Introduction to LLP

Two or more persons coming together to carry on a lawful business activity/object to earn profit may decide to form an LLP. LLP is an acronym used for Limited Liability Partnership. Limited Liability Partnership (LLP) offers the advantage of limited liability to its partners, protecting their personal assets from business debts and liabilities. Additionally, it also provides flexibility in management and taxation, combining aspects of both partnerships and corporations.

Limited Liability Partnership Act, 2008 was enacted to make provisions for the formation and regulation of Limited Liability Partnerships and matters connected therewith or incidental thereto. It is an alternative corporate business form that benefits a company’s limited liability and the flexibility of a partnership. LLP form is a form of business model that is organized and operates based on an agreement.

The LLP Agreement is the main document governing the relationship between the partners and the LLP.

Registering an LLP is a simple, less complicated, and time-consuming process.

What is an LLP Agreement?

Once the LLP is formed, the designated partners/partners are required to execute an agreement known as the LLP Agreement. In simple words, an LLP Agreement is an agreement that contains the clauses regarding the functioning of an LLP such as Name, Object, Registered Office, Contribution, Profit Sharing Ratio, etc, and also helps to determine the rights, duties, and liabilities of the partners mutually and between the LLP.

As per Section 2(1)(O) of the Limited Liability Partnership Act, 2008 “Limited liability Partnership Agreements mean any written agreement between the partners of the Limited Liability Partnership or between the Limited Liability Partnership and its partners which determines mutual rights and duties of the partners and their rights and duties in relation to that limited liability partnership.”.

Further, a copy of the final and executed LLP Agreement is required to be filed with the Registrar within 30 days from the date of formation of the LLP as per Section 23 (2) of the LLP Act 2008 read with Rule 21 of the LLP Rules, 2009.

In this article, we shall explore how to draft an LLP agreement, Important Clauses to be included, Steps to be followed after drafting the Agreement, Format, and FAQs for the LLP Agreement.

How to draft an LLP Agreement?

Drafting is an important skill that requires proper consideration and attention to detail for preparing legal documents like agreements, deeds, contracts, etc. A well-drafted agreement must ensure simplicity, and clarity, mitigate disputes, and protect the interests of all parties to the agreement.

The Limited Liability Partnership Agreement is the foundation and constitutive document of the LLP which is the same as the Memorandum and Articles of Association for a Company. It determines the scope and extent of the functioning and operation of the LLP.

