A sole proprietorship represents the most simplified and affordable structure for a business organization. It is carried on by an individual, popularly known as a sole proprietor. Individuals seeking to commence a business with minimal investment and low compliance expenses can choose this particular business form. In this article, we will discuss the advantages and disadvantages of sole proprietorship and its suitability as a form of business.

Let us understand what is the meaning of sole proprietorship before discussing the advantages and disadvantages of a sole proprietorship.

What is the Meaning of Sole Proprietorship?

A Sole Proprietorship is a type of unregistered business entity. As the name indicates, ‘Sole’ means ‘Single’ and ‘Proprietorship’ means ‘Ownership’, therefore, in sole proprietorship, there is a single owner.

In simple words, a Sole Proprietorship is a business that is owned, managed, and controlled by one person only and he is known as the ‘Sole Proprietor’. Furthermore, the owner receives all the advantages while simultaneously bearing the various risks and liabilities associated with the business.

Generally, grocery shops, salons, and other retail shops operate as Sole Proprietorship firms.

Characteristics of Sole Proprietorship

The following are the main features of a sole proprietorship.

Sole Owner

In the case of Sole Proprietorship, there is a sole or single owner. He conducts the business by himself and gets all the benefits arising out of the business.

Exclusive Control

The single owner has exclusive control over the business. He takes all the decisions and manages the day-to-day operations of the business. However, if the business is carried on at a large scale, the owner appoints individuals to manage operations.

No Sharing of Risk and Reward

Another feature of a sole proprietorship business is that there is no sharing of risks and rewards. The sole owner enjoys the profits generated by the firm and bears risks associated with the business in terms of finance, operations, manpower management, etc.

No Separation Between Owner and Business

A sole proprietorship and its owner are considered the same. Therefore, unlike a company, the sole proprietorship business is not considered a separate legal entity, different from its owner. Moreover, the events like death and insolvency of the owner affect the survival of the business.

Advantages of Sole Proprietorship

The following are the advantages of a sole proprietorship.

