Introduction

A Section 8 Company refers to a type of organization registered under Section 8 of the Companies Act, 2013 (previously Section 25 of the Companies Act, 1956) in India. It is primarily established for charitable or non-profit objectives. It’s one of the available options for registering a non-profit organization, and it’s quite popular due to its corporate structure.

Any person or association of persons aiming to come together for below mentioned specific purposes can consider forming a Section 8 Company.

- The company’s objectives include promoting commerce, art, science, sports, education, research, social welfare, religion, charity, environmental protection, or similar endeavors.

- The company plans to utilize any profits or other income towards advancing its objectives.

- The company intends to refrain from distributing dividends to its members.

In this article, we shall see the features, benefits, exemptions, procedural aspects, documents, and post-incorporation compliances relating to Section 8 Company.

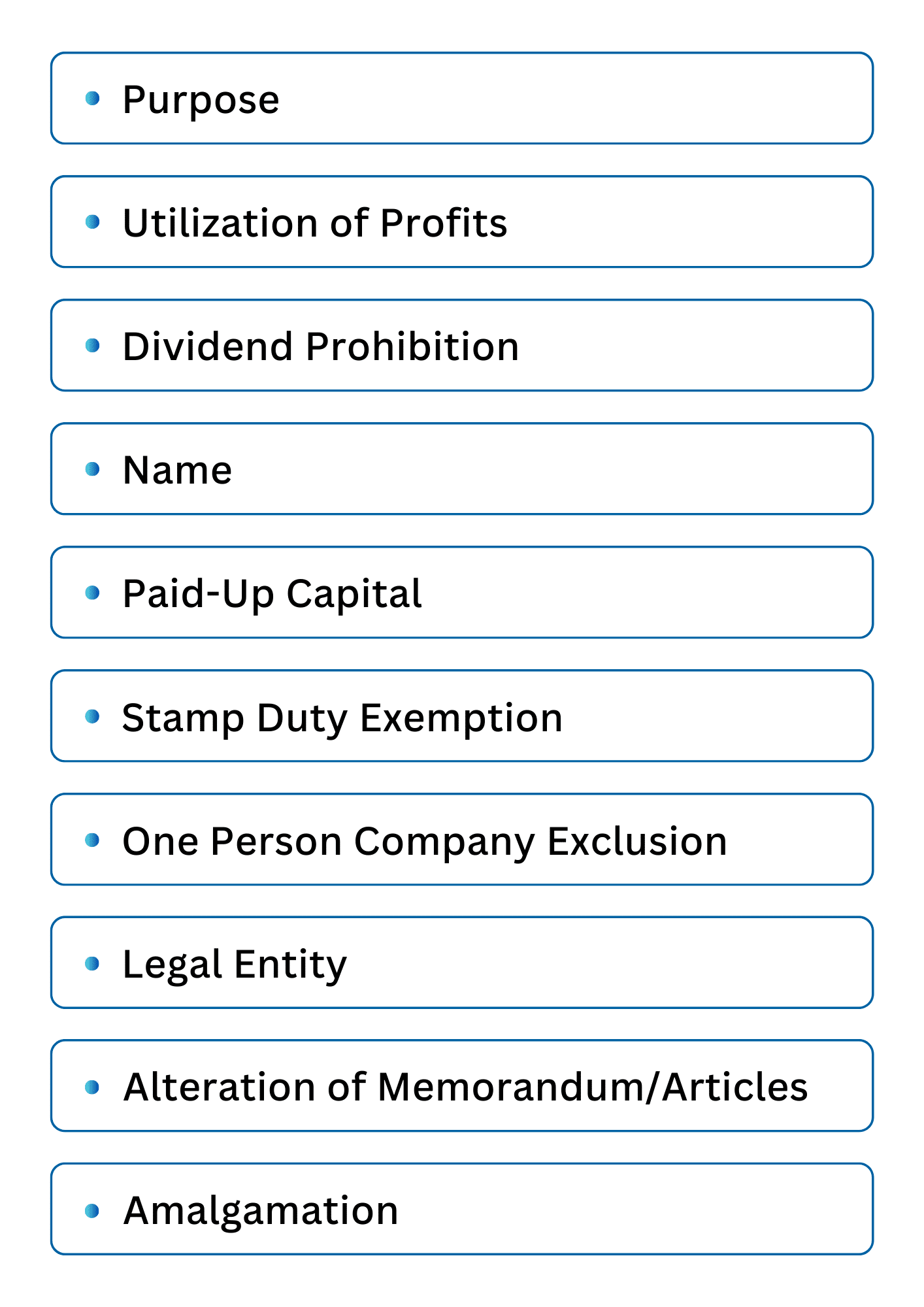

Features of Section 8 Company

Here are some key features of a Section 8 company:

Purpose

It is established to promote various objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, or environmental protection.

Utilization of Profits

Any profits earned by Section 8 Company are reinvested in furthering the company’s objectives.

Dividend Prohibition

It is not permitted to distribute dividends to its members.

Name

Section 8 Company can be registered without the use of “Limited” or “Private Limited”.

Paid-Up Capital

There is no requirement for a minimum paid-up capital.

Stamp Duty Exemption

The company is registered without paying any stamp duty on its MOA and AOA.

One-Person Company Exclusion

A One Person Company cannot operate as a Section 8 Company.

Legal Entity

It has its own independent corporate legal identity, similar to a private company, public company, or Limited Liability Partnership (LLP), enhancing its credibility among the public.

Alteration of Memorandum/Articles

A Section 8 company cannot change its Memorandum of Association (MOA) or Articles of Association (AOA) without prior approval from the Central Government.

Amalgamation

A Section 8 company can only merge with another Section 8 company that has similar objectives.

Benefits of Incorporating Section 8 Company

The benefits of incorporating a Section 8 Company are enumerated below:

Exemptions under Companies Act, 2013

