Introduction

The acronym “CSR” stands for Corporate Social Responsibility. Corporate Social Responsibility is a concept whereby the company considers not just their profits and expansion, but also the well-being of society and the environment by taking responsibility for how their activities affect stakeholders, the environment, consumers, employees, communities, and the broader public.

The main purpose of CSR is to integrate social and environmental concerns in their business operations and interactions with stakeholders. The Companies Act 2013 is legislation that has introduced the concept of CSR as a mandatory provision by specifying CSR Applicability, CSR Committee, CSR Policy, CSR Expenditure, CSR Reporting, etc in detail.

Section 135 of the Companies Act 2013, Companies (Corporate Social Responsibility Policy) Rules 2014, Schedule VII (Activities relating to Corporate Social Responsibility), Companies (Accounts) Rules, 2014, and circulars/clarifications issued by Ministry of Corporate Affairs on Section 135 & Rules made thereunder are the governing provisions relating to Corporate Social Responsibility.

Advantages of CSR

Corporate social responsibility (CSR) enhances a company’s brand reputation, fosters goodwill within the community it operates, not only attracts customers who value ethical practices but also strengthens relationships with stakeholders and investors. The advantages of CSR are enumerated below in detail:

Enhanced Goodwill

The concept of CSR has developed over time and is now employed as a strategic business approach, presenting an opportunity to enhance goodwill, trust, and reputation among customers, employees, and stakeholders.

Competitive advantage

Companies that prioritize CSR often stand out from competitors, attracting customers who prefer socially responsible brands and gaining an edge in the market.

Increased customer loyalty

CSR activities can foster stronger relationships with customers, leading to increased loyalty and growth in business.

Attraction and retention of talent

Companies that engage in CSR initiatives tend to attract and retain top talent who are motivated by the opportunity to work for socially responsible organizations.

Risk management

CSR helps companies identify and mitigate risks related to environmental, social, and governance issues, reducing the likelihood of legal and reputational damage.

Cost savings

CSR initiatives such as energy efficiency measures and waste reduction programs can lead to cost savings over time, improving financial performance.

Access to capital

Investors increasingly consider CSR performance when making investment decisions, and companies with strong CSR credentials may have better access to capital and lower borrowing costs.

Innovation and creativity

CSR encourages companies to think creatively and innovate, leading to the development of new products, services, and business models that benefit society and the environment.

In this article, we shall explore the important definitions relating to CSR, CSR Applicability, CSR Committee, CSR Policy, CSR Implementation, CSR Reporting, CSR Expenditure, CSR Unspent Amount, Website Disclosures, CSR Penal Provisions, etc.