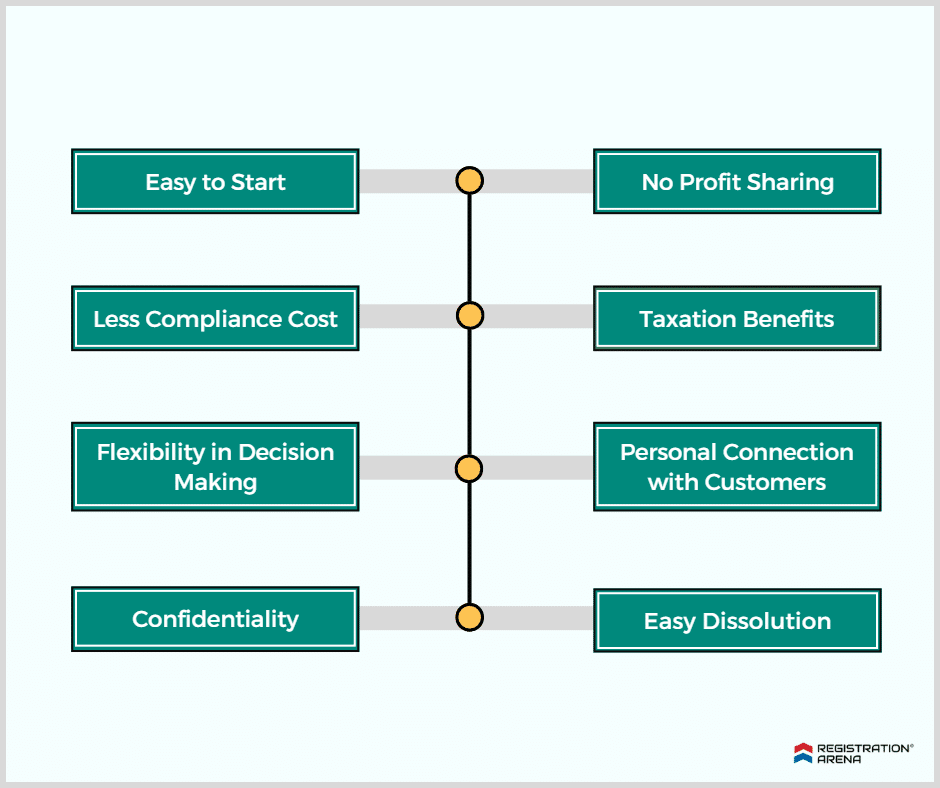

Easy to Start

In India, there is no specific law that governs sole proprietorships. Therefore, it is easy to start a sole proprietorship business. However, starting some businesses requires a few other legal formalities. For example, to open a medicine shop, you require a drug license.

Less Compliance Cost

The compliance cost of a sole proprietorship is very low. This is because, unlike corporates, it is not required to be registered with any governmental authority. Also, MCA compliances are not applicable in the case of proprietary firms. Moreover, an audit is not required for sole proprietorship until its turnover crosses the specified limit as per income tax laws from time to time.

Flexibility in Decision-Making

In a sole proprietorship firm, a single person makes all the business decisions, resulting in easy and simple business operations. As the sole owner of the business, he has the freedom to make desired changes in business operations, strategy, structure, and other aspects without requiring consent from third parties or partners.

Confidentiality

A sole proprietorship involves a few individuals, and unlike a company, its information is not publicly available on websites. This characteristic makes it simpler to uphold confidentiality within the business.

No Profit Sharing

In a sole proprietorship firm, the proprietor exclusively receives the profits generated by the business. In other words, the proprietor retains full ownership of the profits and is not required to share them with any external party or partner.

Taxation Benefits

Sole Proprietorship does not have a separate legal entity. Therefore, the income from a sole proprietorship business is taxable in the hands of the owner only, as his business income.

In India, the Income Tax Act, of 1961 provides different income-based slabs for the taxation of individuals. Therefore, the profits of a sole proprietorship business are subjected to lower tax rates as compared to partnership firms and companies. Moreover, an individual can claim several deductions from income that reduces the tax liability.

Personal Connection with Customers

As the sole face of the business, the proprietor can establish a direct and personal relationship with customers. It helps in fostering trust and loyalty of the customers towards the business.

Easy Dissolution

The process to dissolve a sole proprietorship firm is straightforward or uncomplicated. There is no need to follow extensive legal proceedings as sole proprietorship firms are not regulated by a particular law.

Disadvantages of Sole Proprietorship

The following are the disadvantages of a sole proprietorship.