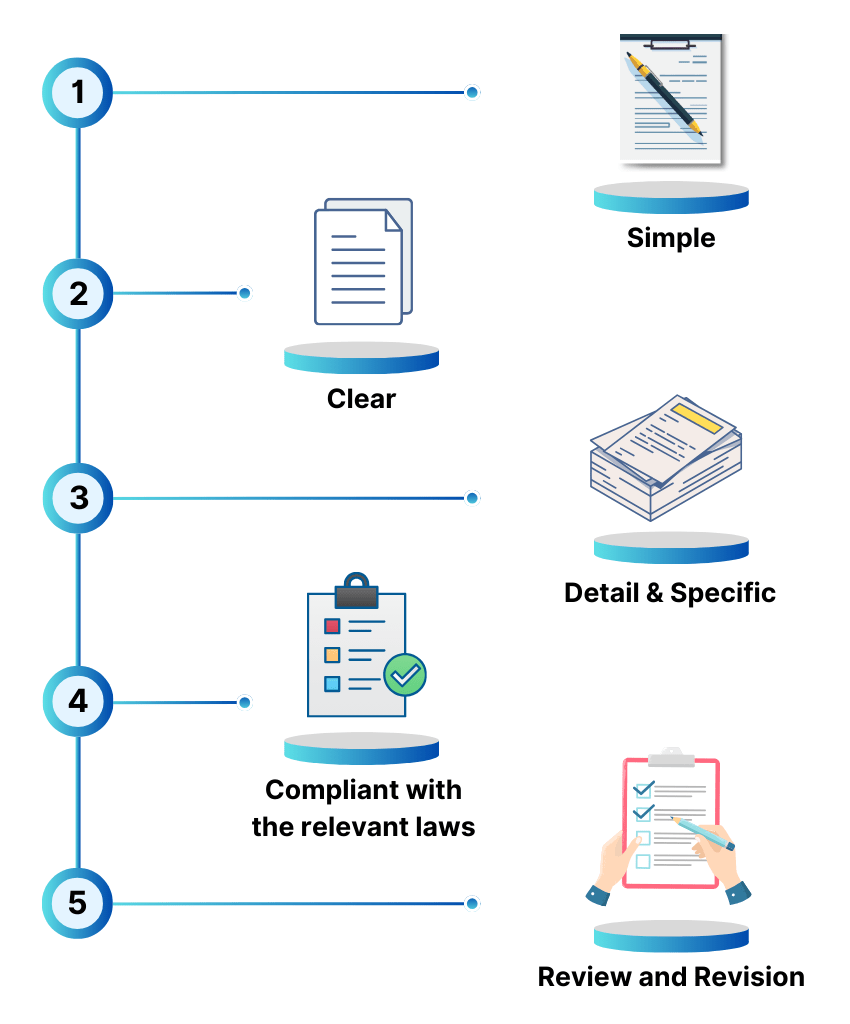

We must follow some basic practices while drafting any agreement which are as follows:

Simple

The first thing to consider when drafting an agreement is to use simple, clear, and precise language, avoiding negative statements. It is helpful to outline a basic design or content plan before beginning the draft.

Clear

Once a simple sketch is in place, the next step is to insert clear and appropriate content using legal and technical terms when necessary. Definitions for these terms should be provided to ensure understanding.

Detail and Specific

The agreement drafted should be detailed and specific and it must serve the purpose of the subject matter of the agreement. It must contain all the important clauses i.e. dispute resolution clause, confidentiality, waiver, and governing laws.

Compliant with the relevant laws

It is crucial to ensure that the agreement is compliant with relevant laws and includes references to pertinent legal provisions.

Review and Revision

The draft agreement that has been prepared should be read carefully and one must be satisfied with the content, interpretation, and the sense it carries. One can make suitable modifications depending upon the requirements of each case and must get it reviewed and vetted by legal experts to ensure its suitability and legal fitness.

Important Clauses to be included in the LLP Agreement

1. Description of Parties

The LLP Agreement must specify the details of the Parties i.e. full name, address, and age of the partners/ designated partners. Also, the heirs, executors, assigns liquidators, successors, etc. should be mentioned against details of each party’s name to safeguard the interest.

2. Recitals

Recitals specify the short background of the facts of the case and show the relation of the parties to the subject matter of the agreement. In simple words, they provide the introduction which specifies the intention behind the execution of the agreement. The introduction generally starts with the word “ Whereas”

3. Definitions

The definition clause is an important aspect of the LLP Agreement. It must specify definitions such as Accounting year, Act, Business, Designated Partner, LLP, LLP Agreement, Partner, etc. as it helps in ascertaining the terms while reading the clauses in the agreement.

4. LLPIN and Name of the LLP

LLP-IN stands for Limited Liability Partnership Identification Number. After the LLP is incorporated, LLP-IN is generated and mentioned in the incorporation certificate granted by the Ministry of Corporate Affairs (MCA). It gives identity to the LLP and can be used for tracking the information of the registered LLP on the MCA portal. The name of the LLP along with the Identification number should be mentioned in the LLP Agreement.

5. Place of Execution and Date of Commencement of LLP

The LLP Agreement must contain the place of execution of the agreement as it helps to ascertain the jurisdiction of a document as to its registration, legal remedies for breaches committed by either party to the document, and also for determining the stamp duty payable on a document as it differs from State to State. Also, the date of commencement of LLP should be specified in the LLP Agreement.

6. Registered Office

Every LLP must have a registered office so that all communications and notices may be addressed to it. LLP Agreement must specify the registered office address of the LLP and also the provisions of change therein.

7. Business of the LLP

The Limited Liability Partnership agreement is the main document governing the relationship between the partners and LLP. It must also specify the business activity/object clause to be carried on by the LLP.

8. Designated Partners

Every designated partner must have a DPIN. Names of the Designated Partners along with DPIN should be mentioned in the LLP Agreement.

