What is Dematerialisation?

Dematerialisation of shares means storing shares electronically instead of in paper form. This process involves converting physical share certificates into electronic records, requiring the opening of a Demat Account. It’s akin to placing money in a bank account. Depositories, such as the National Securities Depository Ltd (NSDL) and the Central Depository Services Limited (CDSL) in India, facilitate this process by electronically storing securities for clients through Depository Participants. Acting as intermediaries, Depository Participants bridge the gap between clients and depositories.

The Ministry of Corporate Affairs (MCA) recently implemented changes affecting the regulations governing securities of Private Limited Companies. Previously, only public companies were mandated to provide shares in Demat form to shareholders. However, a significant notification, the “Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023,” issued on October 27, 2023, extends this requirement to Non-Small Private Limited Companies.

These companies are now obligated to dematerialize existing securities within eighteen months from the end of their financial year ending March 31, 2023, and ensure that all future issuances or transfers are conducted exclusively in Demat form. This alteration aims to improve transparency, safeguard investor interests, and strengthen corporate governance.

Regulatory Background

The MCA has made a significant amendment by extending the requirement for the dematerialization of securities to private companies. Securities include shares, scrips, stocks, bonds, debentures, debenture stock, or other marketable securities of a like nature in or of any incorporated company.

Under the Companies Act of 2013, it was obligatory for all listed companies to have their shares and other securities in dematerialized form for seamless trading on stock exchanges. However, the MCA, through a notification dated September 10, 2018, introduced Rule 9A in the Companies (Prospectus and Allotment of Securities) Rules, 2014 (PAS Rules), mandating every unlisted public company to maintain and issue securities solely in dematerialized form.

As per Section 29 of the Companies Act, 2013, the companies making a public offer and any other class or classes of public companies as may be specified must issue securities solely in dematerialized form. The term “public” was removed from the list of such classes of companies by MCA Notification dated August 14, 2019, effective from August 15, 2019. It was anticipated that the government may prescribe certain classes or classes of private companies for compulsory dematerialization of securities.[1]

Recently, through Rule 9B of the Companies (Prospectus & Allotment of Securities) Second Amendment Rules, 2023 (the “Present Amendment”), the MCA has extended mandatory dematerialization to private companies other than small companies. A small company is a private company which meets the below-mentioned criteria:

Condition 1: The paid-up capital of the company should not exceed INR 4 Crores; and

Condition 2: The turnover of the company should not exceed INR 40 Crores.

There are certain types of companies, even if they meet both conditions mentioned above, that are not eligible to be classified as small companies. These include:

- A public company

- A holding company

- A subsidiary company

- A company registered under Section 8

- A company governed by any specific act.

In this article, we shall explore the advantages of dematerialization, compliance checklist, procedural aspects, FAQs on dematerialization of shares for private limited companies, etc.

Advantages of Dematerialisation

Dematerialization simplifies the way securities are held, making it economical, time-efficient, and user-friendly. It brings various advantages:

Reduced Risk

Holding securities electronically mitigates risks associated with physical certificates, such as theft, loss, damage, or forgery.

Increased Efficiency

Dematerialization streamlines the process of trading securities, enabling quicker transactions and settlements compared to traditional paper-based methods.

Cost Savings

Eliminating the need for physical certificates and paperwork reduces administrative costs, including storage, handling, and postage expenses.

Enhanced Accessibility

Electronic securities are easily accessible and transferable, allowing investors to manage their portfolios conveniently through online platforms.

Convenience

Investors can buy, sell, and transfer securities electronically from anywhere with internet access, reducing the need for physical presence at trading venues.

Improved Transparency

Dematerialization enhances transparency in the securities market by providing real-time access to transaction records and ownership details.

Environmental Sustainability

By reducing paper usage and eliminating the need for physical storage, dematerialization contributes to environmental conservation efforts.

Facilitates Collateralization

Electronic securities can be used as collateral for loans more efficiently than physical certificates, simplifying lending processes for investors.

Regulatory Compliance

Dematerialization helps in complying with regulatory requirements by maintaining accurate and auditable records of securities transactions.

