What is PAN card?

Permanent Account Number or PAN card is a very important document. It is issued to people who have a running source of taxable income in India. It is issued to citizens and non-citizens alike. Anyone that has an income stream in India needs a PAN card. It is issued by the Income Tax Department. It is necessary for tax payers and those who file income tax returns. For those who file tax returns (be it for themselves or on someone else’s behalf) it is a necessary document. It is in a sense, a tool for the government. Since it helps not only with the tax assessment of persons but also with tracking financial transactions of its citizens. It is also a mechanism which prevents tax evasion. Thus, it is important for us to know how to apply for PAN card online.

Why do we need a PAN card?

We require a PAN card for various purposes. Some of them are-

- To file Income Tax returns

- It serves as a valid proof of identity

- Opening a demat (dematerialized) account

- To apply for a bank loan or credit card

- For Transactions involving an immovable property equal to or exceeding Rs.5 lakh in valuation

- Bank Deposits equal to or exceeding Rs.50000

- Transactions involving any vehicle (Two wheelers are exempted)

- Transactions at restaurants exceeding Rs.25000

- Investment of an amount of Rs.50000 or more in Mutual Funds, RBI bonds, Company’s bonds/debentures.

- Any Transaction involving securities (except shares) when the amount exceeds Rs.1 Lakh

- Transactions requiring a payment of or more than Rs.50000 (Insurance Premium, Currency Exchange)

- Any transaction exceeding Rs.1 Lakh involving shares of a company which is not listed on a recognized stock exchange.

Given the above reasons, it is important for us to have a PAN card. Later in the article we discuss how to apply for PAN card online through various portals.

What if a person without a PAN card has to engage in any of the above mentioned activities? How will he do that? The answer to that question lies in Form 60.

Form 60 – What is it?

It is used by people who do not own a PAN card and whose income is not taxable to participate in transactions (mentioned above) requiring a PAN card. It is a declaration that the person concerned doesn’t have or require a PAN card. At the same time, it enables the person to participate in the activity.

Who needs a PAN card?

Anybody who earns taxable income in India needs a PAN card. It is compulsory for all individuals/entities liable to pay taxes. It is also required to furnish a return of income. To understand how to apply for PAN card online, we need to understand the different types of PAN applications or forms. As discussed below, there are different forms to be filled out while applying for a PAN card: 49A and 49AA. The difference between the two is that 49A is meant for individuals/entities holding Indian Citizenship/registered in India while 49AA is for individuals/entities holding foreign citizenship/registered outside of India. It can be issued to all these people:-

This also answers the question – To whom can a PAN card be issued?

Form 49A – When an Indian Citizen or an entity based in India applies for a PAN card, it is required to fill Form 49A.

Below is the list of entities to whom it can be issued under Form 49A-

- Individuals

- Minor Individuals – Even minors earning income which is taxable apply for it. Besides, the guardians of the minor can invest in the latter’s name and obtain a PAN card for those purposes. When the minor’s income is not taxable, the guardian’s PAN can be quoted.

- Individuals of unsound mind – According to Section 160 of IT Act, 1961, a person of unsound mind can obtain a PAN card, if needed. The concerned person will be represented by another person.

- Joint Hindu Family Business/Hindu Undivided Family (JHFB/HUF)

- Partnership Firm/ Limited Liability Partnership (LLP)

- Trusts

- Companies

- Local Authorities

- Society

- Association of Persons

For Individuals/JHFB/HUF

Documents required for applying under Form 49A-

As per Rule 114 (4) of the Income Tax rules, 1962 the following documents are acceptable as proof of identity, date of birth and address.