Section 8 Companies enjoy various exemptions and relaxations under the Companies Act, 2013, which ease compliance burdens and administrative requirements. Exemptions under the Companies Act 2013 are enumerated in detail in this Article.

Tax Exemptions

These companies qualify for various tax exemptions, such as income tax, which enhances their financial attractiveness for both donors and the organization itself. This can be further elaborated as follows:

- Section 8 companies, when registered under Section 12AA of the Income Tax Act, 1961 enjoy a major benefit: complete tax exemption. This advantage stems from their dedication to utilizing their profits exclusively for charitable purposes, rendering all profits generated by them non-taxable.

- Section 8 companies when registered under Section 80G of the Income Tax Act, 1961 encourage donations and enables donors to claim tax deductions on their contributions under this section. Donations to Section 8 companies are eligible for deductions under Section 80G of the Income Tax Act, offering tax benefits to donors.

Benefit of Structural Versatility

Section 8 Companies Offer Options for Incorporation, Allowing Flexibility with or without Share Capital.

Options for Corporate Social Responsibility

Section 8 companies are an attractive option for implementing Corporate Social Responsibility (CSR) initiatives because they are primarily established to promote charitable and socially beneficial activities.

Separate Legal Entity, Perpetual Succession, and Limited Liability

Section 8 Companies enjoy the benefits of being a separate legal entity, having perpetual succession, and providing limited liability protection to their members.

Enhanced Credibility

Section 8 Companies generally have more credibility compared to other forms of non-profit organizations due to their regulated structure and legal recognition.

Increased Recognition and Donations

The formalized structure and legal recognition of Section 8 Companies lead to greater public recognition, which can attract more donations and support for the organization’s objectives.

These benefits collectively make Section 8 Companies an attractive option for those looking to establish non-profit organizations in India and aiming to positively impact society through charitable endeavors.

Exemptions under Companies Act 2013

Name of the Company

Section 8 companies are not required to use the words “Limited” or “Private Limited” at the end of their name, unlike other companies.

