Introduction on Types of Companies in India

A company is one of the business structures available for starting a business. The term “company” originates from the Latin words “com” meaning “with or together” and “panis” meaning “bread”. A company is essentially a group of persons who come together voluntarily to run a business. In India, types of companies are governed by the Companies Act, 2013.

A Company is defined as an artificial person created by law, having a separate entity, with perpetual succession and a common seal. To establish a company, one must apply through the MCA Portal, adhering to the regulations outlined in this legislation or other applicable laws.

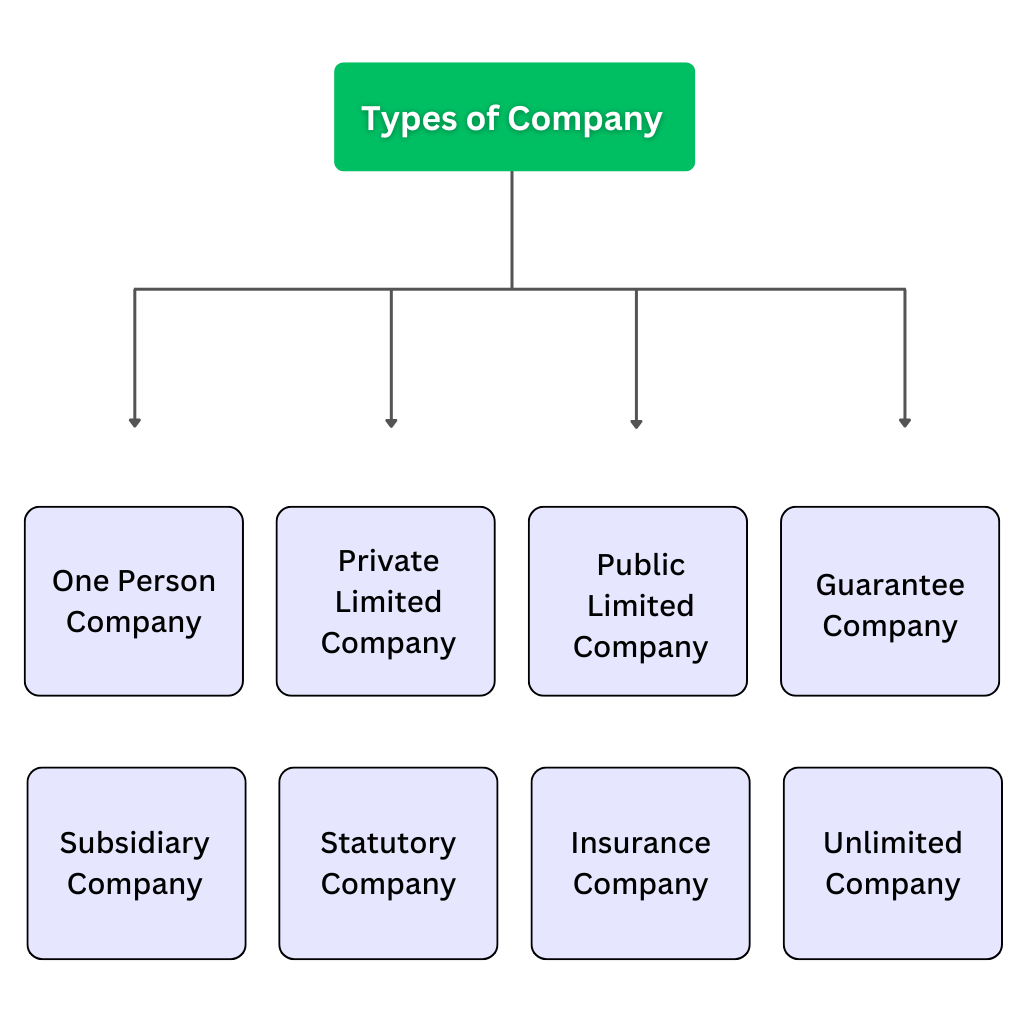

Different types of Companies can be registered in various forms, including Private Limited, Public Limited, One-Person Company (OPC), Section 8, producer, small, government, foreign, holding, subsidiary, producer companies, Nidhi, Chit Fund, Non-Banking Financial Companies (NBFCs), and startups, among others.

Before selecting a specific type of entity, it is essential to evaluate the advantages and disadvantages of each based on the nature and scale of the intended business venture. This ensures that the chosen business structure aligns effectively with the entrepreneur’s objectives and requirements.

This article aims to provide clear insights into the various company options available in India, helping readers make informed decisions that align with their business goals.

Types of Companies in India

1. Private Company

A Private Company is a business entity that is owned either by non-governmental organizations, individuals, or a relatively small group of shareholders. Unlike public companies, private companies do not trade shares on the stock market, and their shares are not available for public purchase. It is one of the common types of companies preferred by startups and small businesses.

Features of a Private Company

Minimum Paid-Up Capital

The Companies Act, 2013 doesn’t specify a minimum paid-up capital requirement for private companies anymore, as per the Companies (Amendment) Act, 2015. This allows flexibility for promoters to decide the capital amount during incorporation.

Restrictions on Share Transfer

The company’s articles restrict the transfer of shares, meaning shares cannot be freely transferred without the consent of existing shareholders.

Limitation of Number of Members

Except in the case of a One Person Company (OPC), the maximum number of members allowed is two hundred. However, certain categories of members, such as employees, are not counted towards this limit.

Prohibition on Public Subscription

Private companies cannot invite the public to subscribe to their shares or securities.

Name Requirement

A private company must include the words “Private Limited” at the end of its name.

Number of directors

Private companies must have at least 2 directors and a maximum of 15 directors. A special resolution is required to be passed for appointing more than 15 directors.