9. Capital Contribution

Capital Contribution by way of tangible, movable immovable, or intangible property or another benefit including money, promissory notes, agreement to contribute cash or property, etc. can be brought in by the partners. The LLP Agreement must specify the total contribution of the LLP, the contribution of each partner along with percentages, the addition withdrawal/transfer of contribution by partners, etc.

10. Profit Sharing Ratio

The LLP Agreement must specify the percentage /proportion in which profits and losses will be shared among the partners.

11. Advances/Borrowings/Guarantees

The LLP Agreement must specify clauses relating to advances/guarantees that can be given by the partners to the LLP and the borrowings to be taken in the name of the LLP.

12. Rights, Duties, Powers, Authority, Mutual Rights, and Duties of Partners

The LLP Agreement must specify the rights and duties of the Designated Partners/Partners, powers of the partners, Authority of the partners, and Mutual Rights and Duties of the Partners. In the absence of such a separate agreement between the partners regarding the rights and duties, etc., the provisions of Schedule I of the Limited Liability Partnership Act, 2008 shall apply as given in Section 23(4) of the said act.

13. Management and Administration

The LLP Agreement must contain the provisions relating to the procedure for calling, holding, and conducting meetings, the manner of obtaining consent from partners, and restrictions on partners’ Authority.

14. Admission Of Partner, Retirement Resignation, and Expulsion of Partners

The LLP agreement must contain provisions concerning the admission of new partners, resignation of partners, retirement, death, and expulsion of partners.

15. Remuneration to Partners

The LLP agreement shall contain a clause regarding the amount of remuneration and the manner in which it is to be paid to the partners for rendering the services.

16. Accounts And Computation of Net Profit and Losses

The LLP must contain the provisions relating to the maintenance of accounts, method of accounting, accounting practices to be followed, year of accounting, etc.

17. Bank Account

The LLP Agreement shall contain clauses concerning the opening of an account in the name of the LLP and the operation of the bank account of the LLP.

18. Indemnity Clause

The LLP agreement must have an indemnity clause. The clause of indemnity states that the LLP shall indemnify its partners from any kind of liability or claim incurred by them while carrying out the business of the LLP. The partners also agree to indemnify the LLP for the loss caused by it due to any breach committed by them.

19. Other Important Clauses

The LLP Agreement must also contain important clauses such as a change in registered office address, additional address for service documents, change in the name of the LLP, appointment and removal of auditor, voluntary winding up, etc.

20. Miscellaneous Provisions

An ideal LLP Agreement should have Miscellaneous Provisions such as Dispute Resolution Clause, Alteration or amendment in the LLP Agreement, Entirety of Agreement, Severability & Waiver Clause, counterparts, serving of notices, waiver, and Governing law.

