A resolution is a formal way for a company to record decisions made at a meeting of company members.

The majority of decisions affecting a company must be made through a resolution. Furthermore, a company’s constitution document (Articles of Association) may have its own rules governing what decisions must be made by resolution.

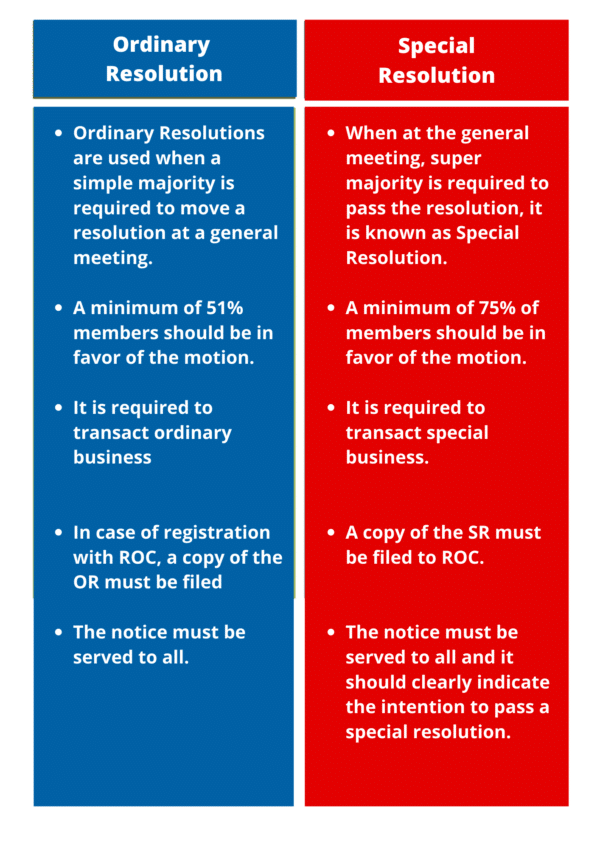

Ordinary Resolution

Ordinary resolution refers to a resolution in which the number of votes cast in favour of the resolution exceeds the number of votes cast against it. If the resolution was supported by more than half of the members (more than 50%) of shareholders or directors or who attended the General Meeting in person or by proxy. It should be passed by votes cast in favour of the resolution in any of the following ways: a show of hands, polling, or electronically.

The members must be given proper notice of the meeting’s convening. Furthermore, members who do not participate in voting are not taken into account. In general, the ordinary resolution must be passed in order to conduct ordinary business at the AGM (Annual General Meeting).

Ordinary resolutions are required for the following decisions:

- Appointment of directors

- Appointment of auditors and their remuneration

- Adoption of financial statements

- Declaration of dividend

Special Resolutions

A Special Resolution (SR) is a resolution in which the number of votes cast in favour of it must be three times more than the number of votes cast against it.

These require at least 75% of the shareholders to agree, unlike ordinary resolutions, which are determined by the number of shares distributed to each shareholder.

Certain changes, as defined in the Companies Act 2013, require special resolutions.

Certain things can only be done by the company if a special resolution is approved at a general meeting. The members should be given proper notice of the general meeting, and the notice should specifically state the intention to purpose the resolution as SR.

The resolution must be passed by any method, like voting by show of hands, polling, or electronic means, by members present in person or by proxy. The Companies Act 2013 along with Secretarial Standards has listed out certain matters which shall be passed through specific mode only.

Some of the matters which require Special Resolutions are as follows:

- Issuance of sweat equity shares

- Changes to the provisions of the memorandum of association

- The purchase of shares or securities

- The objects of the prospectus

- The relocation of the company’s registered office

- Modifying the Articles of Association

- Converting a private corporation to a public corporation

Procedure for the Passing of Resolution

A proposed resolution is referred to as a motion. It becomes a resolution once the necessary approval is obtained in accordance with the provisions of the Companies Act, 2013.

When it comes to matters requiring a special resolution, they must be included in the agenda of the meeting, which is provided when the meeting notice is sent out. Motions arising from negotiation may also be allowed for matters that do not require a special resolution under the Act.

Each resolution is generally introduced by one member and then seconded by another member, according to Secretarial Standard.

The motion that is under consideration may be amended during the debate. The main motion may be amended in any number of ways. However, an amendment can only be changed once.

When a motion includes a lot of amendments, after obtaining common consent, a new motion incorporating all of the amendments may be passed, and the old motion may be withdrawn.

In the case of a Special Resolution, Form MGT–14 must be filed with the Registrar of Companies within 30 days of the resolution being passed.

Documents required for filing the form-

- A copy of the resolution that was passed

- An explanatory statement under section 102 of the Companies Act, 2013.

- Copy of the Articles of Association (where any change is made).

- Copy of the Memorandum of Association (where any change is made).

Differentiation Table