Introduction

Every company after incorporation must appoint the first auditor, either an individual or a firm. A company needs to get its accounts audited even though it may not have any business during the year. Appointment of First Auditor of a company is one of the post-incorporation compliances that is required to be done.

A First Auditor is required to be appointed to review and assess the financial records and statements of a company and provide an opinion on whether the annual accounts of the Company give a true and fair view of its profit or loss for the period under review.

Section 139 (6) of the Companies Act 2013 specifies that the Board of Directors are required to appoint an individual or firm as the first auditors of the Company, other than a Government Company within 30 days from the incorporation of the Company.

In case the Board fails to appoint the first auditor, it shall intimate the shareholders who shall appoint the first auditor within 90 days at an Extraordinary General Meeting. The first auditor shall hold office till the conclusion of the first annual general meeting.

In the case of a government company or a company owned/controlled by the Central Government or State Government(s), the first auditor is appointed by the Comptroller and Auditor-General of India (CAG) within sixty days of the company’s registration.If the CAG fails to appoint the first auditor within the specified time, the company’s Board of Directors shall appoint the first auditor within the next thirty days.If the Board of Directors fails to appoint the first auditor within the given time, it must inform the members.

Subsequently, the members shall appoint the first auditor within sixty days of receiving this information, at an extraordinary general meeting.The first auditor shall hold office till the conclusion of the first annual general meeting.

Read more: Compliances for Private Limited Companies

Why is an auditor required to be appointed in a Company?

An auditor is required to be appointed for several reasons, which serve to safeguard the interests of stakeholders and ensure the reliability and accuracy of a company’s financial reporting. Here are some key reasons why an auditor is required:

Fair and Unbiased Opinion

Auditors play a critical role in ensuring the credibility and reliability of a company’s financial statements by providing a fair and unbiased opinion. This opinion strengthens trust among stakeholders in the accuracy of the financial information disclosed.

Compliance

Companies are legally required to have their financial statements audited annually to comply with regulatory requirements. Every Company must get its books of accounts audited by a statutory auditor i.e. statutory audit is compulsory.

This is often mandated by company law to protect and maintain the integrity of the shareholders who have provided capital to the company for running the business.

Stakeholder Confidence

Audited financial statements provide assurance to stakeholders, such as shareholders, creditors, and potential investors, about the accuracy and reliability of the company’s financial performance and position. This fosters trust and confidence in how the company conducts its business affairs.

Detection of Errors and Fraud

Auditors are trained to identify errors, irregularities, and instances of fraud in financial statements. Their examination can uncover discrepancies or fraudulent activities that may otherwise go undetected, thereby promoting transparency and accountability within the organization.

Risk Management

Auditors assess the internal controls and risk management processes of a company as part of their audit procedures. Their findings can help management identify weaknesses in controls and implement measures to mitigate risks effectively.

Legal and Contractual Requirements

In some cases, audited financial statements are required by lenders, creditors, or regulatory bodies as a condition for obtaining finance, complying with loan covenants, or fulfilling contractual obligations.

Tax Compliance

Audited financial statements may also be necessary for tax compliance purposes, as they provide a reliable basis for calculating taxable income and complying with tax regulations.

Overall, the appointment of an auditor serves to promote transparency, accountability, and confidence in the financial reporting process, benefiting both the company and its stakeholders.

Who can be an Auditor?

Section 141 of the Companies Act 2013 addresses the eligibility, qualifications, and disqualifications of auditors. This section lays down the criteria that individuals or firms must meet to be eligible and also outlines the qualification for appointment as auditors of a company. It specifies the circumstances under which the auditors be disqualified from holding office as auditors.

i. Eligibility and Qualifications

- Individual

An individual can be appointed as an auditor of a company only if he is a chartered accountant with a valid certificate of practice under the Chartered Accountants Act, 1949.

- Firm

A firm can be appointed as an auditor of a company only if the majority of its partners practicing in India are qualified for the appointment i.e. they hold the designation of Chartered Accountants.

In cases where a firm, including a Limited Liability Partnership (LLP), is selected as the auditor of a company, only the partners who hold the designation of chartered accountants are authorized to represent and sign on behalf of the firm.

ii. Disqualifications

The following persons shall be considered ineligible for appointment as auditor of the Company:

(a) Anybody corporate except LLP;

(b) An officer or employee of the company;

(c) A person who is a partner, or employee of an officer or employee of the company;

(d) A person who himself or his partner or relative is

- holding any security or interest in the Company subsidiary, or of its holding or associate company or a subsidiary of such holding company; However, a relative of an auditor may hold securities in the company of face value not exceeding Rs. 1,00,000/-.