Exemption from Appointing Company Secretaries

Section 8 companies are not mandated to appoint whole-time company secretaries in employment.

No requirement for minimum paid-up capital

Section 8 companies are exempt from the mandatory minimum paid-up capital requirement applicable to other types of companies.

Pre-Determination of AGM Details by Board with Shareholder Direction

The Board of Directors of a Section 8 Company can decide in advance the date, time, and venue of the Annual General Meeting (AGM) if shareholders have given instructions to the board during a General Meeting.

Shorter notice period for AGMs

Section 8 Companies can call an Annual General Meeting (AGM) by providing a clear notice of not less than 14 days instead of the usual 21 days.

Exemption from Secretarial Standards subject to conditions

Section 8 companies are not obliged to comply with Secretarial Standards. However, this exemption applies only if the Section 8 company has not defaulted in filing its Financial Statements or Annual Return with the Registrar of Companies.

No requirement of recording minutes unless required

The provision of Section 118 regarding the minutes of proceedings of meetings does not fully apply to Section 8 Companies, except for the requirement to record minutes within thirty days of the conclusion of every meeting if the articles of association provide for confirmation of minutes.

Time period for sending financial statements

Financial statements and other documents can be sent by Section 8 companies at least fourteen days prior to the meeting, instead of the twenty-one days.

No maximum limit on directors

The maximum limit on the number of directors i.e. 15 Directors does not apply to Section 8 companies. However, the requirement for a minimum number of directors remains applicable.

Independent Directors Not Mandatory

Section 8 companies are exempt from clauses mandating the appointment of independent directors, and therefore, they are not obligated to appoint independent directors.

Duration of Board Boarding

Section 8 companies are required to hold a board meeting once every six calendar months.

Relaxation from Directorship Limit for Section 8 Companies

The limitation on holding directorships in more than 20 companies has been relaxed for Section 8 companies. A person serving as a Director in over 20 companies can still be appointed as a Director in a Section 8 Company.

Exemption from Certain Committees under Section 178

Section 8 companies are not mandated to set up the Nomination and Remuneration Committee or the Stakeholders Relationship Committee as required by Section 178 of the Act, as they have been exempted from this requirement.

Exemption from CARO Companies (Auditor Report) Order, 2020

CARO (Companies Auditor’s Report Order) does not apply to Section 8 Companies.

Compliance with disclosure of interest and register of related party transactions in some cases

A director shall be required to disclose his interest in any firm with which the company is making a transactions, and the company shall be required to maintain a register of all such transactions in which its director are interested only and only if with reference to section 188 ( related party transactions), the contract or arrangement exceeds one lakh rupees in value.

Decisions Made by Circulation Instead of Meeting

With amendments to Section 179, the board of Section 8 Companies can make decisions regarding borrowing, investments, granting of loans, advances, and guarantees by circulation, rather than convening a board meeting for such decisions.

