Nidhi Company, formed under Section 406 of the Companies Act, 2013, is a type of finance company that is formed for the mutual benefit of its members. It accepts deposits from its members and grants loans to them for different purposes. Nidhi companies must fulfill certain compliance requirements prescribed under the Companies Act, 2013, and Nidhi Rules, 2014. This article presents the complete compliances checklist for Nidhi Company.

Compliances for Nidhi Company

Nidhi Companies in India are regulated by the Ministry of Corporate Affairs (MCA). Therefore, the provisions of the Companies Act, 2013, and the rules made thereunder, are applicable to Nidhi Companies. For the purpose of understanding, we can divide compliances for a Nidhi Company into the following three categories –

One-Time Compliances

A Nidhi Company has to fulfill the following requirements only once, known as one-time compliances.

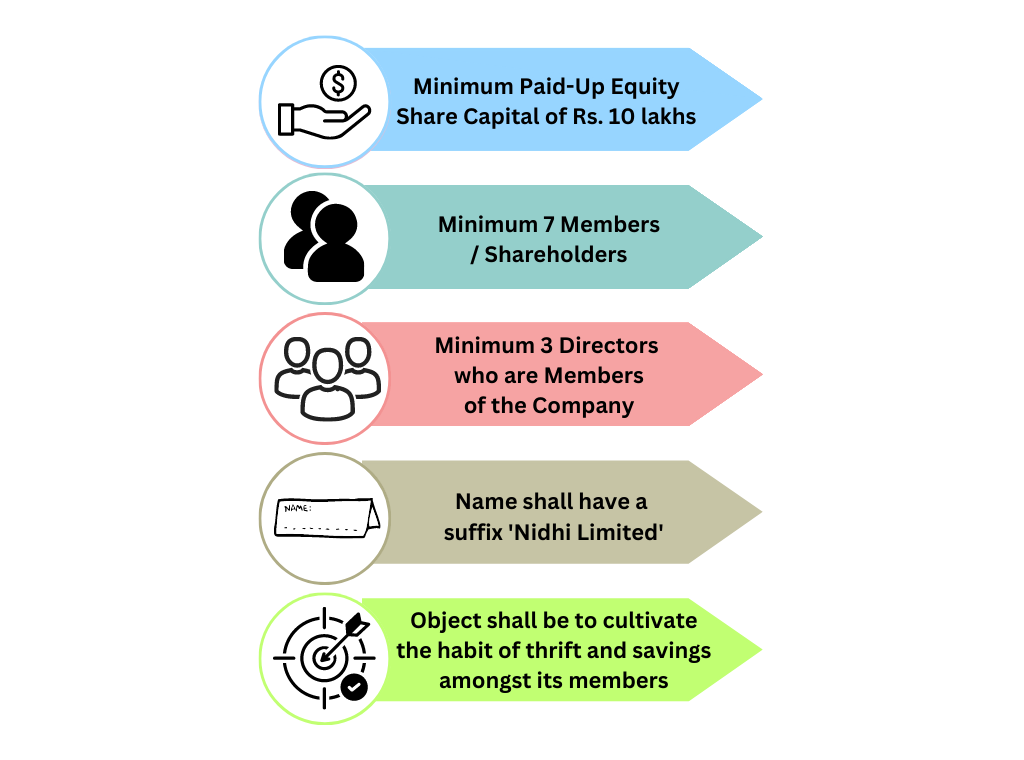

Pre-Incorporation Requirements

The following are the requirements for forming a Nidhi Company, that shall be fulfilled before incorporation –

Post-Incorporation Requirements

For this purpose, Nidhi Companies are divided into the following two categories based on their date of incorporation –

Companies Incorporated Before Commencement of Nidhi (Amendment) Rules, 2022

Nidhi Companies that are incorporated before the commencement of Nidhi (Amendment) Rules, 2022 i.e., 19th April 2022, must comply with the following requirements within one year of their incorporation –

- It shall have at least 200 members.

- The Net Owned Funds of the company shall be equal to Rs. 10 lakhs or more

- Unencumbered term deposits shall be a minimum of 10% of the outstanding deposits (as of the last working day of the 2nd preceding month) of the company.

- The ratio of Net Owned Funds to Deposits cannot be more than 1: 20.

Companies Incorporated After Commencement of Nidhi (Amendment) Rules, 2022

Nidhi Companies that are incorporated on or after the commencement of Nidhi (Amendment) Rules, 2022 i.e., 19th April 2022, must comply with the following requirements within 120 days of their incorporation –

- It shall have at least 200 members.

