As a part of its corporate governance and legal responsibility, a company must be accountable and transparent with all its stakeholders like shareholders, government, customers, etc. They shall disclose their financial position and performance each year. All the companies must file their financial statements with the Registrar of Companies (ROC) in Form AOC 4 for the same.

This blog is a comprehensive guide on Form AOC 4 in which we will discuss various aspects related to the form such as its applicability, due date, fees, certification, etc. Additionally, we will look at the consequences of non-compliance.

What is Form AOC 4

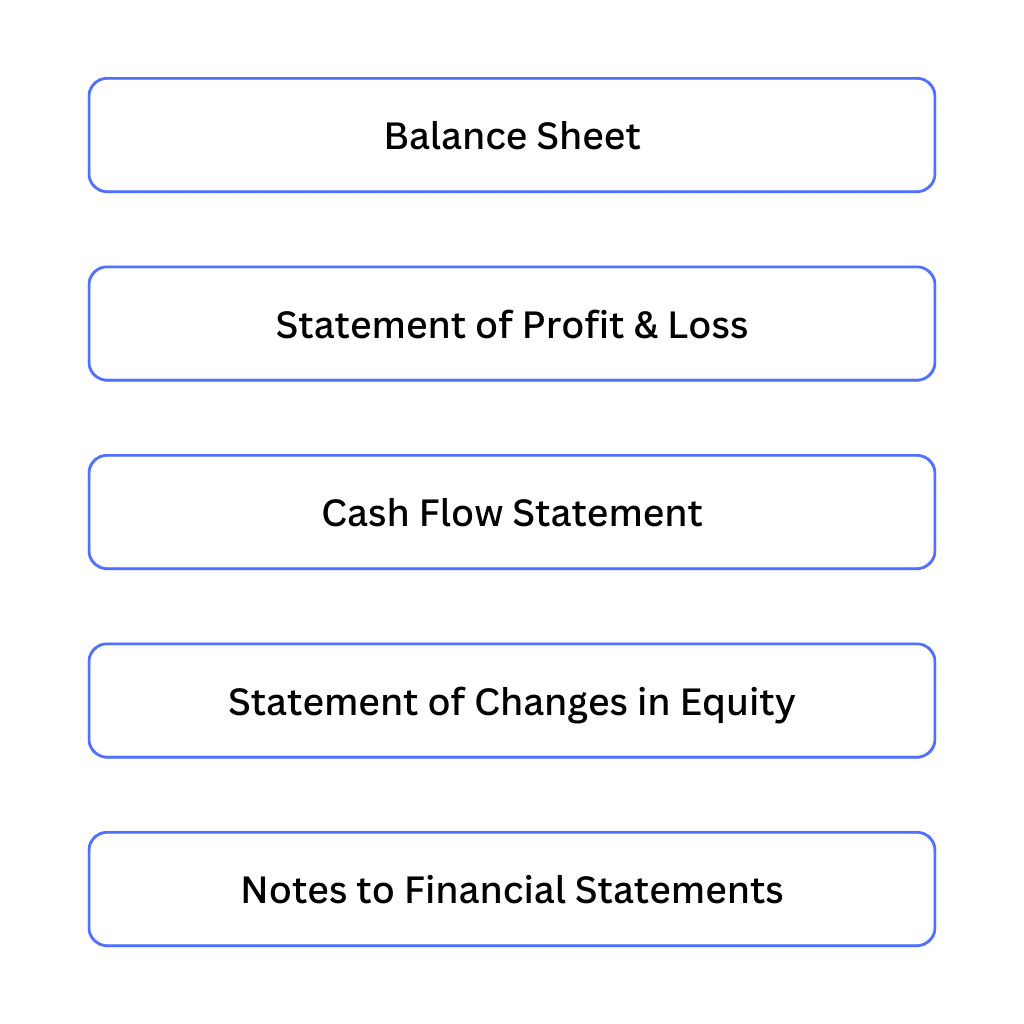

All the companies that are registered as per the Companies Act, 2013 are required to prepare and file their annual financial statements and audit reports with the Registrar of Companies (ROC) every year. Form AOC 4 is used to file such financial statements and audit reports with the ROC. Financial statements typically include –

Therefore, filing of Form AOC 4 is one of the annual compliance requirements of a company.

Read More: Compliances for Private Limited Companies

Applicability of Form AOC 4 CFS, AOC 4 NBFC, and AOC 4 XBRL

Form AOC 4 is applicable for the filing of annual financial statements by a company with the ROC. However, in certain cases, such as Non-Banking Financial Companies (NBFC) and companies that meet specific criteria, must file their financial statements in different variants of Form AOC 4 as outlined below.