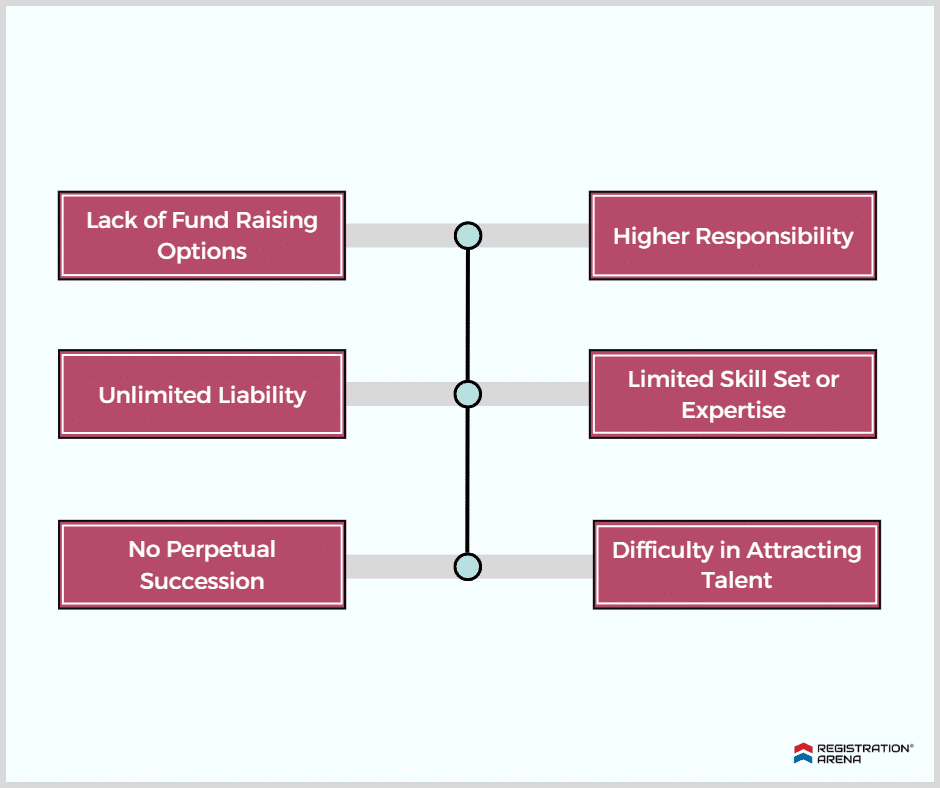

Lack of Fund Raising Options

A sole proprietorship business has fewer options to raise funds. As the credibility of a sole proprietorship is generally low, banks and financial institutions grant limited amounts of loans. Also, angel investors and venture capitalists cannot invest in a sole proprietorship firm as the division of ownership is not possible in a proprietorship firm.

Moreover, due to a lack of funds, a sole proprietorship business has limited chances of expansion.

Unlimited Liability

In Sole Proprietorship, the owner has unlimited liability. It means that in case of losses, the owner becomes personally liable to third parties if the assets of the business are not sufficient to pay off the debts.

In other words, third parties like banks, creditors, etc can raise a claim against the personal assets of the owner.

No Perpetual Succession

The existence of a sole proprietorship depends on the existence of the owner. In case of death or incapacity of the owner, the proprietorship business also comes to an end. Therefore, there is no perpetual succession in sole proprietorship. However, even after the death of the owner, the business can be carried on by his successors or legal heirs.

Higher Responsibility

We all know that ‘With great power comes great responsibility’. Similar is the case with sole proprietorship. The single owner is responsible for decision-making as well as managing the operations of the business. Therefore, the owner becomes overburdened with work.

Limited Skill Set or Expertise

Sole proprietors often have to handle various aspects of the business like marketing, finance, legal matters, etc by themselves only, which generally require expertise. This can be challenging if the owner lacks specific skills or knowledge.

Difficulty in Attracting Talent

As there are fewer growth aspects, limited benefits, and professional development opportunities, sole proprietorship firms generally struggle to attract high-quality employees.

Now that we have understood what are the advantages and disadvantages of a sole proprietorship, let us have a look at what registrations or licenses you need to take.

Which Licences or Registrations do you Require to Start a Sole Proprietorship Firm?

Sole proprietorship firms do not require registration under a particular act like companies and LLPs.

However, a sole proprietorship can obtain local license and registration under state-specific laws, for example, the Shop Act License under the Shops and Establishment Act of the respective state.

Moreover, a Sole Proprietorship can take MSME or Udyam Registration under MSME Act and GST registration if it intends to issue a GST invoice and claim the input tax credit.

Suitability of Sole Proprietorship Firms

A Sole Proprietorship is suitable as a form of business organization in the following cases –

- The capital requirement of business is low

- For individually managed occupations like salons

- To cater to local markets

- When the owner wants to retain control over business

- For small-scale operations, etc.

Conclusion

There are various advantages and disadvantages of a sole proprietorship. On one hand, it gives exclusive control of the business to one person, while on the other hand, it involves several risks and responsibilities. Therefore, before starting a business as a sole proprietor, it is necessary to carefully consider all the factors.

Registration Arena is having a team of experts like CA, CS, and other professionals to guide you regarding which form of business you should select and what is the registration procedure for the same.

For more information, you can connect with us. Call us at +918600544411/22 or drop an email at sales@sregistrationarena.com.