- The Net Owned Funds of the company shall be equal to Rs. 20 lakhs or more.

However, according to Nidhi Rules, 2014, every Nidhi Company (irrespective of its date of incorporation) shall keep a minimum of 10% of its outstanding deposits (as on last working day of 2nd preceding month) as unencumbered term deposits with scheduled commercial bank or post office. In addition, a Nidhi Company can accept deposits only up to 20 times its Net Owned Funds (as per the latest audited financial statements).

Note – Net-owned funds represent the total sum of paid-up capital and free reserves, with adjustments made for accumulated and intangible assets as reported in the latest balance sheet.

Read More – Nidhi Company: Meaning, Benefit, Restrictions and Registration Process

Forms to be filed

A Nidhi Company shall file the following forms after incorporation –

| S. No. | Form No. | Form Type/ Purpose | Due Date | Authority with which form/ return is to be filed or application is to be made |

| 1. | NDH – 1 | Return of Statutory Compliances To furnish details regarding members, deposits, loans, reserves, etc. for the financial year This form should be certified by Practising CA/CS/CMA Note – Nidhi Companies incorporated on or after 19th April 2022 are not required to file this form. | Within 90 days from the end of the first financial year and wherever applicable, the second financial year as well | ROC |

| 2. | NDH – 4 | Application for declaration as Nidhi Company Application by companies desirous of declaring themselves as a Nidhi Company | Within 120 days of incorporation of the company | Central Government |

| 3. | INC-20A | Declaration of Commencement of Business Declaration by a Director that all the subscribers to the memorandum have paid the full value of their shares Note – This form should be certified by Practising CA/CS/CMA | Within 180 days of incorporation | ROC |

| 4. | ADT – 1 | Appointment of Auditor | Within 15 days of the appointment of the auditor (The first auditor shall be appointed within 30 days of incorporation) | ROC |

Other One-Time Compliances

Apart from filing the above forms, a Nidhi Company shall fulfill the following requirements after its incorporation –

- Conduct a board meeting within 30 days of incorporation.

- Open a bank account of the company.

- Issue share certificates within 2 months from incorporation.

- Obtain registration under different applicable laws such as GST registration, Trademark registration, etc.

- Printing of letterhead of the company containing details like name, registered office address, CIN, contact details, etc.

Annual Compliances

A Nidhi Company shall comply with the following requirements every year.

Forms to be filed

A Nidhi Company shall file the following forms on an annual basis –

| S. No. | Form No. | Form Type/ Purpose | Due Date | Authority with which form/ return is to be filed or application is to be made |

| 1. | NDH – 3 | Half Yearly Return To furnish details regarding members, deposits, loans, reserves, etc. for each half-year Note – This form should be certified by Practising CA/CS/CMA | For 1st April to 30th September – 30th October For 1st October to 31st March – 30th April | ROC |

| 2. | AOC – 4 | Annual Financial Statements | Within 30 days of holding of Annual General Meeting | ROC |

| 3. | MGT – 7 | Annual Return | Within 60 days of holding of Annual General Meeting or the due date of the Annual General Meeting, whichever is earlier | ROC |

| 4. | DIR – 3 KYC | Director KYC | 30th September of each year | ROC |

| 5. | DPT – 3 | Return of Deposits | 30th June of each year | ROC |

| 6. | MBP-1 | Disclosure of Interest by the Director to the Company | In the first board meeting of each financial year | – |

| 7. | DIR-8 | Disclosure of Non-Disqualification by the Director to the Company | In the first board meeting of each financial year | – |

| 8. | ADT-1 | Reappointment of Auditor or Casual Vacancy of Auditor | In case of reappointment, within 15 days from the Annual General Meeting in which the Auditor is reappointed In case of a casual vacancy, within 15 days from the Extraordinary General Meeting in which a new auditor is appointed | ROC |

| 9. | IEPF-2 | Statement of Unpaid and Unclaimed Amounts if any | Within 60 days of holding of Annual General Meeting or the due date of the Annual General Meeting, whichever is earlier | ROC |

| 10. | BEN-2 | Disclosure of Significant Beneficial Owner | Within 30 days from receipt of BEN-1 from the shareholder | ROC |

| 11. | MSME-1 | Pending payment to Vendors in case of MSME | As it is a half-yearly return, the following are the due dates – For 1st April to 30th September – 30th October For 1st October to 31st March – 30th April | ROC |

Auditor’s Certificate

Every Nidhi Company shall obtain a certificate from its auditor that it complies with all the applicable rules. Also, it shall attach this certificate with the audit report and if there is any non-compliance, the auditor shall specify the same.

