A private limited company is a popular form of business organization in India. Once a private limited company is registered, it shall meet several compliance requirements specified under different laws. It is mandatory for all the companies registered in India to follow the provisions of the Companies Act, 2013 besides other laws that are applicable. We have created a compliance calendar for Private Limited Companies showing one-time, annual, and event-based Compliances for Private Limited Companies.

Compliance with all the applicable laws, rules, and regulations is important for a company as it helps in attracting new investors and building the credibility of the company. In addition, compliance saves the company from hefty penalties and protects the company and its officers from getting involved in legal complications.

One-Time Compliances for Private Limited Companies

Once the registration process of a private limited company is complete and a certificate of incorporation is issued, it shall comply with several requirements. As these requirements are to be met once in a lifetime by a company, they are also called one-time compliances.

Forms/ ROC Compliances for Private Limited Companies

A company shall file the following forms after its incorporation.

| S. No | Form Type/ Purpose | Verification | Form No. | Due Date |

| 1. | Declaration of Commencement of Business: Declaration by a Director that all the subscribers to the memorandum have paid the full value of their shares

Note: This form is only for companies that are having a share capital. | By Practising CA/CS/CMA | INC – 20A | Within 180 days of incorporation |

| 2. | Appointment of Auditor

| – | ADT-1 | Within 15 days of the appointment of the auditor (The first auditor shall be appointed within 30 days of incorporation) |

Board Meeting within 30 days of Incorporation

A private limited company must hold its first board meeting within 30 days of its incorporation. The following matters shall be discussed at the meeting –

- Opening a bank account for the company

- Issue of share certificates

- Appointment of the first auditor of the company

- Finally, other related matters

Opening of Company Bank Account

A bank account in the name of the company is required for depositing the share capital amount received from shareholders. Also, routine transactions of a company are carried out through a bank account only.

Therefore, after the incorporation of a private limited company, a bank account shall be opened.

Issuance of Share Certificates

A company must issue share certificates to the shareholders within 2 months from the date of its incorporation. Share certificates shall be in Form SH-1 and shall be signed by a director and Company Secretary if the company has appointed a Company Secretary.

However, if there is no Company Secretary, it shall be signed by two directors.

Obtaining Registration Under Different Laws

Apart from obtaining registration under the Companies Act, 2013, a private limited company shall obtain registration and licenses under different laws, if applicable.

Thinking that it is complex to obtain these registrations or licenses? Well, experts at Registration Arena will make the process simpler for you! Get in touch with us to know more.

Printing and Display of Name and Address

A company shall have its letterhead containing details like name, address, CIN, contact no., email ID, and web address (if any). Other documents on which such details shall be printed are invoices, registers, visiting cards, etc.

However, the name of the company shall also be printed on bills of exchange, promissory notes, etc. In addition, the name and registered address of the company shall be displayed at a prominent location outside its premises and on hoardings and signboards as well.

Annual Compliances for Private Limited Companies

As per the Companies Act, 2013, Private Limited Companies are required to file several forms and returns on an annual basis. In addition, the provisions of the Income Tax Act, of 1961 are also applicable to a company, and therefore, a private limited company shall comply with the Income Tax Act, of 1961 as well.

Following are the mandatory annual compliances for Private Limited Companies.

Forms/ ROC Compliances for Private Limited Companies

A Private Limited Company shall file the following forms on an annual basis.

| S. No | Form Type/ Purpose | Form No. | Due Date |

| 1. | Annual Financial Statements Note: If the paid-up share capital of Private Limited Company exceeds Rs. 5 crores or turnover exceeds Rs. 100 crores, then financial statements shall be filed in XBRL format. | AOC – 4 | Within 30 days of holding of Annual General Meeting |

| 2. | Annual Return Note: If the paid-up share capital of Private Limited Company is Rs. 10 crores or more or the turnover is Rs. 50 crores or more, then it shall obtain a certificate from Practising Company Secretary in Form MGT-8. | MGT – 7A (For OPC and Small Companies) MGT – 7 (For Other Companies) | Within 60 days of holding of Annual General Meeting or the due date of the Annual General Meeting, whichever is earlier |

| 3. | Disclosure of Interest by the Director to the Company | MBP – 1 | In the First Board Meeting of each Financial Year |

