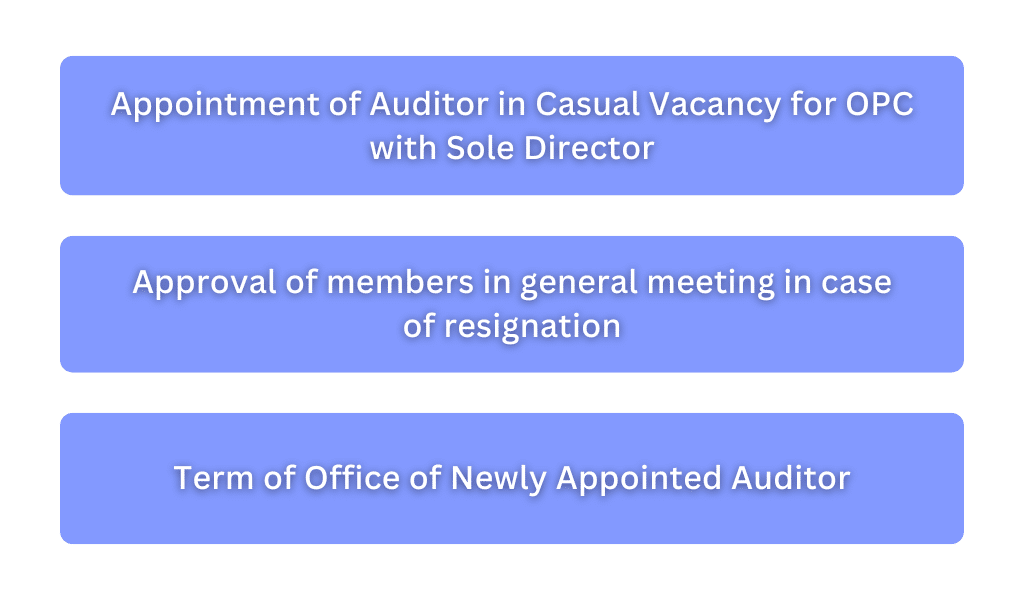

d. In case of One Person Company:

Upon analyzing the provisions concerning One Person Companies (OPCs), there are some points to be noted:

Appointment of Auditor in Casual Vacancy for OPC with Sole Director

If there is only one director in an OPC (One Person Company) and there is a requirement to handle business matters at a board meeting, the director can simply note down a resolution in the minutes book. This resolution must be signed and dated by the director, and the date of this resolution is considered as the date of the board meeting for all legal purposes under the Companies Act 2013.

Approval of members in general meeting in case of resignation

Where the casual vacancy arises due to the resignation of an auditor, the appointment of a new auditor is typically subject to the approval of the members in a general meeting. However, for One Person Companies (OPCs), there is no mandatory requirement to convene a general meeting (AGM/EGM). An OPC can fulfill this requirement by the member communicating the resolution to the company. This communication is then recorded in the mandatory minutes-book as per Section 118, signed, and dated by the member. The date of this resolution is considered the date of the meeting for all legal purposes under the Companies Act 2013.

Term of Office of Newly Appointed Auditor

For One Person Companies (OPCs), the requirement to submit E-Form AOC-4 is within 180 days from the end of a financial year i.e 27 September which means that the financial statements and Board’s report must be approved by the sole member through resolution communication to the company by that date, which in turn decides the Annual General Meeting (AGM) date. Therefore an auditor appointed in a casual vacancy will serve until this date.

It is to be noted that the signing date of minutes serves as the deemed date for Board Meetings (BM), Annual General Meetings (AGM), or Extraordinary General Meetings (EGM) for OPC’s.

Documents Checklist

Following is the broad list of details and documents:

- Copy of Resignation Letter from the outgoing auditor.

- Copy of Board Resolution accepting the Resignation of Auditor and appointing the new Auditor in case of a casual vacancy.

- Copy of Notice of General Meeting along with Explanatory Statement, if applicable.

- Copy of Ordinary Resolution passed at the General Meeting for the Appointment of Auditor in case of a casual vacancy.

- Copy of intimation sent by the company to the auditor.

- Copy of written consent by the auditor confirming eligibility under Section 141 of the Companies Act 2013.

- Basic Details of the Resigning Auditor & Auditor appointed in case of a casual vacancy:

– Pan of the auditor

– Name of the auditor

– Membership No/ Firm Registration No

– Address of the auditor

– Email ID of the Auditor - E-Form ADT 1 along with the receipt filed for the appointment of Auditor who vacated the office.

Applicable Forms and Fees

E-Form ADT 3

- An auditor resigning from their position in a company must submit Form ADT-3 within 30 days from the resignation date on the MCA portal and to the company. The obligation to file Form ADT-3 rests with the auditor, not the company.Additionally, in the case of a Government Company, the auditor must also submit E-Form ADT 3 indicating the reasons and other facts as may be relevant with regard to his resignation with the Comptroller and Auditor-General of India.

- Government fees for filing E-Form ADT 3:

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

In the case of a company without share capital, the fee applicable is Rs 200.

In the case of a foreign company, the fee applicable is Rs 6000.

- Consequences of not filing E-Form ADT 3

The consequences of not filing Form ADT-3 within the prescribed time limit are outlined in Section 140(3) of the Companies Act, 2013. According to this section, if the auditor fails to submit Form ADT-3 within the specified timeframe, they will be subject to a penalty. The penalty amount is either INR 50,000 or the auditor’s remuneration, whichever is lower.

Furthermore, if the non-compliance continues, an additional penalty of INR 500 per day will be imposed for each day of default, not exceeding INR 5,00,000 in total. It’s important to note that when filing Form ADT-3, attaching the resignation letter is mandatory. However, auditors may include any other optional attachments as deemed necessary.

E-Form ADT-1

Filing of E-Form ADT-1 is obligatory for all types of companies, whether listed, unlisted, public, private, or others. The responsibility to file Form ADT-1 lies with the company, not the auditor. Form ADT-1 is required to be filed in the case of appointing an auditor for a casual vacancy. To know more on the government fees and penalty, read our blog First Auditors.

Conclusion on Casual Vacany of Auditor

A casual vacancy occurs when an auditor’s office becomes vacant before the normal expiration of their term. This can happen due to various reasons such as death, resignation, disqualification, or removal.

If this vacancy is due to the auditor’s resignation, the company must fill it at a general meeting within three months of the Board’s recommendation, using an ordinary resolution, and the appointed auditor will hold the office until the next annual general meeting concludes.

At the Registration Arena, our team is skilled in making sure everything goes smoothly in case of a casual vacancy in the office of auditor, handling all the necessary legal and procedural steps with ease.

To get in touch with us, Please contact us