- is indebted to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company in excess of Rs 5,00,000 or

- has given a guarantee or provided any security in connection with the indebtedness of any third person to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company in excess of Rs 1,00,000

(e) a person or a firm who, whether directly or indirectly, has a business relationship with the company, or its subsidiary, or its holding or associate company or subsidiary of such holding company or associate company; The term “business relationship” covers all commercial transactions except professional services permitted for auditors and transactions at arm’s length prices, like ordinary business sales to the auditor.

(f) A person whose relative is serving as a director or key managerial personnel of the Company;

(g) A person in full-time employment elsewhere or a person or partner holding auditor appointments in over twenty companies other than one person companies, dormant companies, small companies and private companies having paid-up share capital less than Rs 100 Crores;

(h) A person convicted of fraud by a court of offense and a period of 10 years has not passed;

(i) A person rendering services specified in section 144, directly or indirectly to the company or its holding company or its subsidiary company.

If an appointed auditor incurs any of the disqualifications after appointment, they must vacate their position, considered a casual vacancy.

Conditions for Appointment of Auditor

i. Written consent and certificate from the auditors

Before the appointment of the auditor is made, the company is required to obtain written consent of the (proposed) auditor to such appointment. The company must also obtain a certificate from the proposed auditor confirming that the appointment, if made, will adhere to the conditions outlined in Rule 4 of the Companies (Audit and Auditors) Rules, 2014 which are as follows:

(a) The individual or firm is eligible for appointment and not disqualified under the Chartered Accountants Act, 1949, and related rules or regulations.

(b) The proposed appointment complies with the term provided under the Act.

(c) The proposed appointment falls within the limits prescribed by or under the authority of the Act.

(d) The list of proceedings against the auditor, audit firm, or any partner of the audit firm related to professional conduct matters, as disclosed in the certificate, is accurate and truthful.

Additionally, the certificate should indicate whether the auditor meets the criteria outlined in Section 141 of the Companies Act, 2013, regarding eligibility, qualifications, and disqualifications of auditors.

ii. Auditor not to render certain services

An auditor appointed under the Companies Act, 2013 may offer such services to the company only upon approval by the Board of Directors or the audit committee, as applicable. However, these services must not include the following, whether provided directly or indirectly to the company, its holding company, or subsidiary company:

(a) Accounting and bookkeeping services;

(b) Internal audit;

(c) Design and implementation of any financial information system;

(d) Actuarial services;

(e) Investment advisory services;

(f) Investment banking services;

(g) Rendering of outsourced financial services;

