An LLP (Limited Liability Partnership) can be viewed as an alternative corporate business that provides many benefits. The same provides numerous benefits of a Limited Liability and at the same time, allows members to enjoy the flexibility of designing their internal structure just as a partnership. This can be done based on a mutual agreement. Having said this, it can be noted that the LLP often is a preferred option for small businesses.

On 4th of March, The Ministry of Corporate Affairs, Government of India, released an announcement regarding LLP Settlement Scheme in regards to all the stakeholders, regional directors and all registrars of companies. The announcement had some points that go as follows :

Need For LLP Settlement Scheme 2020

- The Government had noticed that some LLP’s have defaulted while filling the Form 3 viz. LLP Agreement and appropriate changes therein in LLP Agreement and Form-8- Statement of Account & Solvency (Annual or Interim) and Form-11 Annual Return of LLP. The LLPs are presently required to submit these forms within the given time and any delay would cost them a hundred rupees per day under Section 69 of the LLP Act in addition to the Normal Fees applicable.

- Regarding this, the Government received a large number of requests for the waiver of fee or condonation of delay and relaxations in additional fee on the basis of excessive financial burden.

- It has been noticed that many LLPs are not filling their statutory documents to the Registrar within the prescribed deadlines. Statutory documents include Form 3 (Information with regard to LLP agreement changes in LLP Agreement application) and Form 4 (Notice of Appointment of Partner/Designated Partner and his content) which are required to be filed along with the prescribed fee.

- This causes the delay in updating the records in the electronic registry and make them available to the stakeholders for inspections. By not filling the required documents on time, the LLP representatives and the partners are liable for criminal prosecution and they could not close the LLP until all the compliances are complete.

- As part of Government’s constant efforts to promote ease of doing business The Government is ready to offer one-time relaxation in fee for changing the status of defaulting LLP by filling pending documents and serve compliance.

Benefits of the LLP Settlement Scheme 2020

- Fee Payment : The defaulting LLPs can submit the belated documents in time on payment of 10 rupees per day for each form for any delay. Provided that the maximum fee shall not exceed 5000 rupees per document, Form or return.

- Time period for availing the Scheme shall be : From 16th March, 2020 to 13th June, 2020.

- Immunity from prosecution : Those LLPs which have submitted all the pending documents before 13th June, 2020 are not subjected to any prosecution by Registrar for such defaults.

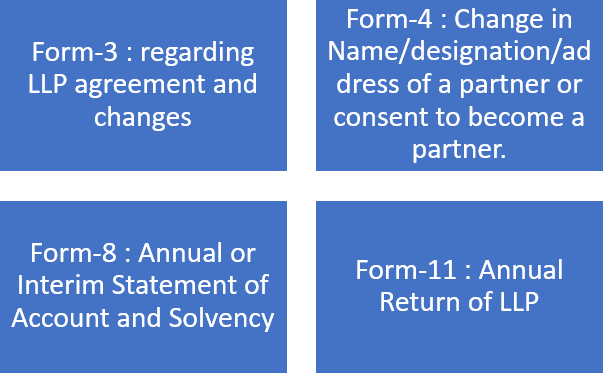

- The following forms can be filed under this scheme by payment of reduced penalty:

- Form-3- Information with regard to limited liability partnership agreement and changes, if any, made therein;

- Form-4- Notice of appointment, cessation, change in name/ address/ designation of a designated partner or partner and consent to become a partner/ designated partner;

- Form-8- Statement of Account & Solvency (Annual or Interim);

- Form-11- Annual Return of Limited Liability Partnership (LLP).

Definitions of the LLP Settlement Scheme 2020

Under the same, the Government is ready to exercise its power under the Companies Act, 2013 and release an “LLP Settlement Scheme, 2020” for allowing the one time condonation in delay fee.

Applicability of LLP Settlement Scheme 2020

Any registered LLP which has made a default in filing of documents which were due for filing till 31st October, 2019 shall avail this scheme.

Inapplicability of LLP Settlement Scheme 2020

This Scheme shall not apply to the filing of documents except the following documents:-

- Form-3- Information with regard to limited liability partnership agreement and changes, if any, made therein;

- Form-4- Notice of appointment, cessation, change in name/ address/ designation of a designated partner or partner and consent to become a partner/ designated partner;

- Form-8; Statement of Account & Solvency (Annual or Interim);

- Form-11- Annual Return of Limited Liability Partnership (LLP).

This Scheme shall not apply to LLPs which has made an application in Form 24 to the Registrar, for striking off its name from the register as per provisions of Rule 37(1) of the LLP Rules, 2009.

Conclusion

The Registrar has the power to take necessary action under the LLP Act against those who do not avail the scheme and are in default of filing the documents under the given provisions.

The following is the exact announcement made by the Ministry of Corporate Affairs :