| 4. | Disclosure of Non-Disqualification by the Director to the Company | DIR – 8 | In the First Board Meeting of each Financial Year |

| 5. | Director KYC | DIR – 3 KYC | 30th September of each year |

| 6. | Return of Deposits | DPT – 3 | 30th June of each year |

| 7. | Reappointment of Auditor or Casual Vacancy of Auditor | ADT – 1 | In case of reappointment, within 15 days from the Annual General Meeting in which Auditor is reappointed In case of a casual vacancy, within 15 days from the Extraordinary General Meeting in which a new auditor is appointed |

| 8. | Statement of Unpaid and Unclaimed Amounts, if any | IEPF – 2 | Within 60 days of holding of Annual General Meeting or the due date of the Annual General Meeting, whichever is earlier |

| 9. | Disclosure of Significant Beneficial Owner | BEN – 2 | Within 30 days from receipt of BEN-1 from the shareholder |

| 10. | Pending payment to Vendors in case of MSME | MSME – 1 | As it is a half-yearly return, the following are the due dates – For 1st April to 30th September – 30th October For 1st October to 31st March – 30th April |

Note: If AOC-4 or MGT-7 are not filed on time, then the company and its officers are liable to a penalty of Rs. 10,000, and a further penalty of Rs. 100 per day, which can go up to Rs. 2,00,000 in the case of the company and Rs. 50,000 in the case of officers in default.

Meetings and Maintenance of Minutes

According to the provisions of the Companies Act, 2013, a Private Limited Company must hold the following meetings every year.

In addition, after the conclusion of every meeting, a summary of the meeting which includes the name of the chairman, no. of directors present, resolutions passed, leave of absence, etc., known as minutes, shall be entered in a minute book to be maintained by the company. Separate minute books shall be maintained for general meetings, board meetings, creditors meetings, and committee meetings.

Annual General Meeting (AGM)

Every company must hold an annual general meeting every year. The first AGM of a company shall be held within nine months from the end of the first financial year. In subsequent years, it shall be held within six months from the end of the financial year. However, the gap between the two AGMs cannot be more than 15 months.

The meeting shall be held during business hours, on any day except a national holiday. It shall be held either at the registered office of the company or within the same city, town, or village in which the registered office of the company is situated.

The Notice for the general meeting shall be given at least 21 clear days prior to the meeting. Along with the notice, attach the financial statements, report of the Board of Directors, and report of the auditors.

Within 30 days of the conclusion of the AGM, minutes (summary of the meeting) shall be signed by the chairman of the meeting and shall be entered in the minutes book.

Board Meetings

Minimum of 4 board meetings shall be held every year in a company in such a manner that the gap between two board meetings is not more than 120 days. However, in the case of a small company and a private company that is a startup, two board meetings shall be held, one in each half of the calendar year and the gap between the two meetings shall be a minimum of 90 days.

The Notice for a board meeting shall be given 7 days prior to the meeting. The quorum for such meetings shall be 1/3rd of the total number of directors or 2 directors, whichever is higher.

Within 30 days of the conclusion of every board meeting, minutes (summary of the meeting) shall be signed by the chairman of the meeting and shall be entered in the minutes book.

