One Person Company is a form of business entity that can be formed by a single person. It is like an alternative to proprietorship firms in which a single person can become both the director and member of the company. Also, it gives the advantages of a company form of business to small business owners who want to retain full control over their business. In this article, we will discuss and analyze everything about One Person Company from its meaning and features to its registration process and disadvantages.

Meaning of One Person Company

The Companies Act, 2013 introduced the concept of One Person Company (OPC) in India. According to Section 2(62) of the Act, One Person Company means a company that has only one person as its member. Therefore, there is a single member or shareholder in an OPC. The same person can become the director of the company as well.

An OPC is similar to a sole proprietorship as it also has a single owner only. On the other hand, an OPC has the features of a company like limited liability, perpetual succession, separate legal existence, etc. Therefore, an OPC is like a hybrid between a sole proprietorship and a company thereby offering advantages of both forms of business entity.

Before the introduction of the concept of OPC, small business owners had the only option of establishing a proprietorship firm. But now they can run their business in a legally recognized manner by forming an OPC.

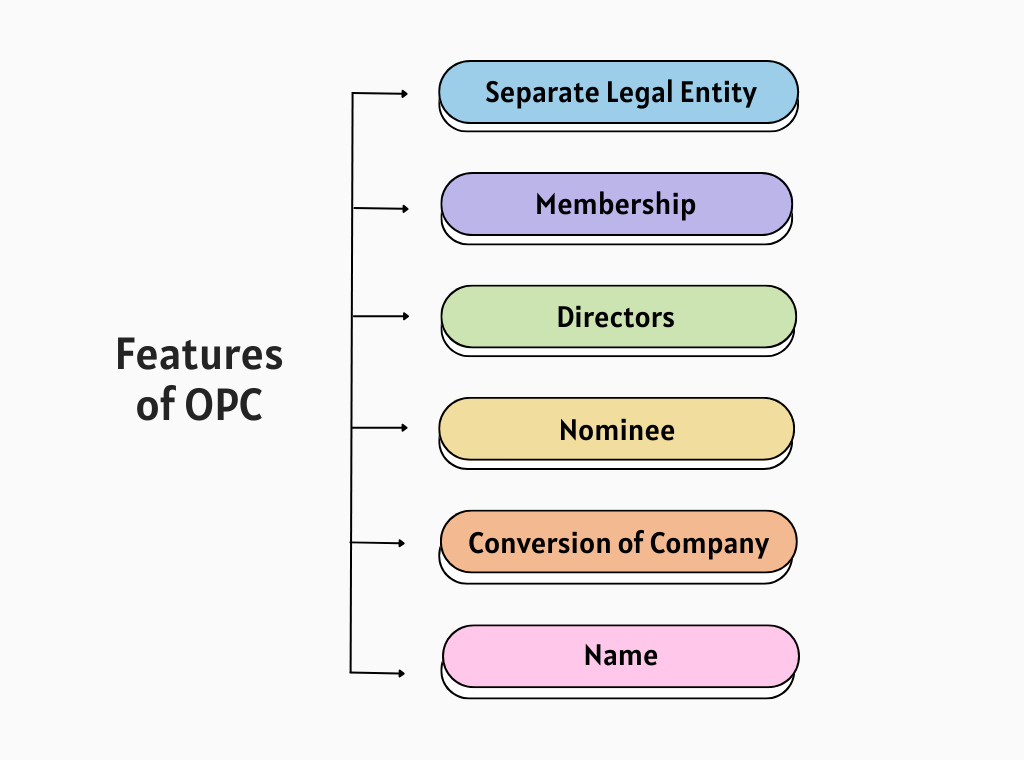

Features of One Person Company

The following are the features of a One Person Company.

Separate Legal Entity

Similar to a private and public limited company, one person company is also considered a separate legal entity, distinct from its member. This means the company is an artificial person that can enter into contracts on its own, purchase and hold property in its name, sue and be sued by other parties, etc.