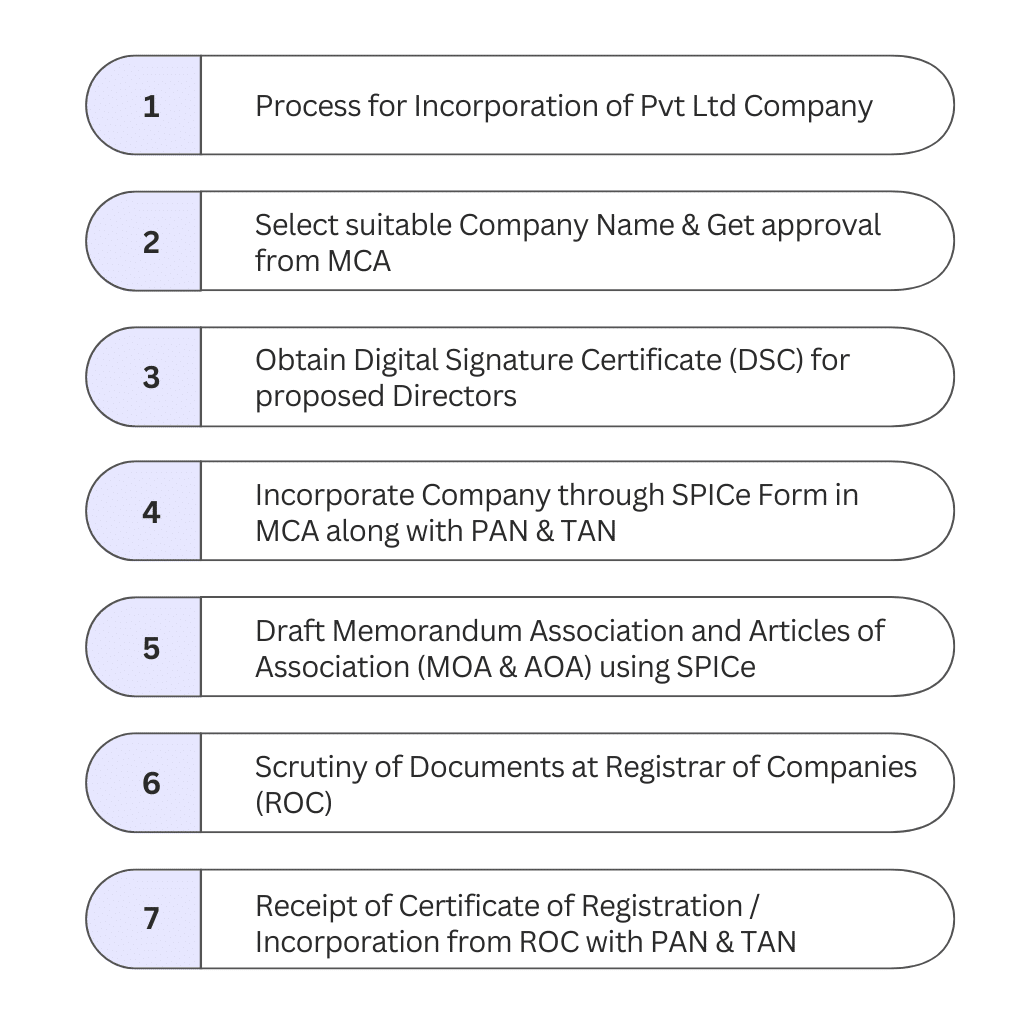

Registration Process of Private Company

Read more: Private Limited Company Registration Online in India: An Overview

2. Public Company

A public company is defined as a company that is not a private company. It typically needs a minimum of seven members (shareholders) to be incorporated under the Companies Act, 2013. Anyone from the general public willing to buy shares or debentures can become a shareholder.

These companies can list their securities on a Stock Exchange. Unlike private companies, there’s no cap on the number of members. Additionally, according to section 58(2), shares or interests in a public company can be freely transferred between members.

It is also to be noted that if a private company is a subsidiary of a public company, it will be considered a public company regardless of its classification as a private company in its articles of association. Among all types of companies, public companies are usually formed for large-scale business operations.

Features of Public Company

Minimum number of shareholders

Public companies require a minimum of 7 shareholders for formation.

Maximum number of members

Public companies have no maximum limit on the number of members.

Number of directors

Public companies must have at least 3 directors and a maximum of 15 directors. A special resolution is required to be passed for appointing more than 15 directors.

Invitation to subscribe for shares

Public companies can invite the general public to subscribe for shares or debentures.

Transferability of shares

Shares of a public company are traded on the stock market, allowing for easy buying and selling between shareholders and anyone participating in stock exchange transactions.

Name Requirement

A public company must include the words ” Limited” at the end of its name.

Among the many types of companies, public limited companies are most commonly used for large fundraising through public participation.