Documents that are acceptable as proof of identity, date of birth and, address:

- Aadhar Card

- Driving License

- Passport

- Voter ID/ Electoral Photo Identity Card (EPIC)

Documents acceptable as proof of identity only:

- Passport of the spouse

- Property Registration Document

- Post Office Passbook (provided it has the applicant’s address)

These documents below are also acceptable provided there are not older than 3 months:

- Electricity Bill

- Water Bill

- Telephone Bill

- Credit Card Statement

Documents acceptable as proof of date of birth only:

- Matriculation certificate or the Examination Mark Sheet issued by a recognized board

- Birth certificate (provided it is issued by the Municipal Authority or any other authorized office)

- Marriage Certificate (provided it is issued by the Registrar of Marriages)

Documents acceptable as proof of Identity only:

- Ration Card (provided it has the applicant’s photograph)

- Arm’s license

- Pensioner card (provided it has the applicant’s photograph)

Only for HUF

- The karta of JHFB/HUF should file an affidavit which states information such as the name, father’s name and address of all the coparceners on the date of application; and

- (The Karta as an individual should file copy of any document specified above (similar to an individual applicant) as Proof of Identity, Address and date of birth, being the karta of the Hindu undivided family/Joint Hindu Family Business.

For companies (registered in India)

Documents acceptable as both Proof of identity and Proof of address:

Registration Certificate (issued by the Registrar of Companies). For Company Registration you can visit us.

Note that there are no other documents that are submitted for the application of a company’s PAN card.

For firms

Documents acceptable as both Proof of identity and Proof of address:

- Partnership deed

- Registration Certificate (issued by the Registrar of Firms)

For LLPs

Documents acceptable as both Proof of identity and Proof of address:

- Registration Certificate (issued by the Registrar of LLPs). For LLP Registration, you can visit us.

For trust

Documents acceptable as both Proof of identity and Proof of address:

- Trust deed

- Registration Certificate number (issued by the Charity Commissioner)

For Association of persons (excluding Trusts)/Body of Individuals/Artificial Judicial Person /Local Authority

Documents acceptable as both Proof of identity and Proof of address:

- Agreement

- Registration Certificate number (issued by the Charity Commissioner/Registrar of Cooperative Society/Any other competent authority)

- Any other document originating from any Central or State Government Department establishing identity and address of such person.

Further instructions for filling out Form 49A and the full list of accepted documents can be found here: (https://tin.tin.nsdl.com/pan/Instructions49A.html#instruct_form49A)

