The term Wholly Owned Subsidiary refers to a company whose shares or voting rights are completely owned by another (parent) company.

A Wholly Owned Subsidiary (WOS) is different from a subsidiary since the former implies that the parent company holds 100% of the entire shares or voting rights while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

Any foreign company can commence business or undertake investment by incorporating a Private Limited Company in India, the company would be known as a Wholly Owned Subsidiary. This is subject to the government’s regulations on FDI and in accordance with the other applicable provisions.

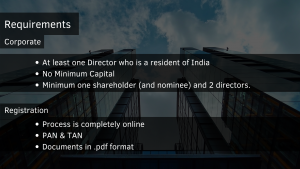

Requirements of Wholly Owned Subsidiaries

- At least one director who is a resident of India: The Wholly Owned Subsidiary company must have at least one Indian resident director on board, with the term resident implying that the individual director has resided an equivalent of or more than 182 days in the preceding year.

- No Minimum Capital: There is no minimum capital required to incorporate the company as per MCA guidelines.

- Minimum one shareholder (and nominee) and 2 directors: In accordance with the Companies Act, 2013 Section 3(1)(b), every company must have at least one shareholder, one nominee shareholder, and a minimum of two directors.

Important information regarding SPICe+ forms

- The process for filing the SPICe+ forms is completely online and the forms can be downloaded and then submitted using the Digital Signature of stakeholders

- The form requires PAN & TAN details

- Documents in PDF format may be required

How to form a Wholly Owned Subsidiary in India

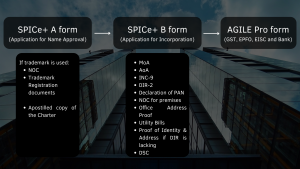

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

- The foreign company can choose to retain its original name for incorporating the subsidiary in India so as to carry forward its goodwill.

- It could add India as a suffix to denote its status.

- If the foreign company has a registered trademark elsewhere, it could use the trademark for the Incorporation of a Wholly Owned Subsidiary in India

- Or, it could go with a new name if it desires to.

Documents required for name reservation of wholly owned subsidiary in India

- If the company decides to use its trademark or original name while starting a business in India, then the company would need to provide NOC from the foreign company to use the same in the form of a Resolution.

- An Apostilled copy of the Charter of the Foreign Company translated into English.

- Such resolution shall be apostille in the foreign country.

- A copy of the trademark registration documents (if the company decides to use the trademark for its business in India)

Process of Name Approval

To initiate the process of Name Approval, the company has to first file the SPICe+ Part A (dedicated solely for name approval) and then SPICe+ Part B for incorporation.

Process of filing SPICe+ Part A for Name approval of wholly owned subsidiary

- Login to your account (or sign up) on the MCA website.

- Click on New Application.

- Fill in the required details such as:

- Type of Company (Section 8, Farmer Producer Company, One Person Company, Private Limited, etc.)

- Class of Company (Private, Public, etc.)

- Category of Company (Limited, Unlimited, etc.)

- Sub-category (Union Government, State Government, Subsidiary of Company incorporated outside India)

- Main Division of Industrial Activity

- Description of the main division

- The Proposed name (The name the company wants to reserve. Bear in mind that this must not violate any pre-existing provisions pertaining to the nomenclature of companies and must also not be a name previously in use or at the time of the company’s incorporation)

- Attach file. (NOC if required in the form of a .pdf)

- Click submit.

Incorporation of Wholly Owned Subsidiary – Part B of formation

Post approval of the name and for proceeding with the incorporation of the company (filing SPICe+ Part B), the applicant needs to have the following documents ready:

- Apostille or Notarized in country of origin copy of the Memorandum of Association (MoA)

- Apostille or Notarized in country of origin copy of the Articles of Association (AoA)

- Apostille or Notarized in country of origin copy of the INC-9 declaration by the first subscriber(s) and directors.

- Apostille or Notarized in country of origin copy of the DIR-2 declaration coupled with the Identity Proof and Proof of Address

- Apostille or Notarized in country of origin copy of the declaration from the foreign subscribers in respect of not possessing a PAN.

- NOC from the owner of the premises

- Proof of Office Address (Property Deed, Rent Agreement, Lease deed, etc.)

- Copy of utility bills (Telephone bills, Electricity bills, etc.)

- Apostille or Notarized in country of origin copy of the Proof of Identity and Proof of Address, if the director does not have a DIN.

- Digital Signature of at least one subscriber

- DIR-2 from any one resident director along with a self-attested copy of PAN and resident proof

Process of filing SPICe+ Part B for Incorporation of Company of wholly owned subsidiary

- Apostille or Notarized copy of the resolution of the foreign company stating information such as the name of the authorized representative of the company, the number of subscription shares, etc.

- Apostille or Notarized copy of the Identity Proof of the authorized representative if the person concerned is a non–resident of India (Non-resident here means if he or she has spent less than 182 days in the country in the year immediately preceding the current year).

- Apostille or Notarized copy of the Charter of the Foreign Company.

- The name of any one resident director (residing in India for a period of or more than 182 days in the immediately preceding year)

- Name of the nominee (of the shareholder)

AGILE Pro Form

After filing both Part A and Part B of the SPICe+ forms fill details in the AGILE Pro form:

- GST (Yes if a company wants to apply then fill in the required information)

- EPFO (Compulsory as it is required by the law)

- ESIC (Compulsory as it is required by the law)

- Bank Account (Compulsory to open a bank account)

INC-9 Form

It is a web-generated form and requires affixation by the directors and the shareholders. It will not be generated if any director or shareholder does not have both the DIN and PAN. Fill details for the INC-9 form:

Post incorporation Compliance

Once the company is incorporated as a WOS, the company has to compulsorily meet some formalities which form a part of post-incorporation compliance.

- The company has to receive the subscription money for its share capital from the foreign subscriber (parent company)

- File e-form 20A (Declaration of Commencement of Business)

- As per FDI Guidelines, the entity has to collect FIRC Certificate from the Bank

- Issuance of share certificate to its subscribers

- As per FDI guidelines, the company has to file FCGPR with RBI.

Summing Up

This is the last step in the way. Now download the SPICe+ Part A & Part B forms, the AGILE Pro form, and the INC-9 form and upload them on the MCA website and pay the required processing fees.

After processing, the Registrar of Companies shall scrutinize the documents following which the incorporation process will be complete. The process as mentioned above is quite clearly time-consuming and requires an expert to smoothen it up. Registration Arena is just the expert hub that can help you not only form a wholly-owned subsidiary but also file taxes, returns, and more.