Read more: Difference between Private Limited Company and Public Limited Company

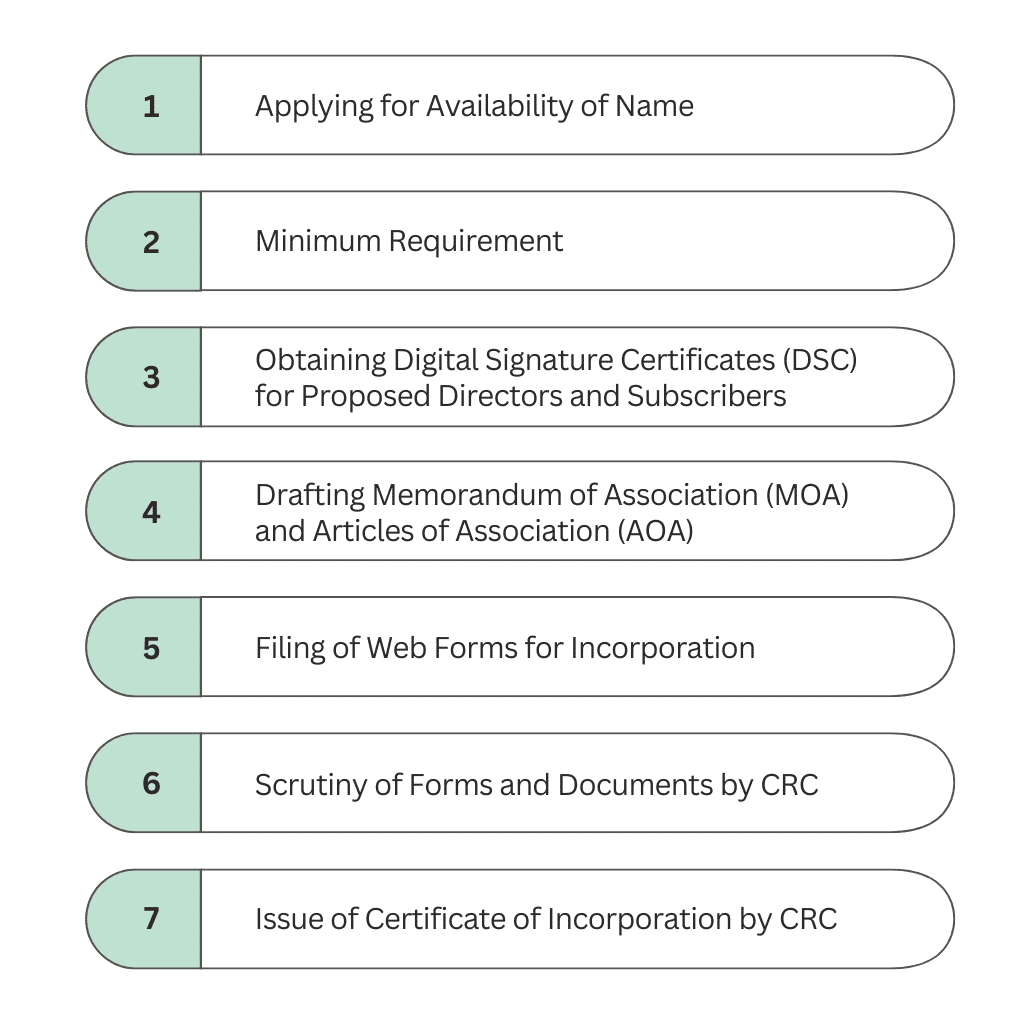

Registration Process of Public Company

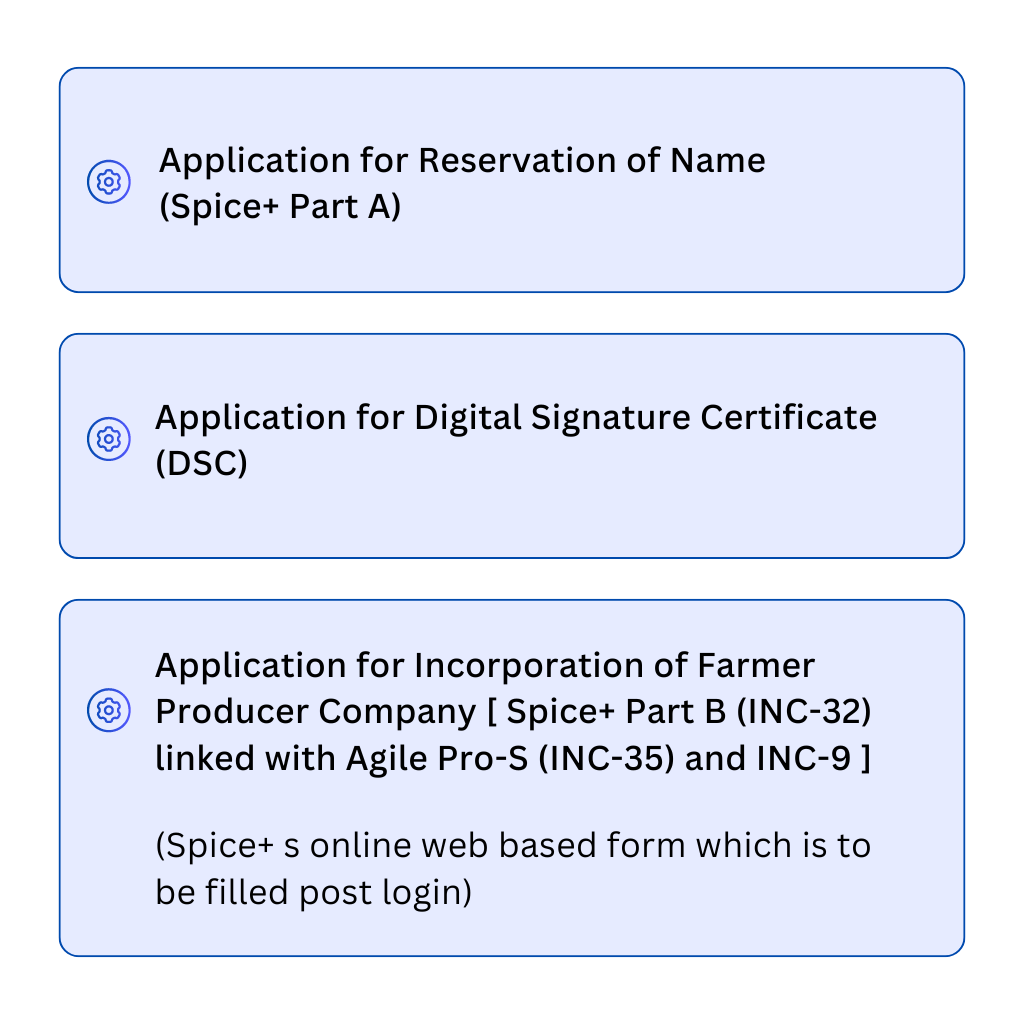

Applying for Availability of Name

The initial step in company formation involves applying for the availability of the proposed company’s name, and adhering to naming guidelines. Web Form Spice + Part A must be filed with the Central Registration Centre (CRC)to reserve the company’s name. The Application for Reservation of Name can be submitted separately in Spice+ Part A or it can be submitted along with Spice+ Part B.

Minimum Requirement

For a Public Limited Company, there are minimum requirements for shareholders and directors:

Minimum Shareholders: 7 (Seven)

Minimum Directors: 3 (Three)

Obtaining Digital Signature Certificates (DSC) for Proposed Directors and Subscribers

DSCs serve as electronic equivalents of paper certificates, required for signing electronic documents like e-forms. These can be obtained from licensed Certifying Authorities.

Drafting Memorandum of Association (MoA) and Articles of Association (AoA)

The MoA outlines the company’s scope of activities, while the AoA regulates its internal workings. Both documents are crucial and are drafted carefully. MCA has introduced Spice E-MOA and Spice E AOA.

Filing of Web Forms for Incorporation

Upon name approval from the CRC, An application for Incorporation of the Company is required to be made by filing Spice+ Part B (Form INC-32) linked with Spice E-MOA, Spice E-AOA, Agile Pro- S (Form INC-35) and Form INC-9 (Declaration form from First Director and Subscribers) on the MCA Portal by paying requisite fees and stamp duty.

Scrutiny of Forms and Documents by CRC

Upon receiving the required documents and forms, the CRC will review them. If they are found to be complete and accurate, the Registrar will proceed to register the company and allocate a Corporate Identification Number (CIN).

