.A company is a registered association of people formed for a certain objective. It is a legal entity separate from its owners in the eyes of the law. Companies in India are of different types owing to the numerous business structures available. While some companies are private others are public; some companies are limited while others are unlimited. We discuss the various types of companies-

Different types of Companies in India are:-

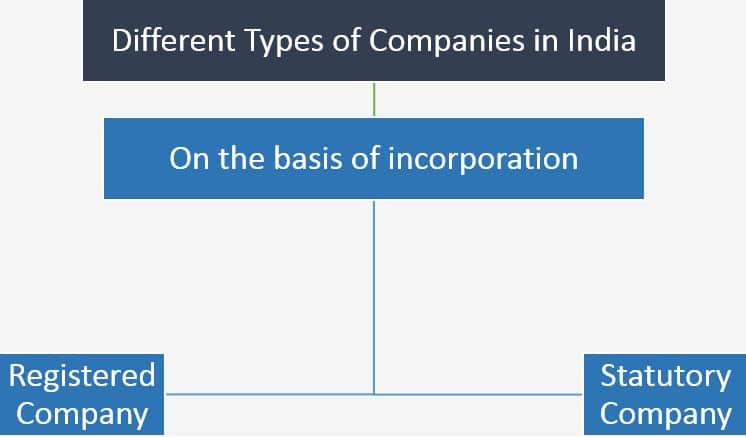

1. Types of companies – On the basis of Incorporatione

This is the broadest outline we classify companies under. All the other company types fall in either of these two heads.

A. Statutory Company

A Company created by a special act passed by the Parliament (Central legislature) or by the State Legislature. These companies are created with or without a profit motive but instead with a service motive. These companies share the same intent which is to help the people. Their financial records are audited by the Comptroller and Auditor General of India.

Features:

- It is an artificial legal entity in the eyes of the law.

- Its employees are different from government employees.

Merits

- Unlike Public Sector Undertakings, these are not affected by outside intervention.

- They can raise capital easily

Demerits

- Since these companies work for a service motive instead of a profit motive, the employees as well as the higher management is reluctant to work hard enough to make profits for the company and the losses generated by the company are made good by the government.

- The employees often misuse their powers for personal gains

E.g. Reserve Bank of India (RBI) formed under the RBI Act, 1934; State Bank of India (SBI) formed under SBI Act, 1955.

B. Registered Company

All the companies which are registered under the Companies Act, 2013 are regarded as Registered Companies. They are subject to the provisions of the Act and are governed by the Ministry of Corporate Affairs. Majority of the different types of companies in India fall under this head.

Features:

They are a separate legal entity in the eyes of the law separate from their owners.

They enjoy perpetual succession.

Merits:

Since they have perpetual succession, they are unaffected by the death, retirement or insolvency of their members

They are created with a motive of fulfilling some objective, hence the management is efficient and works towards fulfilling that objective.

Demerits:

It is tough and complicated to raise capital

Almost all the companies in India fall under the Registered Company category.

Under Registered Companies, we come across the following classifications of company types:

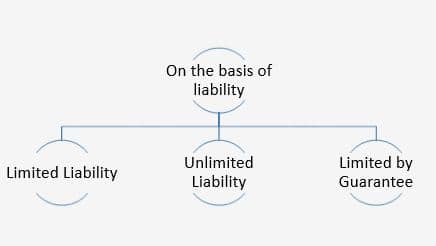

2. Types of companies – On the basis of Liability

A. Limited Companies

These companies feature limited liability for their members (shareholders). It implies that in case of insolvency of the company the personal assets of the shareholders cannot be used to meet the deficit and pay back the debts of the company. The liability of each member is limited to the unpaid face value of the shares held by the respective member. All companies of this nature have the word ‘Limited’ after their name. Among all the different types of companies in India, this type is the most popular.

B. Unlimited Companies

These are companies where the shareholders have unlimited liability, implying that in case of insolvency the personal assets of the shareholder can be and will be used to meet the debts of the firm. Very few companies in India are of such nature.

