Nidhi Company is a type of NBFC i.e., a Non-Banking Financial Company, engaged in the business of accepting deposits from members and providing loans to them. Although Nidhi Company is a type of NBFC, it is neither required to obtain a license from the Reserve Bank of India (RBI) nor follow the guidelines and directions issued by RBI. Instead, the Ministry of Corporate Affairs (MCA) regulates and formulates rules for Nidhi Companies in India. In this article, we will discuss the major rules governing Nidhi company relating to loans, deposits, opening and closing of branches, directors, etc.

Rules Governing Nidhi Company in India

Section 406 of the Companies Act, 2013 contains provisions relating to Nidhi companies in India. Further, Nidhi companies are regulated by Nidhi Rules, 2014. In the year 2022, MCA released a notification dated 19th April 2022 amending some rules relating to Nidhi Companies by introducing Nidhi (Amendment) Rules), 2022.

The following are the major rules governing Nidhi Companies in India.

Issue and Allotment of Shares by Nidhi Company

The following are the rules regarding the issue and allotment of shares by Nidhi Company.

- A Nidhi Company cannot issue preference shares.

- It shall issue fully paid-up equity shares only that have a minimum face value of Rs. 10.

- Nidhi Company cannot levy service charges for the issue of shares.

- The company shall allot a minimum of ten equity shares or equity shares of Rs. 100 to each deposit holder. In addition, a member shall hold a minimum 1 equity share of Rs. 10, whether he is a savings deposit or recurring deposit holder.

Membership in Nidhi Company

The following are the rules regarding membership in Nidhi Company.

- A Nidhi Company shall have at least 200 members at all times. Initially, it can be incorporated with 7 members, but it shall increase the number of members to 200 within 120 days of incorporation.

- Body Corporate or Trust cannot become a member of Nidhi Company.

- Minor cannot become a member of Nidhi Company but the legal or natural guardian of such minor can make a deposit with Nidhi Company in the name of minor.

- A member of a Nidhi Company cannot transfer more than 50% of his shareholding (as on the date of making a deposit or availing loan) if he has a loan or deposit with Nidhi Company.

Branches of Nidhi Company

The following are the rules regarding branches of Nidhi Company.

Meaning of Branch

A branch means a place other than the registered office of the Nidhi Company.

Opening of Branch

- A Nidhi Company can open a branch only if it earns net profit (after tax) during the 3 preceding financial years and files financial statements and annual returns regularly with the Registrar.

- The company can open 3 branches within the same district in which its registered office is situated. However, it cannot open any branch outside the state where its registered office is situated.