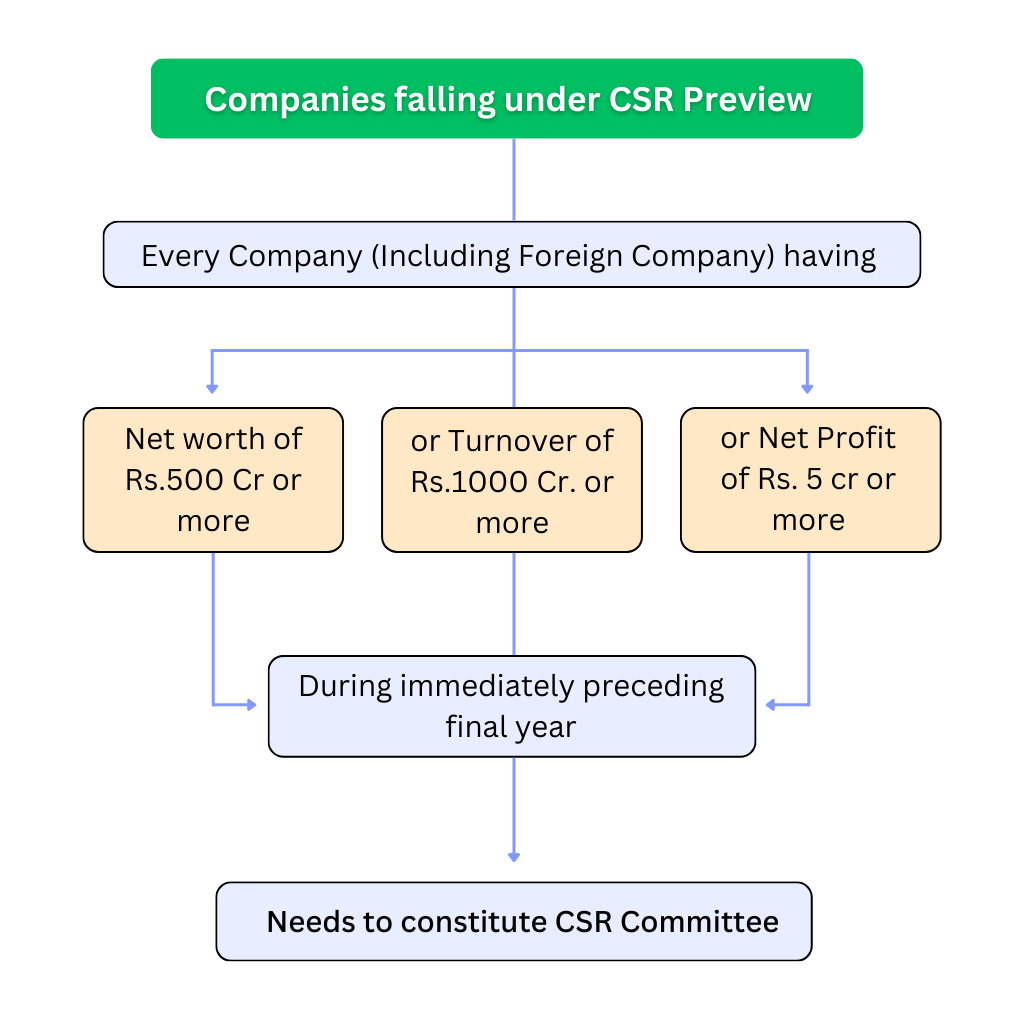

CSR Applicability under the Companies Act 2013

a. Section 135 of the Companies Act 2013 governs the provisions of Corporate Social Responsibility. The Companies fulfilling any of the below-mentioned criteria during the immediately preceding financial year come under the ambit of CSR obligations i.e.

i. Net worth of Rupees five hundred crore or more, or

ii. Turnover of Rupees one thousand crore or more, or

iii. Net Profit of Rupees five crore or more

b. Further as per Rule 3 of the CSR Rules 2014, the holding, subsidiary, and foreign companies having branch office or project office in India, fulfilling the above criteria comes under the purview of CSR Obligations.

c. Net worth means paid-up share capital, reserves generated from profits, securities premium account, and the credit or debit balance of the profit and loss account. From this total, accumulated losses, deferred expenditures, and miscellaneous expenditures not yet written off are subtracted.

However, it does not include reserves resulting from the revaluation of assets, reversal of depreciation, or amalgamation adjustments.

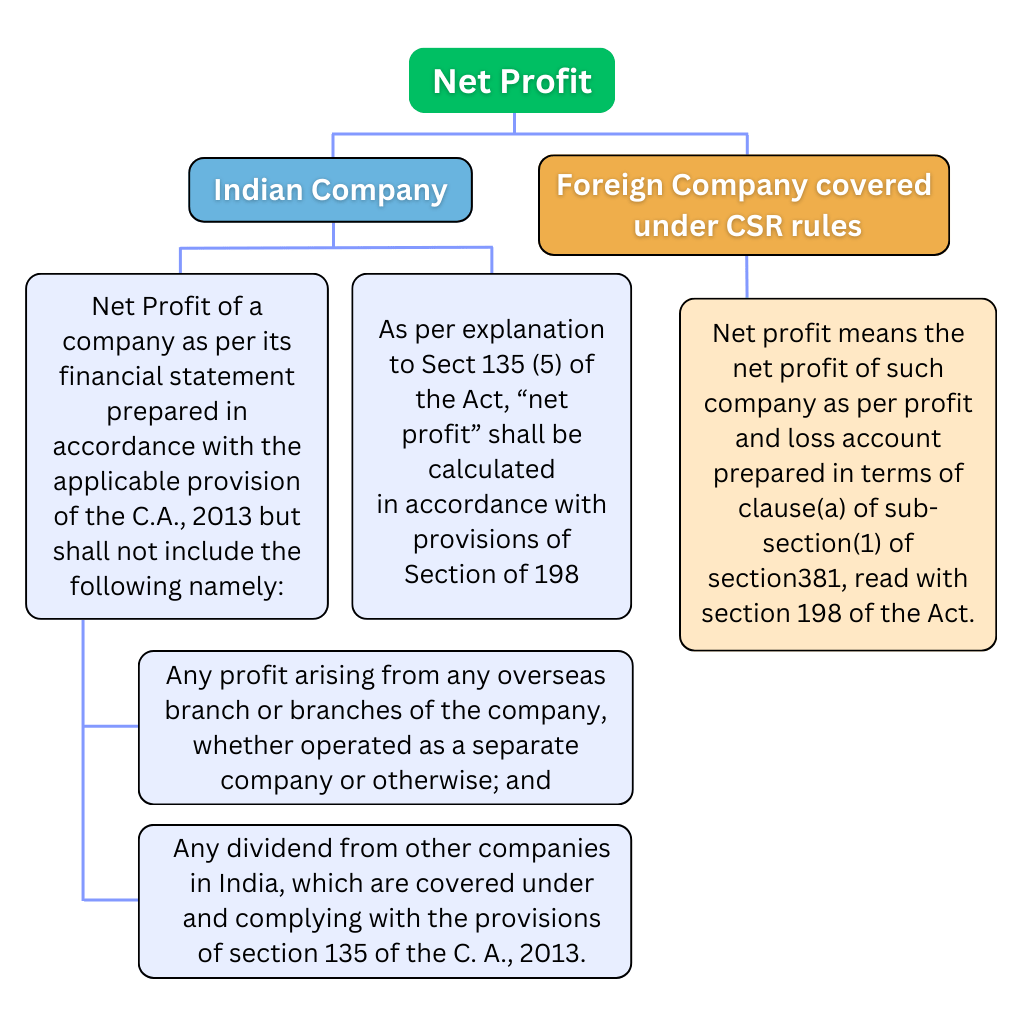

d. Net Profit means the financial statement prepared in accordance with the Companies Act 2013 but does not include any profit from overseas branches and dividends from other companies.