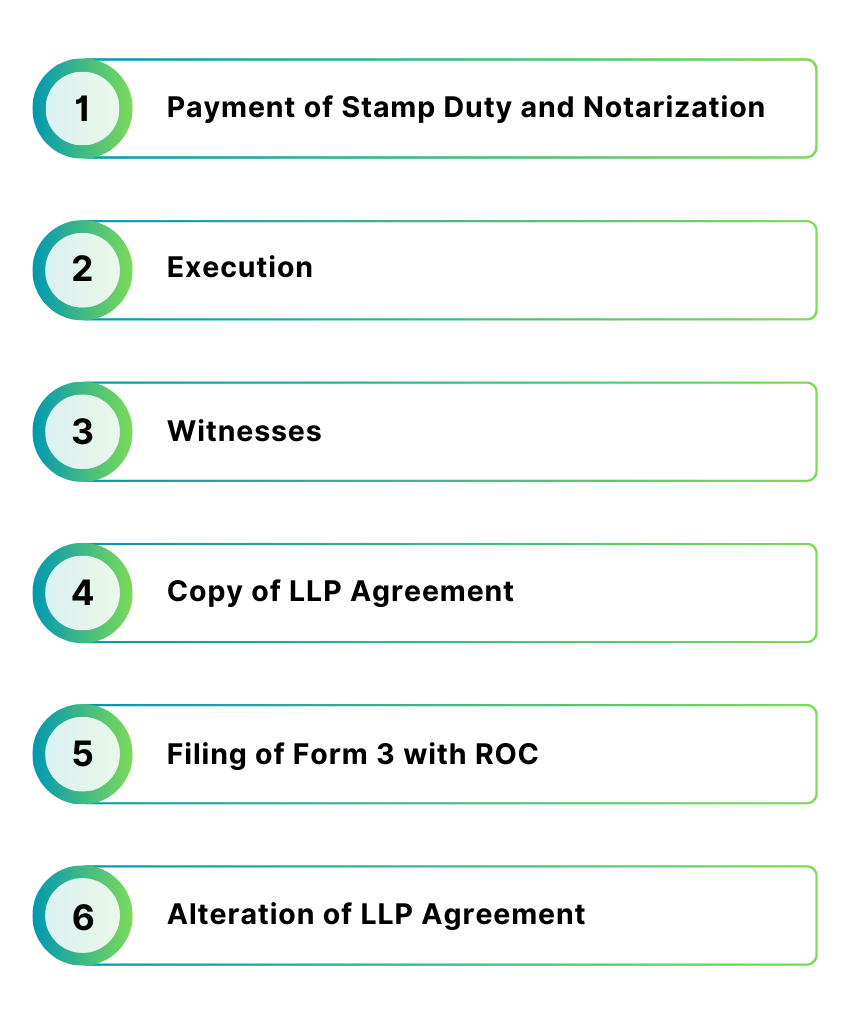

Steps to be followed after drafting an LLP Agreement

Payment of Stamp Duty

Prepare, draft, and finalize the agreement and purchase Stamp paper or generate ESBTR Challan of requisite value. The Value of Stamp Duty depends on the state in which the LLP is incorporated and on the amount of capital contribution from the partners.

For more information, read Stamp Duty on LLP Agreement.

Execution

The LLP Agreement must be signed by all the designated partners/partners at the bottom of all pages.

Witnesses

The LLP Agreement must also be attested by two witnesses at the end where all the designated partners/partners have signed.

Copy of LLP Agreement

Each designated partner/partner must be given a copy of the agreement for their records.

Filing of Form 3 with ROC

A copy of the LLP agreement should be filed with the Registrar in Form 3 (Information for LLP Agreement and changes) within 30 days of the incorporation of the LLP. Form 3 is a web-based form on the V3 Portal.

Fees for Filing, registering, and recording any document, form, statement, Statement of Account & solvency, annual return, and application for Conversion of Firm or Company to LLP:

| S.No | Particulars | Amount (in Rs) |

| 1. | LLP whose contribution of up to Rs. 1 lakh | 50 |

| 2. | LLP whose contribution is Rs.1 lakh-5 lakh | 100 |

| 3. | LLP whose contribution is Rs.5 lakh-10lakh | 150 |

| 4. | LLP whose contribution is Rs.10 lakh-25lakh | 200 |

| 5. | LLP whose contribution is Rs.25 lakh-1 crore | 400 |

| 6. | LLP whose contribution exceeds 1 crore | 600 |

Alteration of LLP Agreement

In case of any change in the clauses of the Initial LLP Agreement, the Supplementary LLP agreement is to be executed for any change and filed with the Registrar in Form 3 (Information for LLP Agreement and changes) within 30 days of such change along with the following attachments:

- Initial LLP Agreement

- Supplementary LLP Agreement

- Any other optional Attachment

LLP Agreement Format

Limited Liability Partnership Agreement

Of

_______________________LLP

This Agreement of Limited Liability Partnership made at ______ this _______________________________

BETWEEN

- ______________son of ______________ residing at __________________________and hereinafter called the party of the FIRST PART; (which expression shall, unless it be repugnant to the subject or context thereof, include their legal heirs, successors, nominees and permitted assignees) and

- ______________daughter of ______________ residing at __________________________and hereinafter called the party of the FIRST PART; (which expression shall, unless it is repugnant to the subject or context thereof, include their legal heirs, successors, nominees and permitted assignees).