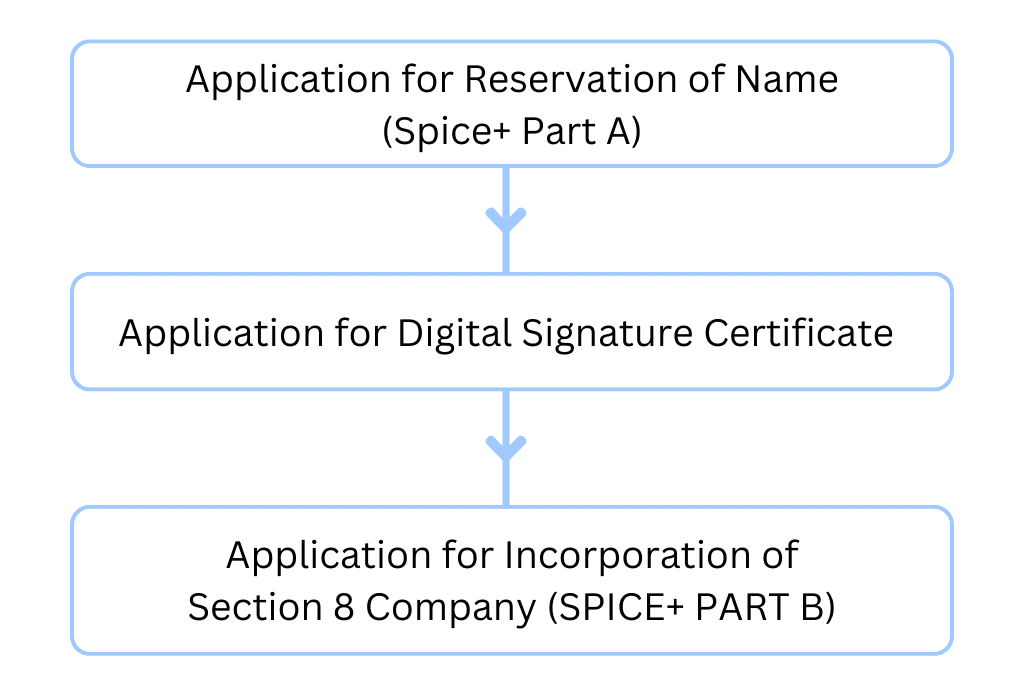

Procedure for Incorporation of Section 8 Company

i. Application for Reservation of Name (Spice+ Part A)

Section 8 Company can be incorporated as a Public Company or as a Private Company the category of Company shall be selected accordingly while applying names. Two names in order of preference can be proposed. The name proposed shall comply with provisions of Rule 8 of Companies (Incorporation) Rules, 2014.

The proposed company’s name must contain terms such as Foundation, Forum, Association, Federation, Chambers, Confederation, Council, Electoral trust, or similar expressions.;

Depending upon the business activity of the proposed Company the Main Division of Industrial Activity code must be entered. A summary of the main objects to be carried on by the Proposed Company must be attached while applying for name reservation.

The Application for Reservation of Name can be submitted separately in Spice+ Part A or along with Spice+ Part B, depending on the preference and convenience of the applicant.

The reservation fee is Rs. 1000/-, and upon approval, the name remains valid for 20 days, during which the incorporation application must be submitted. Extension of the name reservation period can be done by selecting the appropriate period and paying the applicable fees, which vary depending on the extension duration.

ii. Application for Digital Signature Certificate

Apply and Obtain a Digital Signature Certificate (DSC) from the authorized DSC issuing authority for the First Directors and Subscribers, if such persons do not have DSC;

Minimum number of Directors and Members are as follows:

| In case the Company to be formed as Private Company | In case the Company to be formed as Public Company |