Enhanced Security

Digital securities benefit from robust security measures, including encryption and access controls, safeguarding them against unauthorized access or fraudulent activities.

Overall, dematerialization offers numerous benefits, including reduced risk, increased efficiency, cost savings, and improved accessibility, making it a preferred choice for investors and market participants alike.

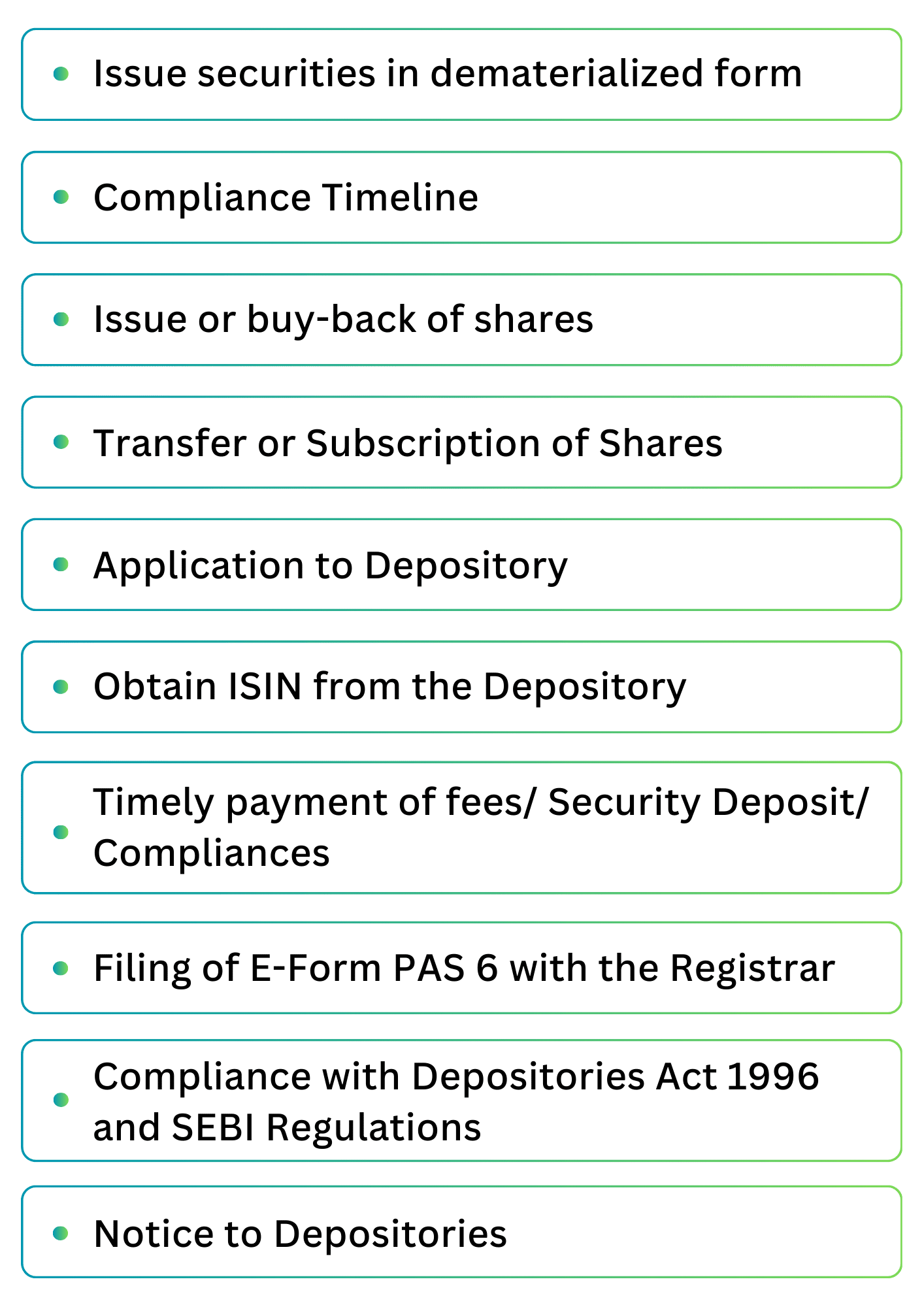

Compliance Checklist for dematerialisation of shares by private companies

Issue securities in dematerialized form

Every private company, except small companies, is required to issue securities only in dematerialized form and facilitate the dematerialisation of all their securities as per the Depositories Act, 1996, and related rules within a prescribed timeline.