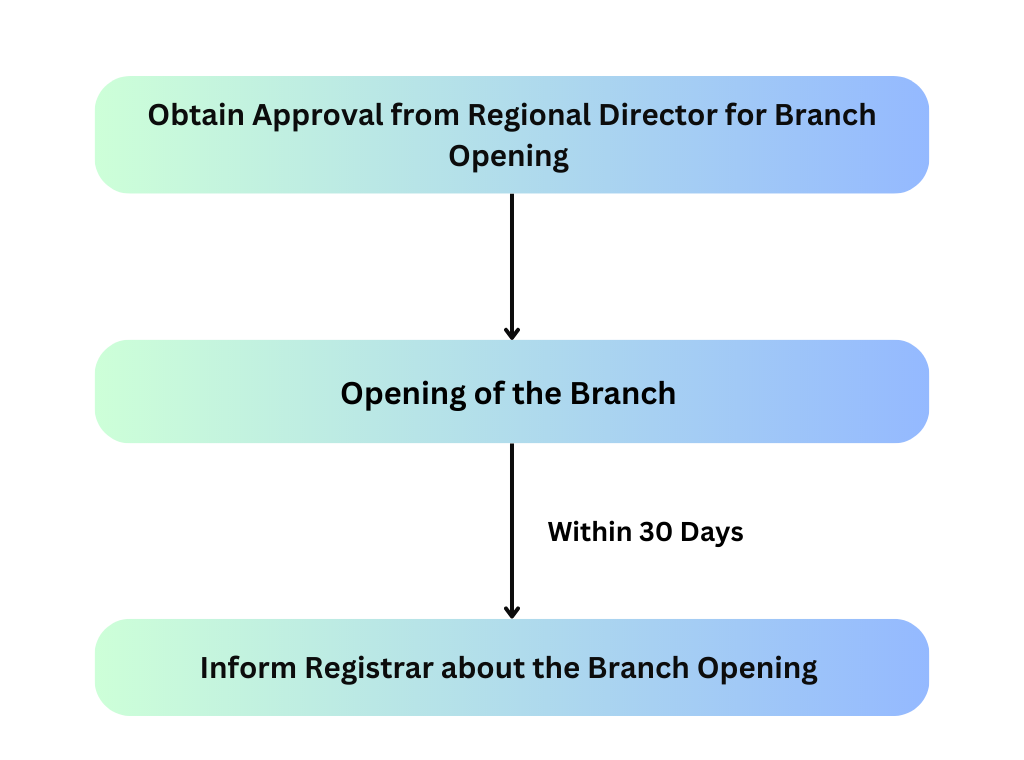

- For opening more than 3 branches within the same district or a branch outside the district, a Nidhi Company shall follow the below procedure –

Closing of Branch

- A Nidhi company can close any branch only when its Board of Directors approves the proposal. Furthermore, the Nidhi Company must obtain the approval of the Regional Director at least 60 days before closing the branch.

- After receiving approval from the Regional Director, the Nidhi company shall publish an advertisement in the newspaper at least 30 days before the branch closure. In addition, it shall display a copy of the advertisement on Nidhi’s notice board and the relevant branch for a minimum of thirty days from the date of publishing the advertisement.

- Further, the company shall inform the Registrar about the closing of the branch within thirty days of the closure.

Acceptance of Deposits by Nidhi Company

A Nidhi Company can accept deposits only up to 20 times its Net Owned Funds (as per the latest audited financial statements). Following are the rules regarding the acceptance of different types of deposits by Nidhi Company.

Fixed Deposits and Recurring Deposits

- A Nidhi Company shall accept fixed deposits for a minimum of 6 months and a maximum of 60 months. While recurring deposits shall be accepted for a minimum of 12 months and a maximum of 60 months.

- If the recurring deposit has a relation with a mortgage loan, the maximum period for which it can be accepted depends on the repayment period of such loan.

- The maximum rate of interest that a Nidhi Company can offer to its fixed deposit and recurring deposit holders depends on the maximum rate of interest prescribed by RBI which NBFCs can pay on deposits.

- Fixed deposit account or recurring deposit account can be foreclosed only if the following conditions are fulfilled –

- Nidhi Company must refrain from repaying the deposit for a minimum of 3 months from the date of its acceptance.

- If the deposit is repaid after 3 months on the request of the depositor, interest shall not be paid to the depositor for 6 months from the date of deposit;

- If the deposit is repaid before its expiry period, on the request of the depositor, the rate of interest shall be reduced by 2% from the original one.

- In the case of the death of the depositor, a Nidhi Company can make premature repayment of the deposit to the nominee or legal heir of such depositor along with the interest. Moreover, in the case of joint holding, the deposit shall be repaid to the surviving depositor(s).

Saving Deposits

The interest on savings deposit account shall not exceed 2% above the rate of interest payable on savings bank accounts by nationalized banks. In addition, the maximum balance in any savings deposit account qualifying for interest shall not exceed Rs. 1,00,000/- at any time.

Unencumbered Term Deposits

A Nidhi Company shall invest at least 10% of the outstanding deposits (as of the last working day of the second preceding month) as unencumbered term deposits in its own name, with a scheduled commercial bank* or post office.

