Introduction

In simple terms, related party transactions happen when a company does business with someone closely linked to it, like a director, employee, or another company owned by the same people. These transactions are significant for how companies operate and how clear their financial dealings are. They include various activities like sales, purchases, loans, leases, or agreements between the company and its connected parties.

When companies interact with related parties, they might offer special deals or terms that they wouldn’t offer to unrelated parties. For example, they might sell goods at cost to a related company. This can lead to transactions with different terms compared to those with unrelated parties.

To ensure fairness and transparency, laws have detailed rules about how companies should handle these transactions. They require companies to comply with the provisions of the law. and disclose these dealings properly to protect the interests of stakeholders. Section 188 of the Companies Act, 2013 along with Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014 deals with related party transactions.

In this Article, let’s understand the meaning of specific terms such as related party, relative, and “arm’s length basis, what is related party transaction, thresholds limits, procedures, and consequences of Non-Compliance.

Meaning of Relative and Related Party under the Companies Act,2013

Relative

Section 2 (77) of the Companies Act,2013 defines the term “ Relative”. Relative means a member of the same HUF, husband, wife, father, stepfather, mother, stepmother, son, stepson, son’s wife, daughter, daughter’s husband, brother, stepbrother, sister, step-sister. Let’s understand by taking A as an example as follows:

| Relative as per the definition | Example |

| Members of the same HUF | A and B are members of the same HUF. so Mr. B is considered as relative of A |

| Husband and wife | C is the husband/wife of A. C is considered as relative of A. |

| Father includes stepfather | D is the father/stepfather of A. He will be considered as relative. |

| Mother includes stepmother | E is the mother/stepmother of A. He will be considered as relative |

| Daughter | F is the daughter of A. She will be considered as relative. |

| Daughter’s Husband | G is the husband of F who is the daughter of A. He will be considered as relative |

| Brother/Stepbrother | H is the brother/stepbrother of A. He will be considered as relative. |

| Sister/ Step Sister | I is the sister/step-sister of A. She will be considered as relative. |

Related Party

Section 2(76) of the Companies Act,2013 defines the term “Related Party” with reference to a company. Let’s understand by taking an example i.e Mr. A, B, and C are directors in the Company ABC Ltd. The related parties for the company as per the definition are as follows:

| Related Parties as per the definition | Examples |

| 1. A Director or his relative | Mr. A, B, and C are directors in the Company ABC Ltd and the relatives of these directors shall come under the purview of the term “ related party”. |

| 2. A Key Managerial Personnel or his relative | Mr. L is the CFO of the Company, his relative will be considered as a related party. |

| 3. A firm, in which a director, manager or his relative is a partner; | Mr.D, relative of director Mr C of the Company is a partner in the firm STR & Co, hence STR & Co will also come under the term related party. |

| 4. A private company in which a director, manager, or relative is a member or director | Mr. B, director of the company is also a director in XYZ Pvt. Ltd, therefore XYZ Pvt Ltd will be considered as related party. |

| 5. A public company in which a director or manager is a director and holds along with his relatives more than 2% of its paid-up capital | Mr. C along with his relatives holds more than 2% of the paid up capital of MNO Ltd. Therefore MNO Ltd will be considered as related party. |

| 6. Anybody corporate whose board of directors, MD or manager is required to act in accordance with the advice, directions or instructions of a director or manager (Not Applicable in cases when these directions are followed in a professional capacity) | When PQR Ltd acts on the directions of Mr. B, PQR Ltd will be considered as related party. |

| 7. Any person on whose advice, directions, or instructions a director or manager is required to act (Not Applicable when this is done in a professional capacity) | Mr. E holds more than 51% in ABC Ltd on whose instructions Mr A has to act, Mr E will be a related party. |

| 8. Company which is Holding, Subsidiary or Associate of such company |

|

| 9. Any company which is a subsidiary of a holding company to which it is also a subsidiary | GHI Ltd and ABC Ltd are subsidiaries of DEF Ltd. Therefore GHI Ltd is considered as a related party. |

Meaning of Related Party Transactions under the Companies Act 2013

Section 188 of the Companies Act 2013 along with Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014 specifies a comprehensive list of such transactions. A Company cannot engage in any contract or arrangement with a related party without obtaining prior approval from the Board or shareholders, depending on the nature of the transaction. The transactions requiring approval are as follows:

| Related Party Transactions under Section 188 of the Companies Act 2013 requiring Prior Board Approval | Transaction Limit requiring Prior approval of shareholders by ordinary resolution |

| Sale, purchase, or supply of any goods or materials directly or through the appointment of an agent | 10% or more of the Turnover of the Company |

| Selling or otherwise disposing of, or buying, property of any kind directly or through the appointment of an agent | 10% or more of the Net Worth of the Company |

| Leasing of property of any kind | 10% or more of the turnover of the Company |

| Availing or rendering of any services directly or through the appointment of an agent | 10% or more of the turnover of the Company |

| Such related party’s appointment to any office or place of profit in the company, its subsidiary company, or associate company; | monthly remuneration exceeding Rs. 2,50,000/- |

| Underwriting the subscription of any securities or derivatives thereof, of the company: | 1% of the net worth of the Company |

Points to be noted

- The limits mentioned above for related party transactions are applicable on a financial year basis.