In case any defects or deficiencies are identified, the CRC will notify electronically, indicating the issues. Once the deficiencies are rectified, the Registrar will proceed with the registration process.

Issue of Certificate of Incorporation by CRC

Following the successful registration, the Registrar of Companies will issue a Certificate of Incorporation bearing his signature and the official seal of his office. This certificate will be sent electronically, and a printed copy can be obtained from the online platform.

3. One Person Company (OPC)

The Companies Act of 2013 introduced a new category of companies known as the One Person Company (OPC), where a single person would constitute a company and which is treated under the law as a private company. This concept emerged from the recommendations of the J.J. Irani Committee, established by the Ministry of Corporate Affairs in 2004.

The objective behind introducing OPC was to foster micro business and entrepreneurship and also stimulate economic activity in the country. Simply put, an OPC is a company with one person as its sole member.

In the case of a One Person Company (OPC), the memorandum must include the name of nominee, along with their prior written consent in the prescribed form. This individual would become the member of the company in the event of the subscriber’s death or incapacity to contract.

The written consent of this person must be submitted to the Registrar at the time of the OPC’s incorporation, along with its memorandum and articles of association.

All the restrictions that are applicable to a private company also apply to a One Person Company (OPC), as an OPC is essentially classified as a private company under the law. Among the types of companies in India, OPC is ideal for solo entrepreneurs.

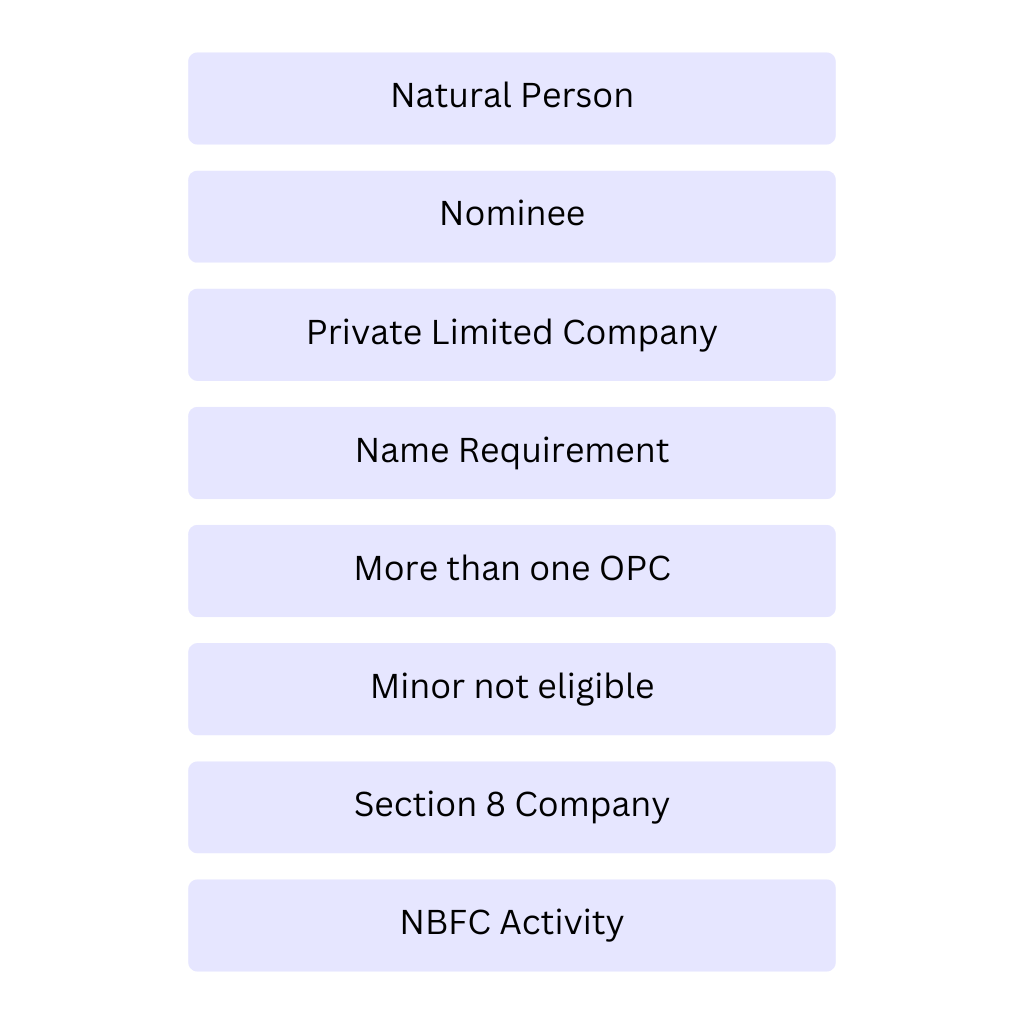

Features of One Person Company

Natural Person

A person forming an OPC should be a Natural Person, an Indian Citizen (whether resident in India or otherwise). Resident in India means a person who has stayed in India for not less than 120 days during the immediately preceding financial year.

Nominee

Adequate safeguards should be provided in case of death/disability of the sole person through the appointment of another individual as Nominee by obtaining his consent and mentioning his name in the MOA.

Private Limited Company

One Person Company is to be incorporated as a Private Limited Company.

Name Requirement

A private company must include the words “OPC ” at the end of its name to distinguish it from other companies.

More than one OPC

An individual is not permitted to incorporate more than one One Person Company (OPC) or act as a nominee in more than one OPC.

Minor not eligible

Minor is not eligible to become a member or nominee of the One Person Company or hold shares with beneficial interest.

Section 8 Company

OPC cannot be incorporated or converted into a company under Section 8 of the Companies Act, 2013, which deals with the formation of companies with charitable objects, etc.

NBFC Activity

OPC is not permitted to engage in Non-Banking Financial Investment activities, including investing in securities of other corporate bodies.

Let’s see the Simple Difference between OPC and Sole Proprietor:

| S.No | One Person Company | Sole Proprietorship |

| 1. | Separate Legal Entity | Not a separate legal entity |

| 2. | Limited Liability | Unlimited liability |

| 3. | Perpetual succession | No perpetual succession |

| 4. | Loan is not the sole responsibility of the owner | Loan – sole responsibility of the owner |

| 5. | Registration required | Registration not required |

| 6. | Finance – credit record of the OPC | Finance – credit record of the owner |

Registration Process of OPC

To know more about One Person Company, read One Person Company – Meaning, Features, Benefits and Registration Process

4. Section 8 Company

A company incorporated under Section 8 of the Companies Act, 2013 (corresponding to Section 25 of the Companies Act, 1956), is one of the types of companies established for the promotion of various objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, or environmental protection.