In addition, as per the explanation given under Section 135 (5) of the Companies Act,2013 net profit shall not include such sums as may be prescribed, and shall be calculated in accordance with the provisions of section 198.

Constitution of CSR Committee

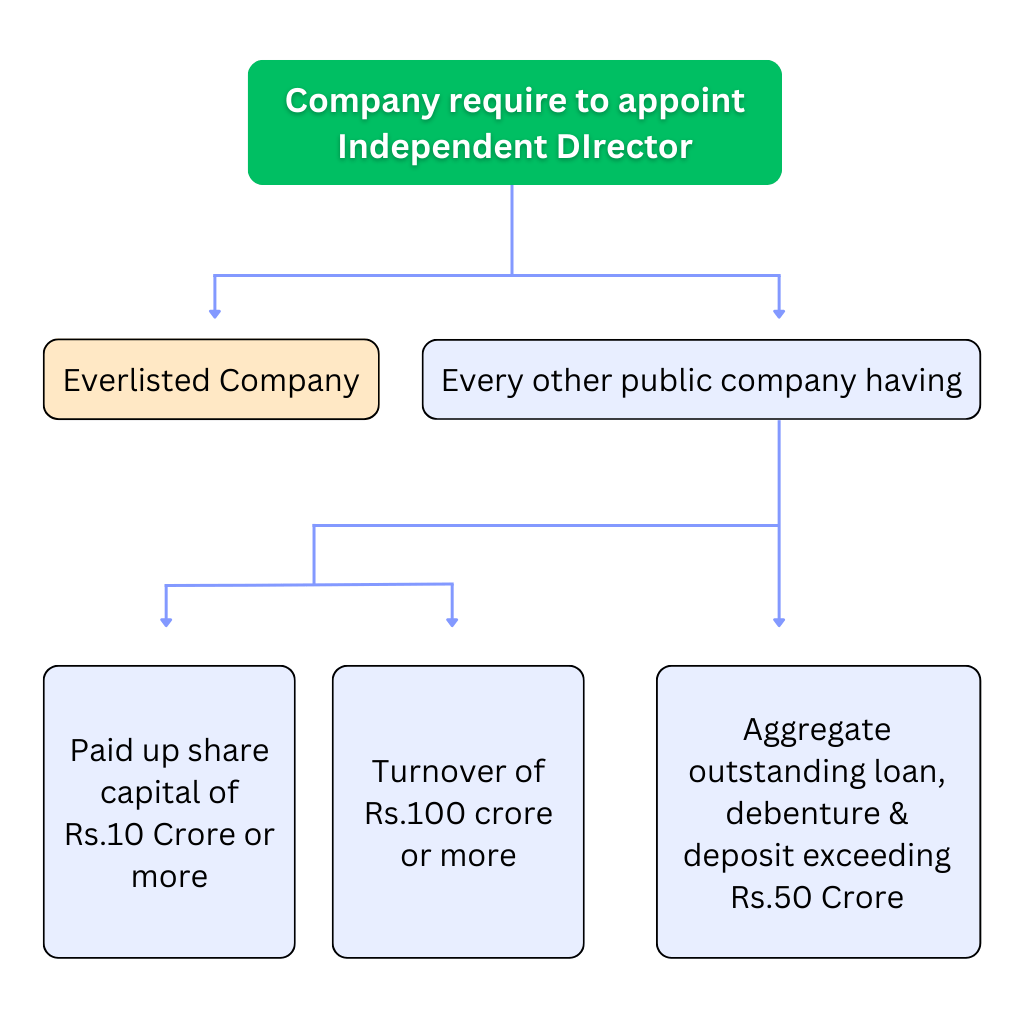

Companies fulfilling the above-mentioned criteria shall Constitute a CSR Committee of the Board to oversee and monitor their Corporate Social Responsibility (CSR) activities. As per Section 135(1) of the Companies Act, 2013, the CSR Committee must consist of three or more Directors, which shall include at least one independent director.

A company that is not required to appoint an independent director shall constitute a Corporate Social Responsibility Committee of two or more Directors.

A private company that has two directors on its Board shall constitute its CSR Committee with two directors. Further, the CSR Committee with respect to a foreign company covered under the Rules shall comprise of at least two persons of which one person shall be resident in India and another person shall be nominated by the foreign company.

CSR Committee shall not be required, if the amount to be spent by a company does not exceed Rs 50,00,000. In such cases, the Board of Directors shall discharge all functions of the CSR Committee. However, a company having any amount in its Unspent Corporate Social Responsibility (CSR) Account shall constitute a CSR Committee and shall comply with the CSR Provisions irrespective of the amount of CSR Spending.

The Board’s report shall disclose the composition of the Corporate Social Responsibility Committee.

