It becomes necessary for business owners to have a bank account separate from their personal accounts to have better accountability and furthermore ensure that their personal finances are not mixed up with that of the business. In previous articles we have covered the list of documents required for GST registration and similarly, the list of documents required for IEC. In this article we describe the list of documents required for opening bank account for different entities.

Note that the documents required for opening a bank account differ from bank to bank

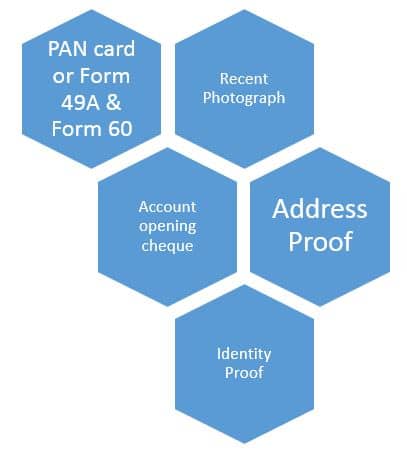

List of documents required for opening bank account – Individual Account for Business purpose

- PAN card/Form 49A along with Form 60 (if PAN has been applied for)

- Recent photograph in color

- An account opening cheque from an existing bank account

- Address Proof

- Identity Proof

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

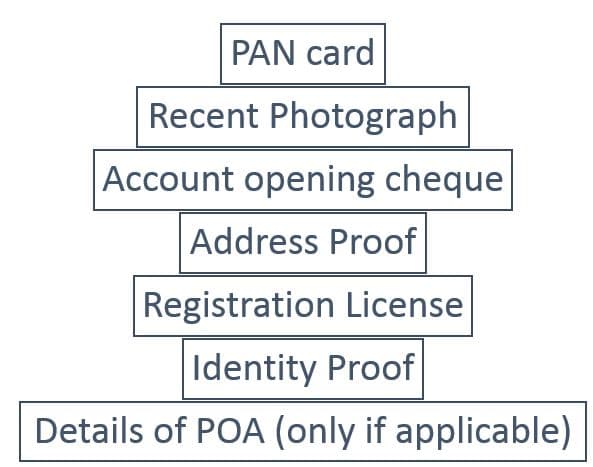

List of documents required for opening a bank account – Sole Proprietorship

- Passport size color photograph

- PAN card

- Identity Proof

- Address proof

- An account opening cheque from an existing bank account

- Registration/License – Shop & Establishment Act Registration / GST Registration Certificate / MSME Registration / Trade License

- If Power of Attorney (POA) has been granted by the proprietor the photo, identity and address proof of the POA holder has to be submitted as well.

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

The following documents can be produced as address proof:

- These documents can be produced as address proof only:

- Utility Bill (Telephone, Electricity, Postpaid mobile phone, Gas or Water Bill). The produced utility bill should not be more than 2 months old

- Property or Municipal Tax receipt. The produced tax receipt should not be more than one calendar year from the date of issuance

- Statement from a bank account or post office savings bank account for the period of three calendar months preceding 4 months along with the Account Opening Cheque

- Identity card (ID card) with the applicant’s Photograph. This card must be issued by Central or State Government Departments, Statutory or Regulatory Authorities, Public Sector Undertakings (PSUs), Scheduled Commercial Banks, and Public Financial Institutions Or Letter issued by gazetted officer, along with a duly attested photograph of the person

Note: a) Letter or card issued to permanent employees only of above entities, b) Applicable for employees, directors or official nominated as authorized signatories or directors etc. working or employed for the same organization

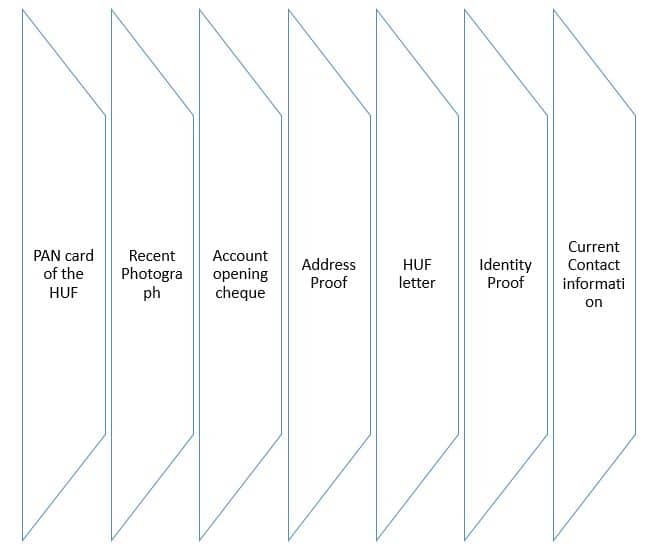

List of documents required for opening a bank account – Hindu Undivided Family/Joint Hindu Family Business