All the parties hereto shall be collectively referred to as Partners. All the Parties hereto are interested in forming a Limited Liability Partnership under the Limited Liability Partnership Act, 2008, and have incorporated _______________________(LLP Identification No.____________), pursuant to section 12(1) of the Limited Liability Partnership Act, 2008 vide certificate of incorporation dated __________________and that they intend to record the terms and conditions of the said formation and;

Now it is hereby agreed by and between the parties hereto as follows: –

- A Limited Liability Partnership shall be carried on in the name and style of M/s. _____________________LLP (hereinafter called as “_________________________ or the LLP”).

- LLP shall have its registered office _______________________________________and/or at such other place or places, as may be agreed to by the majority of the partners from time to time.

- The LLP as constituted under this Agreement shall be deemed to have commenced on ____ day of ______2024.

- The Contribution of the ______________________LLP shall be Rs. _______________/- (RUPEES ONE LAKH) with proportion of each partner as detailed herein below: –

Sr. No. Name Contribution in Figures % of Contribution Contribution in Words 1. 2. Total

Further contribution if any, required by the LLP shall be brought in by the partners in their profit-sharing ratio.

- The contribution brought in by Partners shall be credited to their respective Capital account. The partners shall be entitled to simple interest, on the amount contributed by them from time to time. The rate of interest may be decided by the Partners from time to time. However, the rate of interest shall not exceed the rate prescribed under section 40(b)(iv) of the Income Tax Act, 1961.

- The LLP shall have a common seal to be affixed on documents as defined by partners under the signature of both Designated Partners.

- All the Partners of the LLP are entitled to share profit and losses, including that of capital nature, in the ratio of their respective contribution in the LLP.

- The business activity to be carried out by the LLP shall be: –

(i.) To Carry On The Business Of_______________________________________________________________.

Working Partners and Remuneration

- All the parties hereto have agreed to work in the partnership firm as working partners. It is hereby agreed that they shall be entitled to remuneration as under:(i) First, the aggregate amount of remuneration deductible from the computation of income of the firm as provided under section 40 of the Income Tax Act, 1961 as per the Finance Act, 1992, and as amended from time to time shall be determined.

- Such sum hereafter be called as ‘aggregate’ remuneration.

- Each partner shall be paid remuneration as under: –

(1) Mr. ________________________will be paid 85 per cent of aggregate remuneration

(2) Ms. _____________________will be paid 15 per cent of aggregate remuneration

c. The firm shall credit the account of each partner to whom remuneration is so payable, as detailed at sub-clause (b) above on 31st March each year OR in case of dissolution of the firm on the date of dissolution.

(ii) For the purpose of the above calculation, ‘Book Profit’ shall be computed as defined in Explanation – 3 to Section 40 of the Income Tax Act, 1961 or any other applicable provision as may be in force for the Income tax assessment of the partnership firm for the relevant accounting period.

(iii) The remuneration payable to the above-said partners shall be credited to their respective accounts at the close of the accounting period when final accounts of the partnership are made up and the amount of remuneration shall fall due to them as determined in the above manner.

However, nothing herein contained shall preclude any of the said partners from withdrawing any amount from the partnership firm against the amount standing to the credit of his / their capital and/or current or loan account or his / their share of profit for the relevant accounting year or his / their anticipated remuneration in such manner as may be decided by the partners by mutual consent.

(iv) The partners shall be entitled to increase or reduce the above remuneration and may agree to pay remuneration to other working partner or partners as the case may be. The parties hereto may also agree to revise the mode of calculating the above-said remuneration as may be agreed to by and between the partners from time to time.

(v) It is further agreed that if the agreed remuneration referred to in clause (ii) above exceeds the book profit, the remuneration payable to working partner/partners shall be restricted to the extent of available book profit and to be allocated to working partners mentioned in clause No. 11(i) in the same ratio as mentioned in the said clause No. 11(i). It is clarified that in the case of loss, no remuneration shall be payable to working partners.

Admission of New Partner

- The Partners may admit a new Partner, on such terms and conditions as they may decide. No person may be introduced as a new partner without the consent of all the existing partners. Such incoming partner shall give his prior consent to act as a Partner of the LLP.

- The incoming partner shall bring in contributions as may be decided by the existing partners at that time. The contribution of the partner may be tangible, intangible, moveable, or immovable property.