The Act does not specify the number of meetings required for the CSR Committee within a year. However, according to Secretarial Standard 1, committees should convene as frequently as necessary, with the minimum number and frequency determined by the Board or as mandated by law or authority.

The law does not specify the quorum required for committee meetings, including the CSR Committee. However, according to Secretarial Standard 1, the presence of all committee members is necessary to establish the quorum for meetings, unless otherwise specified by the Act, other laws, the Articles, or the Board.

CSR Policy

The following are the features of CSR Policy:

- It is a document that outlines the company’s approach to corporate social responsibility (CSR).

- It is developed based on the recommendations of the company’s CSR Committee.

- It provides guidance on selecting, implementing, and monitoring CSR activities.

- It includes guiding principles for CSR initiatives.

- It encompasses the formulation of the annual action plan for CSR activities.

Functions of CSR Committee

The Corporate Social Responsibility Committee shall perform the following functions:

(a) Formulate CSR Policy

Develop and propose to the Board a Corporate Social Responsibility Policy that outlines the activities to be undertaken by the company, focusing on the areas or subjects specified in Schedule VII.

(b) Recommendation of expenditure

Recommend the expenditure amount to be allocated for the activities mentioned in point (a).

(c) Monitor CSR Policy

Regularly monitor the company’s Corporate Social Responsibility Policy to ensure its effectiveness and relevance.

(d) Annual Action Plan

The CSR Committee is required to develop and propose to the Board an annual action plan aligned with its CSR Policy. This plan should include the following components:

(i) A list of approved CSR projects or programs to be undertaken, focusing on areas or subjects specified in Schedule VII of the Act.

(ii) The method of executing these projects or programs.

(iii) The procedures for fund utilization and implementation schedules for the projects or programs.

(iv) A monitoring and reporting mechanism for tracking the progress of the projects or programs.

(v) Details regarding the assessment of needs and impact, if applicable, for the projects undertaken by the company.

The Board has the authority to make alteration in this plan at any point of time during the financial year, upon the recommendation of its CSR Committee, if there is reasonable justification for the alteration.

Functions and Responsibilities of the Board

The Board of every company falling under CSR Criteria shall carry out the following functions:

(a) Approval of CSR Policy

Following consideration of the recommendations put forth by the Corporate Social Responsibility Committee, approve the Corporate Social Responsibility Policy for the company. The contents of this Policy should be disclosed in the company’s report and, if applicable, on its website, in a manner specified by regulations.

(b) Carry out the Activities as per CSR Policy

Ensure that the activities outlined in the Corporate Social Responsibility Policy of the company are carried out.