Unlike typical companies, these entities operate as non-profit organizations, resembling NGOs (Non-Governmental Organizations). In essence, these Section 8 companies function similarly to trusts or societies, with a primary focus on social welfare or other specified objectives.

However, they are distinct in that they are incorporated under the Companies Act rather than being registered under the regulations of a state government like trusts or societies.

Features of a Section 8 company

- It is established to promote various objectives such as commerce, art, science, education, etc.

- Any profits generated are reinvested in fulfilling the company’s objectives.

- Dividends cannot be paid to its members.

- The company’s name can be registered without using “Limited” or “Private Limited”. The name shall include the word Association, Foundation, Forum, Federation, and the like, etc.

- No minimum paid-up capital requirement.

- Exempt from stamp duty registration.

- Eligible for privileges and exemptions under the Companies Act, 2013.

- A One Person Company cannot be registered as a Section 8 Company.

- Enjoys an independent corporate legal entity, similar to private or public companies or a Limited Liability Partnership, enhancing its credibility.

Among all types of companies in India, Section 8 Companies are the most popular for non-profit and charitable purposes.

Registration Process of Section 8 Company

Read more: Incorporating a Section 8 Company: Step-by-Step Process and Requirements

5. Producer Company

A Producer Company is a type of comapny designed specifically to benefit its members who are primarily engaged in agricultural production or related activities. These companies are established to promote the interests of their members, typically farmers or producers, by providing a platform for collective bargaining, accessing markets, sharing resources, and obtaining various services like education, training, and technical assistance.

A Farmer Producer Company is a company registered as a Producer Company under either the Companies Act of 1956 or the Companies Act of 2013, with specific objectives or activities outlined in section 378B of the Companies Act 2013.

The membership of Producer Companies is open to individuals who are themselves primary producers, meaning they are engaged in the activity of producing agricultural produce.

This ensures that the ownership and control of the company remain within the hands of those directly involved in agricultural production. While a Producer Company may resemble a Private Limited Company in terms of its structure and membership, there is no limit to the number of members it can have.

However, it’s important to note that a Producer Company can never become or be considered a public limited company, regardless of any circumstance.

Objects of Producer Company

The objects of a Producer Company may include any or all of the following:

(a) Production, harvesting, procurement, grading, pooling, handling, marketing, selling, export of primary produce of the Members, or importing goods or services for their benefit. It’s noted that the Producer Company may conduct these activities either independently or through other institutions.

(b) Processing, including preserving, drying, distilling, brewing, vinting, canning, and packaging the produce of its Members.

(c) Manufacturing, selling, or supplying machinery, equipment, or consumables primarily to its Members.

(d) Providing education on mutual assistance principles to its Members and others.

(e) Offering technical services, consultancy services, training, research and development, and other activities to promote the interests of its Members.

(f) Generating, transmitting, and distributing power, revitalizing land and water resources, their use, conservation, and communications related to primary produce.

(g) Insuring producers or their primary produce.

(h) Promoting techniques of mutuality and mutual assistance.

(i) Implementing welfare measures or facilities for the benefit of Members, as decided by the Board.

(j) Any other activity ancillary or incidental to those mentioned above or any other activities promoting the principles of mutuality and mutual assistance among the Members.

(k) Financing procurement, processing, marketing, or other activities specified in clauses (a) to (j), including extending credit facilities or any other financial services to its Members.

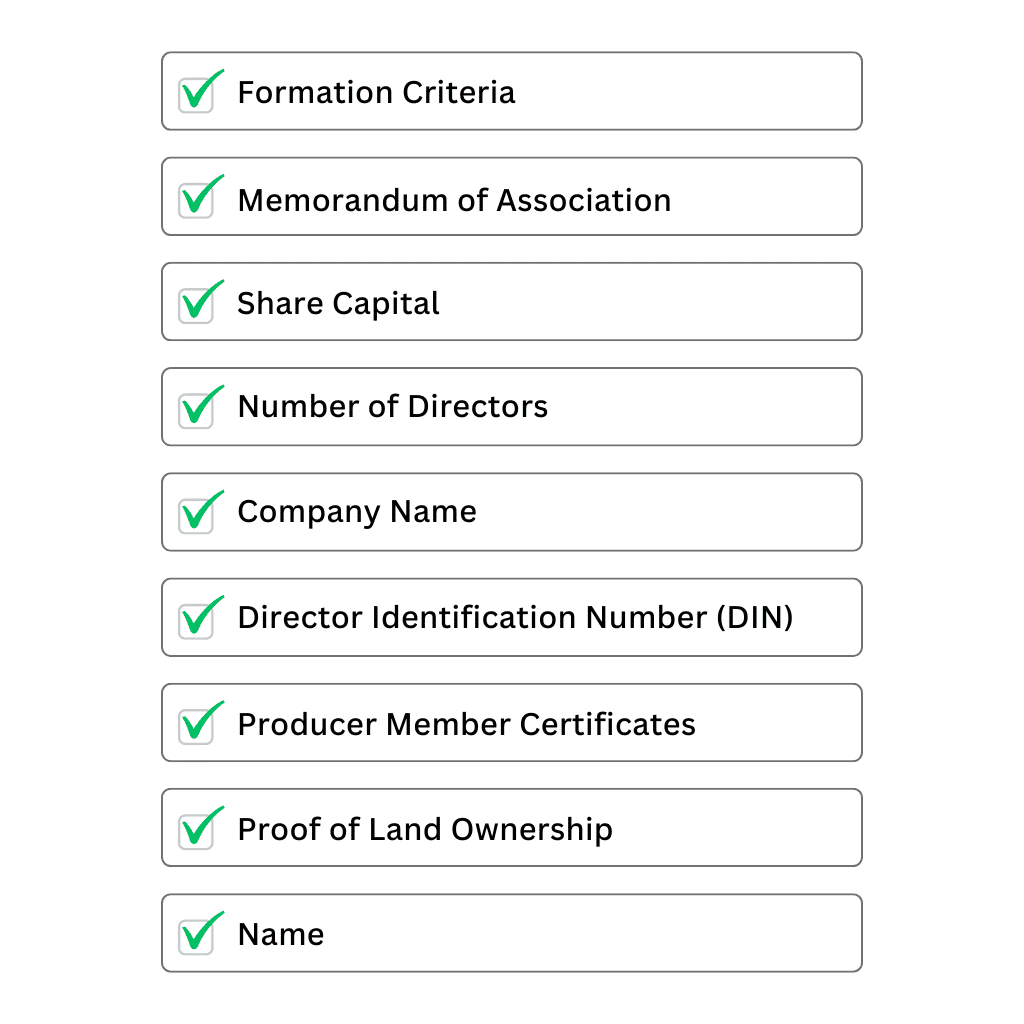

Incorporation Checklist

To incorporate a Producer Company, the following steps and pre-incorporation compliance checks are essential:

Formation Criteria

At least 10 individuals, each being a producer or any combination of two producer institutions or ten or more individuals or producer institutions should come together.