- It’s important to note that turnover or net worth should be calculated based on the audited financial statements of the preceding financial year.

- Approval from the board or shareholders will not be necessary if a company engages in a transaction that is conducted in the ordinary course of business and is carried out on an arm’s length basis.

- Ordinary course of business” means the normal way things are done in regular business operations. An arm’s length transaction refers to a scenario where two related parties conduct business as if they were unrelated, ensuring there is no conflict of interest.

- Transactions between a holding company and its wholly-owned subsidiary, whose accounts are consolidated, do not necessitate approval from shareholders, even if they surpass the limit. A resolution passed by the holding company is adequate for such transactions to be undertaken.

#Note: If a company opts out of consolidating its subsidiary’s accounts according to Rule 6 of the Companies (Accounts) Rules, 2014, and Section 129(3) of the Act, it must obtain shareholder approval for related-party transactions.

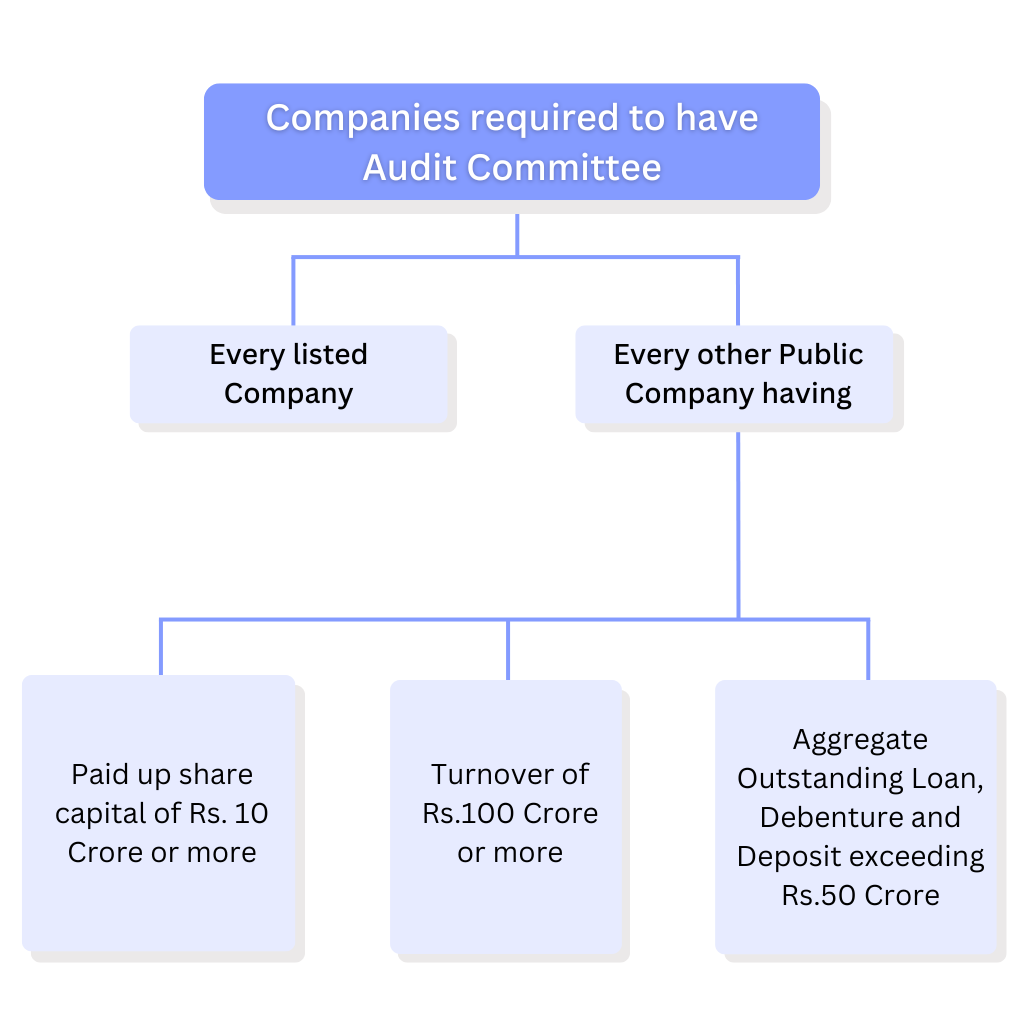

6. All related party transactions must receive approval from the Audit Committee. The Audit Committee may grant omnibus approval for proposed related party transactions, provided the conditions laid down in Rule 6A of the Companies Companies (Meetings of Board and its Powers) Rules, 2014. are met. Omnibus Approval means a blanket pre-activity approval by the Audit Committee subject to compliance of the conditions.

