In India, several laws contain provisions regarding different types of audits such as the Companies Act, 2013 provides for statutory audits, the Central Goods and Services Tax Act, 2017 provides for turnover-based audits, etc. Similarly, Section 44AB of the Income Tax Act, 1961 contains provisions regarding tax audits of certain taxpayers. In this article, we will discuss the objectives and applicability of income tax audits on taxpayers in India.

First, let us understand the meaning of tax audit.

What is a Tax Audit?

A tax audit is an independent examination of books of accounts of a business or profession carried out by a taxpayer. It is done to check whether the books have been prepared as per the provisions of the Income Tax Act,1961, or not. In addition, it helps in computing the correct income of the taxpayer.

A tax audit shall be done by a Practising Chartered Accountant.

What are the Objectives of a Tax Audit?

A tax audit serves several purposes. The following are the main objectives of a Tax Audit –

Proper Maintenance of Books of Accounts

Tax audit helps in ensuring that the books of accounts of an entity are maintained properly and correctly. In addition, they are certified by an auditor.

Reporting of Discrepancies

After verification and inspection of books of accounts, the auditor expresses his opinion and observations in the audit report. Therefore, it helps in reporting discrepancies.

Computation of Income

If books of accounts are maintained properly, it helps in computing the correct income of the taxpayer. In addition, it helps in claiming the deductions thereby reducing the tax liability of the taxpayer.

Assurance to Stakeholders

Tax audit gives assurance to the stakeholders of the business like investors, customers, suppliers, etc. that financial statements present a true and fair view of the financial position of the business.

Applicability of Income Tax Audit in India

In India, an Income tax audit is mandatory for certain taxpayers. Section 44AB of the Income Tax Act, 1961 contains provisions regarding the audit of accounts of certain persons who are either carrying on a business or a profession.

The following table shows different categories of taxpayers who are mandatorily subject to tax audits –

In the case of Business

| Category of Person | Situations in which audit is mandatory |

| Carrying on business but does not opt for presumptive taxation scheme | If the sales/ turnover/ gross receipts exceed Rs. 1 crore in a previous year. Note: If cash transactions are up to 5% of gross receipts or payments, then an audit is required only if the turnover exceeds Rs. 10 crores. |

| Carrying on business and is eligible for presumptive taxation scheme under Section 44AE/ 44BB/ 44BBB | If he claims a lower income as compared to the profit and gains computed as per Section 44AE/ 44BB/ 44BBB. |

| Carrying on business and is eligible for presumptive taxation scheme under Section 44AD | 1) If he claims a lower income as compared to the profit and gains computed as per Section 44AD; and 2) If his income exceeds the maximum amount not chargeable to tax. |

| Carrying on business but is not eligible for presumptive taxation scheme under Section 44AD as he fails to use the same scheme continuously for 5 years once after opting for the same | If the income exceeds the maximum amount not chargeable to tax in the subsequent 5 years from the financial year in which the presumptive taxation scheme has not opted |

| Carrying on business and declaring profit as per Section 44AD | An audit is not mandatory if the sales/ turnover/ gross receipts do not exceed Rs. 2 crores in a previous year. |

In the case of the Profession

| Category of Person | Situations in which audit is mandatory |

| Carrying on Profession | If the gross receipts exceed Rs. 50 lakhs in a previous year |

| Carrying on Profession and is eligible for presumptive taxation scheme under Section 44ADA | 1) If he claims a lower income as compared to the profit and gains computed as per Section 44ADA; and 2) If his income exceeds the maximum amount not chargeable to tax. |

If the Accounts of a Person are required to be audited under any other law, is Income-Tax Audit Still Required?

If any other law requires auditing of a person’s accounts, then an Income tax audit is not necessary. In that case, Section 44AB of the Income Tax Act, 1961 is deemed to be complied if –

- We audit the accounts as per the other law and

- Submit a report to the Income Tax authorities in the prescribed form on or before the due date of filing the Income tax audit report.

For example, in the case of a company, a statutory audit is mandatory as per the Companies Act, 2013. Therefore, a company is not required to undergo an Income tax audit separately even if its turnover exceeds the threshold.