(h) Management services; and

(i) Any other services as may be prescribed

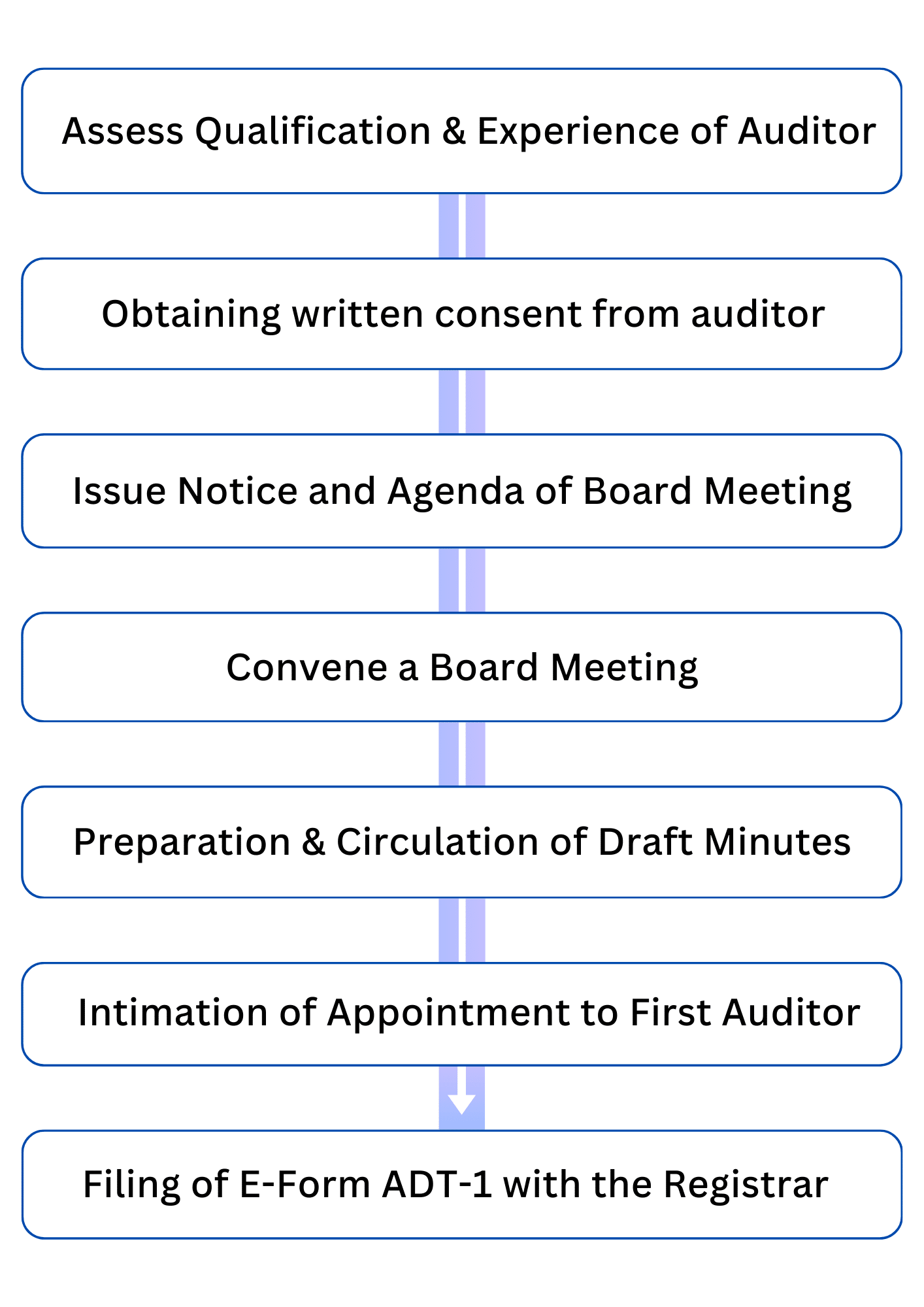

Procedure for Appointment of First Auditor at Board Meeting

Assess Qualification and Experience of the Auditor

The Board of Directors must assess the qualifications and experience of the individual or firm being considered for auditor appointment, ensuring they align with the company’s size and needs. Additionally, the Board should consider any ongoing professional conduct proceedings against the proposed auditor by the Institute of Chartered Accountants of India or relevant authorities. Furthermore, Board has the authority to request additional information from the proposed auditor if necessary.

Obtaining written consent from the auditor

Before the appointment is finalized, a written consent from the proposed auditor agreeing to the appointment and a certificate confirming compliance with the conditions prescribed under Rule 4 of the Companies (Audit and Auditors) Rules, 2014 must be obtained.

Issue Notice and Agenda of Board Meeting

Prepare and issue notice calling Board Meeting to all the directors at least seven days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means.

Convene a Board Meeting

Conduct a Board Meeting within 30 days of incorporation of the Company and pass Board Resolution for appointing the first auditor who shall hold office till the conclusion of the First Annual General Meeting and fix remuneration.

Preparation and Circulation of Draft Minutes

The draft minutes should be prepared and circulated to all directors for their review and comments within 15 days from the conclusion of a board meeting. Directors are required to provide their comments, if any, within 7 days from the date of circulation of the draft minutes.

Intimation of Appointment to First Auditor

The First Auditor must be intimated of his appointment at the Board Meeting by providing a formal appointment letter signed by any one director authorized.

Filing of E-Form ADT-1 with the Registrar

Notice of Appointment of First Auditor can be filed by the Company in E-Form ADT 1 with the Registrar within 15 days of the board meeting in which the auditor is appointed.

Procedure for Appointment of First Auditor at Extraordinary General Meeting

When the Board fails to appoint the first auditor within 30 days of the company’s registration, it is required to inform the members of the company about this failure. In such a scenario, the following procedure is to be followed:

Obtaining written consent from the auditor:

Before the appointment is finalized, a written consent from the proposed auditor agreeing to the appointment and a certificate confirming compliance with the conditions prescribed under Rule 4 of the Companies (Audit and Auditors) Rules, 2014 must be obtained.

Issue Notice and Agenda of Board Meeting:

Prepare and issue a notice in writing calling Board Meeting to all the directors at least seven days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means.

Convene a Board Meeting

Hold a meeting of the Board of Directors to recommend the appointment of the first auditor and fix the day, date, place, and time of the Extraordinary General Meeting of the members for the appointment of the first auditor which shall be held within 90 days of Board’s information of failure to appoint first auditor and approve the notice of the meeting.