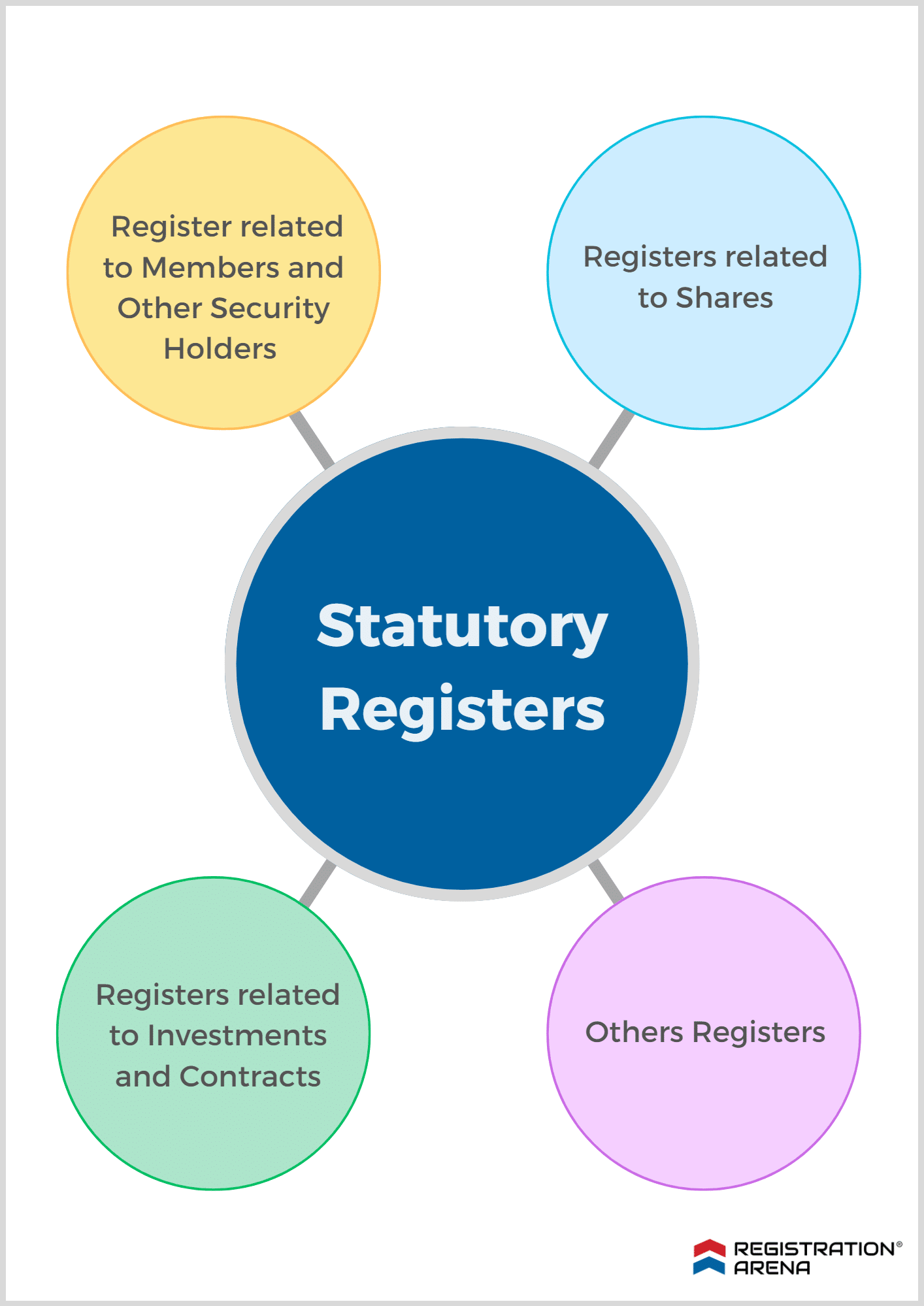

Statutory Registers

According to the provisions of the Companies Act, 2013, every company shall maintain the following registers to maintain records of the company.

Register related to Members and Other Security Holders

- Register of Members in Form No. MGT-1

- Register of Debenture Holders or Other Security Holders in Form No. MGT-2

- Foreign Register

- Register of Significant Beneficial Owners in Form No. BEN – 3

Registers related to Shares

- Register of Renewed and Duplicate Share Certificates in Form No. SH-2

- Register of Sweat Equity Shares in Form No. SH-3

- Register of Employee Stock Options in Form No. SH-6

- Register of Shares and Securities Bought Back in Form No. SH-10

Registers related to Investments and Contracts

- Register of Loans/Guarantee/Securities/Acquisition by Company in Form No. MBP-2

- Register of Investments by the Company not held in its own name in Form No. MBP- 3

- Register of Contracts/Arrangements in which Directors are Interested in Form No. MBP-4

Other Registers

- Register of Charges in Form No. CHG-7

- Register of Deposits

- Register of Directors and Key Managerial Personnel

Directors Report

Every company must attach to its financial statements, a report by the Board of Directors of the company. It shall contain particulars as specified in Section 134 of the Companies Act, 2013.