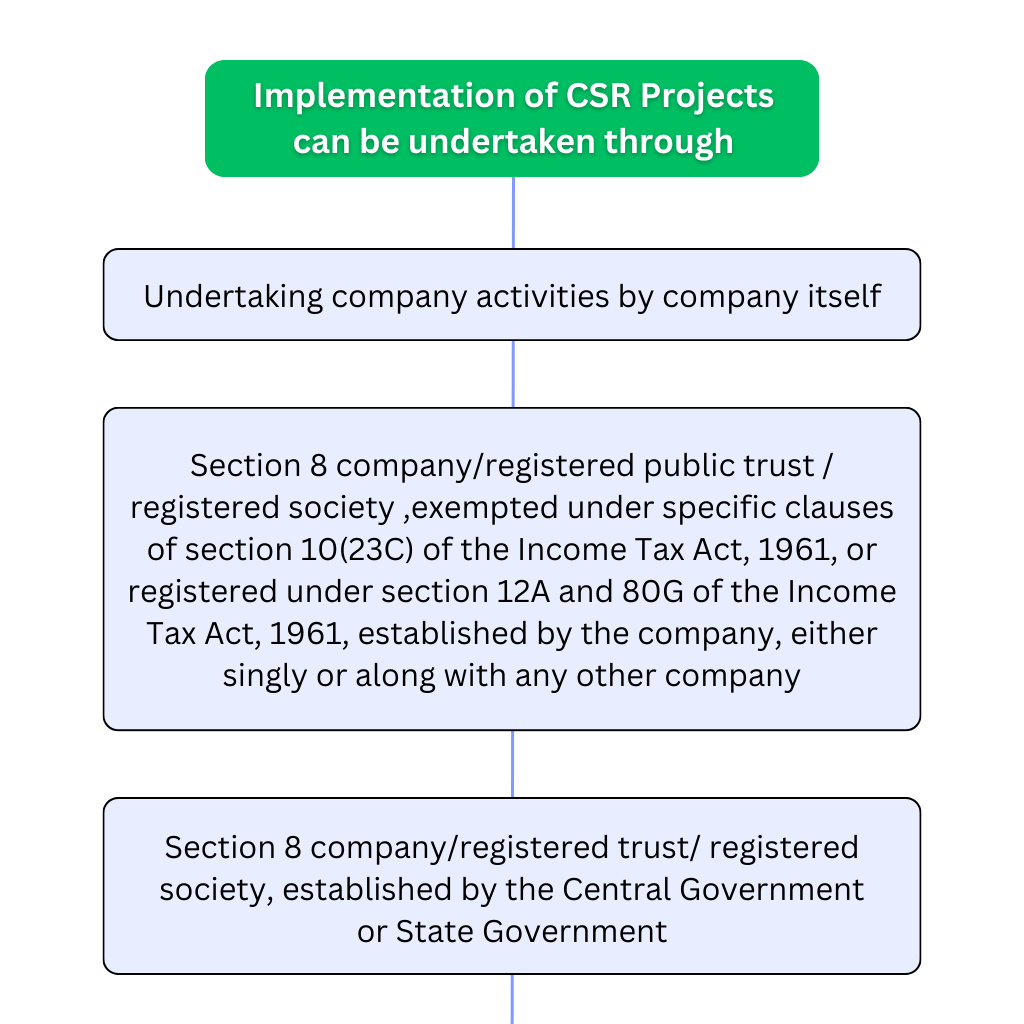

CSR Implementation

CSR Activities Implementation

The Board shall ensure that the CSR activities are undertaken

- By the company itself, or

- Section 8 incorporated under the Companies Act 2013, or a registered public trust, or a registered society exempted under specific clauses of section 10(23C) of the Income Tax Act, 1961, or registered under section 12A and approved under section 80G of the Income Tax Act, 1961 formed by the company itself, either individually or jointly with another company, or

- Section 8 incorporated under the Companies Act 2013, or a registered trust, or a registered society, established by either the Central Government or a State Government, or

- Any entity formed under an Act of Parliament or a State legislature, or

- Section 8 incorporated under the Companies Act 2013, or a registered public trust, or a registered society exempted under specific clauses of section 10(23C) of the Income Tax Act, 1961, and registered under section 12A and approved under section 80G of the Income Tax Act, 1961, and has an established track record of at least three years in engaging in similar activities.

Registration of CSR Entity

Every eligible entity mentioned above (b) to (e) intending to undertake any CSR activity, shall register itself with the Central Government by filing the form CSR-1 electronically with the Registrar, with effect from the 01st day of April 2021:

Certification of Professional

E-Form CSR-1 shall be signed and submitted electronically by the entity and shall be verified digitally by a Chartered Accountant in practice or a Company Secretary in practice or a Cost Accountant in practice.

List of CSR Activities [Schedule VII of the Companies Act, 2013]

Corporate Social Responsibility (CSR) activities are defined according to Schedule VII of the Companies Act,2013 include the following activities but are not limited to:

- Eradicating hunger, poverty, and malnutrition, promoting healthcare, including preventive healthcare and sanitation

- Promoting education, including special education and employment enhancing vocational skills

- Promoting Gender equality, empowering women, and reducing inequalities

- Supporting environmental sustainability, conservation of natural resources, and ecological balance

- Cultural heritage preservation and promotion, including restoration of monuments and sites of historical significance

- Promoting the interests of armed forces veterans, war widows, and their dependents

- Training to promote rural sports, nationally recognized sports, paralympic sports, and Olympic sports

- Contribution to the Prime Minister’s National Relief Fund or any other fund set up by the Central Government for socio-economic development

- Technology incubators, rural development projects, and slum area development

- Disaster management, including relief, rehabilitation, and reconstruction activities

These activities represent the spectrum of CSR initiatives that companies can undertake to fulfill their social responsibility obligations.