Compliance Timeline

A private company, not qualifying as a small company according to its audited financial statements as of or after 31st March 2023, shall dematerialize its securities within 18 months from the closure of such a financial year. The date on which dematerialisation shall be mandatory is 30th September 2024.

Issue or buy-back of shares

Every private company that is required to dematerialize its securities before making such an offer to issue securities, buy back securities, issue bonus shares, or rights offer after the compliance date of this rule i.e 30th September 2024 must ensure that all the securities held by its promoters, directors, and key managerial personnel have been dematerialized in accordance with the Depositories Act, 1996, and its related rules.

Transfer or Subscription of Shares

Every holder of securities in such private companies must dematerialize their securities before transferring them or subscribing to new securities through private placement, bonus shares, or rights offer after the compliance date i.e 30th September 2024

Application to Depository

Such a private company needs to submit an application to a depository, as defined in Section 2(1) (e) of the Depositories Act, 1996, to enable the dematerialization of its current securities. A “depository” refers to a company established and registered under the Companies Act 2013 and has obtained a registration certificate under section 12(1) (A) of the Securities and Exchange Board of India Act, 1992.

Obtain ISIN from the Depository

ISIN stands for International Securities Identification Number, a unique 12-digit alphanumeric code assigned to each security (e.g., INE0C5F04018). Different ISINs are allocated for various types of securities, such as fully paid-up equity shares, partly paid-up equity shares, equity shares with differential voting rights, and preference shares.ISIN must be obtained by such a private Company from the depository for each type of security and inform all its current security holders about this facility.

Timely payment of fees/ Security Deposit/ Compliances

Such private companies must ensure that:

(a) Timely payment of fees (both admission and annual) is made to the depository and registrar to issue and share transfer agent as per the agreement between them.

(b) A security deposit equivalent to at least two years’ fees is maintained with the depository and registrar to an issue and share transfer agent, as agreed upon.

(c) It complies with the regulations, directions, guidelines, or circulars issued by the Securities and Exchange Board or Depository concerning the dematerialization of shares and related matters.

Filing of E-Form PAS 6 with the Registrar

Such private companies are required to submit E-Form PAS-6 (Reconciliation of Share Transfer Audit) to the Registrar within 60 days after the conclusion of each half-year. This form must be duly certified by either a practicing company secretary or a practicing chartered accountant.

Compliance with the Depositories Act 1996 and SEBI Regulations

The dematerialization of securities of private companies is subject to the provisions of the Depositories Act, 1996, the SEBI (Depositories and Participants) Regulations, 2018, and the SEBI (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 with necessary modifications.

Notice to Depositories

The company shall forthwith notify the depositories of any discrepancies between the total capital it issued and the capital held in dematerialized form.

Procedure for dematerialisation of shares by the Company

Provision in the Articles of Association

The company must ensure that its articles of association include a provision authorizing the dematerialization of its shares. If such a provision is not present, the company must amend its articles through a special resolution passed in a general meeting, as per Section 14 of the Companies Act, 2013. Following this, it must adhere to the regulations outlined in the Depositories Act, 1996, and the SEBI (Depositories and Participants) Regulations, 1996, for the dematerialization process of its shares.

Selection of Depository Participant (DP) through Depository and Registrar/Share Transfer Agent

After amending its articles of association to include a provision authorizing the dematerialisation of its shares, the company intending to dematerialize any of its aforementioned shares must then proceed by selecting a DP from among the registered DPs authorized by the depositories, such as NSDL (National Securities Depository Limited) or CDSL (Central Depository Services Limited) and Registrar/Share Transfer Agent i.e. Registrar to the Issue in case of new issue and Share Transfer Agent in case of transfer of shares. A list of registered DPs can be accessed on the NSDL website or the CDSL website.