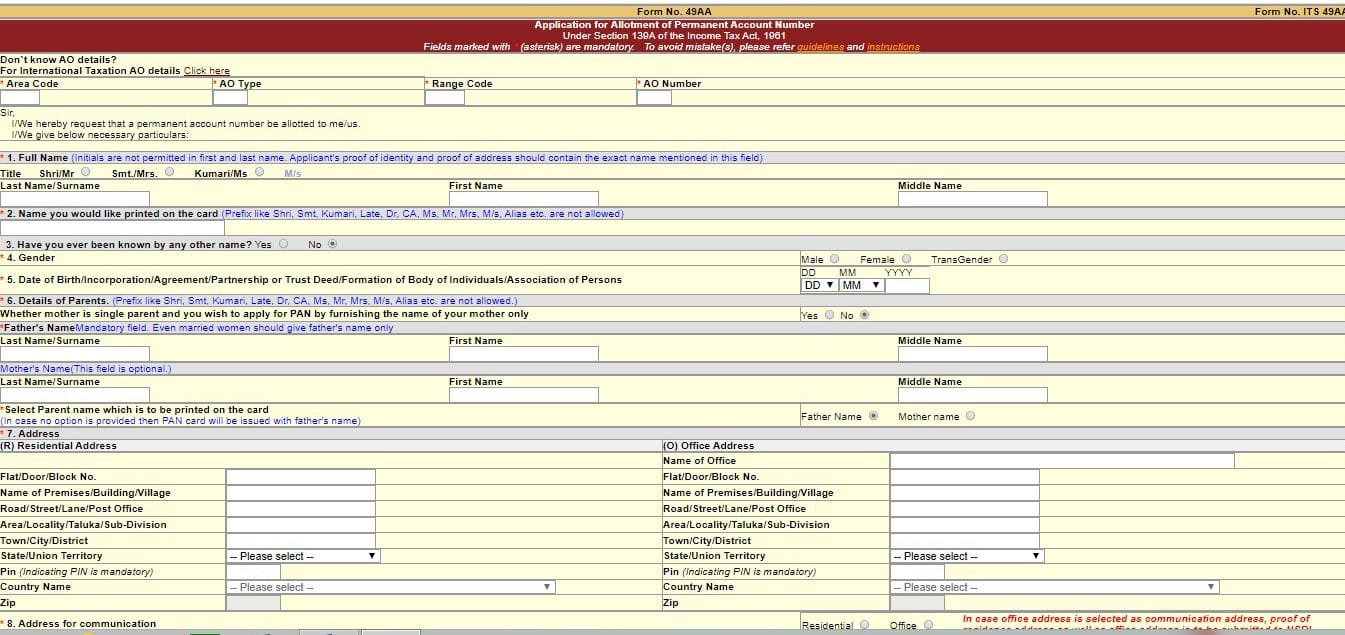

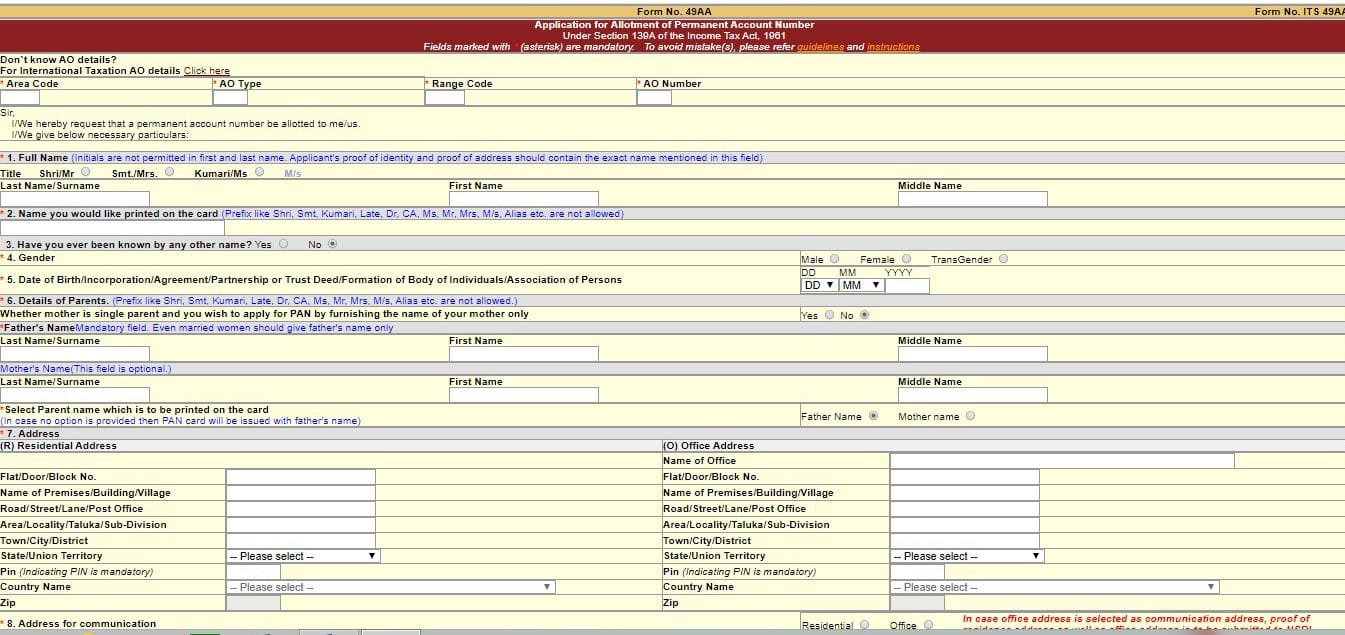

Form 49AA – When a foreign citizen or an entity not based out of India applies for a PAN card, it has to apply under Form 49AA.