- The Profit sharing ratio of the incoming partner shall be in proportion to his/her contribution towards LLP.

- Subject to the Limited Liability Partnership Act, 2008 all the partners hereto shall have the rights, title, and interest in all the assets and properties in the said LLP in the proportion of their contribution.

- Every partner has a right to have access to and to inspect and copy any books of the LLP.

Rights of Partner

- Each of the parties hereto shall be entitled to carry on their own, separate and independent business as hitherto they might be doing or they may hereafter do as they deem fit and proper and other partners and the LLP shall have no objection thereto provided that the said partner has intimated the fact to the LLP before the start of the independent business and moreover he shall not use the name of the LLP to carry on the said business. For new incoming partners separate rules may be framed by the existing partners.

- LLP shall have perpetual succession. Death, retirement, or insolvency of any partner shall not dissolve the LLP. The remaining partners may continue the business of _LLP. However, if due to the death, retirement, or insolvency of any partner, the number of partners falls below two, then LLP shall be compulsorily wound up as per the provisions of the Limited Liability Partnership Act, 2008, and Rules made there under.

- Subject to any special provision/decision made by the partners unanimously, on the retirement of a partner, the retiring partner shall be entitled to full payment in respect of all his rights, title, and interest in the partnership as herein provided (after deducting any dues). However, upon insolvency of a partner his or her rights, title, and interest in the LLP shall come to an end.

- Upon the death of any of the partners herein, any one of his heirs will be admitted as a partner of the LLP in place of such deceased partner with the same terms and conditions as were applicable to the deceased partner.

- On the death of any partner, if his or her heir opts not to become the partner, the surviving partners shall have the option to purchase the rights of the deceased partner in the LLP. The heirs, executors, and administrators of such deceased partners shall be entitled to and shall be paid the full payment in respect of the right, title, and interest of such deceased partner.

- Every partner shall account to the LLP for any benefit derived by him without the consent of the LLP from any transaction concerning the LLP, or from any use by him of the property, name, or any business connection of the LLP.

Duties of Partners

- Every partner shall indemnify the LLP and the other existing partners for any loss caused to it by his fraud in the conduct of the business of the LLP.

- Each partner shall render true accounts and full information of all things affecting the LLP, to any partner or his legal representatives.

- In case any of the Partners of the LLP desires to transfer or assign his interest or shares in the LLP, he has to offer the same to the remaining partners by giving 15 days’ notice. In the absence of any communication by the remaining partners, the concerned partner can transfer or assign his share to any person other than the existing partners.

- No partner shall without the written consent of the LLP:

(i) Employ any money, goods, or effects of the LLP or pledge the credit thereof except in the ordinary course of business and upon the account or for the benefit of the LLP

(ii) Lend money or give credit on behalf of the or to have any dealings with any persons, company, LLP, or firm whom the other partner previously in writing has forbidden it to trust or deal with. Any loss incurred through any breach of provisions shall be made good with by the partner incurring the same.

(iii) Enter into any bond or become surety or security with or for any person or do knowingly cause or suffer to be done anything whereby the LLP’s property or any part thereof may be seized.

(iv) Assign, mortgage, or charge his or her share in the LLP or any asset or property thereof or make any other person a partner therein.

(v) Compromise or compound or (except upon payment in full), release or discharge any debt due to the LLP except upon the written consent given by the other partners.

Meeting

- The meeting of the Partners may be called by sending 15 days’ prior notice to all the Partners at their residential address or by mail at the email IDs provided by the individual Partners in writing to the LLP. In case any partner is a foreign resident the meeting may be conducted by serving 15 days’ prior notice through email. Provided that the meeting may be called at shorter notice if the majority of the partners agree in writing to the same either before or after the meeting.

- The meeting of Partners shall ordinarily be held at the registered office of the LLP or at any other place as per the convenience of the partners.

- With the written consent of all the partners, a meeting of the partners may be conducted through teleconferencing.

- All the decisions taken shall be recorded in the minutes within sixty days of taking such decisions and such minute books are to be kept and maintained at the registered office of the LLP.