Membership

A natural person who is a citizen of India can become a member of an OPC. He may or may not be a resident of India. Earlier, only residents in India were allowed to incorporate an OPC, but after the Companies (Incorporation) Second Amendment Rules, 2021 which came into effect from 01.04.2021, non-residents have also been allowed to become a member of an OPC.

In addition, one natural person can become a member of only one OPC. Moreover, a minor cannot form an OPC.

Directors

There shall be a minimum of 1 director in an OPC and a maximum there can be 15 directors. Further, the member of an OPC can also become its director.

Nominee

The sole member of an OPC must appoint his nominee. The nominee shall also be a natural person and an Indian citizen, whether resident of India or not. Further, a person can be appointed as a nominee in only one OPC and a minor cannot become a nominee.

Appointment of a nominee is done to ensure that he becomes the member and takes over the affairs of the OPC in case of death or incapacity of the sole member.

Conversion into other types of Companies

An OPC can be converted into other types of companies such as private company and public company by increasing the number of its directors and members. For conversion into a private limited company, the number of directors and members shall be increased to 2. While for conversion into a public limited company, the number of directors and members shall be increased to 3 and 7 respectively.

However, an OPC cannot convert itself into a Section 8 Company (a company formed for carrying on charitable activities).

Name

The name of a One Person Company shall contain the words ‘OPC’ in brackets. For example, Alpha (OPC) Private Limited. The words ‘Private Limited’ are also added as OPC functions as a private company only.

Documents Required for Formation of One Person Company

The following table shows the documents that are required for the formation of an OPC –

| S. No. | Particulars | Documents Required |

| 1 | Documents of Company |

|

| 2 | Documents of Member, Nominee and Directors |

|

One Person Company Registration Process

The Ministry of Corporate Affairs (MCA) registers and regulates companies in India. The following are the steps that are required to be followed for registration of a One-Person Company with MCA.

Step 1: Application for Name Approval

It is the first step in the registration of a company. Part-A of the SPICE+ form (form for company registration) is filed for name reservation on the MCA portal in which you have to provide two different names of the proposed company. MCA will approve one out of the two names.

Step 2: Application for DSC of Directors and Shareholders

The next step is to apply for obtaining a Digital Signature Certificate (DSC) of directors and shareholders (member) for digital signing of forms. DSC can be obtained from certifying authorities of the government for which identity proof of the person is required.

However, if the directors/shareholder already have DSC, then this step can be skipped.

Step 3: Collection and Preparation of Documents

After approval of the name and obtaining the DSC of directors and shareholder, all the above-mentioned documents of the company, directors, shareholder, and nominee shall be collected.

In addition, e-MOA and e-AOA can be attached to the SPICE+ form as there is only one shareholder in an OPC.

Step 4: Application for Registration

Once all the documents are collected and prepared, an application for incorporation of the company shall be filed in Part B of the SPICE+ form. Also, the Director Identification Number (DIN) of directors can be obtained through the SPICE+ form.

Further, all the documents and other linked forms shall be attached with the SPICE+ form, and payment of fees shall be made (fees depend on the authorized capital of the company).

Step 5: Issue of Certificate of Incorporation

If the registration form is complete in all aspects along with the required documents, the Certificate of Incorporation containing the Corporate Identification Number (CIN), PAN, TAN, and GSTIN (if applied for) of the company will be issued.

Note: Registration of a company in India requires certification from a Chartered Accountant/ Company Secretary/ Cost Accountant.

Looking for a reliable service provider to register your company? Your search ends here! Contact us and register your company easily.

Benefits of One Person Company

The following are the benefits of an OPC.

Ideal for Solo Entrepreneurs and Small Businesses

One Person Company is an ideal form of business entity for solo entrepreneurs, who want to retain complete ownership of the business while operating through a corporate form. Additionally, it is suitable for small businesses and provides them the advantages like easy formation, limited liability, lower compliance burden, etc.

Easy Formation

It is easy to form a One Person Company as the registration can be done completely online on the MCA portal with less paperwork. In addition, only 1 member and nominee are required for incorporation. Further, the sole member can also act as the director of the company.