Below is a list of entities/individuals whom a PAN card can be issued to under Form 49AA-

- Foreign Nationals

- Companies, Firms or Limited Liability Partnerships registered outside of India

For Individuals & JHFB/HUF

Documents required for applying under Form 49AA-

As per Rule 114 (4) of the Income Tax rules, 1962 the following documents are acceptable as proof of identity and address.

Documents acceptable as both Proof of Identity and Proof of Address:

- Passport

- Person of Indian Origin (PIO) card (provided that it is issued by the Government of India)

- Overseas Citizen of India (OCI) card (provided that it is issued by the Government of India)

Documents acceptable only as Proof of address:

- Bank Account Statement

- Residential permit/Certificate of Residence in India (issued by State Police Authorities)

- Registration certificate showing Indian address (issued by the Foreigner’s Registration Office)

- VISA or Copy of Appointment letter/Contract from Indian Company & original Certificate of Indian Address issued by the Indian Employer.

For all entities apart from Individuals & JHFB/HUF

Documents acceptable both as Proof of Address and Proof of Identity:

Copy of

- Certificate of Registration issued in the country where the applicant is located duly attested by ‘Apostille’ (in respect of the countries which are signatories to the Hague Apostille Convention of 1961) or by the Indian Embassy or High Commission or Consulate in the country where the applicant is located or authorized officials of overseas branches of Scheduled Banks registered in India (in prescribed format)

- Registration certificate issued in India or of approval granted to set up office in India by Indian Authorities.

Further instructions for filling out Form 49AA and the full list of accepted documents can be found here: (https://tin.tin.nsdl.com/pan/Instructions49AA.html#instruct_form49A)

