India is one of the fastest growing economies in the world offering abundant opportunities and expansive markets to businesses. It has a diverse consumer base of 1.4 billion people and a large pool of highly skilled workforce apart from a stable political environment. This attracts foreign investors, particularly companies, to set up their business in India. There are many ways in which a foreign company can conduct business activities in India. In this article, we will discuss the two major ways of foreign company registration in India. Additionally, we will understand the meaning of foreign company and the laws governing it.

What is a Foreign Company?

The Companies Act, 2013 contains provisions regarding foreign companies and their registration in India. According to Section 2 (42) of the Act, foreign company means a company or a body corporate that is incorporated outside India but –

- It has a place of business in India, whether through an agent or by itself, either in physical mode or virtual mode; and

- It conducts business activities in India in any other manner.

Therefore, in the context of India, a foreign company is a company that is registered in some other country but carries on business activities in India either physically or virtually.

Laws Governing Foreign Companies in India

Primarily, the Ministry of Corporate Affairs (MCA) regulates foreign companies in India. Section 379-393A of the Companies Act, 2013 contains provisions governing foreign companies. In addition, such companies shall comply with the Companies (Registration of Foreign Companies) Rules, 2014.

Apart from this, if a foreign company has invested in the shares of an Indian company, i.e., Foreign Direct Investment (FDI), then it shall follow the Reserve Bank of India (RBI) guidelines and shall comply with the Foreign Exchange Management Act, 1999, FDI policy and transfer pricing regulations, if applicable.

Further, if a foreign company has set up a liaison office or branch office, or project office in India, then it shall comply with the Foreign Exchange Management (Establishment in India of a branch or a liaison office or a project office or any other place of business) Regulations, 2016 and RBI’s Master Directions.

Moreover, foreign companies shall comply with taxation laws, labour laws, intellectual property laws, etc. (if applicable) similar to other companies that are registered in India.

Foreign Company Registration in India

Foreign companies are incorporated outside India, but it is necessary to register them as they carry out business activities in India. Following are the two ways in which a foreign company can carry out its business activities in India –

Investment/ Collaboration with an Indian Company

The foreign company can either invest in shares of an Indian company or collaborate with it in the following ways.

Wholly Owned Subsidiary

Meaning

The foreign company can invest in the shares of an Indian company by way of Foreign Direct Investment (FDI). In other words, the foreign company can own 100% of the share capital of a company registered in India and carry on business activities through it. In such case, the Indian company becomes the Wholly Owned Subsidiary (WOS) of the foreign company.

Registration Process

It is noteworthy that a private limited company in India can accept 100% FDI through automatic route, except few sectors. Therefore, it is easy for a foreign company to conduct business activities by setting up a private limited company. There shall be a minimum of 2 shareholders and 2 directors in a private company, out of which one director shall be a resident of India.

The following are the steps that you should follow for registration of a company in India with the Ministry of Corporate Affairs (MCA) –

Step 1: Reserve the name of the proposed company by filing Part A of the SPICE+ form (company registration form) on the MCA portal.

Step 2: Apply for directors’ and shareholders’ Digital Signature Certificate (DSC). It is used for digital signing of company registration forms.

Step 3: Prepare Memorandum of Association (MOA) and Articles of Association (AOA) of the proposed company and collect the following documents –

- Proof of registered office of the company (Copy of sale deed/ utility bills like electricity bill, telephone bill, etc. not older than 2 months/ rent agreement/ NOC from property owner)

- Identity proof of directors and shareholders (Aadhaar card/ PAN card/ Passport/ Driving license/ Voter ID card). In the case of foreign directors or shareholders, the passport is mandatory.

- Address proof of directors and shareholders (Utility bills like electricity bills, telephone bills, etc. not older than 2 months or the Latest bank statement)

- Passport-size photographs of directors and shareholders

Step 4: Apply for registration of the company by filing Part B of the SPICE+ form along with linked forms and the above-mentioned documents. Make the payment of requisite fees. You can also apply for the Director Identification Number (DIN) of directors through this form.

Step 5: If the registration form is complete in all aspects, a Certificate of Incorporation containing CIN, PAN, TAN, and GSTIN (if applied for) of the company will be issued.

Note: Registration of a company in India requires certification from a Practising CA/CS/ CMA.

Embark on your entrepreneurial journey with confidence! Get in touch with our experts to register your company effortlessly.

Joint Venture

Another way in which a foreign company can conduct its business activities in India is through a joint venture with an Indian organization. A joint venture is an arrangement in which two or more parties collaborate to work on a particular project and share the risks and rewards of the business. Therefore, a foreign company can collaborate with an Indian organization to do business in India.