Other Annual Compliances

The following is the list of other annual compliances for Nidhi Company.

- Conduct 4 meetings of the Board of Directors every year in such a manner that the gap between two meetings does not exceed 120 days.

- Conduct an Annual General Meeting (AGM) every year within 6 months from the end of the financial year. Also, the gap between two AGM shall not be more than 15 months.

- Maintain minute book (summary of meetings) of the board meeting and general meetings held in the company.

- Maintain statutory registers related to members, shares, investments, contracts, etc.

- The report of the board of directors shall be attached to the financial statements of the company.

- The company shall get its accounts audited by a Chartered Accountant or a firm of Chartered Accountants to determine whether its financial statements present a true and fair view of the financial position of the company or not.

- Income tax returns shall be filed by the company on or before 31st October of every year.

Event-Based Compliances

A Nidhi Company is required to fulfill the following compliance requirements as and when the events occur in the company.

Forms to be filed

A Nidhi Company shall file the following event-based forms.

| S. No. | Form No. | Form Type/ Purpose | Due Date | Authority with which form/ return is to be filed or application is to be made |

| 1. | NDH – 2 | 1) Application for Extension of Time In case of failure to comply with post-incorporation requirements relating to members or the ratio between Net Owned Funds and Deposits (Only for Companies incorporated before 19th April 2022) 2)Application for Opening of more than 3 branches within the same district or a branch outside the district

3) Application for Closing of a branch 4)Intimation regarding the opening/ closure of a branch 5)Approval for withdrawal from unencumbered term deposits | Within thirty days from the end of the first financial year –

60 days before the closure of a branch Within 30 days of the opening/ closure – | Regional Director Regional Director Regional Director ROC Regional Director |

| 2. | NDH – 5 | Format of advertisement to be given while closing branch (Introduced by Nidhi Company (Amendment) Rules, 2022 ) | – | – |

Other Event-Based Compliances

Following is the list of other event-based compliances for Nidhi Companies –

- Change in the Name of Company (Form INC-24)

- Change in the Registered Office of the Company (Form INC-22)

- Alteration in Share Capital (Form SH-7)

- Return of Allotment (Form PAS-3)

- Appointment/Change in Director or Key Managerial Personnel (Form DIR-12)

- Filing of Resolutions and Agreements with ROC (Form MGT-14)

Consequences of Non-Compliance

If a Nidhi Company fails to fulfill the compliance requirements, it has to face the following consequences.

Additional Filing Fees

If a Nidhi Company fails to file the applicable forms on or before the due date, then additional filing fees is levied.

Penalty

If a Nidhi Company violates any provisions of Nidhi Rules, 2014, both the company and any officer in default shall be subject to a fine of up to five thousand rupees. Further, if the contravention continues, an additional fine of up to five hundred rupees may be imposed for each day.

Other Consequences

Apart from the levy of additional filing fees and penalties, a Nidhi Company may have to face the following consequences –

Nidhi Company formed before 19th April 2022

- If such a company fails to file NDH-4, it can neither file the forms SH-7 (Alteration of Share Capital) and PAS-3 (Return of Allotment) nor accept deposits from or grant loans to its members.

- If such a company does not fulfill the post-incorporation requirements as mentioned above, even after the second financial year, it cannot accept any further deposits until it complies with the provisions.

Nidhi Company formed after 19th April 2022

- If such a company fails to file NDH-4 and does not comply with the post-incorporation requirements as mentioned above, it cannot file the forms SH-7 (Alteration of Share Capital) and PAS-3 (Return of Allotment).

Also Read: Major Rules Governing Nidhi Company: Amended 2023

Conclusion

In conclusion, ensuring proper compliance is not only necessary for meeting the legal requirements but it also aids in the proper functioning of the Nidhi company. This compliances checklist is a comprehensive guide for a Nidhi Company to fulfill the requirements of applicable laws from time to time.

We at Registration Arena are dedicated to helping you comply with all the applicable rules and regulations on time. Get in touch with our experts, call us at +918600544422, or write to us at support@registrationarena.com.