The Import Export Code (IEC) is an important document. It is a necessity for people who undertake the business of import and export. In an earlier article, we explained the documents required for obtaining IEC. In this article, we cover the list of documents required for IEC modification.

The documents required for IEC modifications are different for every business structure. The headings below feature the business structure and under those headings we cover the changes and the corresponding documents. Bear in mind that only those documents are to be filed that correspond to the change required. For e.g. if the PAN details have changed, then only a copy of the modified PAN will be needed. Other documents pertaining to the other changes are not required.

Note that the PAN number once issued for any person/entity remains the same throughout the life of the concerned. It never changes. If the PAN card is lost/damaged, the concerned can file for a duplicate PAN card and NOT a new PAN. Possessing more than one PAN number is illegal. However, you may have more than one PAN card but not two different PAN numbers. The details on the PAN such as Date of Birth, Address, father’s name, etc. may be changed if there is a correction required.

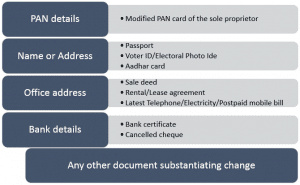

A. Documents required for IEC modification – Proprietorship

If PAN details have been altered, produce a copy of:

- Modified PAN card of the Sole Proprietor

If Name or Address of Proprietor has changed, produce a copy of (any one):

- Passport (first and last page)

- Voter ID/ Electoral Identity Card

- Aadhar card

If Office address is changed:

- Sale deed (if new business premises are self-owned)

- Rental/Lease agreement (if office is rented/lease)

- Latest Telephone/Electricity/Postpaid Mobile Bill

If bank details are changed:

- Bank Certificate as per ANF2A(1)

- Cancelled cheque (it must bear the pre-printed name of applicant and A/c no.)

Any statutory document which substantiates any other change in IEC

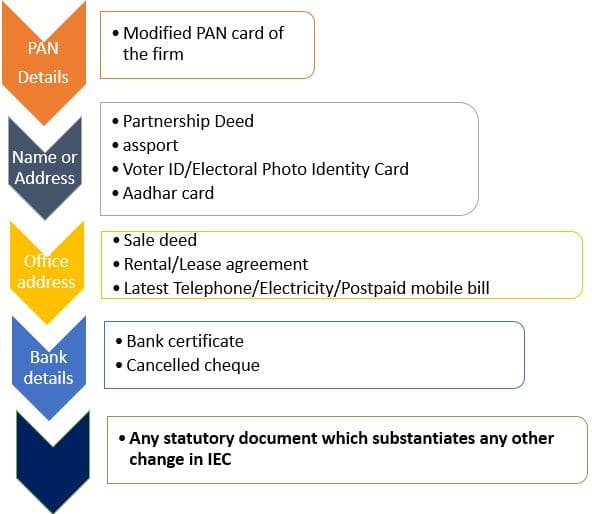

B. Documents required for IEC modification – Partnership Firm

If name is changed in the PAN card, produce a copy of:

- Modified PAN card of the firm

Changes pertaining to a partner, produce a copy of (any one):

- Partnership Deed

- Updated Passport (first and last page) of the Managing Partner

- Voter ID/ Electoral Identity Card

- Aadhar card

If Office address is changed:

- Sale deed (if new business premises are self-owned)

- Rental/Lease agreement (if office is rented/lease)

- Latest Telephone/Electricity/Postpaid Mobile Bill

If bank details are changed:

- Bank Certificate as per ANF2A(1)

- Cancelled cheque (it must bear the pre-printed name of applicant and A/c no.)