- Passport size photo of the Karta and the authorized signatory

- Identity proof of the Karta and the authorized signatories

- Address proof of the Karta and the authorized signatories

- Current contact information (email, mobile no., landline)

- HUF letter

- PAN card of the HUF

- An account opening cheque from an existing bank account

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

The following documents can be produced as address proof:

- Utility Bill (Telephone, Electricity, Postpaid mobile phone, Gas or Water Bill). The produced utility bill should not be more than 2 months old

- Property or Municipal Tax receipt. The produced tax receipt should not be more than one calendar year from the date of issuance

- Statement from a bank account or post office savings bank account for the period of three calendar months preceding 4 months along with the Account Opening Cheque

- Identity card (ID card) with the applicant’s Photograph. This card must be issued by Central or State Government Departments, Statutory or Regulatory Authorities, Public Sector Undertakings (PSUs), Scheduled Commercial Banks, and Public Financial Institutions Or Letter issued by gazetted officer, along with a duly attested photograph of the person

Note: a) Letter or card issued to permanent employees only of above entities, b) Applicable for employees, directors or official nominated as authorized signatories or directors etc. working or employed for the same organization

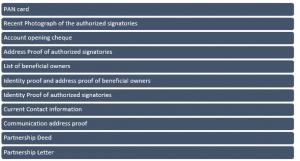

List of documents required for opening a bank account – Partnership

- Passport size photo of the authorized signatories of the account

- Identity proof of the authorized signatories

- Address proof of the authorized signatories

- List of beneficial owners holding more than 15% in the firm (on letterhead).

- Identity and address proof of the beneficial owners identified above.

- Communication address proof of the entity

- Current contact information (email, mobile no., landline) of the entity

- PAN card of the entity

- Partnership Deed

- Partnership Letter

- An account opening cheque from an existing bank account

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

The following documents can be produced as address proof:

- Utility Bill (Telephone, Electricity, Postpaid mobile phone, Gas or Water Bill). The produced utility bill should not be more than 2 months old

- Property or Municipal Tax receipt. The produced tax receipt should not be more than one calendar year from the date of issuance

- Statement from a bank account or post office savings bank account for the period of three calendar months preceding 4 months along with the Account Opening Cheque

- Identity card (ID card) with the applicant’s Photograph. This card must be issued by Central or State Government Departments, Statutory or Regulatory Authorities, Public Sector Undertakings (PSUs), Scheduled Commercial Banks, and Public Financial Institutions Or Letter issued by gazetted officer, along with a duly attested photograph of the person

Note: a) Letter or card issued to permanent employees only of above entities, b) Applicable for employees, directors or official nominated as authorized signatories or directors etc. working or employed for the same organization

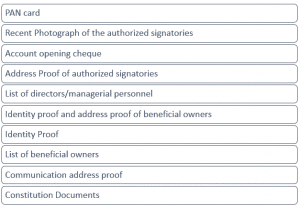

Documents required for opening a bank account – One Person/Private/Public Company

- Incorporation or Registration Certificate

- Memorandum of Association (MoA) and Articles of Association (AoA).

- Board Resolution

- Updated list of the directors of the company

- Proof of Communication address of the entity, if it is different from the address that is mentioned on its Certificate of registration/ incorporation

- Current landline/mobile number and e-mail ID of the entity.

- Permanent Account Number (PAN) of the entity.

- Recent passport sized color photograph of each of the authorized signatories.

- A copy of one valid photo identification document and proof of address of each of the authorised signatories

- Shareholding pattern/ list of beneficial owners holding more than 25% in the company either directly or indirectly (on letterhead).

- Permanent Account Number (PAN) or identity proof of the beneficial owners.

- Address proof of such beneficial owners.

- Identity proof and address proof of the Senior Managing Official if the ultimate natural person is not identified as the beneficial owner.

- An account opening cheque from an existing bank account

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

The following documents can be produced as address proof:

- Utility Bill (Telephone, Electricity, Postpaid mobile phone, Gas or Water Bill). The produced utility bill should not be more than 2 months old

- Property or Municipal Tax receipt. The produced tax receipt should not be more than one calendar year from the date of issuance

- Statement from a bank account or post office savings bank account for the period of three calendar months preceding 4 months along with the Account Opening Cheque

- Identity card (ID card) with the applicant’s Photograph. This card must be issued by Central or State Government Departments, Statutory or Regulatory Authorities, Public Sector Undertakings (PSUs), Scheduled Commercial Banks, and Public Financial Institutions Or Letter issued by gazetted officer, along with a duly attested photograph of the person

Note: a) Letter or card issued to permanent employees only of above entities, b) Applicable for employees, directors or official nominated as authorized signatories or directors etc. working or employed for the same organization

Documents required for opening a bank account – Trust/Registered Society

Constitution document of the entity (as applicable).

