The factors and circumstances surrounding businesses are changing rapidly today. Various factors, including technological advancements, globalization, market trends, and shifting customer expectations, drive this dynamic nature of the business environment. It has created a wide range of choices for entrepreneurs when it comes to selecting the most suitable business structure like partnership, LLP, company, etc. Entrepreneurs generally prefer private limited companies due to their numerous advantages and adaptability to various industries. However, it is equally important to consider the disadvantages of private limited companies while deciding the business structure.

In this article, we will discuss the meaning and major advantages and disadvantages of a private limited company. It will help you in making an informed decision about whether this structure suits your business or not.

What is a Private Limited Company?

Section 2(68) of the Companies Act, 2013 defines a private limited company. Accordingly, a private limited company is a company which by its articles,

- Restricts the right of members to transfer their shares;

- Limits the number of members to two hundred (excluding past and present employees who are also members of the company); and

- Prohibits the invitation to the public for subscribing to its securities.

In simple words, we can say that a private limited company operates as a closely held company where members’ liability is limited to the shares they hold.

Note: Joint members i.e., two or more persons holding the share(s) of a company jointly, are treated as a single member while calculating the total number of members.

What are the Requirements for the Formation of a Private Limited Company?

The following are the fundamental requirements for the formation and registration of a private limited company:

- Minimum 2 directors who are individuals and at least one of them should reside in India for a minimum period of 182 days in the financial year

- Director Identification Number (DIN) and Digital Signature Certificate (DSC) of directors

- Minimum 2 members

- A registered office of the company to carry out the operations

Learn more about the process of Private Limited Company Registration

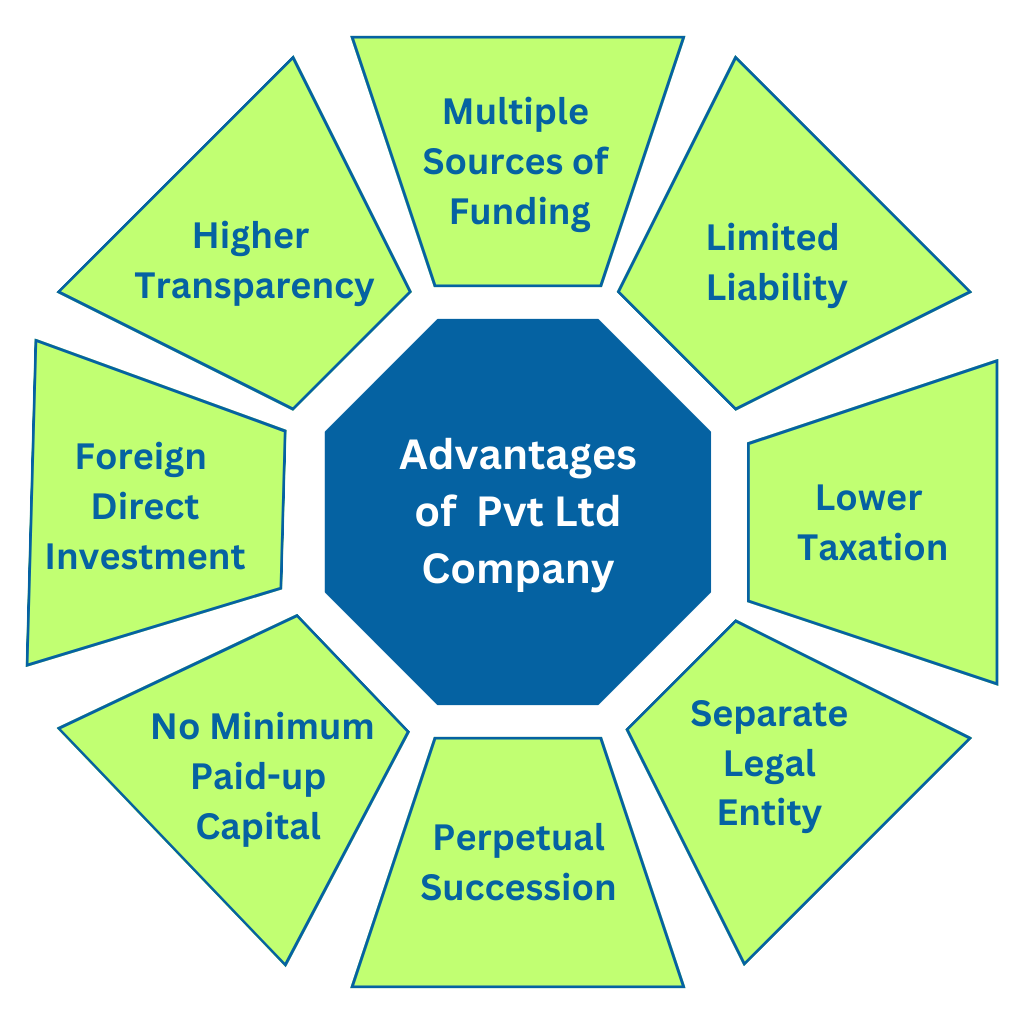

Advantages of Private Limited Company

The following are the benefits or advantages of a Pvt Ltd company.