How to Apply for PAN card online

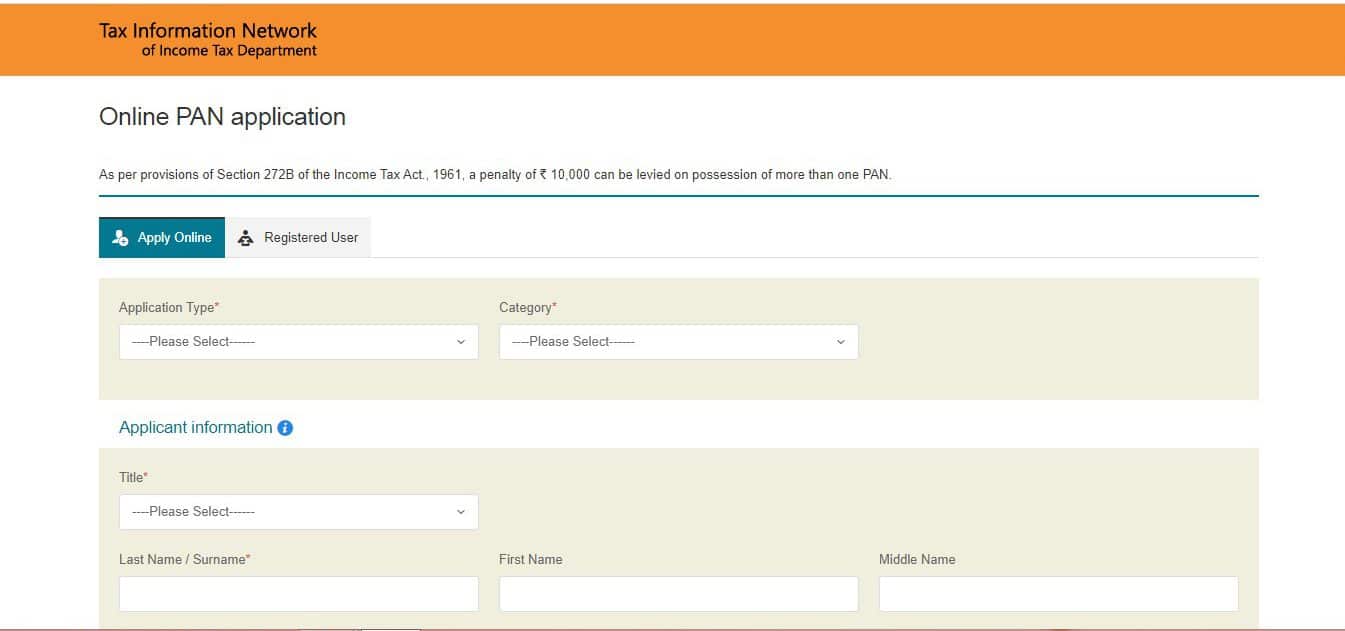

NSDL

To apply for PAN card through the NSDL website, open the link above.

Here, choose Apply Online if you have not yet filled out an application, if you have registered before and could not complete the form click on Registered User and continue where you left off.

After choosing Apply Online-

- Click on Application Type and select New PAN – Indian Citizen (Form 49A)

- Under Category, choose Individual or Type of business organization

- Under the heading ‘Applicant’s information’, fill in the personal details.

- After filling in all the personal details, click on submit

- The next page will display a token number. This is the temporary token number. It is important to write this token number since if the application does not get completed, you can resume where you left off by opening this link again and clicking on Registered User and filling in the required details. (As mentioned above)

- Click on continue with PAN application Form

- Input the required information

- Choose how you want to send the documents. Through post(physically), Digitally (with digital signature or Digital (with e-sign)

- Choose what documents you are submitting for Proof of Identity, Address and Date of birth. (This has been discussed above in the article under form 49A)

- Upload the documents and the signature (if opting for digital submission) otherwise state the documents for submission and click on proceed.

- Fill the AO details. The box below will help in filling details in this section

- For Payment, Choose online payment if you want to pay through Net Banking, Debit Cards, Credit Cards or choose Demand Draft. (Note that the Demand Draft must be generated prior to filling the PAN application since DD details have to be provided)

- After Clicking on ‘I agree to the terms and service’, proceed to pay.

- The fees charged for PAN processing depends on the mode of submission of documents (online or by post)

- After paying, there would be an option to print the acknowledgment receipt. Print this receipt and send it to the NSDL office via post/courier. Note that this must be done within 15 days of application submission.