Statutory Audit

As per the Companies Act, 2013, every company must get its accounts audited every year. This audit shall be done by a Chartered Accountant or a firm of Chartered Accountants appointed as the Statutory auditor of the company.

The auditor shall examine the books of accounts and vouchers of the company. On the basis of such examination, he shall prepare a report and express an opinion as to whether the financial statements of the company present a true and fair view of its financial position or not. Such a report shall be laid down before members of the company in the Annual General Meeting.

Further, it is the responsibility of officers and employees of the company to assist the auditor in carrying out his duties. They shall provide the information and explanation as required by the auditor.

Income Tax Return

As per Section 2(31) of the Income Tax Act, 1961, a person includes a company, and therefore, filing of income tax return is another mandatory annual compliance for a private limited company. However, every private limited company shall file a return of its income in Form No. ITR 6 on or before 31st October of every year.

However, a belated income tax return can be filed before 31st December of the assessment year or before the completion of the assessment, whichever is earlier. On the filing of the belated return, a penalty of Rs. 5000 is levied in case the income of the company exceeds Rs. 5 lakhs. In case the income of a company does not exceed Rs. 5 lakhs, a penalty of Rs. 1000 is levied.

Also, the Finance Act, of 2022 introduced the concept of updated return as per which if a company fails to file a return before the due date or a belated return, it can file an updated return in the ITR-U form. ITR-U can be filed within 2 years from the end of the relevant assessment year along with additional tax and interest.

Don’t wait for the last date, file the income-tax return of your company now! Connect with us for more details.

Advance Tax Payment

As per the Income Tax Act of 1961, if the estimated tax liability of a taxpayer is Rs. 10,000 or more for a financial year, tax shall be paid in advance. It means such taxpayer shall pay the tax in the year in which income is earned.

Therefore, if the estimated tax liability of a Private Limited Company is Rs. 10,000 or more, then it shall pay advance tax in the following installments.

| Due Date | % Of advance tax to be paid |

| On or before 15th June | 15% |

| On or before 15th September | 45% (less tax already paid) |

| On or before 15th December | 75% (less tax already paid) |

| On or before 15th March | 100% (less tax already paid) |

If a Private Limited Company has opted presumptive taxation scheme, then it shall pay 100% advance tax on or before 15th March.

Event-Based Compliances

Various compliances shall be done by a Private Limited Company only if it fulfills certain conditions or on crossing threshold limits or on the happening of a particular event. These compliances are also called event-based compliances.

A compliance checklist for Private Limited Companies in India is given below.

Forms/ ROC Compliances for Private Limited Companies

A Private Limited Company shall file the following event-based forms.

| S. No | Form Type/ Purpose | Form No. | Due Date |

| 1. | Change in the Registered Office of the company | INC – 22 | Within 30 days of such change |

| 2. | Change in the Name of the company | INC – 24 | To be filed after filing the RUN form and MGT-14 with ROC |

| 3. | Transfer of Shares – To be executed and given to the company by the transferor or the transferee | SH – 4 | Within 60 days from the date of execution of the instrument |

| 4. | Notice to Registrar of any increase or alteration in share capital | SH – 7 | Within 30 days of such increase/ alteration |

| 5. | Letter of Offer in case of buy-back | SH – 8 | Shall be filed with ROC before buy-back of shares |

| 6. | Declaration of Solvency | SH – 9 | To be attached with SH-8 |

| 7. | Buy-back of securities | SH – 11 | Within 30 days of completion of the buy-back |

| 8 | Return of Allotment | PAS – 3 | Within 30 days of allotment of securities |

| 9. | Registration of creation/ modification of charge with ROC | CHG – 1 | Within 30 days of such creation/ modification |

| 10. | Satisfaction of Charge | CHG – 4 | Within 30 days of payment of the loan for which the charge is created |

| 11. | Registration of creation or modification of charge for debenture or rectification of particulars | CHG – 9 | Within 30 days of such creation/ modification |

| 12. | Notice of situation or change of situation or discontinuance of situation, of place of keeping a foreign register | MGT – 3 | Within 30 days of the opening of the foreign register |

| 13. | Filing of Resolutions and Agreements with ROC

| MGT – 14 | Within 30 days of passing such a resolution/ making such agreement |

| 14. | Notice of Address at which books of accounts are maintained | AOC – 5 | Within 7 days of passing the board resolution deciding the place for maintenance of books of accounts |

| 15. | Resignation of auditor, to be filed with ROC by auditor himself | ADT – 3 | Within 30 days from the date of resignation |

| 16. | Appointment/ Change in Director/ Key Managerial Personnel Note: A Private Limited Company shall appoint a whole-time Company Secretary if its paid-up share capital is Rs.10 crores or more.