The following points are noteworthy in this regard –

- The foreign company and the Indian organization (the parties) can structure their joint venture in any of the legal business forms like private limited company, public limited company, partnership, Limited Liability Partnership (LLP), etc.

- The agreement between the parties forms the basis of the joint venture. Therefore, they should thoroughly discuss all the terms of the joint venture agreement.

- Draft the joint venture agreement considering both the local laws and the international laws.

- The parties should sign a Memorandum of Understanding (MOU) or a Letter of Intent.

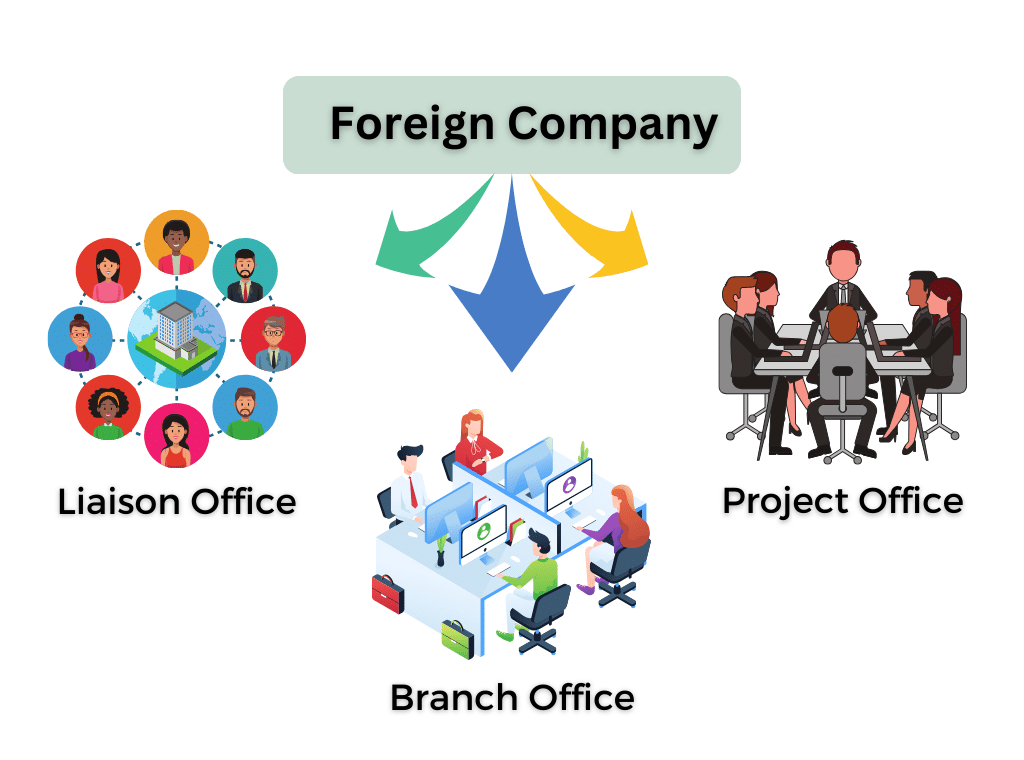

Setting up of Office in India

A foreign company can also set up its own offices in India to conduct business activities. However, for the establishment of such offices, the foreign company shall obtain prior approval from the RBI.

The following are the types of offices that can be set up by a foreign company.

Liaison Office

Meaning

A Liaison Office is a place of business that acts as a medium of communication between the Head Office of the foreign company and the entities in India. It does not undertake any commercial activity and its expenses are met through remittances received from the Head Office.

A foreign company can set up its liaison office in India but it shall obtain prior approval from the RBI and satisfy the criteria given below.

Eligibility Criteria

To set up a liaison office, a foreign company shall meet the following criteria:

- It shall have a track record of profit-making during the 3 immediately preceding financial years in the home country; and

- It shall have a net worth of at least 50,000 USD or equivalent.

However, if such a foreign company is not financially sound and it is a subsidiary of another company, then its parent company may submit a Letter of Comfort (LOC) if it fulfills the above criteria.

Process of Obtaining Approval from RBI

Following is the process that a foreign company needs to follow to obtain approval from the RBI for setting up a liaison office in India –

1. A foreign company shall make an application in Form FNC to a designated Authorized Dealer (AD) Category – I bank. Along with the application, it shall submit LOC (if applicable) and the following documents –

- Copy of Certificate of Registration/ Incorporation, Memorandum of Association (MOA), and Articles of Association (AOA) of the company attested in the country of registration by the Notary Public.

- Audited Balance Sheet of the company for the last 5 years.

- Report issued by the banker of the foreign company in the country of registration showing the number of years the company had a relation with the bank.