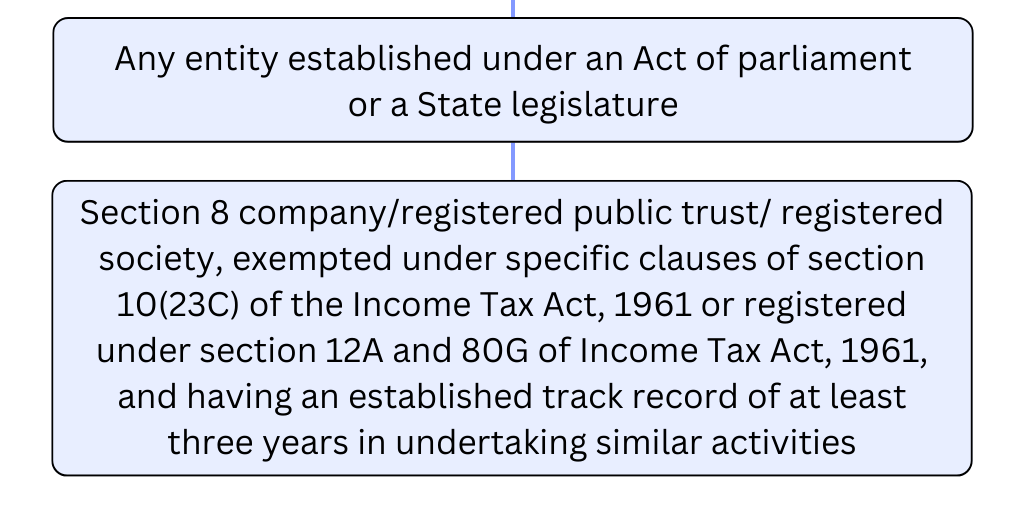

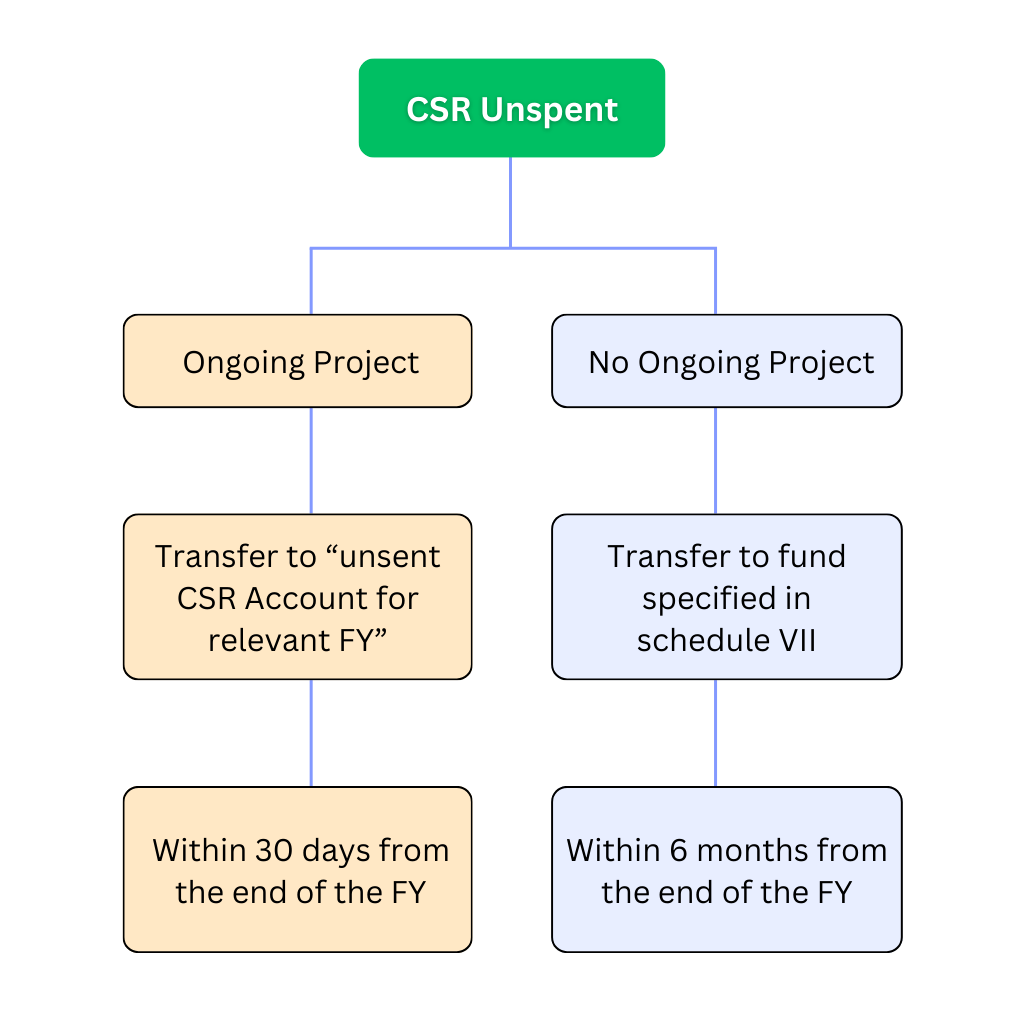

List of Activities not considered as CSR

The following activities shall not be considered CSR:

- Activities are undertaken in pursuance of the normal course of business of the company (except COVID-19 related Research & Development) up to the financial year 2022‐23, subject to certain conditions);

- Any activity undertaken by the company outside India (except for training of Indian sports personnel representing any State or Union territory at national level or India at international level);

- Contribution of any amount directly or indirectly to any political party;

- Activities that significantly benefit the employees of the company;

- Activities supported by the companies on a sponsorship basis for deriving marketing ;

- Benefits for its products or services;

- Activities carried out for the fulfillment of any other statutory obligations under any law in force in India

CSR Expenditure

CSR Spending

The Board of Directors of the company falling under the CSR Criteria shall ensure that the company spends in every financial year at least 2% of its average net profits during the three immediately preceding financial years in accordance with the CSR Policy.

However, if the company has not completed three financial years since its incorporation, it should refer to such immediately preceding financial years. Additionally, the company should prioritize spending the earmarked CSR funds on activities in the local area and surrounding regions where it operates.

It is explained that Net profit shall not include such sums as may be prescribed and shall be calculated in accordance with the provisions of section 198 under the Companies Act,2013.

Administrative Overheads

Administrative overheads mean the expenses incurred by the company for general management and administration of CSR functions in the company but shall not include the expenses directly incurred for the designing, implementation, monitoring, and evaluation of a particular Corporate Social Responsibility project or program;

It must be ensured by the Board that administrative overheads do not exceed five percent of the total CSR expenditure for the company’s financial year.