Form AOC 4 CFS

Those companies (also known as parent companies) that have a subsidiary or associate company shall prepare and file two sets of financial statements. One is a Standalone Financial Statement, which contains details about the financial performance of the parent company only.

Another one is Consolidated Financial Statements (CFS), which include details of the financial performance of both the parent company and the subsidiary or associate company. Therefore, companies use Form AOC 4 CFS to file the consolidated financial statements with the ROC.

Additionally, companies should attach Form AOC 1 to the financial statements, which contain the salient features of the financial statements of the subsidiary company/associate company/joint venture.

Parent Company is a general term used to refer to those companies that have a subsidiary or associate company. Particularly with reference to the subsidiary company, a parent company is also known as a holding company.

Subsidiary Company is a company in which the holding company either controls the composition of its board of directors (power to appoint or remove directors) or holds more than 50% of its total voting power (either by itself or together with its other subsidiaries).

Associate Company is a company in which the other company either holds atleast 20% of its total voting power or participates in its decision-making. It also includes a joint venture company.

Let us take a few examples to understand parent, holding, subsidiary, and associate company.

- ABC Limited holds 75% of the total voting power in XYZ Limited. In such case, ABC Limited is the holding company, and XYZ Limited is the subsidiary company.

- DEF Limited holds 25% of the total voting power in PQR Limited. In such case, DEF Limited is the parent company, and PQR Limited is the associate company.

Form AOC 4 NBFC (Ind AS)

All Non-Banking Financial Companies (NBFC) that are required to comply with Ind AS i.e., Indian Accounting Standards shall file their financial statements in Form AOC 4 NBFC (Ind AS) or Form AOC 4 CFS NBFC (Ind AS).

Form AOC 4 XBRL

XBRL stands for Extensible Business Reporting Language. It is a language that is used worldwide to communicate business and financial data. There are different software available in the market that can be used for the preparation and validation of XBRL reports for example, Gen XBRL Software, MCA XBRL Validation Tool, CompuTax XBRL Software, etc.

As per Companies (Accounts) Rules, 2014, it is mandatory for the following classes of companies to file their financial statements in XBRL format i.e., in Form AOC 4 XBRL –

- All companies listed on an Indian Stock Exchange along with their Indian subsidiaries;

- All companies having a paid-up share capital of Rs. 5 crores and above;

- All companies having a turnover of Rs. 100 crores and above;

- All companies are required to follow the Companies (Ind AS) Rules, 2015 in preparation for their financial statements.

Contents of Form AOC 4

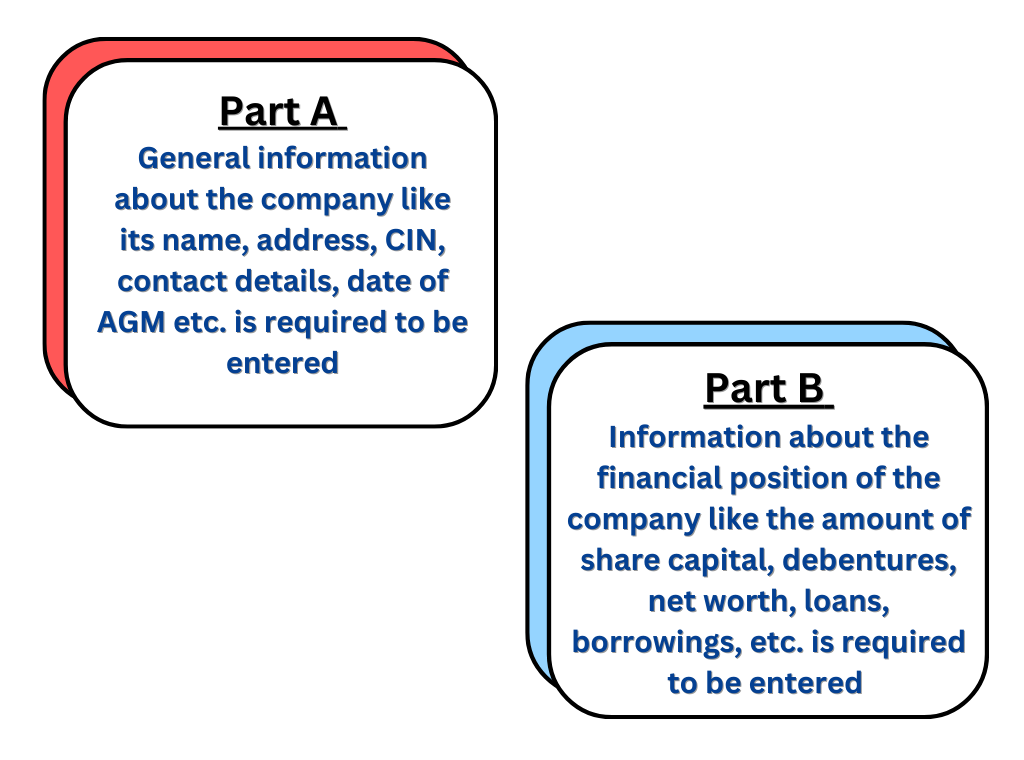

Form AOC-4 is divided into the following 6 segments.