- Power of Attorney, in the favour of the signatory of the Form FNC in case it is not signed by the Head of the company.

2. On receiving the application, the AD bank exercises due diligence and checks whether the foreign company meets the eligibility criteria or not. If the foreign company adheres to the eligibility criteria, the AD bank forwards a copy of the Form FNC to the General Manager, RBI, for the allotment of a Unique Identification Number (UIN).

3. Once RBI allots the UIN, the AD bank issues an approval letter to the foreign company for establishing a liaison office in India.

Further, the foreign company shall inform the date of setting up of liaison office in India to the AD bank which in turn shall inform the RBI. However, the approval lapses if the liaison office is not set up within 6 months from the date of approval.

Moreover, the validity period of a liaison office is 2 years for Non-Banking Financial Companies (NBFC) and entities engaged in construction and development sectors. In other cases, the validity period is 3 years.

Permitted Activities

The following are the permitted activities for a liaison office in India –

- Serving as a representative for the parent company/group entities within India.

- Facilitating and supporting export/import activities to and from India.

- Encouraging technical and financial partnerships between the parent/group entities and Indian companies.

- Operating as a communication channel between the parent company and Indian enterprises.

Branch Office

Meaning

In the context of a Company, a Branch Office means an establishment that has been declared as its branch by the Company. Generally, the branch office is engaged in the same activity as its parent company.

Eligibility Criteria

To set up a branch office, a foreign company shall meet the following criteria:

- It shall have a track record of profit-making during the 5 immediately preceding financial years in the home country; and

- It shall have a net worth of at least 100,000 USD or equivalent.

However, if such a foreign company is not financially sound and it is a subsidiary of another company, then its parent company may submit a Letter of Comfort (LOC) if it fulfills the above criteria.

Process of Obtaining Approval from RBI

The process of obtaining approval from the RBI for setting up a branch office in India is similar to the process required to be followed for opening a liaison office, as outlined above.

Moreover, foreign companies do not require approval from the RBI to establish branch offices in SEZ i.e., Special Economic Zone for undertaking manufacturing and service activities.

Permitted Activities

The following are the permitted activities for a branch office in India –

- Engaging in the export/import of goods.

- Providing professional or consultancy services (excluding the practice of legal professions in any matter).

- Conducting research work that aligns with the parent company’s interests.

- Facilitating technical or financial collaborations between Indian companies and the parent or overseas group company.

- Acting as a representative of the parent company in India and serving as a buying/selling agent within the country.

- Offering Information Technology services and participating in software development activities in India.

- Providing technical support for products supplied by the parent/group companies.

- Representing foreign airlines or shipping companies.

Project Office

Project Office is a place of business that represents the interest of the foreign company executing a project in India. It does not include a liaison office. Therefore, a foreign company can set up its project office in India. In fact, there is no need to obtain approval from the RBI if the foreign company –

- secures a contract from an Indian company to execute a project within India;

- the project has received all the necessary regulatory clearances; and

- it is funded directly by inward remittances from abroad or by a bilateral or multilateral International Financing Agency or by an Indian company that is awarding the contract and that has received a Term Loan from a Public Financial Institution or a bank in India for the same project.

However, if the above conditions are not met, then the foreign company shall obtain approval from the RBI for setting up a project office in India by following the same process as in the case of a liaison office or a branch office. The validity period for a project office is the tenure of the project.

Documents to be delivered by Foreign Companies for Registration

According to the provisions of the Companies Act, 2013, all foreign companies that establish a place of business in India, shall file Form FC-1 with the Registrar of Companies (ROC) within 30 days of such establishment. Along with the form, a foreign company shall also deliver the following documents to the ROC for registration –

- Certified copy of Memorandum and Articles/ Charter/ Statute of the Company or any other instrument that defines its constitution. If such an instrument is not in English, its certified translation in English shall be submitted.

- Full address of the principal or registered office of the company.

- List of directors and secretaries of the foreign company containing their details like name, date of birth, address, nationality, etc.

- Name(s) and Address(es) of the person(s) resident in India who are authorized to accept documents on behalf of the Company.

- Address of the deemed principal place of business of foreign company in India.

- Details of opening and closing of a place of business in India on an earlier occasion(s).

- A declaration that neither the directors of the foreign company nor its authorized representative has/have been convicted or debarred from company formation and management, whether in India or abroad.

Further, the Form FC-1 shall also be supported with approval from the RBI and other regulators, if applicable. However, if approval is not required, then the authorized representative of the foreign company shall furnish a declaration in this regard.

Moreover, if any alteration is made or occurs in the document(s) delivered for registration, then the foreign company shall intimate the same to the Registrar in Form FC-2 within 30 days of such alteration.