A partnership firm is a popular type of business entity in India. It is most suitable when two or more persons want to do business together by pooling resources like capital, skills, manpower, technology, etc. However, the most important limitations of partnership firms are that the liability of partners is unlimited and there is a lack of transparency with respect to historical data. In this article, we will look at the major characteristics, pros, and cons of partnership firms.

Before discussing it further, let us understand the meaning of a partnership firm.

What is a Partnership Firm?

A Partnership Firm is a type of legal entity in which two or more persons join each other to carry out a business and earn profits. Such persons are known as partners and they share the responsibilities, profits, and losses of the partnership firm. In addition, they contribute the capital for carrying on the business.

The Partnership Act, 1932. governs partnership firms in India.

Definitions as per the Partnership Act, 1932

Section 4 of the Partnership Act, of 1932 defines the terms ‘Partnership’ and ‘Partners’’.

Accordingly, ‘Partnership’ is the relation between persons who agree with each other to share the profits of the business that is either carried on by all of them or by any one of them on behalf of all.

‘Partners’ are the persons who have entered into a partnership with each other. Therefore, individually they are called ‘Partners’ and collectively ‘a firm’.

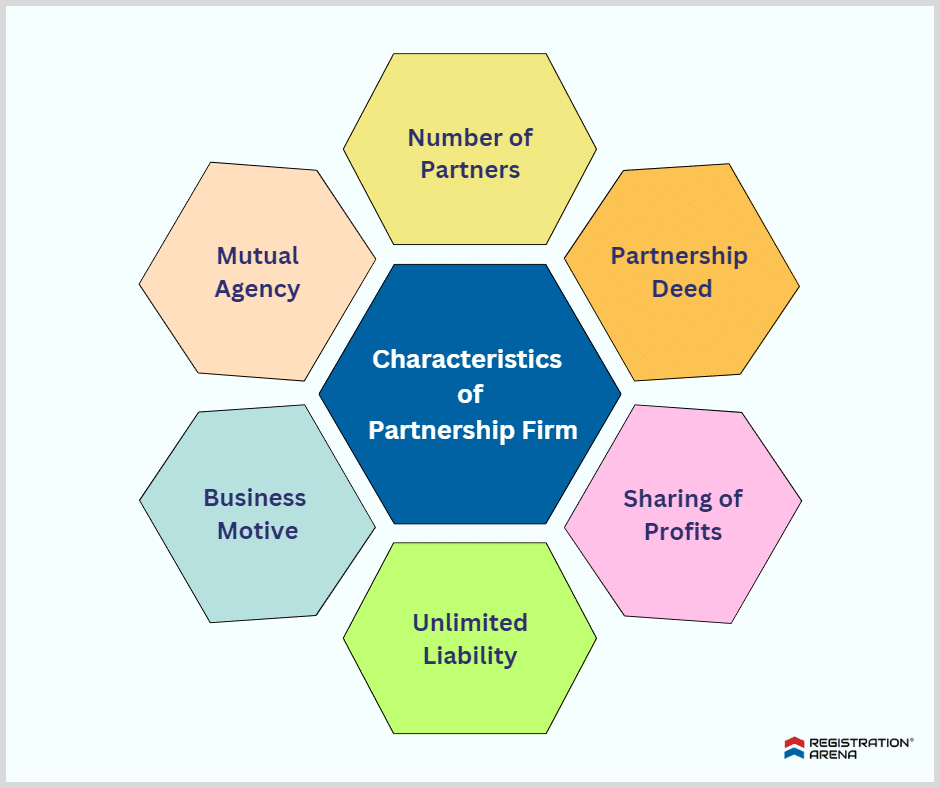

Characteristics of Partnership Firm

Now that we have understood the meaning of different terms related to Partnership, let us have a look at the following characteristics of a partnership firm.

Number of Partners

A partnership firm shall have a minimum of two partners. However, the maximum number of partners can be 50.

The limit on the maximum number of partners in this firm is prescribed by the Companies (Miscellaneous) Rules, 2014. Also, the Government has the power to increase this limit to 100.

Partnership Deed

The rights and duties of partners in a partnership firm are governed by a written agreement between them, known as a Partnership Deed. Such a deed shall be signed by all the partners.

There is no particular format for a partnership deed. However, it shall contain all the important clauses that are necessary for the proper functioning of the partnership firm. For example, if an application is made for registration of a partnership firm, it is necessary to present a copy of the deed which states –

- Name of the Firm

- Nature of Business of the Firm

- Principal Place of Business of the Firm

- Other Places of Business of the Firm

- Date of Joining of Partners

- Full Name and Address of the Partners

- Duration for which the Firm is formed

Sharing of Profits

Sharing of profits is the most fundamental characteristic of a partnership firm. Therefore, all the partners shall share the profits of the business in the ratio as mentioned in the Partnership Deed. However, in the absence of a particular ratio, profits shall be shared equally.

Moreover, sharing of profits includes sharing of losses as well.

Unlimited Liability

In a general partnership, the liability of all the partners is unlimited. This means that in case of losses if the assets of the firm are insufficient to pay off the debts of the firm, the partners become personally liable to third parties.

Business Motive

The motive behind the formation of a partnership firm shall be carrying on a business. In addition, such business shall be lawful.