Memorandum of Association

The memorandum should include the objects specified under Section 378B of the Companies Act, 2013.

Share Capital

The proposed producer company’s share capital should comprise equity shares only.

Number of Directors

Every Producer Company must have a minimum of five and a maximum of fifteen Directors.

Company Name

The name of the Producer Company must end with the words “Producer Company Limited”.

Director Identification Number (DIN)

Each proposed director should possess a valid DIN. If not, DIN for a maximum of 3 directors can be obtained in Form Spice+ Part B and for the remaining directors, Form DIR-3 needs to be filed.

Producer Member Certificates

Each producer member should have a certificate from the respective area agriculture officer printed on their Letterhead and duly signed, confirming their engagement in agricultural activities on the authorized land.

Proof of Land Ownership

Evidence demonstrating the ownership of the land of producer members, such as Land Records indicating details like owner’s name, tehsil, district, plot numbers, etc., is required.

Name

The name of the company should end with “Producer Company Limited”.

Among all the types of companies in India, Producer Companies are crucial for empowering the agricultural sector.

Read more on: All About Producer Company

5. Nidhi Company

A “Nidhi” refers to a company incorporated with the objective of promoting thrift and savings among its members. It accepts deposits from and lends to its members exclusively for their mutual benefit, and it complies with regulations set by the Central Government for this class of companies.

Among the types of companies, a Nidhi Company is unique because it promotes mutual benefit through deposits and loans restricted to its members.

According to Rule 4 of the Nidhi Rules, 2014, a Nidhi Company must be a public company with a minimum paid-up equity share capital of Rs 10 Lakhs. Its memorandum of association must include only one object: cultivating the habit of thrift and savings among its members, receiving deposits from, and lending to, its members only, for their mutual benefit. The name of every Nidhi Company must end with the words “Nidhi Limited”.

Nidhi Companies must adhere to the following requirements within 120 days of their incorporation:

- The company must have at least 200 members.

- The Net Owned Funds of the company must amount to Rs. 20 lakhs or more.

- Unencumbered Term Deposits of not less than 10% of the outstanding deposits. Unencumbered term deposits means fixed deposits that are free from any legal or financial encumbrances. These deposits are important because they provide Nidhi Companies with a stable source of funds, allowing them to offer loans and other financial services to their members without any constraints.

- The ratio of Net Owned Funds to deposits of not more than 1:20.

Note that Net Owned Funds comprise the total sum of paid-up capital and free reserves, with adjustments made for accumulated and intangible assets as reported in the latest balance sheet.

The process of incorporating a Nidhi company is similar to that of incorporating a public company limited by shares.

Among the types of companies, the process of incorporating a Nidhi company is similar to that of incorporating a public company limited by shares.

Read more: Nidhi Company Compliances: Updated Checklist 2023

6. Foreign Company

According to section 2(42) of the Companies Act, 2013, a “foreign company” refers to any company or body corporate incorporated outside India that meets the following criteria:

(a) It has a place of business in India, either directly or through an agent, whether physically or through electronic mode.

(b) It conducts any business activity in India in any other manner.

A foreign company is one of the important types of companies defined under Indian law that conducts business or maintains a place of business within India.

Furthermore, if a minimum of 50% of the paid-up share capital (whether equity or preference or a combination of both) of a foreign company is held by one or more citizens of India, or by one or more companies or bodies corporate incorporated in India, or by one or more citizens of India and one or more companies or bodies corporate incorporated in India, either individually or collectively, such company shall comply with the relevant provisions of the Companies Act, 2013.

Every foreign company must, within thirty days of establishing its place of business in India, submit the following documents to the Registrar for registration:

(a) A certified copy of the charter, statute, memorandum, articles of the company, or any other instrument defining the company’s constitution. If the document is not in English, a certified translation in English is required.

(b) The full address of the registered or principal office of the company.

(c) A list of the directors and secretary of the company along with their particulars.

(d) The names and addresses of one or more persons resident in India authorized to accept service of process, notices, or other documents on behalf of the company.

(e) The full address of the office of the company in India, which is deemed to be its principal place of business in India.

(f) Details of previous openings and closures of places of business in India, if any.

(g) A declaration stating that none of the directors or authorized representatives of the company has been convicted or debarred from forming companies or managing them in India or abroad.

(h) Any other prescribed particulars.

The foreign company is required to file Form FC – 1 as per the Companies (Registration of Foreign Companies) Rules, 2014, within thirty days of establishing its place of business in India and the application shall also be supported with an attested copy of approval torn the Reserve Bank of India under Foreign Exchange Management Act or Regulations, and also from other regulators, if any, approval is required by such foreign company to establish a place of business in India or a declaration from the authorized representative of such foreign company that no such approval is required.

7. Small Company

A small company is a type of private company introduced under the Companies Act, 2013, classified based on its size, specifically its paid-up capital and turnover. Essentially, small companies are private companies that are small in size. making them one of the important types of companies under the Act.

As per section 2(85) of the Companies Act, 2013, a “small company” is defined as a company, other than a public company, that meets the following criteria:

(i) The paid-up share capital of the company does not exceed Rs 4 Crore, and

(ii) The turnover of the company, as per its last profit and loss account, does not exceed Rs 40 Crore

However, certain entities are excluded from this definition, including:

(A) Holding companies or subsidiary companies.

(B) Companies registered under section 8.

(C) Companies or bodies corporate governed by any special Act.