UTIITSL

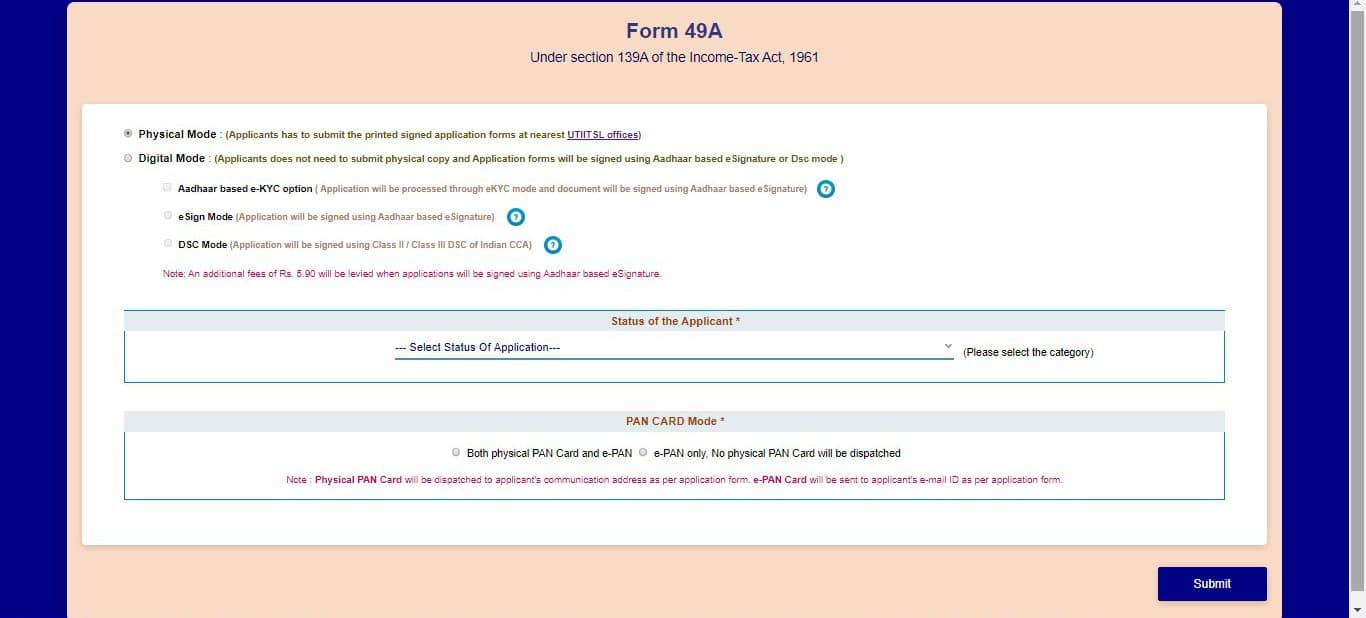

As you open the above link, Form 49A opens.

- You can choose there itself how you want to submit the documents. As earlier, Choose Physical if you want to physically submit the documents or choose digital if you want to submit the documents digitally.

- Under Digital Mode, there are 2 options that you can choose to upload the signature.

- In ‘Status of the Applicant’ choose Individual or Type of business organization

- Choose the type of PAN card you want to receive. e-PAN is less expensive since it is digital. It is sent to the email ID of the applicant. Choosing both Physical and e-PAN is more expensive since the physical PAN card is then sent to the applicant’s communication address. (Note that e-PAN is compulsory in the second option. You cannot just opt for the Physical PAN card, the e-PAN card will be sent anyway to the email of the applicant)

