What is Registered Office?

The registered office of a company is its principal place of conducting business as prescribed under Section 12 of the Companies Act, 2013. Promoters decide where the registered office of the company will be situated. All governmental communications with a business are made through its registered office. The state in which the registered office is situated in mentioned in the ‘situation clause’ of the Memorandum of Association.

Rules for disclosing Registered Office

As per Section 12 of the Companies Act, 2013, it is mandatory for companies to have a registered office during commencement of their business or within 30 days of incorporation. However, as per the rules applicable presently, a company has to disclose its registered office at the time of incorporation itself.

If after incorporation of the company, there is any change in the registered office then a notice has to be sent to the Registrar within 15 days specifying the said change. The Registrar will record the changes that have been communicated.

Penalty

As per Section 12(8), a penalty of Rs. 1000/- is levied for each day until the continuance of the offence. However, there is an upper limit of Rs. 1 lakh. This penalty shall be levied on the company and every officer who is found responsible for violating the provisions of registered office as prescribed under Section 12.

Shifting of Registered Office

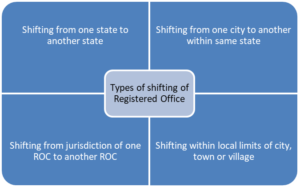

There might arise a need for shifting of the registered office of a company. The Companies Act, 2013 read with Company (Incorporation) Rules, 2014 and SEBI (LODR) Regulations, 2015 provide requisite provisions in this behalf depending upon the type of shift required. There can be four types of shifts in the registered office:

There are different set of provisions, rules and forms applicable to different types of shifting of the registered office. Appropriate procedure needs to be adhered to in order to avoid any legal complications.

Shifting of Registered Office from one state to another

Provisions regarding the procedure involved in change of registered office from one state to another are provided in Section 13(4) of the Companies Act 2013, Rule 30, 31 of the Companies (Incorporation) Rules 2014 and Regulation 30, 46 (3) of SEBI (LODR) Regulations (2015). Shifting of registered office from one state to another is inclusive of change of jurisdiction of Registrar of Companies (ROC).

INC 23 is filed with the Central Government as per Rule 30 of the Company Incorporation Rules, 2014. The necessary fillings to be made along with INC 23 are mentioned further in the article, along with the mandatory provision to file INC 26 not more 30 days before filing of INC 23.

Important Guidelines before commencing with the shifting procedure

Certain important guidelines must be followed before commencing with the procedure of shifting:

1. An approval must be taken from Central Government through the Regional Director before shifting the registered office to another state.

2. As per Section 30 (9) of the Companies (Incorporation) Rules, 2014 no shifting of the registered office of a company can take place if there is any pending investigation, inspection or inquiry being conducted against the company.

3. As per Section 110 of Companies Act, 2013 read with Rule 22 (16) of Companies (Management and Administration) Rules, 2014, it is mandatory to pass a special resolution through postal ballot if the total number of members of company is more than 200.

Procedure for shifting

Following is the step-by-step procedure for shifting of registered office of a company to another state:

Step 1: Meeting of Board of Directors as per Section 173 of the Companies Act, 2013 and Secretarial Standard 1

• 7-day notice (or shorter if necessary) to be sent to the directors at their registered addresses regarding the meeting along with the Agenda of the meeting and the Draft Resolution.

• Passing of board resolution regarding:

i) The shifting of registered office from one state to another

ii) Alteration of MOA

iii) Authorisation of CS/CFO for filing application to Regional Director seeking permission for the shift

iv) Authorisation of CA/CS/Advocate to appear before the Regional Director.

v) Preparing and confirming the list of creditors with the debt payable to them mentioned specifically.

vi) Send individual notices to the creditors and debenture holders via registered post mentioning the change of registered office from one state to another and also seeking no objection certificate towards the same.

vii) Confirming that no employees shall be retrenched by way of shift in the registered office.

viii) Authorising one of the directors to digitally sign and submit the said application.

• Decide the date and time for General Meeting for approval of shareholders regarding the shift or decide if the same is to be conducted via postal ballot.

• In accordance with Section 102 of Companies Act, 2013 approve the draft notice of General Meeting or Postal Ballot.

• As per Regulation 30 and 46(3) of SEBI LODR, the company has to disclose the board meeting within 24 hours and post on company website within 2 days.

• Within 15 days of the meeting, prepare and circulate Minutes of the Meeting to all directors.

Step 2: Approval of Shareholders

• Obtain approval by convening General Meeting or via Postal Ballot.

• If General Meeting is convened then follow procedure as per Section 96, Section 100 and Secretarial Standard 2.

• A 21 days’ notice to be given to all directors, members, auditors, debenture trustees as per Section 101 of Companies Act, 2013.

• Passing of Special Resolution in the General Meeting regarding shifting of R.O. and change in MOA.

Step 3: Filing of Form MGT-14 with the ROC

• After the special resolution is passed in the General Meeting, within 30 days Form MGT-14 must be filed with the ROC along the requisite fee as prescribed in Companies (Registration offices and fees) Rules, 2014.

• Following documents must be attached along with:

i) Copy of notice of meeting and the explanatory statement.

ii) Copy of Special Resolution

iii) Copy of the altered MOA

iv) Copy of attendance sheet and the agenda of General Meeting.