Read More: Post-incorporation of Private Limited Company

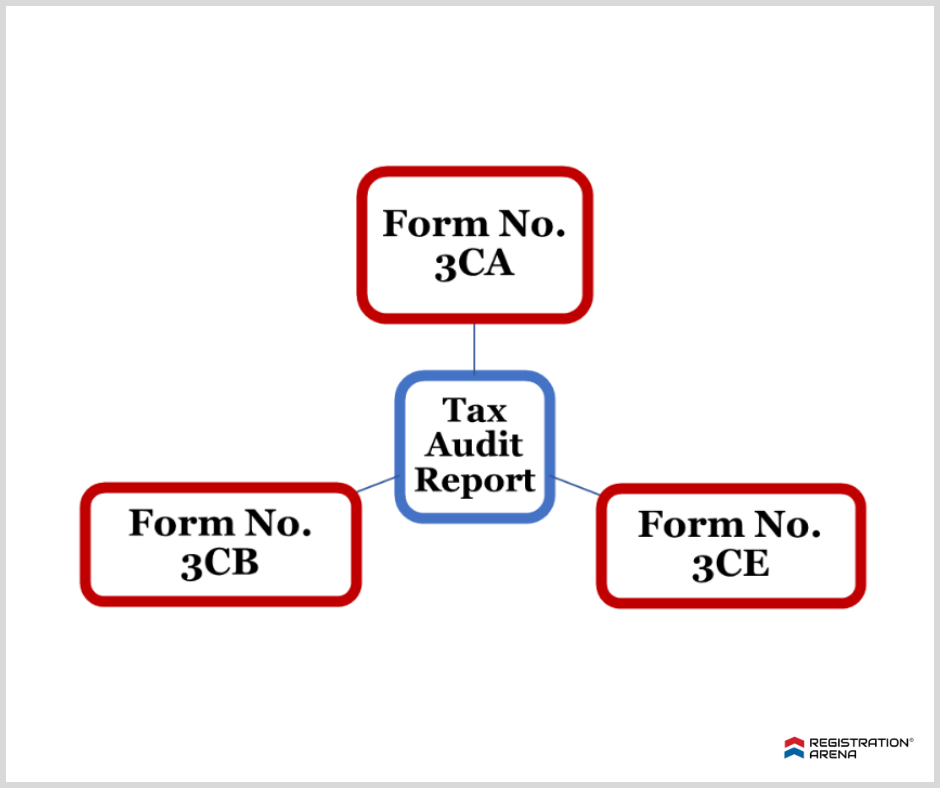

In which Form Tax Audit Report shall be furnished?

A tax auditor shall furnish his report in either of the following forms –

Form No. 3CA – When accounts of the person carrying on a business or a profession are required to be audited under any other law.

Form No. 3CB – When accounts of the person carrying on a business or a profession are not required to be audited under any other law.

Form No. 3CE – Audit report in respect of non-residents (other than a company) and foreign companies –

- carrying on a business or a profession in India; and

- receiving royalty or fees for technical services from the Indian Government or an Indian Concern.

Note: Form No. 3CD with Form No. 3CA and Form No. 3CB containing the statement of prescribed particulars.

What is the Due Date for furnishing a Tax Audit Report?

If a tax audit is mandatory for a person carrying on a business or a profession, then he shall obtain such a report from a tax auditor and furnish it on or before 30th September of the assessment year.

Don’t wait for the last date! Connect with our experts and file your returns well before time.

Penalty in case of Failure to get Accounts Audit or Non-Filing of Tax Audit Report

If a person carrying on a business or a profession fails to get their account audit or file the tax audit report before the due date, the Assessing Officer may levy the following penalty as it is mandatory to undergo a tax audit.

- 0.5% of the total turnover/sales/gross receipts in case of business or gross receipts in case of a profession in a previous year; or

- Rs. 1, 50,000, whichever is less.

Conclusion

All persons don’t need to get their account audited as per Income Tax laws. However, there are several benefits of income tax audit and if it is applicable, one should file the audit report on time to avoid penalty. However, Registration Arena has a professional team who can assist you in filing tax audit reports for your business on time.

Call us now at +918600544411/22 or also drop an email at sales@registrationarena.com for more information.