Small companies have specific privileges that differentiate them from other private or public companies, establishing them as a unique category within the corporate framework.

Read more: Small Company

8. Government Company

A “Government company,” as defined in subsection (45) of Section 2 of the Companies Act, 2013, refers to any company where not less than fifty-one percent of the paid-up share capital is held by the Central Government, one or more State Governments, or a combination of both. This definition also includes subsidiary companies of such Government companies.

Government companies are one of the distinctive types of companies subject to specific rules under the Companies Act. They may be formed as either Private Limited or Public Limited companies.

9. Holding Company

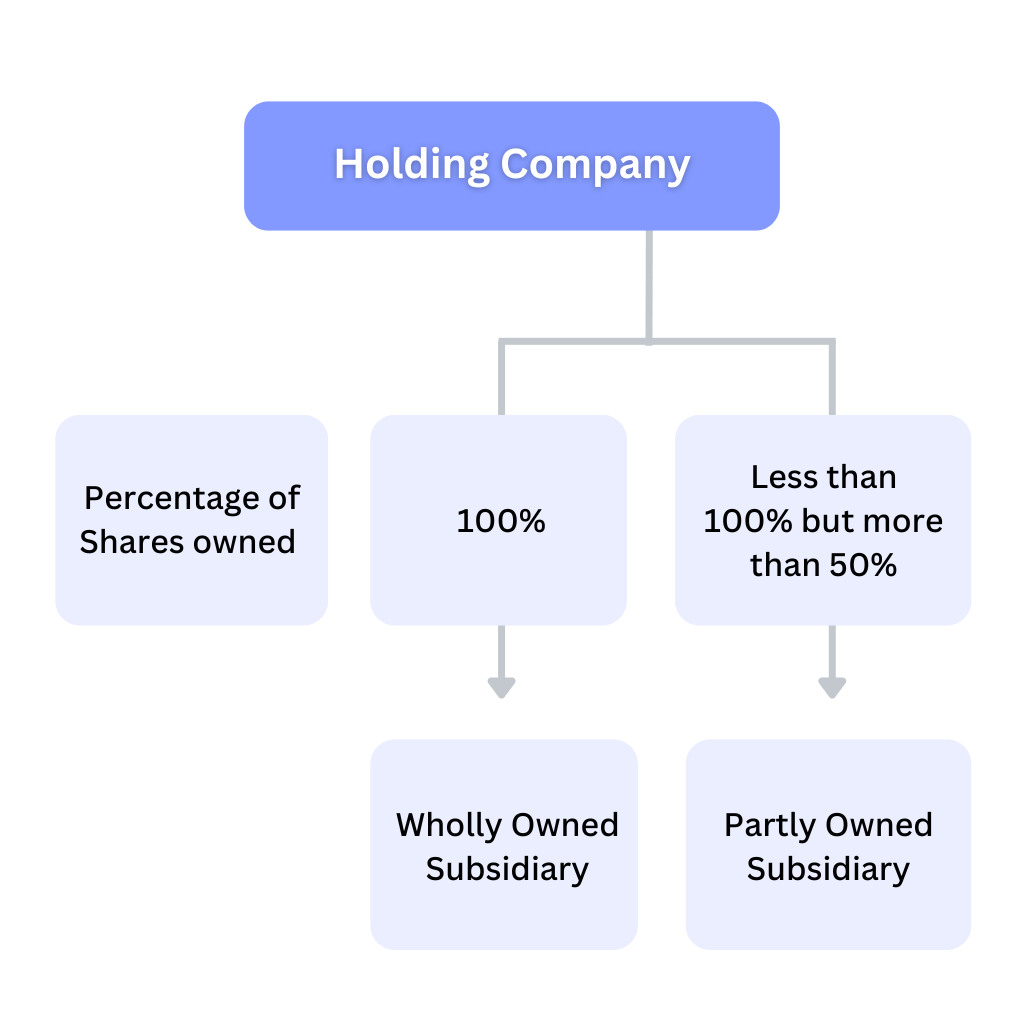

According to Company law, a subsidiary company is one that is under the control of another company, known as the holding company. In simple words, a holding company means a company having one or more subsidiaries.

Therefore, the concept of “control” is pivotal in determining the status of a holding company under company law. This control can be established either through management control or through ownership of shares.

As per Section 2(46) of the Companies Act, 2013, a holding company, in relation to one or more other companies, means a company of which such companies are subsidiary companies. Holding companies represent an important classification within the various types of companies recognized under Indian law.

In order to be called a Holding Company, ABC Ltd. must control the composition of the Board of Directors of DEF Ltd. or it must exercise or control more than half of the total Share Capital in DEF Ltd.

10. Subsidiary Company

Section 2(87) of the Companies Act, 2013 provides that subsidiary company or subsidiary, in relation to any

other company (that is to say the holding company), means a company in which the holding company—

(i) controls the composition of the Board of Directors i.e power to appoint or remove the whole or a majority of the directors ; or

(ii) exercises or controls more than one-half of the total share capital either at its own or together with one or more of its subsidiary companies:

Subsidiary companies form an essential part of the corporate structure and are included among the many types of companies regulated under the Companies Act.

11. Non-Banking Financial Company

NBFC, short for Non-Banking Financial Company, refers to a company primarily involved in accepting deposits as its core business activity. These entities are registered under either the Companies Act 1956 or the Companies Act 2013 and engage in various financial activities.

Specifically, an NBFC is engaged in activities such as providing loans and advances, investing in securities issued by the government or local authorities, leasing, hire-purchase, insurance, and chit-fund businesses.

NBFCs represent a specialized category among the different types of companies operating in India’s financial sector.

However, it’s important to note that NBFCs do not include institutions whose primary activities involve agriculture, industrial operations, trading of goods (excluding securities), provision of services, or dealing in immovable properties.

The initial step in establishing an NBFC involves the incorporation of a new company under the Companies Act 2013. It’s imperative that the chosen name appropriately reflects the nature of an NBFC. Typically, names containing terms like “Investment,” “Finvest,” “Finstock,” “Finance,” and similar expressions may be utilized.

However, it’s essential to ensure that the name aligns with the characteristics and activities associated with NBFCs, as the Reserve Bank of India (RBI) generally does not permit names that do not accurately represent the nature of an NBFC. NBFCs are required to obtain a Certificate of Registration (CoR) from the Reserve Bank of India to commence/carry on business of NBFI.