Step 4: Publishing of Advertisement in Newspaper

• Prior to filing of INC-23 by the company (minimum 30 days prior), the company must advertise in Form INC-26 in newspaper of principal vernacular language and in English. The newspaper must be circulated in registered office’s state. This is as per Rule 30 of the Companies Incorporation Rule, 2014.

• The attachments to be filed with Form INC 23 are:

i) Copy of MOA along with proposed changes to be made. This must be accompanied by the authorised official’s certification.

ii) Copy of the minute of the meeting wherein special resolution was passed for the proposed alteration.

iii) Copy of the board resolutions passed for this alteration and shift in the registered office

iv) Copy of the acknowledgement regarding the service of application’s copy to the ROC as well as the Chief Secretary.

v) An affidavit for verifying the application

vi) Copy of relevant newspapers advertisements

vii) Affidavit for verification of notice

viii) Names, addresses along with nature and amounts of the debenture holders and creditors

ix) Copy of individual notices sent to the debenture holders and creditors and their resultant no objection responses

x) However, if any objections are received, then their copy to be attached as well

xi) Proof certifying the dispatch of said notice to the debenture holder and the creditors

xii) Affidavit for verification of creditors

xiii) Director’s affidavit for verification and confirmation of rules

xiv) Proof for payment of the fees of application

xv) Affidavit for ascertaining that no pending enquiry, inspection or investigation is present against the company.

xvi) True and certified copy of the audited financial statements of the company, whichever is latest.

xvii) True and certified copy of the provisional financial statements on the ‘cut-off date’

xviii) Certified copy of the list of directors of the company

xix) Certified copy depicting the patterns of shareholding of the company

xx) Memorandum of Appearance as per Form 2.

• Copy of this advertisement must be submitted to the Central Government, Registrar and SEBI (if the company is listed).

Step 5: Filing of Form INC-26 with the Regional Director

• This form is filed for seeking approval for altering the MOA for changing the address of registered office from one state to another. The form is filed with the Central Government (through Regional Director). Rule 30 mentions that this has to be filed not more than 30 days before filing of INC 23 with the central government.

• The form must accompany the proposed changes in MOA, copy of Board Resolution and minutes of General Meeting, list of creditors and debenture holders of the company.

Step 6: Considerations before passing of orders

• It is important to understand the procedure in case of receipt of objections from persons who might be affected by the decision:

i) Regional Director on behalf of the Central Government shall conduct hearing (or hearings) for resolution of objections and when consensus is reached then an order confirming the shifting shall be passed within 60 days of the application filing.

ii) If consensus is not reached then the company is supposed to file an affidavit giving an explanation as to how it seeks to resolve the objection in a specified time frame. The original jurisdiction should be reserved for the objector for him pursuing legal remedies even post the shifting of the registered office. The Central Government shall then pass an order approving or rejecting the shift within 60 days of the filing of application.

• In case no objection is received by any of the parties then the application shall be forwarded for final orders without any hearings and the approval or rejection order shall be passed within 15 days of the receipt of application.

Step 7: Filing of Form INC-28 with ROC

• Post approval of Central Government regarding the shift of registered office from one state to another, a copy of the approval order must be filed in Form INC-28 and the requisite fee within 30 days of the receipt of such order from the regional director.

Step 8: Filing of Form INC-22 with MCA

• Within 30 days of receiving the approval, E-Form INC-22 must be filed with the MCA specifying the change in address of the registered office. Fees as prescribed in Companies (Registration Offices & Fee) Rules, 2014 must also be paid.

• The form must be sent along with the following documents:

i) Proof of Registered Office Address

ii) Utility Bills

iii) Proof that the company is allowed to use the premises as its registered office

iv) A proof of ownership of the premises or authorisation from the owner of the property

Step 9: New Certificate of Incorporation

• ROC of the new state where the registered office has shifted will issue a fresh certificate of incorporation to the company which contains the altered address of the registered office.

Step 10: Notifying the Stock Exchanges

• In accordance to Regulation 30 and 46(3) of the SEBI LODR Regulations, the company (if it is a listed company) has an obligation to notify the Stock Exchanges regarding the shifting of the registered office within 24 hours of the approval by the ROC. The same has to be posted on the company’s website within 2 working days.

Step 11: Compliances to be made post ROC’s approval

• A general notice to be issued by the company in a newspaper informing about the change in the registered office.

• Alter the name of registered office on all the documents and nameplates posted outside each branch of the said company.

• Inform the banks regarding the change and thereby add the new address.

• Update the address of the company in PAN by informing the Income Tax Authority.

• Update new address of the company with government authorities and basic utility providers.

Step 12: Filing of Amendment Application under relevant acts

• Amendment application to be filed under the following acts:

i) EPF, ESI and other Labour Laws

ii) FEMA

iii) Factories Act

iv) Inter-state Migrant Workmen Act

v) GST Act

Conclusion

This article has explained the important steps to be followed for shifting of registered office from one state to another. The entire article is elaborative and self-explanatory after taking into consideration all the relevant sections, rules and regulations as mentioned in the Companies Act, 2013.