Interim Finance Minister Piyush Goyal presented Union budget on 1st February 2019 which had major amendments in existing tax structure. In this article we will discuss some key highlights on income tax changes in budget 2019 on individual and business entities which will come into effect from 1st April 2019. The following are the Income Tax Changes:

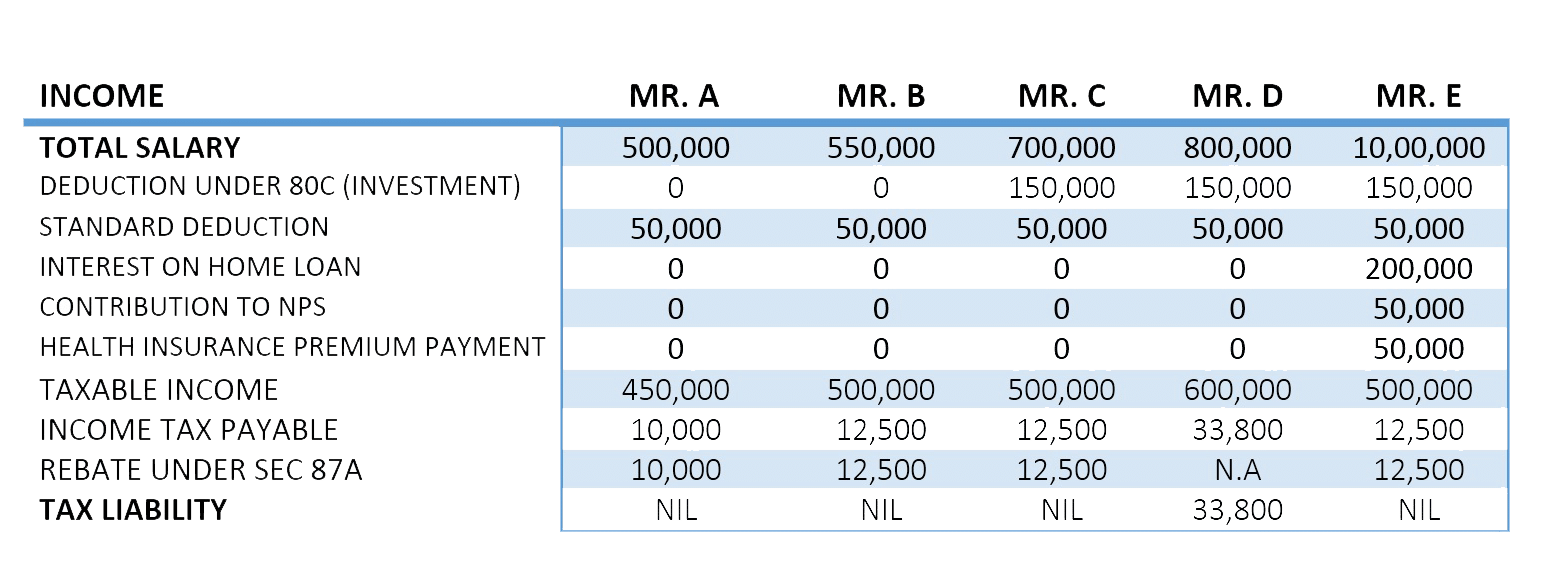

1. RELIEF TO SMALL TAXPAYER :

- The proposed Union Budget does not provide any change in Income Tax Slab Rates applicable to individual.

- Previously a relief in form of Rebate upto Rs. 2500 was provided to resident individual if his total income does not exceed Rs. 3,50,000

- The above relief (Sec 87A) has been extended to Rs. 12,500 which shall be available to those individuals whose Total Income does not exceed Rs. 5,00,000

CHART ANALYSIS OF TAX LIABILITY ON SALARY

2. HIGHER STANDARD DEDUCTION :

- It is proposed to increase the limit of standard deduction for the salaried taxpayer from existing INR 40,000 to INR 50,000.

- The benefit of increased standard deduction shall be available to salaried persons and pensioners

3. INCREASE IN THRESHOLD LIMIT FOR TDS ON DEPOSITS :

- Threshold limit for Tax Deduction at Source (TDS) from interest paid or payable by a banking company or Co-operative bank or Post office is proposed to be increased from INR 10,000 to INR 40,000.

- From 1st April 2019, the Deductor (Banks, Post-office) shall be liable to deduct tax if the interest payable on deposits (term deposits, recurring deposits, fixed deposits, etc.) exceed the threshold limit of INR 40,000 (Rs. 50,000 in case of Senior Citizen)

4. INCREASE IN THRESHOLD LIMIT FOR DEDUCTION OF TAX FROM RENT :

- Every person are required to deduct tax under Section 194-I from payment of rent.

- The tax shall be deducted if the amount of rent paid or payable during the financial year exceeds INR 1,80,000. The threshold limit for deduction of tax, is proposed to be increased from INR 1,80,000 to INR 2,40,000

5. NO DEEMED RENTAL INCOME ON HAVING TWO HOUSE PROPERTY :

- As per Current Law, if an individual owns more than one house property for his own residence then only one house property, as per his choice, would be treated as self-occupied and its annual value is deemed as nil. The other house property is deemed to be let-out and Rent (notional) of such house is taxed.

- It is proposed to amend this provision by allowing an option to the person to claim NIL annual value in respect of any two houses declared as self-occupied.

- Now a taxpayer can now claim that he has two self-occupied house properties

- Interest on housing loan can be claimed with respect to both the houses. However, the aggregate monetary limit for the deduction would remain INR 2,00,000

6. OPTION TO CLAIM EXEMPTION ON CAPITAL GAIN FOR INVESTMENT IN TWO HOUSES :

- As per current law, any long-term capital gains, arising to an Individual from the sale of residential house property is exempted to the extent such capital gains are invested in another residential house property

- It is proposed to extend the exemption for investment made, by way of purchase or construction in two residential houses provided the amount of capital gains does not exceed INR 2 crores.