| Minimum Directors – 2 | Minimum Directors- 3 |

| Minimum Members – 2 | Minimum Members – 7 |

iii. Application for Incorporation

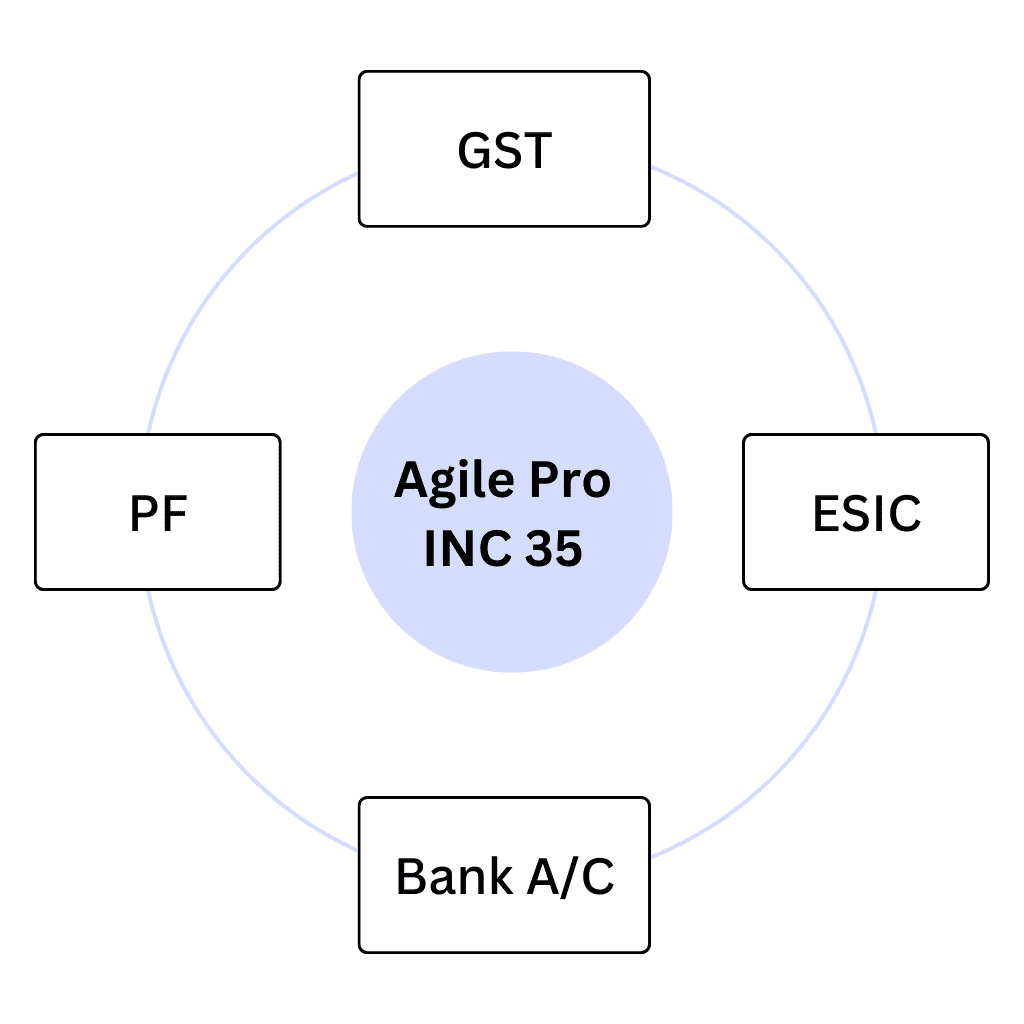

An application for incorporation is to be made in Spice Part B (Form INC-32) linked with E-MOA (Form INC-13), E-AOA (Form INC-31), Agile Pro-S (Form INC-35), and Form INC-9 (Declaration form from First Director and Subscribers) on V3 MCA Portal. The following details are required for Incorporation:

- Share Capital: Provide details related to authorized, subscribed, and paid-up share capital.

- Registered Office Details: Furnish proof of office address along with NOC, and utility bills if registered and correspondence addresses are the same.

- Contact Details: Provide the email ID and contact number of the proposed company.

- Jurisdiction of ROC: Mention the appropriate ROC jurisdiction based on the registered office location.

- Details of First Directors and Subscribers: Documents required for proposed directors and subscribers:- (Voters Identity Card/ Passport/ Driving License/Aadhar Card) & Address Proof: – (Bank Statement / Electricity Bill/ Telephone bill/ Mobile bill.)along with PAN and Aadhar Card. Additional Documents w.r.t First Directors: – DIR-2 (Consent to Act as Director) & Disclosure of Interest in other entities

- PAN TAN Codes: Enter the appropriate Area Type, Range Code, and AO type based on the registered office location.