Notice of Board Meeting

Prepare and issue notice calling Board Meeting atleast 7 days before the meeting as prescribed in Sec 173(3) of the Companies Act 2013 and Secretarial Standard 1 on Board meetings.

Convening a Board Meeting

Conduct a Board Meeting for the following:

- Approving dematerialisation of shares of the company, the appointment of Depository (NSDL/CDSL)/ Depository Participant and Registrar/Share Transfer Agent i.e. Registrar to the Issue in case of new issue and Share Transfer Agent in case of transfer of shares

- Granting authority to any person to file an application, sign documents, and enter into agreements for the dematerialization of shares.

Basic Documents and Details

- Certificate of Incorporation of the Company

- Memorandum and Articles of Association of the Company

- PAN and GST Registration Certificate of the Company.

- Certified true copy of the Board Resolution approving dematerialization of shares and appointing persons for the operation of demat account and execution of documents

- List of Authorized Signatories along with specimen signature

- Latest List of Directors and Shareholders of the Company

- Latest Audited Financial Statements of the Company

- Net worth certificate from a Chartered Accountant

- PAN and Aadhaar Card Copy of Directors & Authorised Signatory.

- Email ID, Contact Number, and Name of Authorised Signatory.

- Undertaking by the Company in the prescribed format

- Any other details/ documents as required

Entering into a Tripartite Agreement

The depository shall enter into a tripartite agreement with the company and the registrar or share transfer agent, as appropriate with respect to the shares identified by the depository as suitable for holding in dematerialised form.

Issue of ISIN

Upon receiving the application along with the necessary documents, the Depository will enable the dematerialisation of shares and Issue an International Securities Identification Number (ISIN) for each security.

Communication with Shareholders

The shareholders must be informed by the Company about their decision to dematerialize shares and provide guidance on the process. The shareholders must be provided guidance by the Company for opening their demat account with a Depository Participant (DP). The process of opening a demat account by a shareholder is enumerated below in detail.

Dematerialisation of Shares

After the opening of a demat account by both the company and the shareholder, the shareholders shall surrender their share certificates to the company, which in turn notifies the depository participant. Once the company receives the share certificates from its shareholders, it must proceed to cancel the certificates, a process known as the dematerialization of shares.

Updation of records

The company shall then update its records by replacing the shareholder’s name with the depository as the registered owner of those shares and inform the depository participant accordingly. After receiving the information from the Company, the depository participant informs the depository to update its records by entering the names of the shareholders as the beneficial owners of the shares.

Subsequently, the depository participant informs the company, which, in turn, informs the shareholders that their shares have been dematerialized and their names have been recorded in the depository’s electronic records as beneficial owners of the shares, Section 6(3) of the Depositories Act, 1996.