Multiple Sources of Funding

Compared to a sole proprietorship or partnership firm, a private limited company can raise funds easily. Primarily, a private limited company can raise capital by issuing shares, debentures, convertible securities, etc. In addition, banks and other financial institutions also consider private companies reliable and grant loans to them.

Moreover, venture capitalists and angel investors also prefer to invest in private limited companies due to several associated benefits such as limited liability, exit options, compulsory audit requirements, etc.

Therefore, a private limited company has access to multiple sources of funding.

Limited Liability

Generally, private limited companies either limit their liability by shares or by guarantee. Therefore, members’ liability in a private limited company is limited to the extent of the shares they hold or the guarantees they provide.

In simple words, it means that if the company incurs losses, the members are liable only up to the extent of the amount that is unpaid on their shares. If they have paid the entire amount on shares, they are not liable to pay anything and the third parties cannot raise a claim against their personal assets.

Lower Taxation

A private limited company gets the benefit of a concessional tax rate under various schemes. For example, a domestic company can pay tax @22% for AY 20-21 onwards if it does not claim a deduction under Section 10AA, Section 32, Section 32AD, etc.

According to another scheme, a manufacturing company registered after 01st March 2016 can pay tax at a rate of 25% if it does not claim deductions under Section 10AA, Section 32, Section 32AD, etc. Moreover, if a manufacturing company is registered after 01st October 2019 and commenced its operations before 31st March 2023, it can choose to pay a tax of @15%.

Separate Legal Entity

A private limited company is considered a separate legal entity, distinct from its members. It means that the company has an identity of its own. It can enter into contracts, own property in its name, can have a common seal, etc. Further, it can be sued and can sue third parties in its capacity.

Perpetual Succession

A private limited company enjoys the benefit of perpetual succession as it remains distinct from its members. In simple words, it means ‘Members may come and members may go, but the company goes on forever’.

Therefore, unlike in a sole proprietorship or partnership where the owner/partner’s retirement or death leads to dissolution, a company continues to operate irrespective of the entry or exit of members.

No Minimum Paid-Up Capital Requirement

No minimum paid-up capital is required to form or register a private limited company. Earlier, a private limited company needed to have a minimum paid-up share capital of Rs. 1 lakh, but after the Companies (Amendment) Act, of 2015, there is no such requirement for a private company.

Foreign Direct Investment

Except for prohibited sectors, a private limited company can accept Foreign Direct Investment (FDI) up to 100%. It means that a non-resident person or entity can invest in the shares of an Indian private limited company. FDI not only benefits the company but also contributes to the growth and development of the economy.

Higher Transparency

Private Limited Companies are required to prepare financial statements including balance sheets, statements of profit & loss, cash flow statements, etc. Further, these statements are shared with regulatory authorities like ROC and shareholders of the company.

In addition, incorporation details of the company like year of incorporation, authorized capital, registered office address, etc. are available on the MCA website. Therefore, private limited companies demonstrate higher transparency as they make their data available in the public domain. Moreover, it is accessible to different interest groups such as investors, clients, suppliers, etc.

It is always advisable to register the company under the guidance of experts to make the process hassle-free. Connect with us now!