Segment I

In this segment, information relating to the balance sheet is required to be filled. It is further divided into 2 parts –

Segment II

In Segment II, information about the financial performance of the company like profit or loss, revenue, expenditure, etc. is required to be filled.

Segment III

In this segment, information about Corporate Social Responsibility (CSR) like average net profit for the last 3 years, prescribed CSR expenditure, details of the implementing agency, etc. shall be provided by the company.

Segment IV

In Segment IV, details about the related party transactions entered into by the company shall be entered like the number of contracts, duration of contracts, date of approval by the Board of Directors, etc.

Segment V

In this segment, if the company is a government company, it shall disclose whether the Comptroller and Auditor General of India (CAG) has commented on its audit report or not, whether it has expressed a qualified opinion, etc.

Segment VI

Segment VI is miscellaneous under which a company shall provide information such as the applicability of secretarial audit and attachment of detailed disclosure with respect to the Board report.

Attachments of Form AOC 4

The following documents shall be attached to Form AOC 4 –

- Copy of Financial Statements (including Auditors Report and Board Report)

- Form AOC 1 – Statement of Subsidiaries

- Statement of facts and reasons, if financial statements are not adopted in the AGM or for not holding the AGM

- Approved letter of extension for holding AGM (if an extension is sought)

- CSR Policy of the Company (if applicable)

- Details of remaining CSR activities

- Details of other entity

- Form AOC 2 – Details of salient features and justification for entering into contracts/Arrangements/transactions with related parties

- Secretarial Audit Report (if applicable)

- Optional attachments (if any)

Note – Form CSR – 2 i.e., Report on CSR shall be filed as a linked form with Form AOC 4.

Signing and Certification of Form AOC 4

Form AOC 4 shall be digitally signed by the Director/ Manager/ CEO/ CFO/ Company Secretary of the company. Such person shall declare that he is authorized by the company to sign the form and that the information furnished is true and correct.

In addition, Form AOC 4 shall be certified by a Practicing CA/CS/CMA, except in the case of a small company.

Due Date for Filing Form AOC 4

The following table shows the due date for filing Form AOC 4 in different scenarios.

| S. No. | Particulars | Due Date |

| 1 | AGM is conducted before the due date and financial statements are adopted at the AGM | Within 30 days of the AGM |

| 2 | AGM is adjourned | Within 30 days of the adjourned meeting along with the filing fees or additional filing fees, as the case may be. |

| 3 | AGM is not conducted | Within 30 days from the due date of the AGM* |

| 4 | Financial statements are not adopted at the AGM | Within 30 days of the AGM. However, the Registrar considers them as provisional until the duly adopted financial statements are filed. |

| 5 | Financial Statement of One Person Company (OPC) | Within 180 days from the end of the financial year. |

*Note – The due date for holding an AGM is 6 months from the end of the financial year, i.e. 30th September each year. Also, the gap between two AGMs shall not exceed 15 months.

Haven’t filed AOC 4 yet? Get in touch with our experts and file it now to avoid late fees and penalties!

Fees for Filing Form AOC 4

It can further be divided into the following 2 categories.

For Companies Having Share CapitalI

The fees for filing Form AOC 4 depend on the authorized share capital of the company. The following table shows the applicable fees –

| S. No. | Authorized Share Capital | Filing Fees (per document) |

| 1 | Less than Rs. 1,00,000 | Rs. 200 |

| 2 | Rs. 1,00,000 – Rs. 4,99,999 | Rs. 300 |

| 3 | Rs. 5,00,000 – Rs. 24,99,999 | Rs. 400 |

| 4 | Rs. 25,00,000 – Rs. 99,99,999 | Rs. 500 |

| 5 | Rs. 1,00,00,000 or more | Rs. 600 |

For Companies Not Having Share Capital

Rs. 200 per document is the standard fee for filing Form AOC 4.

Consequences of Non-Compliance

If a company fails to file Form AOC 4 on or before the due date, it has to face the following consequences.

Late/ Additional Filing Fees

If Form AOC 4 is filed after the due date, then additional filing fees of Rs. 100 per day is levied.

Penalty

In case of default in filing Form AOC 4, the company is liable to a penalty of Rs. 10,000 and a further penalty of Rs. 100 per day which can go up to Rs. 2,00,000.

In addition, the officers in default (of the company) are liable to a penalty of Rs. 10,000 and a further penalty of Rs. 100 per day which can go up to Rs. 50,000