Perpetual Succession

Similar to a private/ public limited company, there is perpetual succession in an OPC. It means the company continues to operate irrespective of the death or incapacity of its sole member. However, in the case of death or incapacity of the member of OPC, the nominee takes over the affairs of the company.

Limited Liability

The single member of the OPC has limited liability. His liability is limited up to the unpaid amount on shares held by him. It also implies that in the case of losses, creditors cannot recover their debt by selling the personal assets of the sole member.

No Minimum Paid-Up Share Capital Required

There is no requirement for minimum paid-up share capital for incorporation of an OPC. Earlier, an OPC needed to have a minimum paid-up share capital of Rs. 1 lakh, but this requirement has been removed by the Companies (Amendment) Act, 2015 dated 29.05.2015.

Appointment of Nominee

The sole member of an OPC shall mandatorily appoint his nominee in the company. The nominee takes the place of the sole member in case such member dies or becomes incapable to contract. This helps in avoiding any ownership-related dispute that may arise after the death or incapacity of the member.

Lower Compliance Burden

One Person Companies have been given several compliance-related relaxations and exemptions under the Companies Act, 2013, and the governing rules. This lowers the compliance burden of such companies. For example, OPCS doesn’t need to prepare a Cash Flow Statement.

Read More: Annual Compliance for One Person Company

Higher Flexibility

The sole member of the OPC has exclusive control over the company. He is not required to consult with anyone before making decisions. Therefore, the decision-making process in an OPC is quick and flexible.

Relaxations and Exemptions for OPC

The Companies Act, 2013, and the rules made thereunder provide the following compliance-related relaxations and exemptions to One Person Companies.

- Unlike other companies, OPCs are not required to conduct an Annual General Meeting (AGM).

- OPCs are required to conduct only 2 board meetings, one in each half of the calendar year. However, there shall be a minimum gap of 90 days between two such meetings.

- The financial statements and board report of an OPC can be signed by one director only.

- The annual return of an OPC (Form MGT 7A) shall be signed by the Company Secretary (CS) and if it is not required to appoint a CS, it can be signed by the director of the company. In other words, it need not be signed by a Practising CS.

- An OPC doesn’t need to include a Cash Flow Statement in its financial statements.

- An OPC is not required to appoint independent directors to its board.

- If there is only 1 director in an OPC, it is not required to comply with Secretarial Standard – 1 (Meeting of the Board of Directors). Further, Secretarial Standard – 2 (General Meetings) is also not applicable to an OPC.

Disadvantages of One Person Company

The following are the disadvantages of One Person Company.

Limited Access to Funds

An OPC can have only one member, therefore it cannot raise funds by way of issuing shares and Employee Stock Option Plans (ESOPs). Also, it cannot obtain funds from angel investors and venture capitalists. Therefore, One Person Companies have limited access to funds which in turn limits their growth and expansion opportunities.

Restriction on Certain Activities

An OPC cannot carry out Non-Banking Financial Investment Activities. It cannot invest in the securities of other companies. Also, a One Person Company cannot be converted into a Section 8 company. Such restrictions limit the scope of OPCs.

Suitable for Small Businesses Only

As a form of business entity, OPC is suitable for small businesses only as it can only have one member or shareholder. More shareholders cannot be added to raise additional capital. Also, the sole member generally acts as the director of the company as well, therefore there is no separation between ownership and management.

Higher Tax Liability

The profits of an OPC are taxed similarly to other companies, i.e., at a flat rate of 30%. This is because the company is considered an artificial person that is separate from its member. Therefore, the tax liability is higher in the case of an OPC as compared to a proprietorship firm whose profits are taxed as per slab rates applicable to individuals.

Other Restrictions

Several other restrictions are imposed in the case of an OPC that are likely to discourage a person from becoming a member of an OPC. For example, a person can become a member or nominee of 1 OPC only.

Conclusion

In conclusion, we can say that One Person Company is an ideal form of business entity for small business owners. They can retain full control over the business while operating through a legally registered business entity. However, its suitability depends on the nature and scale of business operations and therefore, one should carefully weigh its pros and cons before selecting it as a form of business entity. If you want to register Company in India, Contact us for easy incorporation.