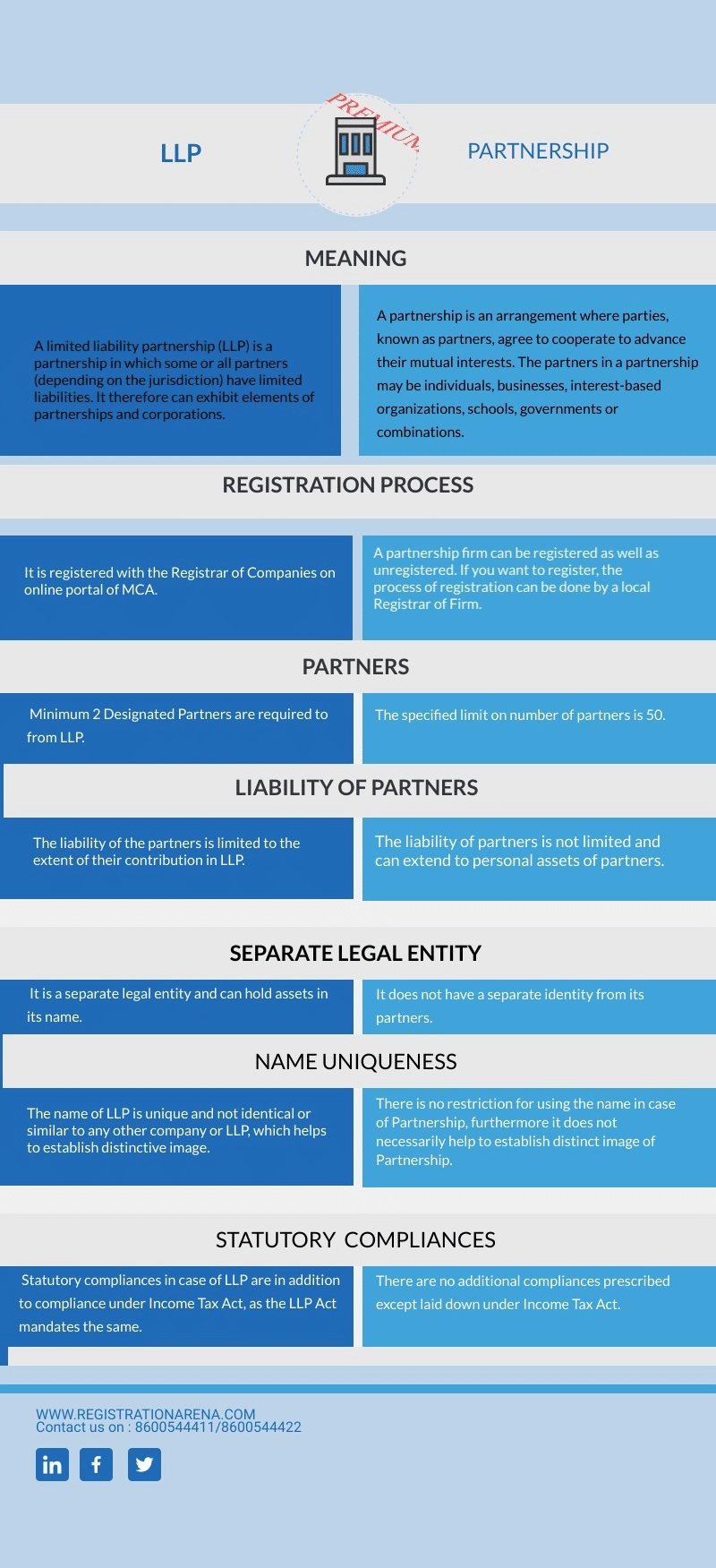

MEANING

LLP: A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit elements of partnerships and corporations.

PARTNERSHIP: A partnership is an arrangement where parties, known as partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations may partner to increase the likelihood of each achieving their mission and to amplify their reach.

There are many benefits of an LLP over the Partnership. The following article talks about the benefits of an LLP over Partnership.

REGISTRATION PROCESS

LLP: The LLP Registration is mandatory. It is registered with the Registrar of Companies on online portal of MCA. So here, it gets a benefit of Centralised Registration.

PARTNERSHIP: A partnership firm can be registered as well as unregistered. If you want Partnership Registration, the process of registration can be done by a local Registrar of Firm. Online portal is not available for its registration.