Surplus arising out of the CSR Activities

Any surplus generated from CSR activities shall not be included in the company’s business profits. Instead, it must be reinvested in the same project, transferred to the Unspent CSR Account, or allocated towards CSR initiatives outlined in the company’s policy and annual action plan.

Alternatively, the surplus amount may be transferred to a Fund specified in Schedule VII within six months after the end of the financial year.

Excess CSR set off

If a company exceeds the mandated CSR expenditure i.e. 2% then the excess amount spent may be offset against future CSR obligations for up to the immediate succeeding three financial years. However, certain conditions must be met:

- The excess amount eligible for set-off does not include any surplus arising from CSR activities as per sub-rule (2) of this rule.

- The company’s Board must pass a resolution to authorize this action.

Acquisition of Capital Assets

A company can utilize the CSR funds for the creation or acquisition of a capital asset, which must be held by:

- A company established under section 8 of the Act, or a Registered Public Trust, or Registered Society, with charitable objectives and possessing a CSR Registration Number under sub-rule (2) of rule 4; or

- The beneficiaries of the CSR project, such as self-help groups, collectives, or other entities; or

- A public authority

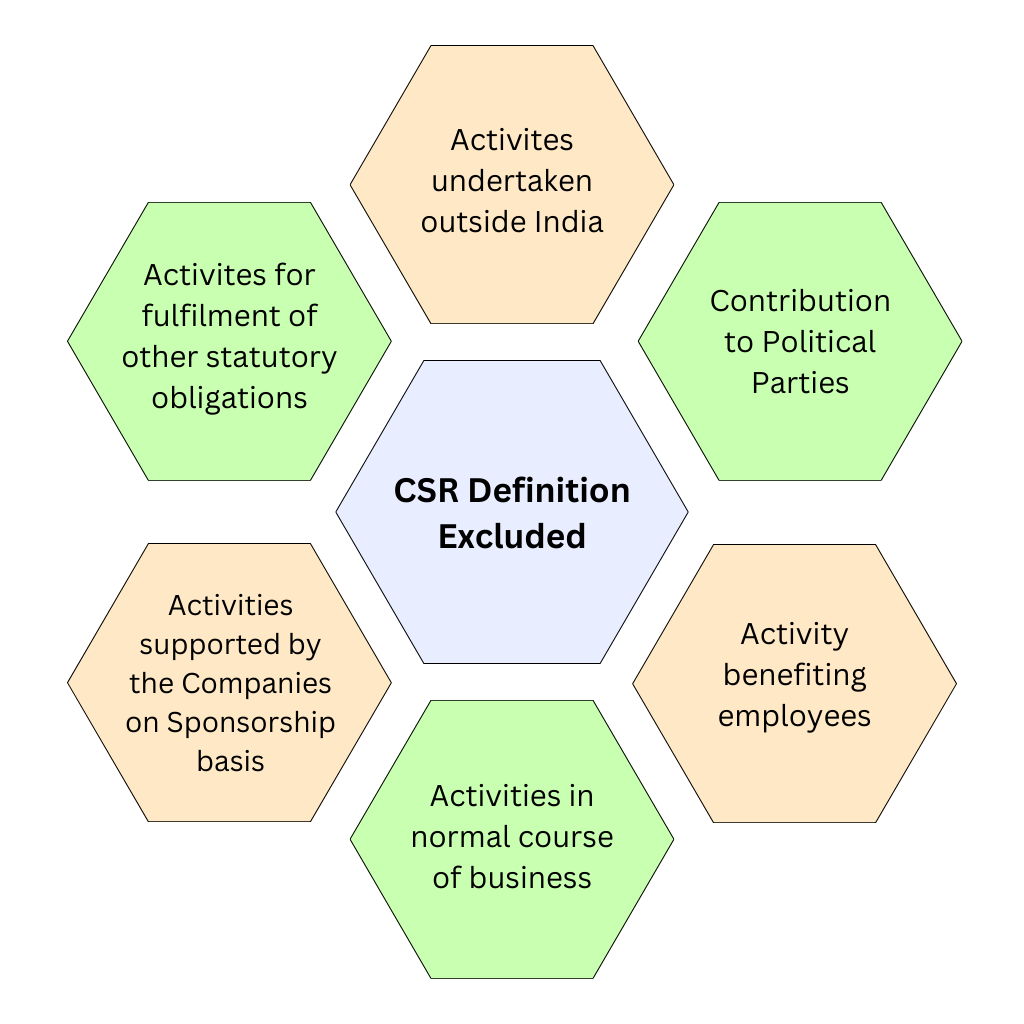

CSR Unspent Amount

Unspent amount relating to Ongoing Project

If the unspent amount is associated with any ongoing project, it must be ensured that it is to be transferred within a period of 30 days from the end of the financial year to a special account to be opened by the company for that financial year in any scheduled bank to be called the Unspent Corporate Social Responsibility Account (UCSRA).

A company with funds remaining in its Unspent Corporate Social Responsibility (CSR) Account, as outlined in section 135 (6) of the Companies Act, 2013, must constitute a CSR Committee and comply with the CSR provisions.

