Permanent Account Number card or PAN card is a must have document for every person or entity that undertakes business in India. It is especially necessary for anyone who earns a taxable income. It is a useful tool for the government since it is used majorly for tax assessment of the citizens. In a previous article we covered how to apply for PAN card online, we also stated the advantages and benefits of owning a PAN. We explained the different forms: Form 49A, Form 49AA and Form 60. In a later article, we discussed how to check PAN card status post application filing. In this article we cover how to apply for Instant e-PAN through Aadhaar or Fast-track PAN card.

This facility was launched by the Finance Minister Nirmala Sitharaman to ease the process of PAN allotment. By availing this facility, PAN applicants will be instantly allotted a Permanent Account Number. This will be done by taking into consideration the aadhar card of the applicant and the e-KYC details derived from the same. This enables the concerned person to obtain an e-PAN card without going through the hassle of filling out an application. This is an important step forward towards the Digital India Campaign.

Note that this facility is available only to Indian Citizens

What is e-PAN?

In case you are not familiar with Electronic PAN or e-PAN as it is commonly known, it is a PAN card in electronic format. It is issued by the Income Tax Department along with a Physical PAN card. It can be stored on digital devices and produced when required. e-PAN reduces the hassle of carrying around a physical PAN card.

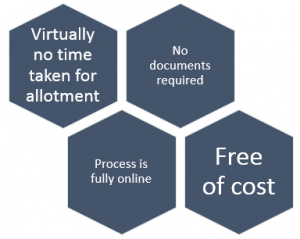

Benefits of Instant e-PAN

- There is a drastic reduction in the time taken to allot PAN to a person. The applicant can be allotted a PAN virtually no time.

- Hassle free filing process. No need to file the application

- This process is carried online and hence there isn’t any requirement for commutation

- Earlier, the application for e-PAN was the same as that for a Physical PAN card. Additionally, a fee of Rs.66 was charged. Now the applicant can obtain an e-PAN free of cost.

- No paperwork or documents required whatsoever. (Apart from the applicant’s aadhaar card)

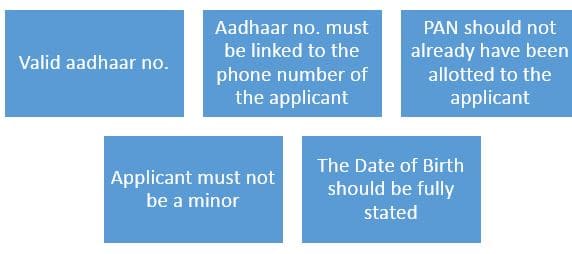

Requirements

- Note that to obtain instant e-PAN, it is compulsory to have a valid Aadhaar Number

- The aadhaar no. must be linked with the mobile number of the applicant.

- In no case shall the applicant already be in possession of a PAN

- The Date of Birth of the applicant must be stated fully on the Aadhaar. (This is important because in some cases only the year is stated)

- The applicant must not be a minor

How to apply for Instant PAN through Aadhaar

Visit the Income Tax Website for e-PAN

- Click on Get New PAN

- At the next page, enter the Aadhaar number.

- Enter the Captcha

- Tick ‘I confirm that’. Note that this implies that you abide by all the 5 points given below. These requirements have also been mentioned above in the article.

- Click on Generate Aadhaar OTP

- Following this, the applicant will receive an OTP.

- Post validating the OTP, a 15 digit acknowledgment number will be sent to the former’s mobile number and email. This number will then be used to continue the application

- Post validation of the OTP and the Aadhaar details, the PAN card will be issued.

- The applicant can check the status of the e-PAN application on the e-PAN website

- Once approved, the applicant can download the e-PAN by quoting the aadhaar no.

- An OTP will be sent to the Registered Mobile Number.

- After filling in the OTP, the applicant will be able to download the e-PAN and use it freely

Conclusion

PAN card comes across as a boon for people that require an instant PAN. Following the receipt of ePAN, the applicant can easily produce it whenever and wherever required and this in turn eliminates the hassle of carrying one around. Reach out to us at Registration Arena, where we help people obtain PAN card and file the list of documents required for obtaining PAN.