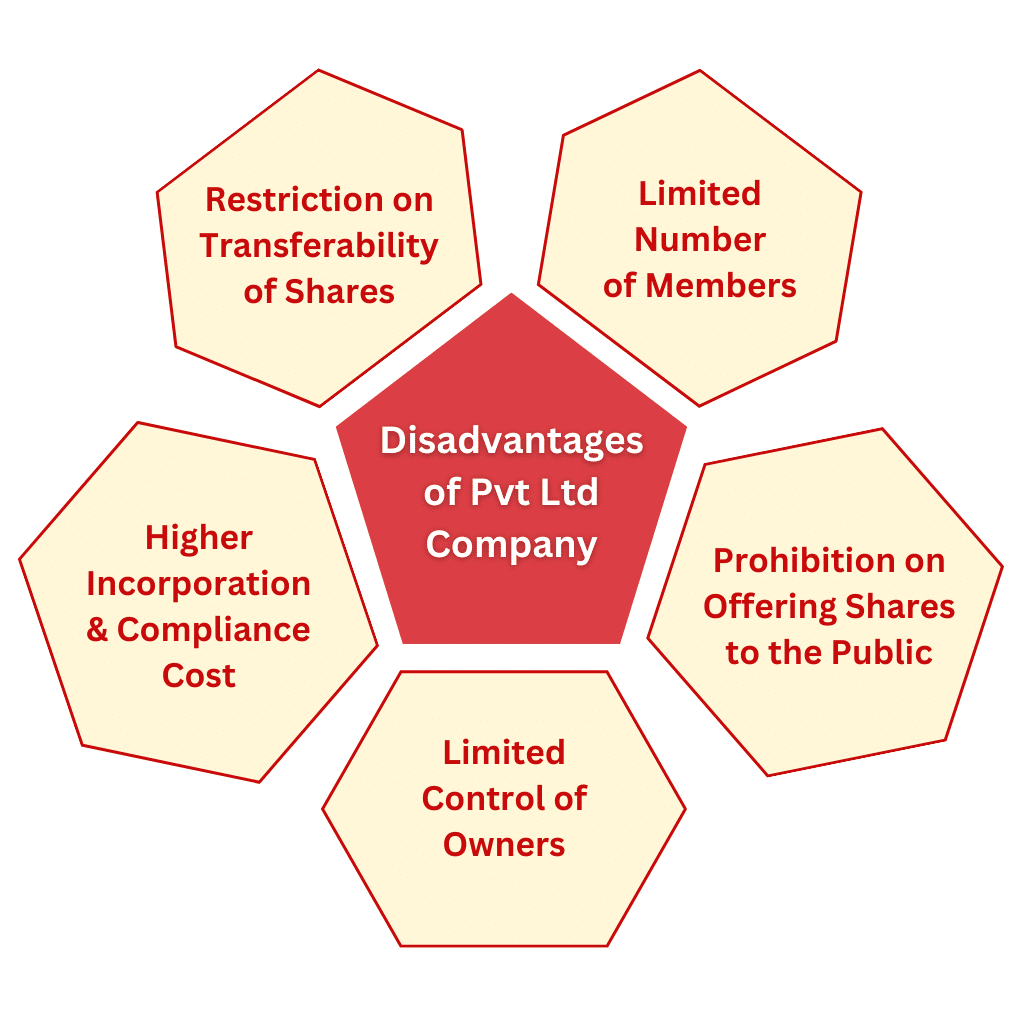

Disadvantages of Private Limited Company

The following are the disadvantages of a private limited company.

Restriction on Transferability of Shares

A private limited Company, by its Articles of Association, restricts the right to transfer its shares. It means that the members of a private limited company cannot freely transfer their shares. Generally, such types of companies put up a restriction on share transfer in the form of ‘Right of Pre-emption’. Right of Pre-emption means that if a member wants to sell his shares of a private limited company, he should first offer those shares for sale to other members of the company.

In addition, directors of the company can also refuse to register the transfer of shares if authorized by the Articles of the company. This is another way in which a private limited company can restrict share transfer.

Limited Number of Members

A limit exists on the number of members in a private limited company. It can have a maximum of 200 members only, excluding the past and present employees who hold shares in the company. Therefore, unlike a public company, it cannot have unlimited members.

Prohibition on Offering Shares to the Public

A private limited company cannot offer its shares to the general public for subscription. In other words, a private limited company is restricted from issuing a public invitation, commonly known as a prospectus.

It also implies that shares of a private limited company cannot be traded on a stock exchange. This limits the chances of growth and expansion of the company.

Higher Incorporation and Compliance Cost

The cost of incorporation of a private limited company is higher in comparison to a sole proprietorship or partnership firm. A company has to pay name reservation fees, stamp duty, etc. for registration with the ROC of the respective state.

In addition, after incorporation as well, a company has to file different MCA forms and returns, income tax returns, maintain statutory registers, etc. Therefore, the compliance cost of a private limited company is also high.

Limited Control of Owners

A company has a broad ownership base as it involves investment from multiple investors or shareholders. This wide distribution of control leads to limited control of the owner, as each shareholder has a proportionate influence on decision-making. Shareholders make many decisions through a simple majority vote during general meetings. Also, some resolutions require at least 75% of the votes from shareholders.

Therefore, the decision-making authority gets divided amongst all the shareholders of the company irrespective of being in exclusive control of the owner.

Conclusion

Investors and entrepreneurs should consider the various advantages and disadvantages of a private limited company. On the positive side, there are benefits like limited liability, higher transparency, etc. While at the same time, a private limited company suffers from limitations like limited members, higher cost of incorporation, etc. To sum up, we can say that it is important to understand the advantages and disadvantages of a private limited company before selecting it as a business structure.

We, at Registration Arena, aim to deliver the best incorporation, compliance, and advisory services to our clients. Our team consists of professionals like CA, CS, Lawyers, etc. to assist you in every possible way. Reach out to us at +918600544422/11 (Call/ WhatsApp) or sales@registrationarena.com for more information.