Prepare and Issue Notice of Extraordinary General Meeting :

Prepare and issue a notice in writing calling an Extraordinary General Meeting by giving at least 21 days’ clear notice to all the members by hand or by ordinary post or by speed post or by registered post or by courier or by facsimile or by e-mail or by any other electronic means. An explanatory statement must be annexed with the Notice of the meeting.

Convening of Extraordinary General Meeting:

Convene an extraordinary general meeting and pass an Ordinary resolution for appointing the first auditor who shall hold the office till the conclusion of the First Annual General Meeting and fix the remuneration.

Preparation and entering of EGM minutes:

Minutes of Extra-Ordinary Meeting shall be prepared, entered, and signed in the Minutes Book within thirty days from the date of conclusion of the Meeting as per Section 118 of the Companies Act 2013 and Secretarial Standards 2.

Intimation of Appointment to First Auditor;

The First Auditor must be intimated of his appointment at the Extraordinary Meeting by providing a formal appointment letter signed by any one director authorized.

Filing of E-Form ADT-1 with the Registrar:

Notice of Appointment of First Auditor can be filed by the Company in E-Form ADT 1 with the Registrar within 15 days of the Extraordinary General Meeting in which the auditor is appointed.

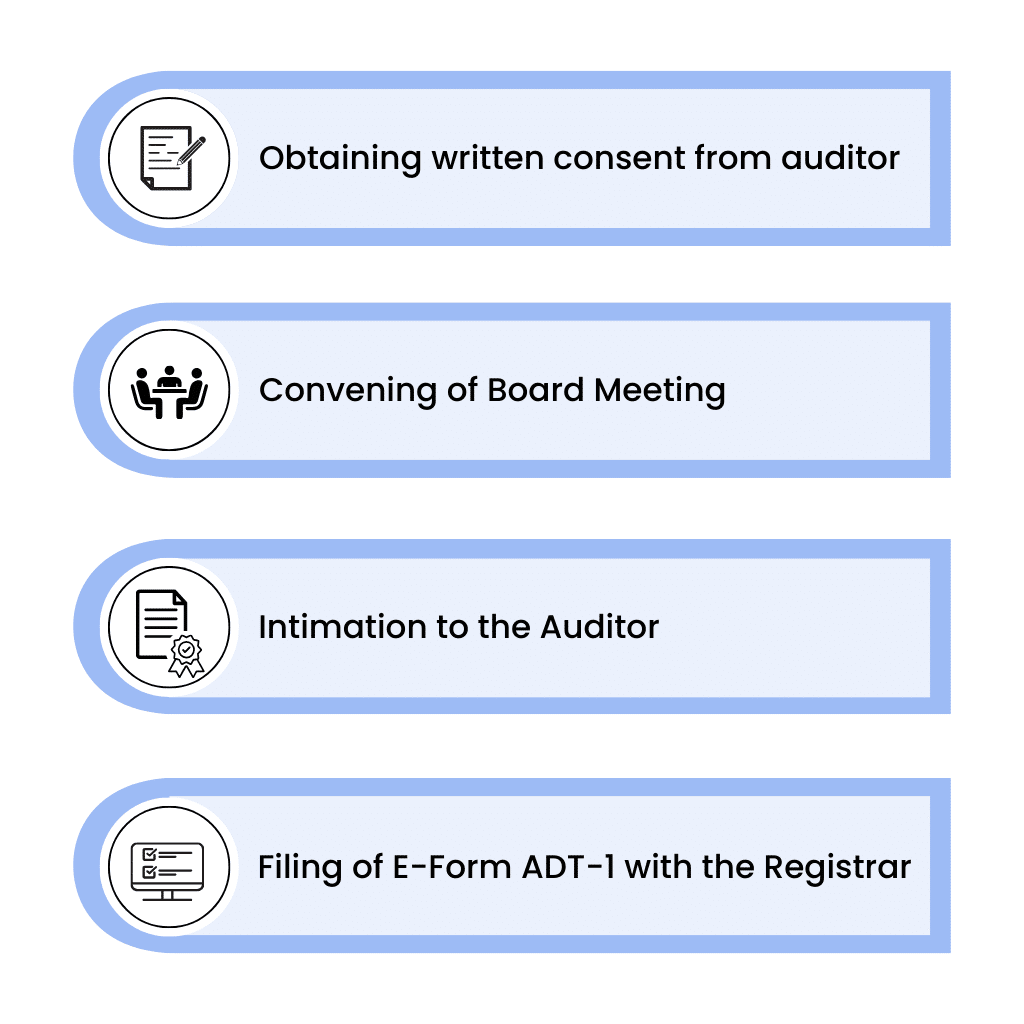

Procedure for Appointment of First Auditor for Government Companies

The Comptroller and Auditor-General of India (CAG) fails to appoint: In the case of Government Companies, CAG is tasked with appointing the first auditor within sixty days of the company’s registration. If the CAG fails to do so within this timeframe, the following steps are required to be taken:

Obtaining written consent from the auditor

The company must obtain a written certificate from the proposed auditor, affirming their eligibility and consent to be appointed as the company’s auditor.

