Ministry of Corporate Affairs has issued Circular No. 11/2020, dated 24th March, 2020 and in furtherance of circular in order to facilitate the companies registered in India to make a fresh start on a clean slate, this Ministry has decided to take certain measures for the benefit of all companies and launched a COMPANY FRESH START SCHEME 2020 also known as CFSS-2020. CFSS-2020 offers benefits such as relaxation from additional fees and penalty. CFSS-2020 is applicable to “defaulting company”. The CFSS-2020 scheme shall be valid from 01.04.2020. Under CFSS-2020, Companies registered under Companies Act 2013/1956 are required to file relevant documents.

NEED FOR LAUNCH OF THE COMPANY FRESH START SCHEME 2020 (CFSS-2020) ?

- Companies Act, 2013 requires all companies to make annual statutory compliance by filing the Annual Return and Financial Statements. Apart from this, various other statements, documents, returns, etc are required to to be filed on the MCA21 electronic registry within prescribed time limits failing to which additional fees and penalty would be liable to companies.

- The Ministry has received representations from various stakeholders requesting for grant of one-time opportunity, so as to enable them to complete their pending compliance by filing necessary documents in the MCA-21 registry including annual filings without being subject to a higher additional fees on account of any delay.

- In order to give such an opportunity to the defaulting companies and to enable them to file the belated documents in the MCA-21 registry, the Central Government has decided to introduce a scheme namely “Companies Fresh Start Scheme, 2020 (CFSS-2020) condoning the delay in filing the documents (Ex. Form Form AOC-4, MGT-7) with the Registrar, waiving of additional fees, and granting of immunity from launching of prosecution or proceedings for imposing penalty on account of delay associated with certain filings. Only normal fees for filing of documents in the MCA-21 registry will be payable in such ease during the period of the scheme.

- In addition, the scheme gives an opportunity to inactive companies to get their companies declared as “dormant company under section 455 of the Act by making a simple application at a normal fee. The said provision enables inactive companies to remain on the register of the companies with minimal compliance requirements.

BRIEF DETAILS ON COMPANY FRESH START SCHEME 2020 (CFSS-2020)

A) TO WHOM THE COMPANY FRESH START SCHEME 2020 (CFSS-2020) IS APPLICABLE ?

The scheme shall be applicable to “defaulting company” which means :

- a company defined under the Companies Act, 2013, and

- which has made a default in filing of any of the documents, statement, returns, etc including annual statutory documents like Form AOC-4, MGT-7, on the MCA-21 registry.

B) BENEFITS OF THE COMPANY FRESH START SCHEME 2020 (CFSS-2020) ?

- Relaxation from Additional fees and penalty : Every defaulting company shall be required to pay only normal fees {as prescribed under the Companies (Registration Offices and Fee) Rules, 2014 on the date of filing of each belated document and no additional fee shall be payable by company in respect of such documents, statement, returns, etc

- Immunity from the launch of prosecution : Immunity from the launch of prosecution or proceedings for imposing penalty shall be provided pertaining to any delay associated with the filings of belated documents. The ROC or MCA will not initiate prosecution or impose penalty in respect of documents filed under the scheme.

But, if any other consequential proceedings, including any proceedings involving interests of any shareholder or any other person of company, or its directors, Key managerial persons would not be covered under such immunity. For example under section 42(8), every company is required to file a return of allotment within the period provided therein. However, it also requires that the utilization Of money raised through private placement shall not be made unless the return of allotment has been filed with Registry hence for such an act the immunity shall not be granted.

C) PERIOD OF COMPANY FRESH START SCHEME 2020 (CFSS-2020) :

The scheme shall be valid from 01.04.2020 and shall remain in force till 30.09.2020

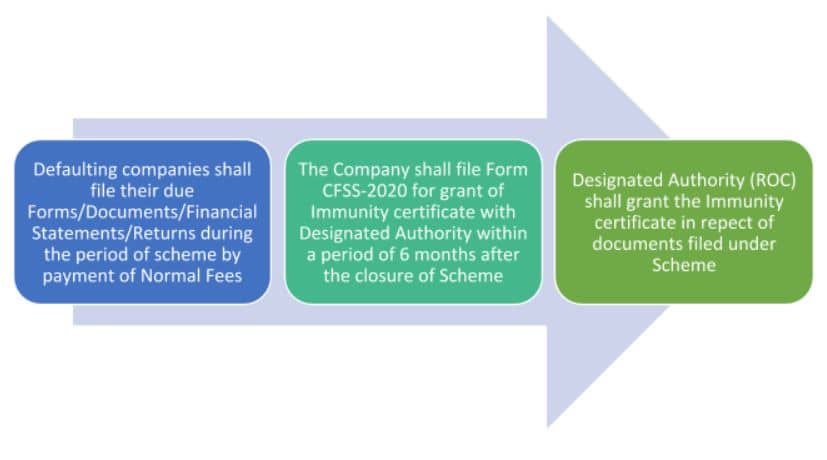

D) PROCEDURE TO AVAIL THIS COMPANY FRESH START SCHEME 2020 (CFSS-2020):

E) IN WHICH CASES THE COMPANY FRESH START SCHEME 2020 (CFSS-2020) SHALL NOT APPLY ?

