A private limited company is easy to incorporate when compared to a public company. However, the ease of incorporation has little to do with the conduction of business. When the business does not effectively function or runs into losses continually, it becomes mandatory for the business owners to permanently discontinue their company’s business operations. The closure of a Private Limited Company is not an easy task. In this article, we explain how to close a Private Limited Company in India.

The closure of a Private Limited Company is a lengthy process. When a Private Limited Company is closed: its assets are sold or distributed among the shareholders. Then, all of the company’s liabilities are settled. It is important to note that a company is a separate legal entity. Since it is a separate legal entity it is different from its owners. The company pays off the creditors and any other liability.

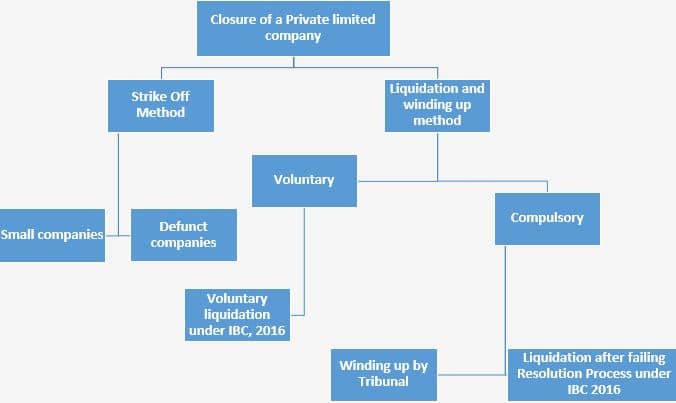

Methods of closure of Private Limited Company

There are only two methods of closure: Strike Off method and Liquidation & Winding Up method. We begin by providing an in-depth insight on the Strike Off method.

1. Strike Off Method of Closure

Note that this method is only applicable to small companies or defunct companies. This method was earlier known as Fast Track Exit Mode.

Defunct Company –

Sec 248 of the Companies Act provides for a defunct company. A defunct company is one which has no assets or liabilities or which has failed to commence its business within a year of incorporation.

Procedure for Strike-Off Closure of Private Limited Company

To get its name struck off, the company can file for closure with the Registrar of Companies through an application in e-form STK-2. It is filed and submitted electronically.. The form must be certified by a Chartered Accountant/Company Secretary/Cost Accountant in whole time practice. If the current directors are different from the ones mentioned in the MCA’s records, the CA/CS/CWA can provide a certificate claiming that the applicants are the present directors.

Before filing for closure it has to: do good on all its liabilities, Pass a special resolution effecting the closure, or get consent from 75% of the members (considering the paid-up share capital). It also has to disclose any pending litigations against it.

The process step-wise is-

a. Board Resolution

The company holds a board meeting and passes a board resolution regarding the closure of the company. It also authorizes any director to apply to the Registrar of Companies (ROC) for the closure.

b. Meeting liabilities

The company meets all the liabilities and repays the amount it owes to its creditors.

c. General Meeting

The company holds a general meeting with its shareholders. Then a resolution to dissolve the company is put forward. After the approval of 75% of members (as per the paid up share capital) and following the special resolution, the company will file E-form MGT-14 in the next month.

d. Seeks Approval of Regulators and Concerned Authorities

The company then seeks the approval of any regulator/body under which it operates or abides to. For Example, A Banking Company needs to get approval from RBI, Insurance Company needs to seek approval from IRDAI

e. Application to ROC

The following documents must be attached to the application filed through Form STK-2.

Indemnity bond – It must be signed by all directors. This is submitted in Form STK-3

Statement of Accounts – comprising the assets and liabilities of the company. It is made up for a day and certified by a Chartered Accountant. Note that this must not be older than 30 days on the day of application.

An Affidavit – by every director of the company in Form STK-4. The existing directors of the company through the way of this affidavit swear that the company has not indulged in carrying out any activity.

CTC of Special Resolution passed by the company. It must be duly signed by all the directors.

Approval of the concerned authority.(if any)

A statement containing pending litigations against the company (if any)

The company needs to do its annual filing before applying for Strike Off. If the company has never transacted and does not have a functioning bank account then it can do without annual filing.

Until the application is disposed, a copy of the application will be displayed on the company’s website.

The company’s involvement in the closure is now complete, the ROC takes over the process and proceeds with the closure

ROC’s procedure

After receiving the application to strike off the name, the ROC publishes a public notice in STK-6. Following the date of the publication of the notice, objections can be put forward in the following 30 days.