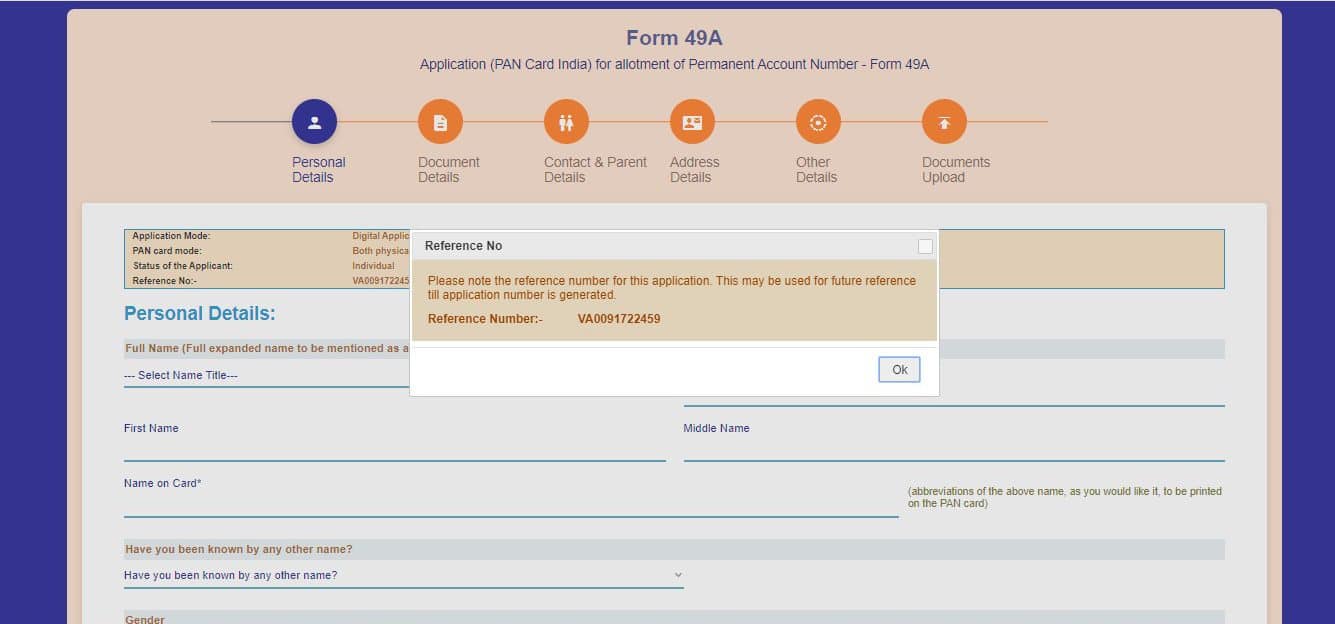

- After clicking on submit, the image below opens.

- It is very important to note the Reference no. which is presented in the form of a pop-up just like the one in the image below.

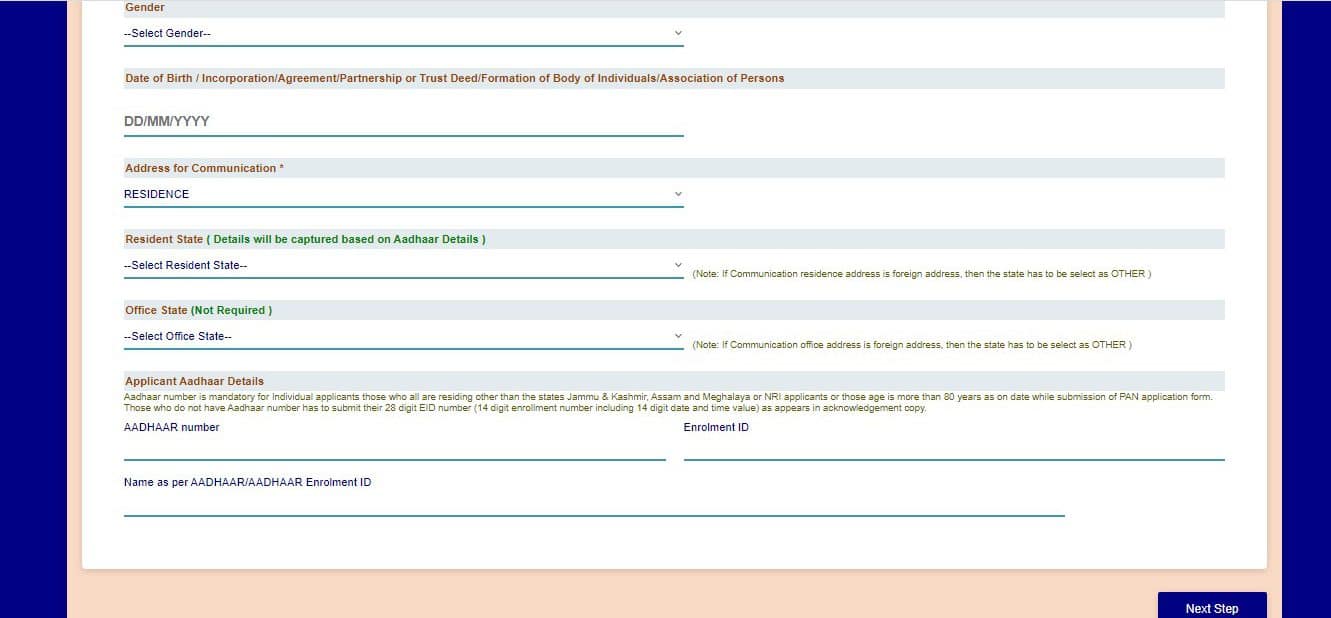

- Fill out your personal details

- Choose the documents you want to upload (if any) and then proceed to fill in the rest of the details.