7. The Audit Committee shall consider certain factors while specifying the criteria for making omnibus approval namely:

(a) repetitiveness of the transactions (in the past or in the future);

(b) justification for the need for omnibus approval.

8. It must ensure the necessity of omnibus approval for repetitive transactions and confirm that such approval serves the company’s best interests.

9. The omnibus approval shall include or indicate specific details related to the transaction. This approval will be valid for a period not exceeding one financial year, requiring fresh approval upon its expiration.

10. Omnibus approval shall not be granted for transactions involving the sale or disposal of the company’s undertaking.

11. The Audit Committee may also impose any other conditions it deems appropriate.

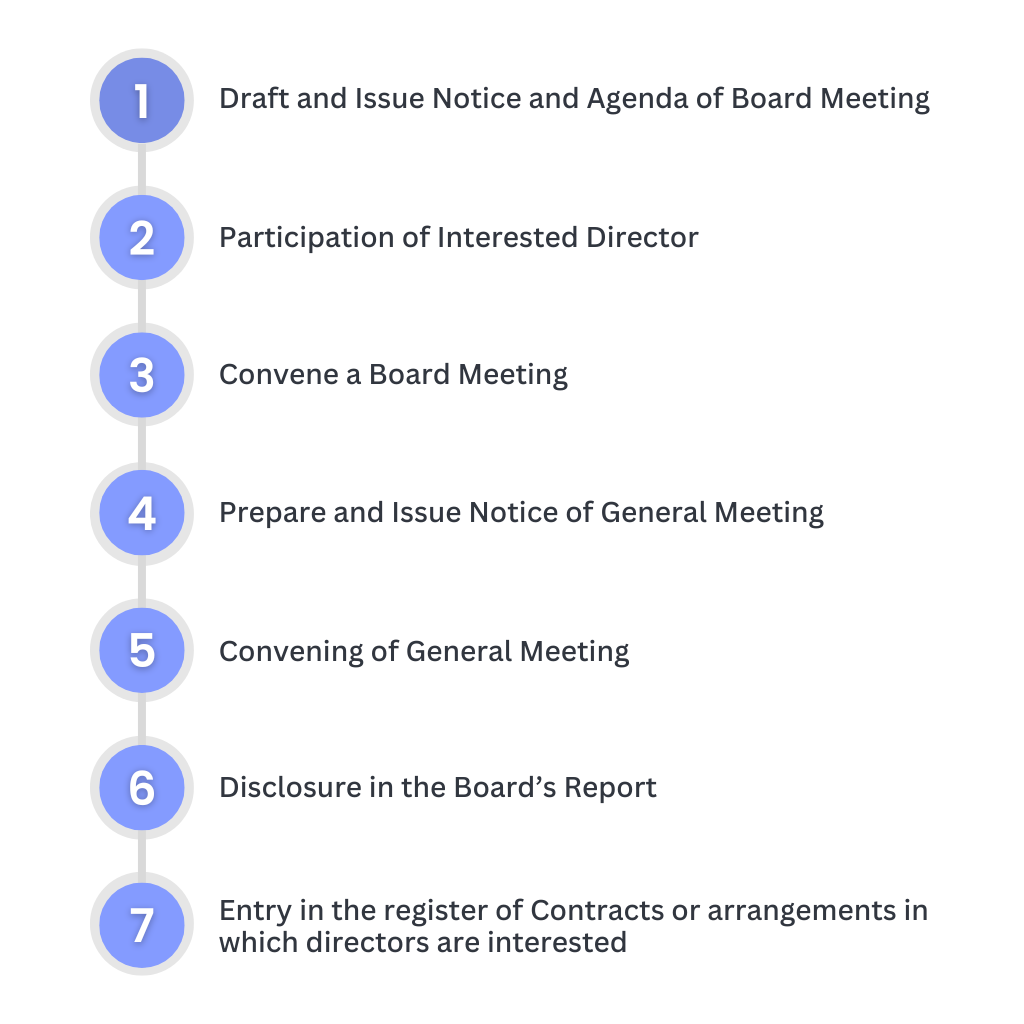

Procedure for entering into related party transaction

1. Draft and Issue Notice and Agenda of Board Meeting

Prepare and issue a Notice and Agenda calling Board Meeting to all the directors at least seven days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means. The Notice of the meeting shall mention the following Agenda:

(a) the name of the related party and nature of relationship;

(b) the nature, duration of the contract and particulars of the contract or arrangement;

(c) the material terms of the contract or arrangement including the value, if any;

(d) any advance paid or received for the contract or arrangement, if any;

(e) the manner of determining the pricing and other commercial terms, both included as part of contract and not considered as part of the contract;

(f) whether all factors relevant to the contract have been considered, if not, the details of factors not considered with the rationale for not considering those factors; and

(g) any other information relevant or important for the Board to take a decision on the proposed transaction.

