HOW TO INCREASE PAID-UP CAPITAL OF A COMPANY?

Paid up capital is the amount which has been received by the company through the issue of shares to the respective shareholders. Basically, the money brought into the firm by the shareholders in exchange for the shares purchased by them is called the paid-up capital. The paid up capital can be equal to or less than the authorised capital, this depends on the company. If a company is issuing fewer shares against the maximum capital limit, it is authorised to sell. On the other hand, if a company’s paid up capital is equal to the authorised capital, and then the company cannot increase paid-up capital its additional capital requirements through the issue of shares, unless the authorized capital is increased.

Example Given: A company has an authorised capital of Rs. 10,000,000 and the value of each share will be Rs. 10 each. The company issued only 10, 00,000 shares of Rs. 6 each. Therefore, the paid up capital will be Rs. 60, 00,000.

Thus, the company’s capital has been funded by Rs 60, 00,000 by the shareholders against the number of shares purchased by them. The remaining capital worth Rs 40, 00,000 can be raised by the company whenever needed.

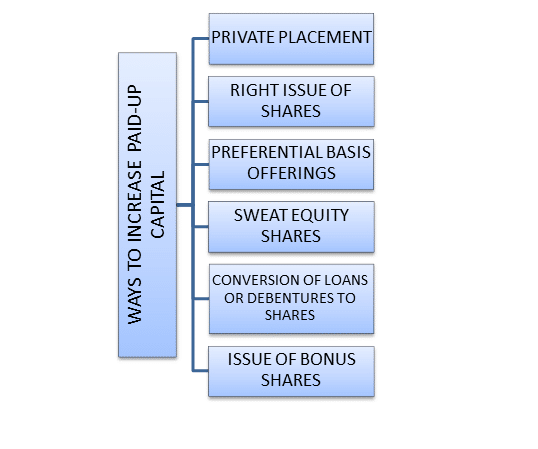

A company many increase paid-up capital by issuing securities through right issue and bonus issue and also through private placement. A Private Company can either issue shares to its existing shareholders by way of rights issue or by way of giving them bonus shares or it can issue securities through private placements.

PRIVATE PLACEMENT:

Private placement involves offering of securities or an invitation to subscribe securities by issuing offer letter. The offer of securities or invitation to subscribe securities shall be made to not more than two hundred persons in the aggregate in a financial year but excluding qualified institutional buyers and employees of the company being offered securities. This restriction would be reckoned individually for each kind of security that is equity share, preference share or debenture (i.e. 200 for equity shares, 200 for preference shares and 200 for debentures)

The value of such offer or invitation per person shall be with an investment size of not less than twenty thousand rupees of face value of the securities.

Companies to which this condition is not applicable:

- Non-Banking Financial Companies

- Housing Finance Companies

Payment: The payment for the subscription of securities shall be made from the bank account of the person subscribing to the securities and the company shall keep the record of the Bank account details from where such payments for subscriptions have been received.

The offer letter has to be accompanied by an application form serially numbered and addressed specifically to the person to whom the offer is made and shall be sent to him, either in writing or in electronic mode, within thirty days of recording the names of such persons. The offer letter has to be previously approved by the shareholders of the company, by a Special Resolution, for each of the Offers or Invitations.

Non-Convertible Debentures: Talking about non-convertible debentures, it will be sufficient if a company passes a previous special resolution only once in a year for all the offers or invitation for such debentures during the year.

Restrictions of offers and invitation: No fresh offer or invitation shall be made unless the allotments with respect to any offer or invitation made earlier have been completed or withdrawn or abandoned by the company. For example of a company issuing equity shares then it cannot issue preference shares or debentures until procedure of equity shares is completed.

Allotment of securities: Company can allot its securities within 60 days from the date of receipt of the application money for such securities and if the company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the date of completion of sixty days and if the company fails to repay the application money within the aforesaid period, it shall be liable to repay that money with interest at the rate of twelve per cent per annum from the expiry of the sixtieth day.

RIGHT ISSUE OF SHARES:

A right issue is an invitation to the existing shareholders to purchase additional new and fresh shares in the company. Instead of approaching the public, they prefer offering these shares to their existing shareholders. This type of issue gives the shareholders securities called rights. The existing shareholders can purchase new shares at a discount to the market price on a stated future date. The company is giving shareholders a chance to increase their exposure to the stock at a discount price.

Important Notes to keep in mind:

- A right issue is one way for a company to raise capital often to pay down debt.

- Shareholders can buy new shares at discount for a period of time.

- As more shares are issued to the market with right issue, the stock price is diluted and will likely go down

If a company wishes to increase its paid up capital, it can increase it by offering Right issue of shares. Right Issue can be offered to only:

- The existing shareholders.

- To employees under a scheme of employees’ stock option, subject to special resolution passed by company.

- To any persons, if it is authorised by a special resolution, whether or not those persons include the persons referred to in clause (a) or clause (b), either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered value.

PREFERENTIAL BASIS OFFERINGS:

Preferential Allotment is the process by which allotment of securities/shares is done on a preferential basis to a select group of investors. In this Company makes bulk allotment of Shares/ Securities to individuals, companies, venture capitalists or any other person through a fresh issue of shares.

If authorised by a Special Resolution passes in a general meeting, a company may issue shares in any manner whatsoever including by way of a preferential offer. A valuation report of registered value determining the price of shares is also mandatory.

SWEAT EQUITY SHARES:

Sweat equity shares means such equity shares as are issued by a company to its directors or employees at a discount or for consideration, other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called. Such shares can only be issued to:

- A permanent employee of the company who has been working in India or outside India, for at least last one year; or

- To a director of the company, whether a whole time director or not; or

- An employee or a director mentioned above of a subsidiary, in India or outside India, or of a holding company of the company.

CONVERSION OF LOANS OR DEBENTURES INTO SHARES:

A company may convert loans raised by the company or debentures issued by the company into shares by passing of special resolution, if there is such a term attached to the debentures issued or loan raised by the company to convert such debentures or loans into shares in the company.

ISSUE OF BONUS SHARES:

Bonus Shares are shares given to the existing shareholders in proportion to the number of shares they hold. They are additional shares given to the current shareholders. It is the further issue of shares by a company to its existing shareholders without any receipt of any consideration. For Example if investor holds 100 shares of a company and a company declares 2:1 bonus offer, his holding of shares will now be 300 instead of 100. While Issue of Bonus Shares increases the total number of shares issued and owned, it does not increase the value of the Company, the ratio of number of shares held by each shareholder remains constant.

Benefits of issue of bonus shares:

- To increase retail participation, increase of the equity base of the company.

- Increase in the number of shares by bonus issue, reduces the price per share. It becomes easy for an investor to buy shares of that particular company.

- Bonus share is a sign of a good health of a company.

- The investor does not need to pay any tax upon receiving the bonus shares.

- Bonus issue allows the company to conserve cash foe reinvesting back into the business.

- Increase in issued share capital increases the perception of company size.

I want to increase the majority stake in my own company.i have 10 lac authorised capital and 6 lacs paid up capital.i hold 36000 shares and my partner holds 24000 shares that means total holding is with us is 60% what is tge easiest way to increase holding .thanks