- Attachments as per Rule 19 of Companies Incorporation (Rules) 2014

i. Memorandum of Association (MOA) and Articles of Association (AOA) of proposed Company (* The MOA of the proposed Company shall be in Form INC-13); E-MOA and e-AOA have been introduced for Section 8 Companies.ii. A declaration by Practicing Chartered Accountant/ Company Secretary/Cost Accountant/ Advocate in Form INC-14 stating that MOA & AOA have been drawn up in conformity with Section 8 and requirements of Act and Rules relating to registration of Section 8 Company has been complied with; The requirement to provide INC-14 as an attachment to be done away with by adding it in the ‘Declaration by Professional.iii. Estimated Future Income and Expenditure of the Company for the next three years specifying the sources of Income and Objects of Expenditure;iv. Declaration by each of the person making application; Such declaration shall be in Form INC-15.The requirement to provide INC-15 as an attachment is to be done away with by adding it in the ‘Declaration by all subscribers and directors’ - Linked Forms: Fill Agile Pro-S (Form INC-35) for EPFO, ESIC, Professional Tax Registration (Mandatory only for Companies to be registered in Maharashtra, Karnataka and West Bengal) Bank Account Opening, GSTIN, and Shops and Establishment Registration Number. Also, submit INC-9 which is an auto-generated Form and is required to be submitted in electronic form.

- Submission and Payment: After completing the forms, download them, affix DSCs, and upload them like normal e-forms after paying the requisite fees. Issuance of License: Upon successful incorporation, a license is issued in Form INC-16.

Documents Checklist

Following are the documents required for incorporating Section 8 Company:

- PAN and Aadhar of all the proposed directors and subscribers

- Identity Proof of all directors and subscribers- any one of the following

– Voters Identity Card

– Passport

– Driving License - Address Proof of all Directors and Subscribers (Should be in the name of respective person): – any one of the following (not older than 2 months)- self-attested in BLUE INK

– Electricity bill or

– Telephone bill or

– Mobile bill or

– Bank statement - Photograph of all the proposed directors and Specimen Signature for EPFO of Directors

- No Objection Certificate and Utility Bill i,e Electricity, Water, Telephone, Gas of the Registered Office Address of the proposed company

- For Registered Office Address in case of self-acquired property Index- II and For rented property -or rent agreement/ lease agreement

- Estimated Future Income and Expenditure of the Company for the next three years specifying the sources of Income and Objects of Expenditure

Post-Incorporation Compliances for Section 8 Company

Filing E-Form INC 20A with Registrar

Declaration of commencement of business is required to be filed with the Registrar by way of filing of E-form INC 20A along with the Bank statement reflecting the said amount deposited and a photograph of the registered office (inside and outside premises) within 180 days of Incorporation.

Appointment of Auditor

Company needs to appoint the First Auditor within 30 days of the incorporation at its First Board Meeting and the same is required to be intimated to the Registrar by filing E- form ADT-1.

Issue of Share Certificates

Section 8 Company with share capital shall issue Share Certificates to the Subscribers of Memorandum within 2 months from the date of Incorporation. The Share Certificates issued to the subscribers is the documentary evidence that the shares are held by them. The Company should receive the Share Subscription money before issuing share certificates. Share Certificate issued by the Company has to be stamped as per respective Stamp Act & Rules.

Maintenance of Statutory Registers

Section 8 companies are required to maintain statutory registers and records under the Companies Act, 2013 i,e register of members, inter-corporate loans, register of charges, register of directors, etc.

Conclusion

A company formed under Section 8 of the Companies Act, 2013, is indeed a non-profit business entity. These companies are established primarily for promoting charitable, educational, religious, or other similar purposes for the public welfare.

Unlike for-profit companies, they do not distribute dividends to their members, and any profits earned are reinvested into furthering their objectives rather than being distributed among shareholders. The main focus of such companies is to serve the community or society at large rather than generating profits for private benefit.

At Registration Arena, our team of experienced professionals/ experts is equipped to support and guide you through the incorporation process of a Section 8 Company, including drafting necessary documents, facilitating regulatory filings, and ensuring timely completion of compliances.

To get in touch with us, Kindly contact us.