C. Companies Limited by Guarantee

In this company, the liability of each member varies. The liability of each member is defined in the Memorandum of Association of the company. Here, the liability structure of the company is in a way a combination of the above two types. The members of this type of company are liable to pay the unpaid face value of the shares that they own as well as the amount that they have to pay under guarantee at the time of winding up or liquidation,

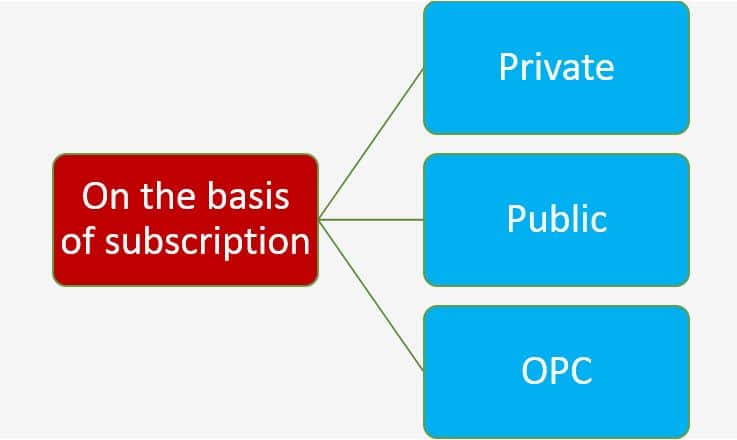

3. Types of companies – On the Basis of Subscription

Companies inviting the public to subscribe to their shares are known as public companies while those companies which do not invite the public to subscribe to its shares (since they are prohibited by the Act to do so) are known as private limited companies.

It is important to note that Private companies and Public Companies are different from Private Sector companies and Public Sector Companies. We explain this under the heading ownership below since it is a matter of much confusion.

A. One Person Company

Introduced in the companies Act, 2013, A One person Company is a type of company structure wherein a single person is the owner of the company. In a way, it is a much narrowed down version of a Private Limited Company suitable for small businesses. It has very less compliance and way more relaxations.

- It can have only one member

- There is no minimum paid up share capital

- It can only be incorporated by an Indian resident

- An OPC can voluntarily as well as mandatorily convert into a Private Limited Company on pre-defined grounds.

B. Private Company:

One which is characterized by its inability to raise capital from the stock exchange or from any form of public offering. The shares cannot be transferred to a non-member without the permission of the existing members. It is a popular structure for growing startups and this is how they are usually incorporated.

- The minimum number of members in a Private company is 2 while the maximum is 200.

- It does not have a minimum paid up capital requirement

- These companies have less compliance as compared to public limited companies

- They enjoy perpetual existence similar to all registered companies

- It is not required to issue prospectus

A Private company can go public if & when it offers to sell its shares.

C. Public Company:

One which raises capital from the market by offering its securities to the public through stock exchanges or other modes

- It must have a minimum of seven members

- No upper limit for members

- Ease in raising capital

- They invite the public to subscribe to their shares

- The shares of such a company are freely transferable implying that they can be traded without any restriction

- They have to abide by more regulations owing to their public nature

- It has to publicly publish its financial statements, once again owing to its public nature

A Public company can go private when it buys off all of its securities from the primary or the secondary market.

Bear in mind that any company whether it be Private or Public can be limited, unlimited or limited by guarantee.

4. Types of companies – On the Basis of Ownership:

The company can be a privately held company which is owned by individuals and not the Government or a Government Company which is held by the government and is also known as a public sector enterprise or a public sector company. Note that a privately held company can be an OPC which is headed by a single member or a private limited company which requires at least 2 members.

A. Private Sector Company / Non-Government Company

A Private Sector company/ Non-Government Company is one which is held by individuals and not by the government. It does not necessarily mean that it is a private company (those companies which do not invite the public to subscribe to its shares, as discussed above) rather it means that it is a privately owned company.

B. Government Company/Public Sector Company

It is a company which is registered under the Companies Act, 2013, it differs from Public Sector Undertakings. A government company is one in which the Central Government or State Government or both combined have at least 51% or more of the equity. Any company which is a subsidiary of a Government company is also classified as a Government Company. Subsidiary companies have been detailed below under the heading Subsidiaries.

- The Comptroller Auditor General audits these companies

- Their primary motive is that of service but they do not forgo profit making.