TIMELINE

LLP: It takes approximately 20 days for a LLP to incorporate

PARTNERSHIP: It will take approx. 7 days to incorporate.

LEGAL MATTERS

LLP: LLP can sue as well as be sued.

PARTNERSHIP: Only registered partnership can sue.

TAXATION PROCESS

LLP: The Profits of a LLP are taxed at 30% + educational cess. LLP must file annual return with the Ministry of Corporate Affairs (MCA).

PARTNERSHIP: The Profits of a Partnership firm are taxed at 30% + educational cess. There is no annual return filing requirement for a Partnership firm.

PARTNERS

LLP: Minimum 2 Designated Partners are required to from LLP. However, there is no specified limit on maximum number of Partners.

PARTNERSHIP: The specified limit on number of partners is 50. Partnership firm having more than 50 partners are declared as an illegal association.

LIABILITY OF THE PARTNERS

LLP: The liability of the partners is limited to the extent of their contribution in LLP. In LLP one partner is not affected or not held liable for the actions of another partner which seems to be fair.

PARTNERSHIP: Case here is totally opposite; the liability of partners is not limited and can extend to personal assets of partners. The action of active partner can hold another liable.

SEPARATE LEGAL ENTITY

LLP: It is a separate legal entity and can hold assets in its name.

PARTNERSHIP: It does not have a separate identity from its partners.

NAME UNIQUENESS

LLP: The name of LLP is unique and not identical or similar to any other company or LLP, which helps to establish distinctive image.

PARTNERSHIP: There is no restriction for using the name in case of Partnership, furthermore it does not necessarily help to establish distinct image of Partnership.

UNINTERRUPTED EXISTENCE

LLP: The change in the partners of LLP does not affect the existence of LLP.

PARTNERSHIP: The Partnership Firm dissolves due to removal or death of Partner subject to clauses of Partnership Deed.

STATUTORY COMPLIANCES

LLP: Statutory compliances in case of LLP are in addition to compliance under Income Tax Act, as the LLP Act mandates the same. These compliances ensure transparency of operations and financials of the entity.

PARTNERSHIP: There are no additional compliances prescribed except laid down under Income Tax Act.

DATA AVAILABILITY

LLP: MCA allows availability of data except the agreement between partners. Also, one can see the last balance sheet filed with MCA in the master data of the entity which creates high creditability and reliability among the other parties to the LLP.

PARTNERSHIP: Any of the information or the data of the Partnership are not disclosed on public platform.

HIGHER CREDITABILITY

LLP: Due to higher compliances and transparency in operation, the credibility of LLP is higher and thus it eases the fund rising from financial institutions.

PARTNERSHIP: Compared to partnership firms, other body corporates are having higher credibility and hence are less preferable.

PURCHASE OF PROPERTY

LLP: LLP can also purchase movable / immovable property in its name. There are no restrictions.

PARTNERSHIP: Partnership firm cannot purchase movable / immoveable property in its name. The same must be purchased in the name of partners.

TRANSFER OF INTERESTS

LLP: Rights/ interest of the partners are transferable as per the provisions of the LLP agreement.

PARTNERSHIP: Transferability of the Interest subject to the mutual consent of all the members.

MAINTAINING BOOKS OF ACCOUNTS

LLP: The book of account has to be prepared and also maintained as specified in the LLP ACT.

PARTNERSHIP: No such procedure has to be followed. Not applicable.

REMUNERATION

LLP: The remuneration to the partners will be provided only if it is mentioned in the LLP agreement.

PARTNERSHIP: A partner is not entitled to receive any remuneration for taking part in the conduct of business.

CHANGE IN DIRECTORS/DESIGNATED PARTNERS/PARTNERS

LLP: The notice of change of director is to be given to the ROC (Register of Companies)

PARTNERSHIP: Notice of change of partners should be given to Registrar of Firms.

DRAWINGS

LLP: Drawings are permitted as per the LLP agreement.

PARTNERSHIP: Drawings are permitted in partnership firm

From the above given difference you can now decide which one to opt for. Nature of simplicity and transparency are the basics of LLP, and are more advantageous than partnership firm. This does not mean that people should only go for LLP, if you are looking for a long term growth in business and are willing to jump into corporate world without facing the high restriction caused in case of companies; the person may prefer LLP considering its advantages and disadvantages.