Any statutory document which substantiates any other change in IEC

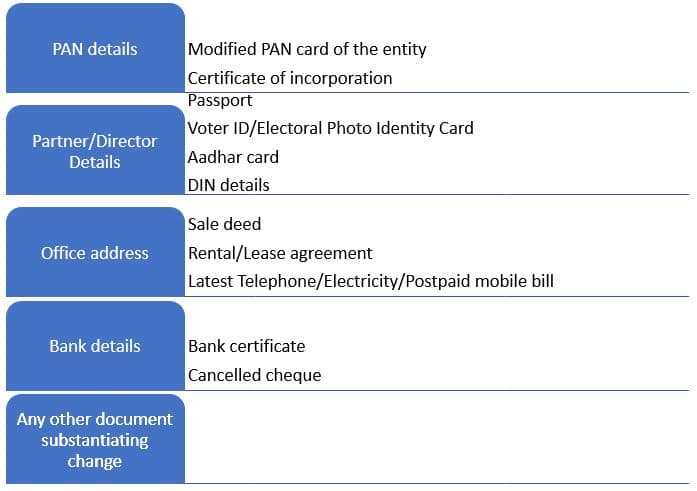

C. Documents required for IEC modification – LLP Firm/Government Undertaking/Public Limited Company/Private Limited Company/Section 8 Company/OPC

If PAN details have been altered, produce a copy of:

- Modified PAN card of the entity

- Certificate of Incorporation issued/modified by the Registrar of Companies

Change pertaining to Designated partner/director, produce a copy of (any one) concerned partner/director’s:

- Passport (first and last page)

- Voter ID/ Electoral Identity Card

- Aadhar card

- DIN details as in the MCA website

If Office address is changed:

- Sale deed (if new business premises are self-owned)

- Rental/Lease agreement (if office is rented/lease)

- Latest Telephone/Electricity/Postpaid Mobile Bill

If bank details are changed:

- Bank Certificate as per ANF2A(1)

- Cancelled cheque (it must bear the pre-printed name of applicant and A/c no.)

Any statutory document which substantiates any other change in IEC

D. Documents required for IEC modification – Registered Society/Trust

If PAN details have been altered, produce a copy of:

Modified PAN card of the entity

Change pertaining to Secretary or Chief Executive/Managing Trustee, produce a copy of the concerned person’s (any one):

- Passport (first and last page)

- Voter ID/ Electoral Identity Card

- Aadhar card

If Office address is changed:

- Sale deed (if new business premises are self-owned)

- Rental/Lease agreement (if office is rented/lease)

- Latest Telephone/Electricity/Postpaid Mobile Bill

If bank details are changed:

- Bank Certificate as per ANF2A(1)

- Cancelled cheque (it must bear the pre-printed name of applicant and A/c no.)

Any statutory document which substantiates any other change in IEC

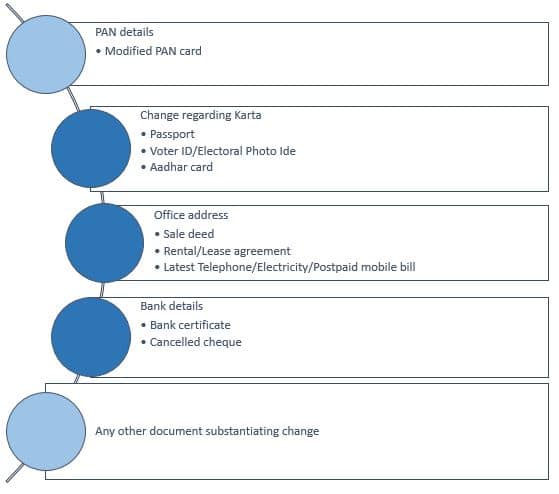

E. Documents required for IEC modification – Hindu Undivided Family/Joint Hindu Family Business

If PAN details have been altered, produce a copy of:

- Modified PAN card of the HUF

If Karta has changed, produce a copy of the new Karta’s (any one):

- Passport (first and last page)

- Voter ID/ Electoral Identity Card

- Aadhar card

If Office address is changed:

- Sale deed (if new business premises are self-owned)

- Rental/Lease agreement (if office is rented/lease)

- Latest Telephone/Electricity/Postpaid Mobile Bill

If bank details are changed:

- Bank Certificate as per ANF2A(1)

- Cancelled cheque (it must bear the pre-printed name of applicant and A/c no.)

Any statutory document which substantiates any other change in IEC

Conclusion

We have emphasized the importance of the IEC several times in the article. It is a crucial document for any business engaged in the import export business. It is only fair that we let our readers know its significance. Moreover, the modifications pertaining to the IEC must be taken care of as soon as they occur. If you find the process of modification or obtaining IEC difficult, reach out to us at Registration Arena. We help you file the mentioned list of documents required for IEC modification. We streamline the process and make it easy for you to file for IEC or IEC modifications.