| DIR – 12 | Within 30 days of appointment/ change |

| 17. | Application by company for removal of the name of the company from the register of companies | STK – 2 | N.A. |

CSR

CSR i.e., Corporate Social Responsibility is a concept introduced by the Companies Act, 2013 as per which certain classes of companies are required to spend some amount of their profit for the betterment of society.

According to Section 135 of the Companies Act, 2013, every company having –

- Net Worth of Rs. 500 crores or more; or

- Turnover of Rs. 1000 crores or more; or

- Net Profit of Rs. 5 crores or more

Is required to constitute a CSR committee and spend at least 2% of the average net profit of the company of immediately preceding 3 years towards activities specified in Schedule VII to the Companies Act, 2013.

Therefore, if a Private Limited Company meets any of the above thresholds, it shall constitute a CSR committee and spend the amount towards CSR.

Note: All the thresholds shall be checked for the immediately preceding financial year.

Internal Audit

Companies Act, 2013 provides for internal audit of certain companies to check their overall performance.

According to Section 138 of the Companies Act, 2013, every private company having –

- Turnover of Rs. 200 crores or more; or

- Outstanding loans or borrowings from Banks or Public Financial Institutions of Rs. 100 crores or more

shall appoint an internal auditor for audit of the operations of the company. However, An internal auditor can be a CA, CMA, or any other professional as the Board of Directors decide.

Therefore, if a Private Limited Company meets any of the above thresholds, it shall appoint an internal auditor.

Note: All the thresholds shall be checked for the immediately preceding financial year.

Secretarial Audit

As per Section 204 of the Companies Act, 2013, every company (whether public or private) having outstanding loans or borrowings from banks or public financial institutions of Rs. 100 crores or more in the immediately preceding financial year, shall attach a Secretarial Audit Report with the board report of the company.

Whereas, a Practising Company Secretary shall conduct a Secretarial Audit and report in Form No. MR-3.

Read more to know about: Secretarial Audit

Income Tax Audit and Audit Report

Section 44AB of the Income Tax Act, 1961 provides for a mandatory tax audit of a company if the company carries on a business and turnover exceeds Rs. 1 crore or if the company provides professional services and turnover exceeds Rs. 50 lakhs.

Further, if a tax audit is mandatory for a company, then it shall file an audit report on or before 30th September every year.

Other Event-Based Compliances

Other required event-based compliances involve the following:

- Filing of TDS Returns

- Deposit of TDS with the government

- Filing of GST Returns

- Payment of GST (Monthly/ Quarterly)

- Filing of Professional Tax Returns, if applicable in the state

- Deposit of Provident Fund with the government

- Filing of Employee State Insurance Returns

- Deposit of Employee State Insurance amount with the government

What are the Documents and Information Required for the Annual Filing of a Company?

The annual filing of a company requires the submission of the following documents and information-

- Incorporation Documents (Memorandum of Association, Articles of Association, Certificate of Incorporation)

- PAN Card of the Company

- Audited Financial Statements of a company (Balance Sheet, Statement of Profit and Loss, Cash Flow Statement, Statement of Changes in Equity, Notes to Financial Statements)

- Board Report

- Auditor’s Report

- Digital Signature Certificate (DSC) of any director

Conclusion

A company shall follow all the compliances that apply to it as it not only improves the reputation of the company but also protects the company and its officers from fines or penalties. However, it is always advisable to take help from professionals to ensure Private Limited Company completes all applicable compliances in a timely manner.

Registration Arena is having a team of CA/ CS/ Lawyers who will assist you in filing different forms and returns of your company well on time by following the prescribed process. Call/ WhatsApp us at +91 8600544411/22 right away to know more. Additionally, you can also reach out to us by email at sales@registrationarena.com.