- The annual reports are presented in the concerned legislature. (State or Central Government depending on the ownership)

- The Central Government can exempt any provision of the Companies Act and relieve the Government Company concerned from complying with it.

5. On the Basis of Origin:

The classification based on the origin of the company is very simple to understand yet it plays an important role in the life of the concerned company.

A. Domestic Company

Any company based in India is considered a domestic company. Companies originating in India have different compliance and lesser taxes as compared to those who do not.

B. Foreign Company

Any company that has been incorporated in a foreign country is known as a foreign company.

6. On the basis of Status:

A. Small Company

Any company which has a paid up share capital of less than Rs.10 crores and a turnover of less than Rs.100 crores is classified as a small company. It is important to note that any company which qualifies both the above criteria is considered to be a Small Company and it does not have to be necessarily registered under any clause of the Act. However for a company to qualify as a small company, it should not be a public company, Section 8 Company or governed by an Act apart from the Companies Act, 2013.

- A small company does not need to rotate its auditors

- It does not need to file Cash Flow statement with its financial statements.

- The Merger and Amalgamation process is quite simple for such companies

- They need not conduct 4 Annual General Meetings.

B. Dormant Company

A company formed to undertake a project in the future or hold an asset/intellectual property. These companies do not make any significant transactions or carry on their business. These companies can obtain the status of a dormant company.

C. Holding or Parent Company

- A company which holds – more than 50% of the equity in another company or

- Controls the composition of the latter’s board of directors or

- If it is the parent company of the subsidiary’s holding company. This may be a little typical to understand so let’s explain it with an example. LinkedIn acquired Slideshare.net, with this LinkedIn became the parent/holding company while Slideshare became the subsidiary company. Years later, Microsoft acquired LinkedIn. With this acquisition, Microsoft controlled LinkedIn which in turn controlled Slideshare, hence Microsoft controlled Slideshare or

- Controls more than half of its total voting power.

D. Subsidiary Company

A company which is held by another company; implying that the latter has more than 50% of the equity in the former. The controlling company is known as Holding/Parent Company (as discussed above) while the controlled company is known as a Subsidiary Company. Ex. Reliance Jio is a subsidiary of Reliance Industries limited

E. Associate Company

When a company exerts significant influence over another company, the latter is known as an associate company. It is important to note that in this case significant influence means control of over 20% equity in the associate company or voting power.

Now we will study company structures which have been provided for in the Companies Act, but do not fall under a classified head.

In all the different types of companies in India, these are comparatively uncommon. Though they exist, they do so in small numbers.

Section 8 Company

Any company registered under Section 8 of the Companies Act, 2013 is known as a Section 8 Company. It is also known as a Non-Profit Organization (NPO). These companies have a service motive. They do not work for profits and hence do not pay dividends.

- It cannot be converted into an OPC

- The revenue generated by a Section 8 Company is used only for promotion and growth purposes. The revenues are not distributed among the members

- A special license from the Central Government is required for the formation of such a company

- It is not treated as a small company

- It must have a minimum of two directors and two shareholders. The director and the shareholder can be the same person.

- It is a separate legal entity

- It features limited liability for its members.

Producer Company

A producer company as the name suggests is created to help the farmers with regard to their agricultural produce.

- Producer Companies feature limited liability for their members

- The minimum paid up share capital is Rs.5 lakh

- No limit of the maximum number of members but all the members must be a farmer/producer as defined under Companies Act

- A minimum of 5 directors and a maximum of 15 directors.

- The board has to meet at least once every 3 months.

Nidhi Company

A Nidhi Company is a type of company which serves to promote savings among its members and to provide easy loans to them. It is based on the principle of mutual benefit. Therefore it is also known as a Mutual Benefit Society.

- Easy to incorporate

- No outside intervention

- Less compliance

- Perpetual Succession/Going Concern

- It helps channelize small savings

Conclusion

India is one of the fastest growing economies all around and the second most populated country in the world. It is only right that the country has a wide variety of business structures to suit people. Different Types of Companies in India serve different people on the basis of their business requirements. This article helps readers understand the types of companies available and the one most beneficial to their venture. It is important to know about them as well as their features to understand the one that falls in line with the business.