Introduction

Under the GST, the Central Board of Indirect Taxes and Customs (CBIC) introduced the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme to assist small taxpayers with a turnover of less than Rs.5 crores. The QRMP scheme allows taxpayers to file GSTR-3B quarterly and pay tax monthly.

It allows the registered person (i.e., who is required to furnish Form GSTR-1 & GSTR-3B and has an aggregate turnover of up to Rs.5 crores) to furnish such return quarterly along with the monthly payment of tax by a simple challan in FORM GST PMT-06.

The Central Goods and Services Tax (‘CGST’) Act of 2017 empowers the government to notify a specific class of registered persons who must file a return for each quarter or part thereof in the manner prescribed in the CGST Rules, 2017.

According to the CGST Act, 2017, notified persons are required to pay the tax due to the government within such time as may be prescribed, taking into account particulars such as inward and outward supplies, input tax credit availed, and so on, during a month.

Benefits

- Compliances for taxpayers are reduced

- Taxpayers are required to file Only Four GSTR-3B returns instead of Twelve (12) GSTR-3B return in a year.

- Taxpayers will be required to file only Four GSTR-1 returns as Invoice Filing Facility (IFF) is provided under this scheme.

- Flexible Invoice Filing Feature

Eligibility

- The QRMP Scheme is open to any registered person who is required to file a GSTR-3B return

- Has an aggregate turnover of up to Rs.5 crore in the previous financial year.

(The aggregate annual turnover for the preceding financial year shall be calculated in the common portal using the information provided by the taxpayer in the returns for the tax periods in the previous financial year.)

- If the registered person’s aggregate turnover exceeds Rs.5 crore during any quarter of the current financial year, the registered person will be ineligible for the scheme beginning with the following quarter.

This scheme is optional and can be accessed using the GSTIN.

Opting QRPM Scheme

Taxpayers can opt out by going to

GST.GOV.IN > Services > Returns >

To opt in or out of the QRMP scheme, select the Quarterly Return option. The option to use the scheme will be available all year.

The person can opt-in for any quarter between the first day of the second month of the preceding quarter and the last day of the first month of the quarter for which they want to participate in the scheme.

There is no requirement to select the Scheme each quarter. When the Scheme is used, it is valid for future tax periods as well.

Once a registered person elects quarterly filing, he must continue to file his return every quarter for all future tax periods.

Details of Outward Supply with Invoice Furnishing Facility

Registered persons opting for the Scheme would be required to file Form GSTR-1 every quarter with the details of an outward supply.

However, the supplier has been given the option of providing the information on a monthly basis. The Invoice furnishing facility (‘IFF’), which is optional, has been introduced to provide details of invoices of supply made to registered persons for the first two months of the quarter.

Notably, the taxpayer can upload a maximum of Rs. 50 lakhs in invoices in each of the quarter’s two months. From the first day of the month until the 13th day of the following month, invoices can be uploaded in IFF either all at once or continuously.

The information uploaded in the IFF must be reflected in the recipient’s Form GSTR-2A and Form GSTR-2B

Quarterly Filing of Form GSTR-3B

Registered persons opting for the QRMP Scheme would be required to submit Form GSTR-3B on or before the 22nd or 24th day of the month following such a quarter for the Class A States[1] and Class B States[2], respectively, or such notified date, for each quarter.

Class A States – States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu, and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep.

Class B States- States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi

Any amount found to be paid in excess after filing the FORM GSTR-3B for that quarter may be claimed as a refund or used for any other purpose in subsequent quarters.

Monthly Payment of Tax

The registered person under the QRMP Scheme would be required to pay the tax owed in each of the first two months of the quarter by submitting Form GST PMT-06. The funds must be deposited by the 25th of the following month.

The amount deposited by the registered person in the first two months shall be debited solely to offset the liability disclosed in Form GSTR-3B for that quarter.

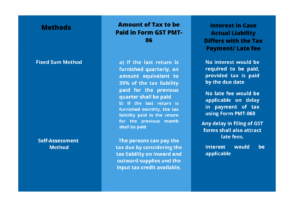

A facility for generating a pre-filled challan in Form GST PMT-06 would be made available on the portal. During the first two months, the individual may choose either of the two following options for making monthly tax payments

Self-Assessment Method

This is the method by which a taxpayer can pay the tax liability by taking into account the tax liability on inward and outward supplies as well as the available input tax credit. The taxpayer must manually calculate his or her tax liability for the month and pay it using form PMT-06. The taxpayer can use form GSTR-2B to calculate the amount of ITC available for the month.

There are some situations where no money is required to be deposited, such as–

For the first month of the quarter, if the balance in the electronic cash/credit ledger is sufficient to cover the tax liability for the month OR if the tax liability is zero.

For the second month of the quarter, the balance in the electronic cash/credit ledger must be sufficient to cover the cumulative tax liability for the first and second months of the quarter OR the tax liability is nil.

Note- A registered person will be ineligible for the aforementioned procedures unless he has filed the return for the entire tax period preceding such month. A complete tax period is one in which the individual is registered from the first to the last day of the tax period.

Drawbacks of QRMP

- If invoice uploading is postponed to the following month, registered buyers may lose their input tax credit for that month.

- The filing of monthly details would result in an increase in compliance costs.

- Opting for IFF would not be advantageous for registered persons with a low volume of B2B transactions.

- Although it states that no additional compliance burden is required, for many, it has indirectly become Monthly Compulsory compliance.

- The total value of invoices is limited to Rs.50 lakhs per month. There are times when there are no sales in one month and then there are sales of more than Rs.50 lacs in the next.

Registration Arena is the expert hub that helps in getting GST registration and filing returns under QRMP Scheme. For more details call us at 8600544411 / 8600544422.