The notice regarding the closure of the company is placed on the Ministry of Corporate Affairs’ Website. It is also published in the official gazette and in a leading English newspaper. The notice is also published in a Vernacular newspaper depending on the location of the registered office of the concerned company

It also informs the regulatory authorities regarding the closure. For instance the income tax department, service tax authorities and any such authority that exercises jurisdiction over the company. The ROC actively seeks objection from such departments

After fulfilling the formalities it strikes of the name and dissolves the company. This is done by sending notice through form STK 7 in the official gazette.

Once the notice is published in the official Gazette, the company stands dissolved. The notice is also placed on the official website of the Ministry of Corporate Affairs.

The company ceases to operate as one from the date of its dissolution and the incorporation certificate stands cancelled.

Restrictions on opting for voluntary strike off

A company cannot opt for Voluntary strike off, If the company:

- Changed its name or if its registered office shifted from one state to another

- made a disposal for value of property or rights held by it, immediately before cesser of trade or otherwise carrying on of business, for the purpose of disposal of gain in the normal course of trading or otherwise carrying on of business;

- Has engaged in any other activity except the for one which is mandatory or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company or complying with any statutory requirement;

- Has applied to the Tribunal for sanctioning of a compromise or arrangement. Also, the proceedings for the same have not reached a conclusion

- Is being wound up by the Tribunal or Voluntarily under Chapter XX

- Is listed

- has been delisted on grounds of non-compliance of regulations or related regulations

- Is a Vanishing company

- has been subjected to inspection or investigation (regardless of the fact if the same is yet to go through, underway or awaiting verdict)

- Is battling prosecution

- Has a pending application for compounding

- Has outstanding liabilities

- Is a Section 8 Company

- Is yet to comply with any formality ordered by the Registrar of Companies or Inspector or the Court.

Before the closure of the company, an objection plea is entertained for a period of 30 days. During this period, all departments, entities or persons that have an objection regarding the closure of the concerned company come forward and state their objection. The closure is also advertised in the newspaper so as to make people and potential stakeholders beware of the situation.

After the closure of the company the directors remain liable to any grievance that comes up for an indefinite period of time. The government can raise bring about an objection at any point of time during or following the company’s closure. The employees can do so in a stipulated time frame of 20 years. At the time of making application for Strike off, it is made clear that the directors would be liable for grievances following closure.

2. Mandatory Closure through Strike Off

We discussed voluntary closure through Strike Off: How the Closure of a Private Limited Company is brought about voluntarily. We now discuss how it is initiated by the Registrar of Companies when he sees it fit to dissolve a company.

The ROC can order the dissolution of a company on the following grounds-

- Company has not commenced business within one year following incorporation

- The subscribers to the MoA of the company have not paid the subscription.

- The company has not indulged in business in the immediately preceding two financial years. They also gave not applied for a dormant status under Section 455 of the Companies Act.

3. Liquidation and Winding Up

We discussed the Strike Off method above in the article now we proceed to give an overview of the Liquidation & Winding Up method of closure of a private limited company/Limited Company. This method can be further classified, depending on how the closure is brought about, into Voluntary closure and Mandatory Closure.

A. Mandatory Closure

- Liquidation after failing Resolution Process under IBC 2016

When a company owes money, its creditors can file for its liquidation if it does not do good on its debts. The court or the tribunal works to repay the debt without resulting in the company’s closure. It may sell part of the assets to repay the debt. This process is known as resolution. If this does not work out, then it is said the resolution process has failed. Following which, the court or the tribunal orders the liquidation of the company’s assets to repay the money under IBC 2016

- Winding up by Tribunal

When a company indulges in an illegal activity or when it engages in unlawful activity, the court or the tribunal can order its closure. This is a form of compulsory closure. The registrar of companies or the tribunal has to take the prior permission of the Central Government to pursue the mandatory closure of a company. The company is also given a chance to defend its side of the argument.

B. Voluntary Closure

- Voluntary liquidation under IBC 2016

When a company no longer wants to continue its business operations for reasons relating to loss in business or otherwise, the owners can voluntarily liquidate the company. This is a lengthy process and requires a lot of time. The tribunal or the Registrar of the companies ensure that the company does not have any outstanding debts and that it has made well on all its creditors. Following which the former then post an advertisement stating the closure of the company and wait to see if there are any objections to the same. The company is also liable for future objections relating to its closure.

Conclusion

The closure of a private limited company is a long process. It may even be considered more tiring than its incorporation. Though in this article, we explored how to close a Private Limited Company in India, it is best to explore other options before pursuing the closure of a company. However, if the decision is to close the company is final, it may involve a lot of your time. Reach out to us at Registration Arena to help with the closure of your company. We streamline the process of closure and ensure that our clients get the best value for their money.