Extended time for spending unspent amount relating to ongoing Project

The amount kept in the Unspent Corporate Social Responsibility Account (UCSRA) shall be spent within a period of 3 financial years from the date of such transfer, failing which the company shall transfer the same to a Fund specified in Schedule VII (List of CSR Activities), within a period of thirty days from the date of completion of the third financial year.

Unspent amount not relating to ongoing Project

If the unspent amount is not associated with any ongoing project, failing to utilize the CSR expenditure, will necessitate its transfer to a Fund specified in Schedule VII within six months from the end of the financial year. Additionally, the reasons for not spending must be disclosed in the Board Report.

Annual Report on CSR

- It is obligatory to incorporate an Annual Report on CSR in the prescribed format within the Board’s Report of the Company. Additionally, the report, which encompasses the particulars of CSR Activities carried out by the company and the contents of its CSR policy, must be accessible on the Company’s website, if any.

- The company shall annex with its Board Report an annual report on CSR containing details specified in Annexure I (for F.Y. Commenced prior to 1st day of April 2020) or Annexure II (w.e.f. F.Y. Commencing on or after 1st day of April, 2020), as applicable. For a Foreign Company, the balance sheet filed under Section 381 (1) (b) of the Companies Act, 2013 shall contain an annual report on CSR mentioning the particulars specified in Annexure I or Annexure II, as applicable.

- Every Company with a minimum average CSR obligation of Rs. 10 crore or more in the immediately preceding 3 financial years and companies that have CSR projects with a minimum outlay of Rs. 1 crore which have been completed at least one year prior to the assessment must conduct an impact assessment.Impact assessment shall be conducted on project to project basis when both the above-mentioned conditions are met. It can also be carried on a voluntary basis by the company in other instances.

- Impact assessment is the process of evaluating and analyzing the social and environmental effects of a particular project, policy, or program and helps to understand the outcomes and consequences, both positive and negative, that result from the implementation of the initiative.

- Impact assessment must be carried out by an independent agency.

- The impact assessment report must be presented to the Board and included as an annexure to the annual report on CSR.

- The spending on impact assessment, which can be considered as part of CSR expenditure, should not exceed 2% of the total CSR commitment for the applicable financial year, or ₹50 lakh, whichever is greater.

CSR Reporting in Form CSR-2

As per Rule 12 of the Companies (Account) Rules 2014, Every company falling under CSR Criteria is required to submit a Corporate Social Responsibility report in Form CSR-2 to the Registrar as an addendum to Form AOC-4 or AOC-4 XBRL or AOC-4 NBFC (Ind AS), as applicable.

As per the recent notification, For the financial year 2022-2023, Form CSR-2 shall be filed separately on or before 31st March, 2024 after filing Form No. AOC-4 or Form No. AOC-4-NBFC (Ind AS), as specified in these rules or Form No. AOC-4 XBRL as specified in the Companies (Filing of Documents and Forms in Extensible Business Reporting Language) Rules, 2015 as the case may be.

Website Disclosure

- The Board must ensure contents of the CSR Policy should be disclosed in the Board’s report and also place the policy on the website of the Company, if any

- The Board of Directors of the Company shall disclose the composition of the CSR Committee, along with the CSR Policy and approved Projects, on their website, if any, for public access.

CSR Penal Provisions

- If a company fails to comply with the provisions relating to CSR Expenditure {Section 135(5)} and unspent CSR amount {Section 135(6)} under the Companies Act 2013, it will be subject to the following penalty:

For the Company: The penalty amount will be twice the sum that the company was required to transfer to the Fund specified in Schedule VII or to the Unspent Corporate Social Responsibility Account (UCSRA), or Rs 1,00,00,000, whichever is lower. Every officer of the company who is found to be in default: Penalty shall be equal to 1/10th of the amount the company was required to transfer to the specified Fund in Schedule VII or to the Unspent Corporate Social Responsibility Account (UCSRA), or Rs 2,00,000, whichever is lower. - If there is non-compliance with any other provisions of the section or rules, the general penalty under Section 450 of the Companies Act 2013 will apply i.e. Any officer in default, or any other person will be liable to a penalty of Rs 10,000.In the case of a continuing contravention, an additional penalty of Rs 1,000 per day may be imposed after the first day, with a maximum penalty of Rs 2,00,000 for a company and Rs 50,000 for an officer in default.

Conclusion

The concept of Corporate Social Responsibility has progressed over recent decades from simple charitable activities to aligning the interests of businesses with those of the communities where they operate. CSR can contribute to long-term sustainable growth and profitability while also making a positive impact on society and the environment.

Companies are expected to contribute back to society in exchange for the support they receive, whether directly or indirectly, from that society. Section 135 of the Companies Act 2013 outlines the brief provisions relating to CSR.

At Registration Arena, our team of experienced professionals can assist & guide you in understanding CSR Applicability, drafting the CSR Policy, complying with the CSR Provisions under the Companies Act 2013 & filings of E-Forms CSR-1 and CSR-2 on the MCA Portal so that the goal of CSR can be met by creating long-term value for both the company and society as a whole.

To get in touch with us, Please contact us