Further, the term business includes trade, occupation, and profession.

Mutual Agency

There is a contract of mutual agency between the partners of a partnership firm and between a partner and the firm. It means that all the partners are liable for the acts of each other and similarly, a partner is liable for the acts of the firm.

However, the partners and the firm are not considered separate as the firm is nothing but a collection of partners.

Advantages of Partnership Firm

The following are the advantages of a Partnership Firm.

Easy Formation

Compared to other forms of business such as a Company or an LLP, it is easy to start a partnership firm. There are very few legal formalities that are involved. In addition, the cost of formation is also low.

Pooling of Resources

Two or more persons who are having different sets of resources can join each other and start a business through a partnership firm. Therefore, a partnership firm allows the pooling of resources.

For example, if Mr. A wants to invest his money into a business and Mr. B possesses excellent management skills, they can start a partnership together by combining the resources that they are having i.e., capital and skills.

Flexibility

These firms are very flexible as business decisions can be taken easily and quickly. There is no need of passing a resolution as in the case of a company.

Access to Funds

It is easy for a partnership firm to raise funds from banks and other financial institutions as compared to a Sole Proprietorship. This is because a partnership is a ‘collection of partners’ and therefore, it enjoys high credibility.

Division of Work

In a partnership firm, work can be divided amongst different partners based on their skills and expertise. Therefore, it brings the benefits of specialization and work efficiency.

Closure

Just like it is easy to start a partnership firm, the process of closure or winding up is also simple. The process involves very few legal formalities and takes less time.

In terms of partnership, the process of closure is known as dissolution. However, there is a difference between the dissolution of a partnership and the dissolution of a firm. Dissolution of partnership takes place whenever there is a change in the partnership firm such as admission, retirement, or death of a partner.

On the other hand, the dissolution of a firm takes place in circumstances like completion of tenure, achievement of purpose, or by operation of law. In crux, the dissolution of a firm implies the dissolution of a partnership but not vice versa.

Less Compliance Cost

In comparison to a company, the compliance cost of a partnership firm is very low. A partnership firm doesn’t need to get its accounts audited by a chartered accountant. In addition to this, MCA compliances are not required to be done, unlike companies.

However, it shall file an income tax return every year.

Disadvantages of Partnership Firm

The following are the disadvantages of a Partnership Firm.

Unlimited Liability

The liability of all the partners in a Partnership Firm is unlimited. Therefore, in the event of losses, third parties can raise a claim against the personal assets of partners if the assets of the firm are not sufficient to pay off the debts of the firm.

Limited Chances of Expansion

It can have a maximum of 50 partners. This restricts the growth and expansion of partnership firms to a limited extent.

Also, modern-day startups issue securities with different features for meeting their financial and working capital requirements. For example, debentures, convertible notes, preference shares, etc. A partnership firm cannot issue these securities.

Further, companies today provide the option of ESOP i..e, Employee Stock Option Plan to its employees to retain them, but a partnership firm cannot provide such benefits to its employees.

Undesirable for Investment

Angel investors and venture capitalists do not consider a partnership firm as a lucrative investment option. This is because if a person wants to hold an interest in a partnership firm, he shall become a partner, and generally angel investors and venture capitalists do not want to engage as partners and run the show.

In addition, foreign citizens and entities also consider partnership firms undesirable for Foreign Direct Investment (FDI) as the records of a partnership firm are not available in the public domain.

Lack of Transparency

There is a lack of public trust in the case of partnership firms as their data like accounts are not accessible to the general public. Other forms of organizations such as Companies and LLPs enjoy higher public trust as their data is available in the public domain.

Higher Tax Liability

The rate of income tax applicable on a partnership firm is higher as compared to a Sole Proprietorship. A flat tax rate of 30% is levied on the income of the partnership firm.

Haven’t filed the return of your firm yet? Get in touch with our experts and file the return now!

No Perpetual Succession

Unlike a Company, a partnership firm is not a separate legal entity and therefore, it does not continue for a perpetual period. The dissolution of a partnership can take place on the happening of events like the retirement of a partner, or the death of a partner. Therefore, there is no perpetual succession in a partnership firm.

Restriction on the Transferability of Interest

There is a restriction on the transferability of interest in a partnership firm. A partner may transfer his interest in a partnership firm to another person with the prior consent of other partners if required as per terms of the partnership deed. Therefore, taking an exit from a partnership firm may be a complex process at times.

Is Registration of Partnership Firm Compulsory?

No, the registration of a partnership firm is not compulsory.

However, it is always advisable to register a partnership firm as registration brings the benefit of legal identification. Also, as per Section 69 of the Partnership Act, of 1932, an unregistered firm suffers from the following consequences.

So, don’t wait and connect with our experts now for registration of your partnership firm!

Conclusion

In conclusion, we can say that there are several advantages and disadvantages of a partnership firm. In some aspects, it is better than a company and sole proprietorship, while in other aspects it suffers from various limitations. Therefore, its suitability depends on several factors like the nature of the business, capital requirement, scale of operations, etc.

Registration Arena is having a team of experts to help you with the registration of your partnership firm. Our team will make the process easier for you. We can also assist you in the registration of your trademark and filing of income tax, GST returns, etc.

Call us now at +918600544411/22 or drop an email at sales@registrationarena.com for more information.