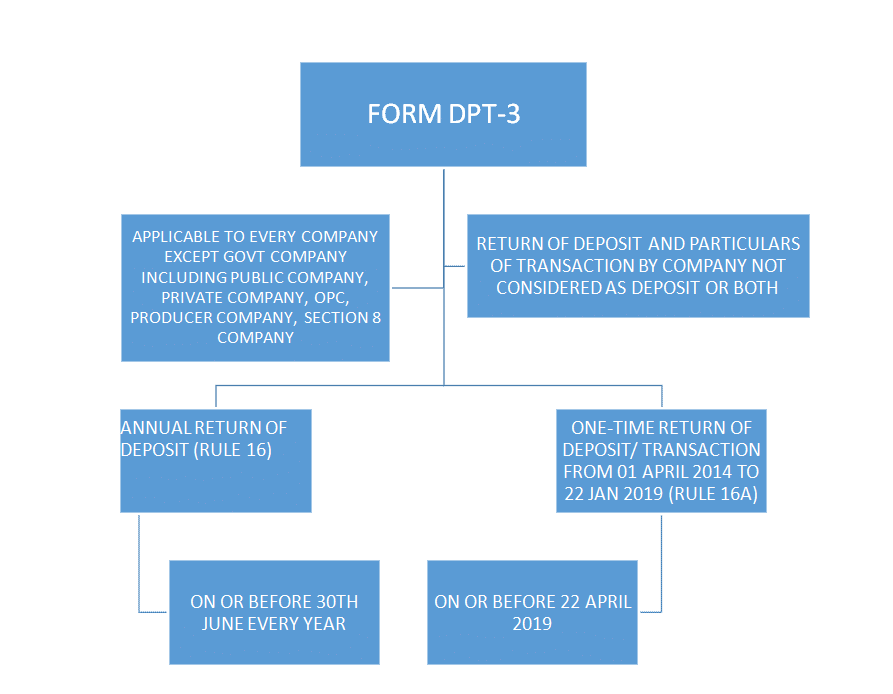

MCA vide notification dated 22nd January 2019introduced Rule 16 and Rule 16A under Companies (Acceptance of Deposits) Rules, 2014 which makes mandatory for every company except Government Company to file one time and annual return of outstanding deposit, money or loan received by company. The Form DPT-3 is applicable to every company except Government companies and other companies exempted by Central Government.

What is the Importance of E-Form DPT-3?

- ANNUAL RETURN : Every Company to which the Companies (Acceptance of Deposits) Rules, 2014 apply, shall on or before 30th Day of June every year, file a return of deposit and particulars of transactions not considered as deposit or both as per Rule 16 of Companies (Acceptance of Deposits) Rules, 2014

- ONE TIME RETURN : Everycompanyother than Govt company shall file one-time return of outstanding money or loan received by a company from 1st April 2014 to 22nd January 2019 on or before 22nd April 2019 as per as per Rule 16A of Companies (Acceptance of Deposits) Rules, 2014

Which companies are required to file DPT-3 ?

EForm DPT-3 is applicable to every company except Government companies and other companies exempted by Central Government. EForm is applicable for following classes of company

- Private Limited Company

- Public Limited Company

- One Person Company

- Producer Company

- Section 8 company

WHICH TRANSACTIONS ARE INCLUDED IN EFORM DPT-3 ?

There are 3 main categories of transactions which has to be disclosed under this EFORM DPT-3

i. RETURN OF DEPOSIT – Deposit means any amount of money received by company by way of deposits or loans or any other form as defined under Sec 2 (31)

ii. PARTICULARS OF TRANSACTION BY COMPANY NOT CONSIDERED AS DEPOSIT – The transaction which are not considered deposit will fall under this category.

- The amount received from Central Govt, State Govt, Banks, Financial Institution, Foreign Bodies, Foreign or International Banks

- Amount received from director or relative of director, Amount received from another company etc are included in particulars of transaction by company not considered as deposit.

iii. COMBINATION OF BOTH – FORM DPT-3 is also required to be filed by a company which has accepted deposits and has incurred transactions not considered as depositas mentioned in point i and ii, suchtransactions will fall under this category.

EFFECT OF RULE 16A ON FINANCIAL STATEMENT ?

- Every company, other than a private company, shall disclose in its financial statement, by way of notes, about the money received from the director.

- Every private company shall disclose in its financial statement, by way of notes, about the money received from the directors, or relatives of directors