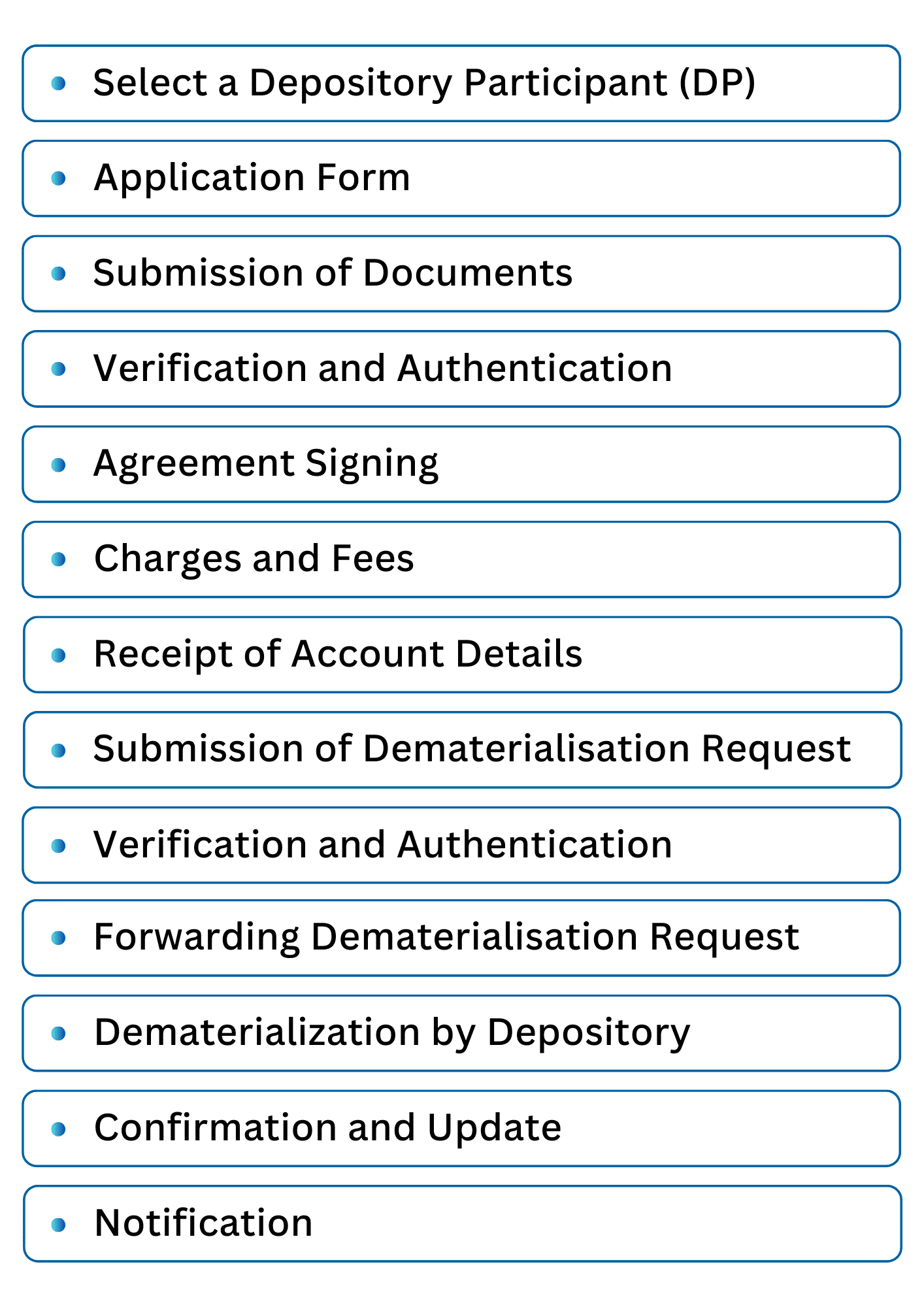

Dematerialisation of shares process for shareholder

Select a Depository Participant (DP)

Shareholders need to select a DP from among the registered DPs authorized by the depositories, such as NSDL (National Securities Depository Limited) or CDSL (Central Depository Services Limited). They can choose a DP based on factors like reputation, service quality, charges, and convenience.

Application Form

Shareholders obtain the Demat account opening form either online from the DP’s website or by visiting the DP’s office directly. They fill out the form with accurate details including personal information, bank account details, nominee details, and other necessary information.

Submission of Documents

Shareholders need to provide certain documents as per the KYC (Know Your Customer) norms. These typically include:

- Identity proof: PAN card, Aadhar card, passport, voter ID, etc.

- Address proof: Aadhar card, passport, utility bills, etc.

- Passport size photographs

- Bank account details

Verification and Authentication

The DP verifies the documents submitted by the shareholder. This may involve physical verification of original documents or online verification in some cases.

Agreement Signing

Shareholders will be required to sign an agreement with the DP, which outlines the terms and conditions of the Demat account opening and operation.

Charges and Fees

Shareholders should be aware of the charges and fees associated with opening and maintaining the Demat account. These may include account opening charges, annual maintenance charges, transaction charges, and other service charges.

Receipt of Account Details

Once the account is successfully opened and all documents are verified, the DP provides the shareholder with the Demat account number (similar to a bank account number) and other account details.

Submission of Dematerialisation Request

Shareholders fill out a dematerialisation request form provided by their DP and submit it along with the physical share certificates they wish to dematerialize.