12. Chit Fund Company

Chit basically means transaction. It has various other names such as chit fund, chitty, kuree, etc. Chit funds are a popular financial instrument in India, representing a significant part of the informal money market. They serve as a means for individuals to pool their resources and collectively save and borrow money.

Operated by Chit Fund Companies, these funds provide a unique avenue for financial transactions, offering participants a platform to contribute, save, and borrow funds within a regulated framework.

According to Section 2(b) of the Chit Fund Act, 1982, a chit fund company is one which manages, supervises, and keeps a check on chit funds. It is a scheme that allows the user to borrow as well as save some money.

While chit-fund companies fall under the category of Non-Banking Financial Companies (NBFCs), they are not required to register with the Reserve Bank of India (RBI) . This exemption allows chit funds to operate under the supervision of state-level regulators rather than the RBI.

Chit fund companies are a distinct example among the many types of companies functioning in India’s financial ecosystem.

To establish a chit-fund business in India, it is advisable for the promoters to initially incorporate a Private Limited Company with the specific objective of engaging in chit-fund operations.

Following the incorporation of the private limited company, the next step involves applying for registration with the relevant Chit Fund Registrar of the respective state. It is crucial to obtain registration from the state registrar before commencing chit-fund operations in India.

13. Start-Up Company

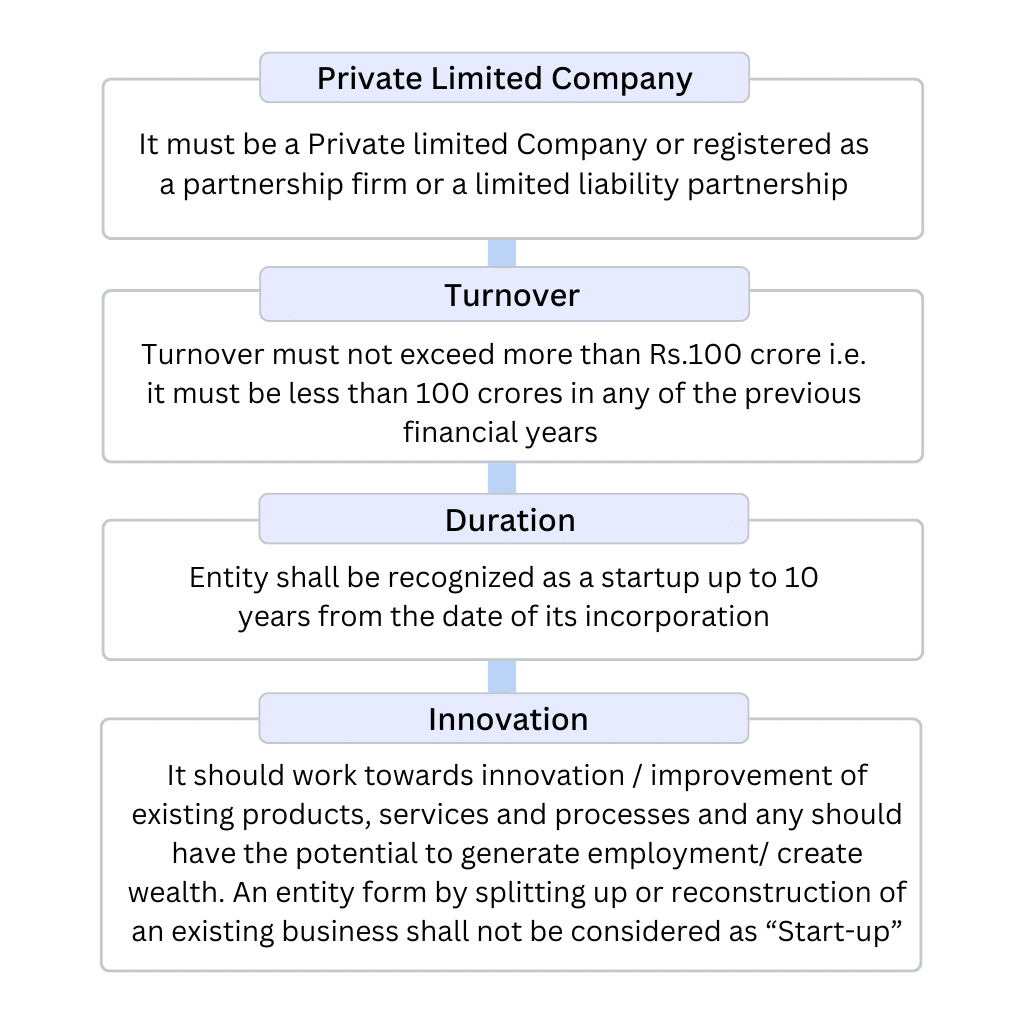

A startup is a new business that’s growing quickly and aims to fill a gap in the market with its innovative product, service, or idea. It’s all about finding a unique solution to a problem and building a business around it.

On 15th August 2015, the Hon’ble Prime Minister Narendra Modi announced the “Startup India initiative” which aimed at fostering entrepreneurship and promoting innovation by creating an environment that is suitable for the growth of Startups.

To meet the objectives of the initiative, the Hon’ble Prime Minister on 16th January 2016 launched the “Startup India Action Plan”.

Under the Start-up India Action Plan, start-ups meeting the criteria as prescribed under G.S.R. notification 127(E) are eligible to apply for getting recognition by DPIIT (Department for Promotion of Industry and Internal Trade) under the plan. The Start-ups are required to submit necessary documents, at the time of application.

Start-ups have emerged as one of the most dynamic and promising types of companies in India’s business landscape.

Eligibility Criteria for Startup Registration

Read more: Startup India Scheme – Eligibility, Benefits and How to Apply

Conclusion on Types of Companies in India

Different types of companies in India are designed to meet different business needs. It’s important for entrepreneurs to understand these structures and their features to choose the right one for their ventures.

Ultimately, the choice of company registration depends on factors such as business objectives, risk tolerance, and regulatory compliance. By understanding the features and implications of each registration type, entrepreneurs can make informed decisions to set up their businesses for success in the dynamic Indian market.

Discover the right Type of Companies in India to kickstart your business journey! Whether you’re considering a private limited company, a public limited company, a one-person company (OPC), or any other form of entity, our experienced team of professionals at Registration Arena is here to guide you through the process.

Need help with registration? Connect with our experts now!