However, the company can temporarily withdraw money from unencumbered term deposits for the purpose of repayment to depositors. It requires the prior approval of the Regional Director and fulfillment of the conditions as he may specify.

*Note – The amount cannot be invested with a cooperative bank or regional rural bank.

Grant of Loan by Nidhi Company

A Nidhi Company can provide loans to its members only. However, there are certain limits up to which it can provide such loans. Rule 15 of Nidhi Rules, 2014 specifies that the amount of loans that a Nidhi company can provide depends on the deposits it accepts from the members.

The following table shows the amount of loan that a Nidhi Company can grant based on the deposits it accepts from its members.

| S. No. | Total Deposits Accepted* | Limit on Grant of Loan |

| 1 | Less than Rs. 2 crores | Upto Rs. 2 lakhs |

| 2 | More than Rs. 2 crores but less than Rs. 20 crores | Upto Rs. 7.5 lakhs |

| 3 | More than Rs. 20 crores but less than Rs. 50 crores | Upto Rs. 12 lakhs |

| 4 | Rs. 50 crores or more | Upto Rs. 15 lakhs |

*as per the latest audited annual financial statements

If a Nidhi Company does not earn profit in the previous three consecutive financial years, it can grant loans only up to 50% of the above limits. In addition, if a member of a Nidhi Company takes a loan and commits a default in its repayment, the company cannot grant any further loan to him.

Moreover, if two or more persons hold share(s) in the company jointly i.e., joint shareholders, the loan is provided to the first named member in the Register of Members.

Collateral Against Loan

Collateral is the valuable asset or property that the borrower pledges with the lender for securing a loan or credit facility. A Nidhi Company can grant loans to its members only against collateral.

Following are the securities against which a Nidhi Company can grant loans –

| S. No. | Type of Security | Maximum Tenure of Loan |

| 1 | Gold, Silver, and Jewellery | 1 year |

| 2 | Immovable Property | 7 years |

| 3 | Fixed Deposit Receipts (FDR) | Up till the expiry of fixed deposits |

| 4 | National Saving Certificates (NSC), Insurance Policies, and Other Government Securities | Earlier of the maturity date of such securities or one year |

Rate of Interest on Loan

The following are the rules regarding the rate of interest on loans granted by a Nidhi Company.

- The maximum rate of interest on a loan can be 7.5% above the highest rate offered by the Nidhi Company on the deposit that it accepts.

- The rate of interest shall be calculated using the reducing balance method.

- The company should charge the same rate of interest on loans of the same class.

- All rates of interest shall be prominently displayed on the notice board, at the registered office and branch offices of a Nidhi Company.

Directors of Nidhi Company

The following are the rules regarding the directors of a Nidhi Company.

- Only a member of a Nidhi Company can become its director.

- The Director of a Nidhi Company shall hold office for up to a period of 10 consecutive years.

- A director becomes eligible for reappointment only on the expiry of 2 years after he ceases to be a director.

- If the tenure of a director is extended by the Central Government, then he shall continue to hold the office until the expiry of such extended tenure.

- To become a director of a Nidhi Company, a person shall have Director Identification Number (DIN) and he shall not be disqualified to become a director.

Dividend by Nidhi Company

A Nidhi Company can declare a maximum dividend of 25% in a financial year.

Penalty for Non-Compliance

If a Nidhi Company violates any provisions outlined in the rules, both the company and any officer in default shall be subject to a fine of up to five thousand rupees. If the contravention continues, an additional fine of up to five hundred rupees may be imposed for each day.

Also Read – Nidhi Company: Meaning, Benefits, Restrictions and Registration Process

Conclusion

In conclusion, understanding and adhering to the Nidhi Company Rules is of paramount importance for the successful and responsible operation of these financial entities. By complying with the prescribed regulations, Nidhi companies can foster trust and credibility among their stakeholders, thereby attracting more members and depositors.