- The Trust Deed in case of public or private trust.

- Bye-laws in the case of society/association/ club

- Memorandum of Association or Article of Association in the case of Sec 8 companies

- Rules of acts or Gazette notifications if the entity is a Govt., Quasi-Govt. or Semi –Govt., entity. or entities established under Act

The list of directors /Members of the Managing committee / the Managing Council.

A copy of the proof of identity of the entity (as applicable)

- Registration Certificate issued by the Registrar of Companies if the entity is a society.

- Registration Certificate issued by the charity commissioner if the entity is a trust or societies engaged in charitable work

- Certificate of Incorporation issued by Registrar of Companies in case of companies.

- Recognition certificate in the case of educational institutions.

PAN card or proof of exemption from income tax (if applicable).

Proof of communication address of the entity.

Recent color passport sized photograph of each of the existing authorised signatories.

A copy of one valid photo identification document and address proof document of each of the existing authorised signatories

A List of beneficial owners who hold more than 15% in the Trust. (Directly or Indirectly)(on letterhead)

Permanent Account Number (PAN) / Identity proof of beneficial owners.

Address proof of beneficial owners.

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

The following documents can be produced as address proof:

- Utility Bill (Telephone, Electricity, Postpaid mobile phone, Gas or Water Bill). The produced utility bill should not be more than 2 months old

- Property or Municipal Tax receipt. The produced tax receipt should not be more than one calendar year from the date of issuance

- Statement from a bank account or post office savings bank account for the period of three calendar months preceding 4 months along with the Account Opening Cheque

- Identity card (ID card) with the applicant’s Photograph. This card must be issued by Central or State Government Departments, Statutory or Regulatory Authorities, Public Sector Undertakings (PSUs), Scheduled Commercial Banks, and Public Financial Institutions Or Letter issued by gazetted officer, along with a duly attested photograph of the person

Note: a) Letter or card issued to permanent employees only of above entities, b) Applicable for employees, directors or official nominated as authorized signatories or directors etc. working or employed for the same organization

Documents required for opening a bank account – LLP

- Registration Certificate issued by the Registrar of LLP.

- Proof of Communication address of the entity. It is applicable only if it is different from the address mentioned on the Registration Certificate.

- Communication details:- Current landline or mobile number and e-mail ID of the entity.

- Permanent Account Number (PAN) of the entity.

- Recent passport size color photograph of each of the authorised signatories.

- A copy of one valid photo identification document and address proof of each of the authorised signatories.

- If Power of Attorney (POA) has been granted for account operations, then the POA holder’s photograph, and identity and address proof has to be submitted along with the POA agreement.

- Shareholding pattern or the list of beneficial owners holding more than 15% in the company either directly or indirectly (on letterhead).

- PAN or identity proof of the beneficial owners.

- Address proof of the beneficial owners.

- LLP deed agreement.

- LLP Letter

- Updated list of designated partners.

- An account opening cheque from an existing bank account

The following documents can be produced as proof of Identity, Address, Relationship and Age.

- Valid passport with photograph & signature.

- Driving License issued by the applicable regional transport authority

- Voter ID or Electoral Photo Identity Card.

- Job card which is issued by NREGA and signed by an officer of the State Government.

- Aadhaar letter card issued by UIDAI.

The following documents can be produced as address proof:

- Utility Bill (Telephone, Electricity, Postpaid mobile phone, Gas or Water Bill). The produced utility bill should not be more than 2 months old

- Property or Municipal Tax receipt. The produced tax receipt should not be more than one calendar year from the date of issuance

- Statement from a bank account or post office savings bank account for the period of three calendar months preceding 4 months along with the Account Opening Cheque

- Identity card (ID card) with the applicant’s Photograph. This card must be issued by Central or State Government Departments, Statutory or Regulatory Authorities, Public Sector Undertakings (PSUs), Scheduled Commercial Banks, and Public Financial Institutions Or Letter issued by gazetted officer, along with a duly attested photograph of the person

Note: a) Letter or card issued to permanent employees only of above entities, b) Applicable for employees, directors or official nominated as authorized signatories or directors etc. working or employed for the same organization

Conclusion

A bank account is a must for every business be it a small retail business or a conglomerate. However with all the things that the business owners have to take care of, the hassle of opening a bank account seems to add to their burden. We here at Registration Arena work to minimize the hassle by helping business owners incorporate their Company, Partnership or LLP and get on with their business in as little a time as possible. We even help businesses obtain PAN/TAN card, GST number and tax filing. Reach out to us for any help concerning your business.