Convening of Board Meeting

Within 30 days of being informed of the CAG’s failure to appoint the first auditor, the company must convene a Board meeting. Notice of this meeting must be provided to all directors in accordance with section 173 of the Companies Act. During this meeting, a resolution is passed to appoint the first auditor and determine their remuneration.

Intimation to the Auditor

The company then informs the first auditor of their appointment, providing them with a certified copy of the resolution passed by the Board.

Filing of E-Form ADT-1 with the Registrar

Notice of Appointment of First Auditor can be filed by the Company in E-Form ADT 1 with the Registrar within 15 days of the board meeting in which the auditor is appointed.

If the Board of Directors fails to appoint

The Board, upon failing to exercise its power to appoint the first auditor within 30 days of being notified of the CAG’s failure, must inform the company’s members about this failure. Subsequently, the following steps are taken:

Convening of Board Meeting:

Convene a Board meeting to discuss the matter, determine the date, time, and venue of an extraordinary general meeting (EGM), within 60 days from the Board’s notification of the failure to appoint the first auditor, and approve the notice of the meeting.

Prepare and Issue Notice of Extraordinary General Meeting :

Issue a notice of the extraordinary general meeting to all members of the company.

Convening of Extraordinary General Meeting:

Hold the extraordinary general meeting and pass an ordinary resolution to appoint the first auditor.

Intimation to the Auditor:

Immediately inform the appointed auditor of their appointment, providing them with a certified copy of the resolution passed during the meeting.

Filing of E-Form ADT-1 with the Registrar:

Notice of Appointment of First Auditor can be filed by the Company in E-Form ADT 1 with the Registrar within 15 days of the Extraordinary General Meeting in which the auditor is appointed.

Points to be Noted

a. It is important to note filing of E-Form ADT-1 for the appointment of the first auditor is not obligatory. The company may opt to file the form for better corporate governance and internal records. The first auditor appointed shall audit the accounts from the date of incorporation up to the date of closure of the first financial year.

b. E-Form ADT 1 is mandatorily required to be filed for appointment of subsequent auditor at the annual general meeting/ in case of casual vacancy of auditor.

c. Government (ROC) Fees for filing E-Form ADT 1 with the Registrar:

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

In the case of a company without share capital, the fee applicable is Rs 200.

4. Additional government (ROC) fees in case of delay in filing E-Form ADT-1:

| Period of delays | Additional fees as a multiple of normal fees |

| Upto 15 days | One time |

| More than 15 days and up to 30 days | 2 times of normal filing fees |

| More than 30 days and up to 60 days | 4 times of normal filing fees |

| More than 60 days and up to 90 days | 6 times of normal filing fees |

| More than 90 days and up to 180 days | 10 times of normal filing fees |

| Beyond 180 days | 12 times of normal filing fees |

Details and Documents Checklist

Following is the broad list of details and documents required for filing E-Form ADT-1:

| Sr.No | Documents |

| 1. | PAN of the Auditor |

| 2. | Membership No / Firm Registration No of the Auditor |

| 3. | Complete Address of the Auditor |

| 4. | Email Id of the Auditor |

| 5. | Certified Copy of Board Resolution for appointment of First Auditor |

| 6. | Copy of Notice of General Meeting along with Explanatory Statement |

| 7. | Certified Copy of Ordinary Resolution passed at the General Meeting for appointment of First Auditor |

| 8. | Copy of Appointment letter by the company to the auditor |

| 9 | Copy of written consent by the auditor, in regard with eligibility u/s 141 of the Companies Act 2013 |

| 10. | Digital Signature Certificate of any one director |

Conclusion

The appointment of the First Auditor is a critical step for any company upon its incorporation. Auditors are professionals appointed to review and assess the financial records and statements of a company. Auditors play a crucial role by providing an Auditor’s Report, which is submitted to the members of the company as per Section 143 of the Companies Act. This report serves to communicate the auditor’s findings and opinions on the financial statements, ensuring transparency and accountability to the company’s stakeholders.

Our team at Registration Arena is highly experienced in ensuring smooth adherence to all legal and procedural requirements associated with appointing the First Auditor.

To get in touch with us, Please 📞 Contact Us