- Each partner shall: –

(i) Punctually pay and discharge the separate debts and engagement and indemnify the other partners and the LLP’s assets against the same and all proceedings, costs, claims, and demands in respect thereof.

(ii) Each of the partners shall give time and attention as may be required for the fulfillment of the objectives of the LLP business and they all shall be the working partners.

Duties of Designated Partner

- The party of the First Part and Second Part shall act as the Designated Partners of the LLP in terms of the requirement of the Limited Liability Partnership Act, 2008.

- The Designated Partners shall be responsible for the doing of all acts, matters, and things as are required to be done by the limited liability partnership in respect of compliance with the provisions of this Act including the filing of any document, return, statement, and the like report pursuant to the provisions of the Limited Liability Partnership Act, 2008.

- The Designated Partners shall be responsible for the doing of all acts arising out of this agreement.

- The Designated Partners shall be considered as “Working Partners”. The LLP may pay such remuneration to all or any of the Working Partners as may be decided by the Partners from time to time. However, the amount of remuneration to the working partners shall not exceed the ceiling for such payment provided under section 40(b)(v) of the Income Tax Act, 1961.

- The LLP shall indemnify and defend its partners and other officers from and against any and all liability in connection with claims, actions and proceedings (regardless of the outcome), judgment, loss or settlement thereof, whether civil or criminal, arising out of or resulting from their respective performances as partners and officers of the STEPUP INDIA LEGAL SERVICES LLP, except for the gross negligence, fraud or willful misconduct of the partner or officer seeking indemnification.

Cessation of existing Partners

- A partner may cease to be a partner of the LLP by giving a notice in writing of not less than thirty days to the other partners of his intention to resign as a partner.

- No majority of partners can expel any partner except in the situation where any partner has been found guilty of carrying out activity/business of LLP with fraudulent purposes.

- The LLP can be wound up with the consent of all the partners subject to the provisions of the Limited Liability Partnership Act, 2008.

Extent of Liability of LLP

- LLP is not bound by anything done by a partner in dealing with a person if –

(i) the partner in fact has no authority to act for the LLP in doing a particular act; and

(ii) the person knows that the partner has no authority or does not believe him to be a partner of the LLP.

Miscellaneous Provisions

- The limited liability partnership shall indemnify each partner in respect of payments made and personal liabilities incurred by him: –

(i) in the ordinary and proper conduct of the business of the LLP; or

(ii) in or about anything necessarily done for the preservation of the business or

property of the LLP.

- The books of accounts of the LLP shall be kept at the registered office of the LLP for the reference of all the partners.

- The accounting year of the LLP shall be from 1st April of the year to 31st March of the subsequent year. The first accounting year shall be from the date of incorporation of LLP i.e._______________________________________.

- The Share of Profit of each partner shall be credited to the respective Current Accounts of each partner

- It is expressly agreed that the bank account of the LLP shall be operated by Mr. _________________ (Designated Partners of LLP).

All disputes between the partners or between the Partner and the LLP arising out of the limited liability partnership agreement that cannot be resolved in terms of this agreement shall be referred for arbitration as per the provisions of the Arbitration and Conciliation Act, 1996 (26 of 1996).

IN WITNESS WHEREOF the parties have put their respective hands the day and year first hereinabove written.

Mr. _______________________

Address: _______________________

DPIN: ________________

Designated Partner 1/ First Party

_______________________________

Mr. _______________________

Address: _______________________

DPIN: ________________

Designated Partner 2/ Second Party

Witnesses:

(a) Name:

Address:

Occupation:

Signature:

(b) Name:

Address:

Occupation:

Signature:

Conclusion

LLP agreement creates the foundation for the smooth functioning of LLP. It determines the roles, responsibilities, rights, duties, authority, and powers of the partners to the LLP and between each other. LLP agreement grants flexibility to the partners in organizing their internal management and provides clarification to the managerial, operational as well administrative responsibilities. It also ascertains clear methodologies for decision-making, adding a new partner, and resignation, death, and removal of an existing partner.

We are Registration Arena, having a team of experienced professionals/ experts who can assist you in incorporating LLP, drafting of the LLP Agreement, filing with regulatory authorities, and ensuring that the LLP can carry on with its business smoothly.

For more information, please contact us.