2. Participation of Interested Director

Ensure that the Directors interested in related-party transactions should not attend the meeting while the discussion takes place.

3. Convene a Board Meeting

Conduct a Board Meeting and pass a Board Resolution for approving the related party transactions when the transaction is within the above-specified threshold limits

4. Prepare and Issue Notice of General Meeting

Prepare and issue a notice in writing calling a General Meeting to obtain prior approval of shareholders for the related party transactions exceeding the above-mentioned threshold limits by giving at least 21 days clear notice to all the members by hand or by ordinary post or by speed post or by registered post or by courier or by facsimile or by e-mail or by any other electronic means. An explanatory statement must be annexed with the Notice of the meeting and shall contain the following particulars, namely:-

(a) name of the related party;

(b) name of the director or key managerial personnel who is related, if any;

(c) nature of relationship;

(d) nature, material terms, monetary value, and particulars of the contract or arrangements;

(e) any other relevant information

5. Convening of General Meeting

Convene a general meeting and pass an ordinary resolution for the related party transactions exceeding the above mentioned threshold limits. A member of the company is not permitted to vote on a resolution approving any contract or arrangement that the company may enter into if that member is a related party except in 2 cases:

- Company in which ninety percent. or more members, in number, are relatives of promoters or are related parties:

- In the case of Private Company and Specified IFSC Public Company exempted vide MCA Notification dated 5th June 2015 and 4th January 2017

6. Disclosure in the Board’s Report

Each contract or arrangement made under section 188(1) must be mentioned in the Board’s report, and presented to the shareholders in Form AOC-2, along with the rationale for engaging in such contract or arrangement. This requirement is stated in Section 188(2) and Section 134(3)(h) in conjunction with Rule 8 of the Companies (Accounts) Rules, 2014.

7. Entry in the register of Contracts or arrangements in which directors are interested

Every company is required to enter the details of all contracts or arrangements falling under section 184(2) (Disclosure of Interest by Directors) or 188 (Related Party Transactions) in the register to be maintained in Form MBP-4. After entering the particulars, these registers must be presented at the next Board meeting and signed by all the directors present. The register is to be maintained at the company’s registered office, preserved indefinitely and kept under the custody of the company secretary or any other person authorized by the Board for this purpose

However, according to Section 189(5), entries in the register are not necessary for contracts or arrangements:

- Involving the sale, purchase, or supply of goods, materials, or services, provided the total value does not exceed Rs. 5 lakh in any year.

- By a banking company for the collection of bills in the normal course of its operations.

Note: For section 8 companies, entry in the register is only required if the transaction, based on the terms and conditions of the contract or arrangement, exceeds Rs. 1 lakh, as per the MCA Notification dated June 5th, 2015.

Repercussions in case of non-compliance with respect to Related party transactions (RPT)

1. RPT entered by the director without approval

If an RPT is entered into by a director or employee without obtaining the required approvals, the RPT must be ratified by the Board or shareholders within three months. Failure to do so renders the RPT voidable at the option of the Board or shareholders. If the RPT involves a related party of the director or is authorized by a director, the concerned director(s) must indemnify the company against any resulting loss. The company can take legal action against such directors or employees to recover any losses incurred.

2. Penal Provisions

- Any director or employee who enters into or authorizes an RPT in violation of Section 188 of the Companies Act 2013 is liable for a penalty:

For listed companies: Rs. 25 lakh.

For other companies: Rs. 5 lakh.

- Each Director who fails to comply with Section 189 ( Register of Contracts or arrangements in which directors are interested) along with relevant rules shall be subject to a penalty of twenty-five thousand rupees.

3. Vacation of office of Director

A director convicted of the offense related to RPT under Section 188 of the Companies Act 2013 becomes disqualified from serving as a director in any company for five years and must vacate the office of director.

Conclusion

Related party transactions are important for businesses as they involve dealings with closely connected individuals or entities. While these transactions are common and sometimes essential for business operations, they also come with risks like conflicts of interest, siphoning of funds, and diversion of resources of the Company.

Therefore, the provisions of the law require certain compliances with respect to related party transactions.

For expert guidance on navigating related party transactions in compliance with the Companies Act 2013, 📞 Connect with our Team at Registration Arena.

We’re here to help you ensure transparency and adherence to legal requirements in all your business dealings.