Verification and Authentication

The DP verifies the documents submitted by the shareholder and ensures they meet the dematerialization requirements.

Forwarding Dematerialisation Request

Once verified, the DP forwards the dematerialization request along with the physical share certificates to the respective depository (NSDL or CDSL).

Dematerialisation by Depository

The depository processes the dematerialization request and converts the physical shares into electronic form. The electronic shares are then credited to the shareholder’s Demat account.

Confirmation and Update

The DP updates the shareholder’s Demat account with the dematerialized shares and provides a statement confirming the dematerialisation.

Notification

The shareholder receives notifications confirming the successful dematerialization of their shares.

By following these steps, shareholders can convert their physical share certificates into electronic form, making transactions more convenient and secure.

Conclusion

To promote transparency, safeguard investor interests, and bolster corporate governance, the Ministry of Corporate Affairs (MCA) announced the introduction of the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 (PAS Amendment Rules) on October 27, 2023. According to this amendment, private companies (excluding small companies) are required to dematerialize their existing securities within a specified timeframe and issue new securities exclusively in dematerialized form.

We at Registration Arena, having a skilled team of professionals can offer guidance on meeting procedural obligations for the dematerialisation of shares and aid in the timely submission of E-Form PAS 6 (Reconciliation of Share Transfer Audit) to avoid penalties.

To get in touch with us, Please contact us

Frequently Asked Questions

Which companies are subject to mandatory dematerialisation of securities?

Listed Companies, Unlisted Public limited companies, non-small private limited companies, Section 8 Companies, Subsidiary of a Foreign or Indian Company, Producer Companies (non-small), Dormant Company (non-small), a wholly owned subsidiary of a private company, Non- Banking Financial Companies are subject to mandatory dematerialization of securities.

Which companies are outside the purview of dematerialisation?

Nidhi Company, Government Companies, Wholly owned subsidiary of Public Companies, and Small Private Companies are not required to dematerialize their shares.

Whether a private company which is a holding/ subsidiary company of another private company is also covered under dematerialisation?

If a private company is a subsidiary of another private company or is a holding company of another private company, then even if paid-up and turnover falls within the parameters indicated for a small company, it will not be considered as a small company and therefore, will be required to comply with the dematerialization.

What is the deadline for complying with the dematerialisation of shares for private companies?

The Private companies which are not small companies as of 31st March 2023 must comply with the dematerialization of securities within 18 months following the conclusion of the financial year on 31st March 2023. Consequently, the deadline for compliance is scheduled for September 30, 2024.

What are the consequences of not complying with the requirement of dematerialisation?

Consequences of Non-Dematerialisation-

For the Applicable Company:

Failure to dematerialize securities by the deadline i.e. 30th September 2024 restricts the company from making offers for securities, conducting buybacks, or issuing bonus shares or rights offers after 30th September 2024 unless the holdings of promoters, directors, and key managerial personnel are dematerialized.

For Security Holders:

Security holders who fail to dematerialize by the deadline i.e. 30th September 2024 cannot transfer, purchase, or subscribe to any securities of the Applicable Company after the deadline unless their securities are dematerialised.

What is the due date for filing E-Form PAS-6?

E-Form PAS 6 pertains to the reconciliation of the Share Capital Audit Report, mandated for submission by unlisted public companies and private companies to the Registrar of Companies within 60 days following the conclusion of each half-year period. For instance, for the half-year ending on March 31st, the filing deadline is May 30th, and for the half-year ending on September 30th, the deadline is November 29th. Additionally, E-Form PAS 6 must be certified by a Practicing Company Secretary or Practicing Chartered Accountant.

What penalty is imposed for not submitting E-Form PAS 6?

There is no specific penalty outlined for failing to file E-Form PAS 6 under the Companies (Prospectus and Allotment of Securities) Rules, 2014. However, Section 450 of the Companies Act, 2013, will apply. According to Section 450, the company, its officers in default, or any other persons involved will face a penalty of Rs 10,000 initially, and for each subsequent day of non-compliance, an additional penalty of Rs 1,000 will be imposed. The maximum penalty for a company is Rs 2,00,000, and for an officer in default or any other person, it is Rs 50,000.