This scheme shall not apply in the following cases :

- To companies against which action for final notice for striking off the name u/s 248 of the Act has already been initiated by the Designated authority;

- Where any application has already been filed by the companies for striking off the name of the company from the register of companies;

- To companies which have amalgamated under a scheme of arrangement or compromise under the Act;

- Where applications have already been filed for obtaining Dormant Status under section 455 of the Act before this Scheme;

- To vanishing companies;

- Where any increase in authorized capital is involved (Form SH7) and also charge related documents (CHG-1, CHG-4, CHD-8 and CHG-9);

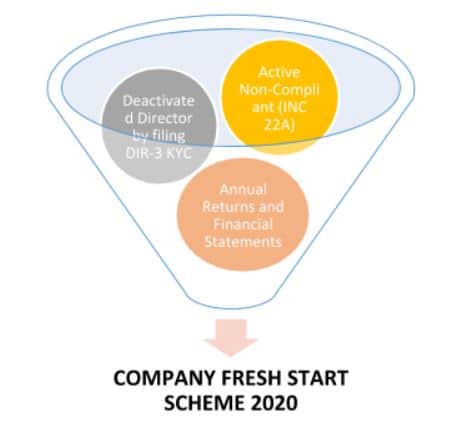

F) CAN DIRECTOR WITH DEACTIVATED DIN AND ACTIVE-NON COMPLIANT COMPANIES TAKE THE BENEFIT OF COMPANY FRESH START SCHEME 2020 (CFSS-2020) ?

Yes, DIN holders of DINs marked as ‘Deactivated’ due to non-filing of DIR-3KYC/DIR-3 KYC-Web and those Companies whose compliance status has been marked as “ACTIVE non-compliant” due to non-filing of Active Company Tagging Identities and Verification(ACTIVE) Eform are encouraged to become compliant once again in pursuance of this scheme and file DIR-3KYC/DIR-3KYC-Web/ACTIVE as the case may be between 1st April, 2020 to 30th September, 2020 without any filing fee of INR 5000/INR 10000 respectively.

G) WHAT IS IMMUNITY FROM PROSECUTION AND WHAT ARE CFSS-2020’sEFFECTS ?

- Companies registered under Companies Act 2013/1956 are required to file relevant documents, statement, returns within a prescribed time, failing to which the Adjudication Authority/Registrar of Companies/Designated Authority may initiate prosecution or procedings and impose heavy penalty for such default.

- Grant of Immunity shall exempt the companies from any proceedings or prosection by Designated Authority with respect to belated forms filed during the Scheme.

- Application for issue of immunity in respect of document(s) filed under the Scheme – The application for seeking immunity in respect of belated documents filed under the Scheme may be made electronically in the Form CFSS-2020 after closure of the Scheme and after the document(s) are taken on file, or on record or approved by the Designated authority as the case may be but not after the expiry of six months from the date of closure of the Scheme. The last day for filing Application for Immunity Certificate shall be 31.03.2021

- This immunity shall not be applicable :

- In the matter of any appeal pending before the court of Law and in case of management disputes of the company pending before any court of law or tribunal.

- No immunity shall be provided in case any court has ordered conviction in any matter, or an order imposing penalty has been passed by an adjudicating authority under the Act, and no appeal has been preferred against such orders of the court or of the adjudicating authority, as the case may be, before this Scheme has come into force.

- Immunity Certificate : Based on the declaration made in the Form CFSS-2020, an immunity certificate in respect of documents filed under this Scheme shall be issued by the designated authority granting immunity from penalty and prosecutlon.

- Effect of Immunity: After granting the immunity, the Designated authority concerned shall withdraw the prosecution(s) pending, if any, before the concerned Court(s) and the proceedings of adjudication of penalties under section 454 of the Act, other than those specifically referred, in respect of defaults against which immunity has been so granted shall be deemed to have been completed without any further action on the part of the Designated authority;

H) APPLICABILITY OF COMPANY FRESH START SCHEME 2020 (CFSS-2020) TO COMPANIES UNDER PROSECUTION, ADJUDICATION OR APPEALS ?

- The applicant shall before filing an application for issue of immunity certificate, withdraw the appeal – If the defaulting company, has filed any appeal against any notice/complaint/order before a competent court or authority for violation of the provisions under the Companies Act 2013/1956, in such case, company/applicant can file the pending/belated forms under this scheme and before filing an application for issue of immunity certificate, withdraw such appeal and furnish proof of such withdrawal along with the application.

- Special measures for cases where the order of authority was passed but the appeal could not be filed: In all cases where due to delay associated in filing of any document, statement or return, etc. in the MCA-21 registry, penalties were imposed by an adjudicating officer and no appeal has been preferred by the concerned company or its officer before the Regional Director, the following would apply:-

- Where the last date for filing the appeal falls between the 1st March, 2020 to 31st May, 2020 (both days included), a period of 120 additional days shall be allowed with effect from such last date to all companies and their officers for filing the appeal before the concerned Regional Directors;

- During such additional period as stated in (a) above, prosecution for non-compliance of the order of the adjudicating authority, relating to delay associated in filing of any document, statement or return, etc. in the MCA-21 registry shall not be initiated against companies or their officers.

I) COMPANY FRESH START SCHEME 2020 (CFSS-2020) FOR INACTIVE COMPANIES :

The defaulting inactive companies, while filing due documents under the scheme can, simultaneously, either –

- Apply to get themselves declared as Dormant Company under section 455 of the Companies Act, 2013 by filing e-form MSC-1 at a normal fee; or

- Apply for striking off the name of the company by filing e-Form STK-2 by paying the fee payable on form STK-2.

CONCLUSION

After the conclusion of the COMPANY FRESH START SCHEME 2020 (CFSS-2020), the Designated authority shall take necessary action under the Act against the companies who have not availed this Scheme and are still in default in filing these documents in a timely manner. Registration Arena can help Non-Compliant and Inactivate companies as well as Directors with deactivated DIN to a complete the pending annual compliance and Director KYC and make a fresh start at affordable price and also help to comply with Laws and regulation on timely basis.