- The process for filling out the rest of the form is similar to filling it out on NSDL.

How to Apply for PAN card online through application:

UTIITSL application

UTIITSL released an application ‘MyPAN’ for both iOS and Android which deals with all the processes associated with a PAN card. We can apply for PAN card, track its status or file for corrections.

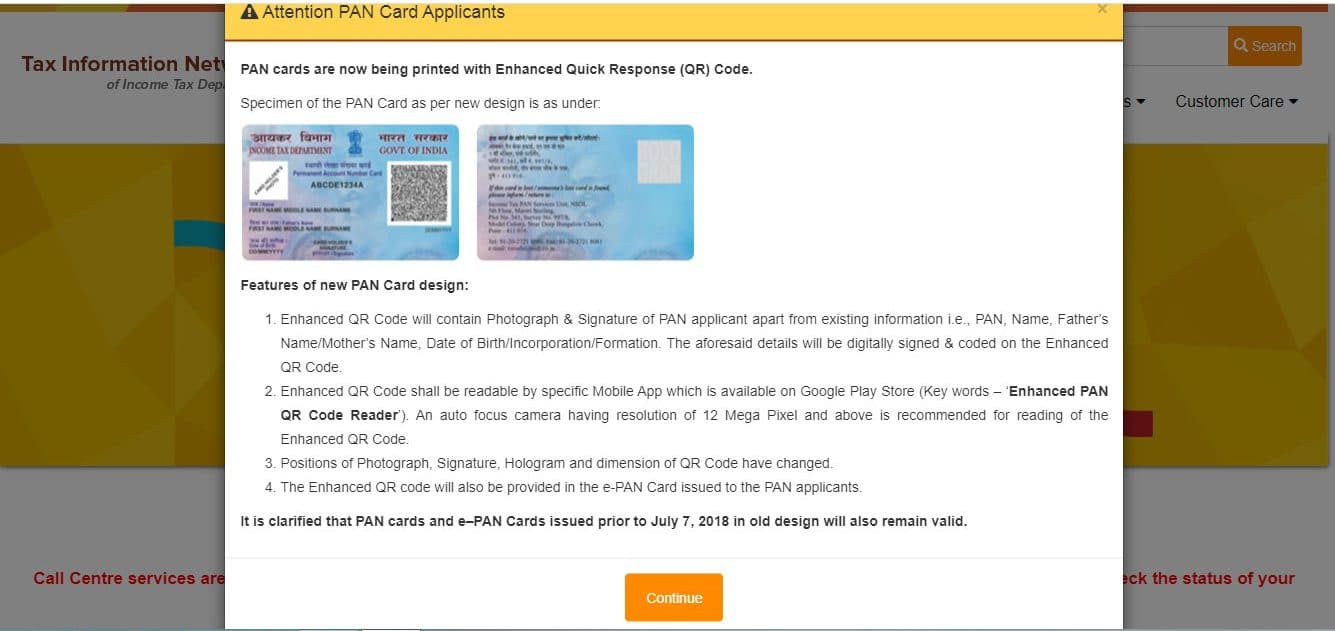

New pan card format

It is against the Law to have more than one PAN card

Conclusion

Through this article we have discussed the importance of having a PAN card and the various purposes we need it for. We primarily discussed how to apply for PAN card online. Though a person not requiring it could always fill out a Form 60 to get through, it is usually good practice to have it. Possessing a PAN card is not the only thing; as responsible citizens we must be aware of its various uses as well as the concept behind it.

Most importantly, as mentioned right above, it is illegal to have more than one PAN card. The person concerned could be fined up to Rs.10000 for possession of more than one PAN card. We can always file for a duplicate card if it is lost or damaged and not a new one. The process is a little time consuming and requires some effort. If you want to obtain a PAN card with some ease, you can reach us.