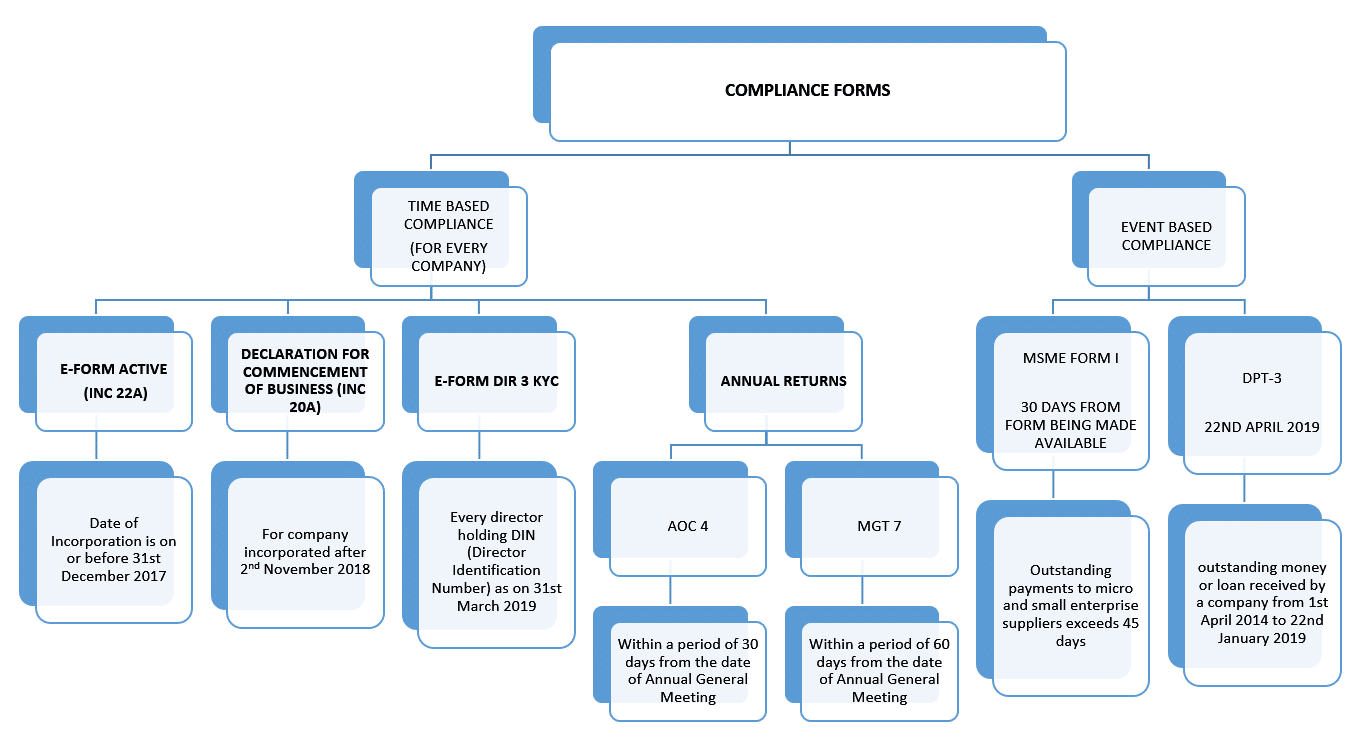

The Ministry of Corporate Affairs (MCA) has mandated new compliances through various notification which every Company Incorporated under the act has to be complied. The below compliances are basically of two categories viz. mandatory company compliances and event based company compliances. This article, gives us an idea on Company Compliances to be completed, their applicability and due dates.

- E-FORM INC 22A OR ACTIVE

- Every company whose Date of Incorporation is on or before 31st December 2017 including Private Limited, One Person Company (OPC), Public Limited, Nidhi Limited, Producer company, Section 8 Company etc is required to file E-FORM INC 22-A or ACTIVE

- Further the Companies which has not filed its financial statements and annual returns with the Registrar of Companies, shall be restricted from filing EFORM INC-22 A (EFORM ACTIVE), unless such companies are under management dispute in the records of registrar

- The due date for filing this form is 25th April 2019

- After The Due Date, 25th April, 2019 the Companies can file the form ACTIVE only with the payment of late fees of Rs. 10,000/-

Read more – ALL ABOUT INC 22A OR E-FORM ACTIVE (ACTIVE COMPANY TAGGING IDENTITIES AND VERIFICATION)

- DECLARATION FOR COMMENCEMENT OF BUSINESS (INC 20A)

- After incorporation, a Declaration is filed by director that every shareholder of the company has paid the value of shares (paid-up capital) agreed to be taken by him/her during incorporation.

- The declaration has to be filed within a period of 180 days from the date of incorporation for company incorporates after 2nd November 2018

- If any default is made in complying with the requirements of this section, the company shall be liable to a penalty which may extend to five thousand rupees.

Read more – Certificate of Commencement of Business -The Companies (Amendment) Ordinance 2019

- E-FORM DIR 3 KYC

- Every director holding DIN (Director Identification Number) as on 31st March 2019 of the financial year has to file e-form DIR-3-KYC on or before 30th April of 2019

- In cases the director who is supposed to file the E-Form does not file it by due date, the MCA will mark the DIN of such director as ‘Deactivated’ with the reason shown as ‘Non-filing of DIR-3 KYC’.

- If the director wishes to re-activate his DIN in future by filing the missed out E-Form DIR-3 KYC, he can do so after paying a late fee of 5,000 rupees.

Read more – DIR-3 KYC – Mandatory for Directors of Companies

- EFORM DPT -3 FOR COMPANY COMPLIANCE

- E-Form DPT 3 is applicable to every company except Government companies who has outstanding money or loan received by a company from 1st April 2014 to 22nd January 2019

Additionally, Every Company to which the Companies (Acceptance of Deposits) Rules, 2014 apply, shall on or before 30th Day of June every year file a return of deposit

- Every Company to whom Form DPT-3 applies has to be file form on or before 22nd April 2019

- Non-filing of DPT 3 within the due dates shall attract a penalty of 5,000 rupees and 5,000 rupees per day in case of a continuing default, on the company and its officers in default.

Read more – FORM DPT-3 : RETURN OF DEPOSITS

- FORM AOC-4 (ANNUAL FILING)

- Form AOC 4 is used to file the financial statements for each financial year with the Registrar of Companies (ROC)

- The Form AOC-4 has to be filed within a period of 30 days from the date of Annual General Meeting of the company

- The penalty for not filing an annual return or delayed filing of Form is increased to 100 (Rupees one hundred) per day

- FORM MGT-7 (ANNUAL FILING)

- Form MGT-7 is a used by companies to fill their annual return details for each financial year with the Registrar of Companies (ROC)

- The Form MGT-7 has to be filed within a period of 60 days from the date of Annual General Meeting of the company.

- The penalty for not filing an annual return or delayed filing of Form is increased to 100 (Rupees one hundred) per day

- MSME FORM I

- Every company whose payments to micro and small enterprise suppliers exceed 45 days from the date of acceptance or the date of deemed acceptance of the goods or services is required to file MSME Form I

- One-time return is required to be filed within 30 days of the form being made available by the MCA in case of amount is outstanding to be payable as on 22nd January 2019

Additionally, the Form has to be filed for Half year

- For period April to September – 31st October

- For half year period October to March – 30th April

- Non-Filing may cause a penalty upto 25,000 rupees from on company and officer in default.