The authorised capital of a company is the maximum amount of share capital that the company is authorized by its constitutional documents to issue (allocate) to shareholders. Part of the authorized capital can (and frequently does) remain unissued. The authorized capital can be changed with shareholders’ approval. The part of the authorized capital which has been issued to shareholders is referred to as the issued share capital of the company.

The device of the authorized capital is used to limit or control the ability of the directors to issue or allot new shares, which may have consequences in the control of a company or otherwise alter the balance of control between shareholders. Such an issue of shares to new shareholders may also shift the profit distribution balance, for example if new shares are issued at face value and not at market value.

Why to Increase Authorised Capital: Generally, the companies are registered with a small authorised capital and they increase it as per the requirements or conditions imposed by the lender/investors, customers (particularly the government companies and large corporates where the capital and net worth of the suppliers are prescribed and when the company wants to issue the bonus shares). The Companies Act 2013 allows the companies to alter its authorised share capital with certain procedures which are governed by Section 61-64 of the Act along with Section 13 and 14 of the act which governs the alterations to the Chartered Documents being the Memorandum of Association and Articles of Association of the company.

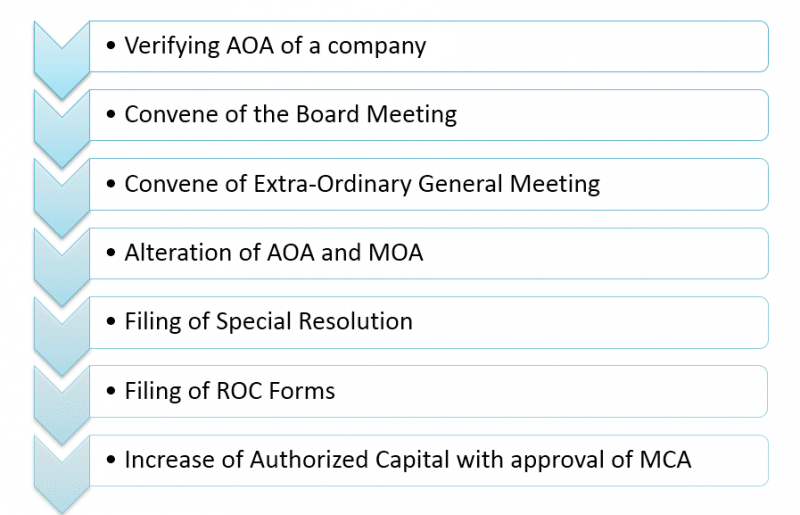

PROCEDURE FOR INCREASING AUTHORISED CAPITAL:

- Verifying AOA of the Company: Firstly, go through the Articles of Association (AOA) of the company to verify if the required power is there to increase the authorised share capital of the company. If in case such authority is not provided in the Articles of Association, then the provisions in AOA should be amended to include provisions authorising the company to increase its share capital. Such amendment could be done by passing of Special Resolution at the Extra Ordinary General Meeting of the members.

- Convene of the Board Meeting: In the next step, the notice of Board Meeting should be issued to the members, seven days prior of the commencement. In the board meeting, decide about the increase of capital and fix the date, time, place and agenda for convening a General Meeting for passing of the Ordinary Resolution or Special Resolution. Generally, an EGM is called in regard to increase the share capital business and look after the consent of the members.

- Convene of an Extra-Ordinary General Meeting: After the notice, the extraordinary General meeting is convened and the members vote in favour or against increasing the authorised share capital of the company and it is during in this meeting the alteration of memorandum of association or/and Articles of Association takes place. After holding the extraordinary General meeting, the Members/Shareholders of the company pass an ordinary or special resolution, as the case may be.

- Alteration of AOA and MOA: A limited company having a share capital may, if so authorised by its articles, alter its memorandum of Association (MOA) or Articles of Association (AOA) in its general meeting to increase its authorised share capital. A company can increase its authorised share capital by altering the memorandum of association.

- Filing of Special Resolution: A company may, by a special resolution, alter the provisions of its memorandum (Clause V of the memorandum of association) and Articles of Association has to be altered.

Form MGT-14 is required to be filed in case of special resolution passed for the alteration of the AoA.

AMMENDMENT EXAMPLE IN CLAUSE V: The Authorized Share Capital of the company is Rs.1, 00,000/-, divided into 10,000 Equity Shares of Rs.10/- each. The minimum paid up share capital of the company is Rs. 1,00,000/-’

- Filing of ROC Forms: A notice has to be given to the registrar within a period of 30 days of such alteration along with an altered memorandum. Forms to file with the ROC are E-Form SH-7 and E-Form MGT-14 (only if required.)

Filing E-Form SH-7: In case, a company alters its share capital/number of members independently or increases the share capital by conversion of debentures/loans due to order of Central Government, then a return shall be filed with the registrar within 30 days of such alteration or increase. The return shall also be filed where the company redeems any redeemable preference shares. Stamp duty can be paid electronically through the MCA portal and the following documents are to be attached:

- Notice of extra ordinary general meeting

- Certified true copy of ordinary resolution

- Altered Memorandum of association

- Altered Articles of association, if any.

Filing E-Form MGT-14: A copy of resolution which has an effect of altering the articles and copy of every agreement shall be embodied in or annexed to every copy of the articles issued after passing of the resolution or making of the agreement.

The changed status of authorised capital of the Company can be checked at MCA site.

Documents Required:

- Certified true copy of resolution along with copy of explanatory statement under Section 102

- Altered memorandum of association (Mandatory in case any change in MOA).

- Altered articles of association

Time Limit for Filing the Forms with ROC: A company has to file with the concerned ROC certain Resolutions and agreements. These are filed after passing the resolution at the meeting. The particulars of such resolutions are to be filed along with this form. The e- form has to be filed with ROC within 30 days of passing of the resolution.

Consequences of not Filing the Form with ROC: If in any case a company fails to file resolution or the agreement, the company shall be punishable with fine which shall not be less than five lakh rupees but which may extend to twenty-five lakh rupees and every officer of the company who is in default, include liquidator of the company, if any, shall be punishable with fine which shall not be less than one lakh rupees but which may extend to five lakh rupees.