Introduction

Every company must have a place of business as its registered office. The registered office of a company is the official address of the company as recorded in official documents and during the time of various registrations as required under multiple legislations as may be applicable to the company.

As per Section 12 of the Companies Act, 2013, every company is mandatorily required to have a registered office within 30 days of incorporation and at all times maintain a registered office where all communications & notices can be sent.

At the time of forming a company one can determine the ROC under whose jurisdiction the company will fall, with the help of the registered office address and all the documents for incorporation are to be submitted with the same ROC only.

If at any time after incorporation, the company intends to change its registered office address, the Registrar of Companies (ROC) shall be notified by the Company by filing E-Form INC 22 within 15 days of the change.

Change of registered office address involves altering the registered location where the company receives official communications, notices, and legal documents. A company may decide to change its registered office address due to several reasons such as, business Expansion or Relocation, Cost Savings, Lease Termination, Operational Efficiency, Better Market Access, Change in Business Focus, Corporate Restructuring, Customer Convenience, Strategic Partnerships, Tax benefits, etc.

In order to shift office outside city/town – the consent of shareholders will be required by way of passing of a Special Resolution. In case of changing the registered office address from the jurisdiction of one ROC to another ROC within the same state, confirmation by the Regional Director (RD) is required. The change of registered office from one State to another State involves alteration of Memorandum (MOA), which must be confirmed by the Central Government ( through the Regional Director) upon application made to it

In this Article, let us understand the modes of changing the registered office address, procedural aspects, compliances post approval from ROC, Documents checklist Applicable forms, and penalty, with respect to the change of registered office address.

Modes of changing registered Office

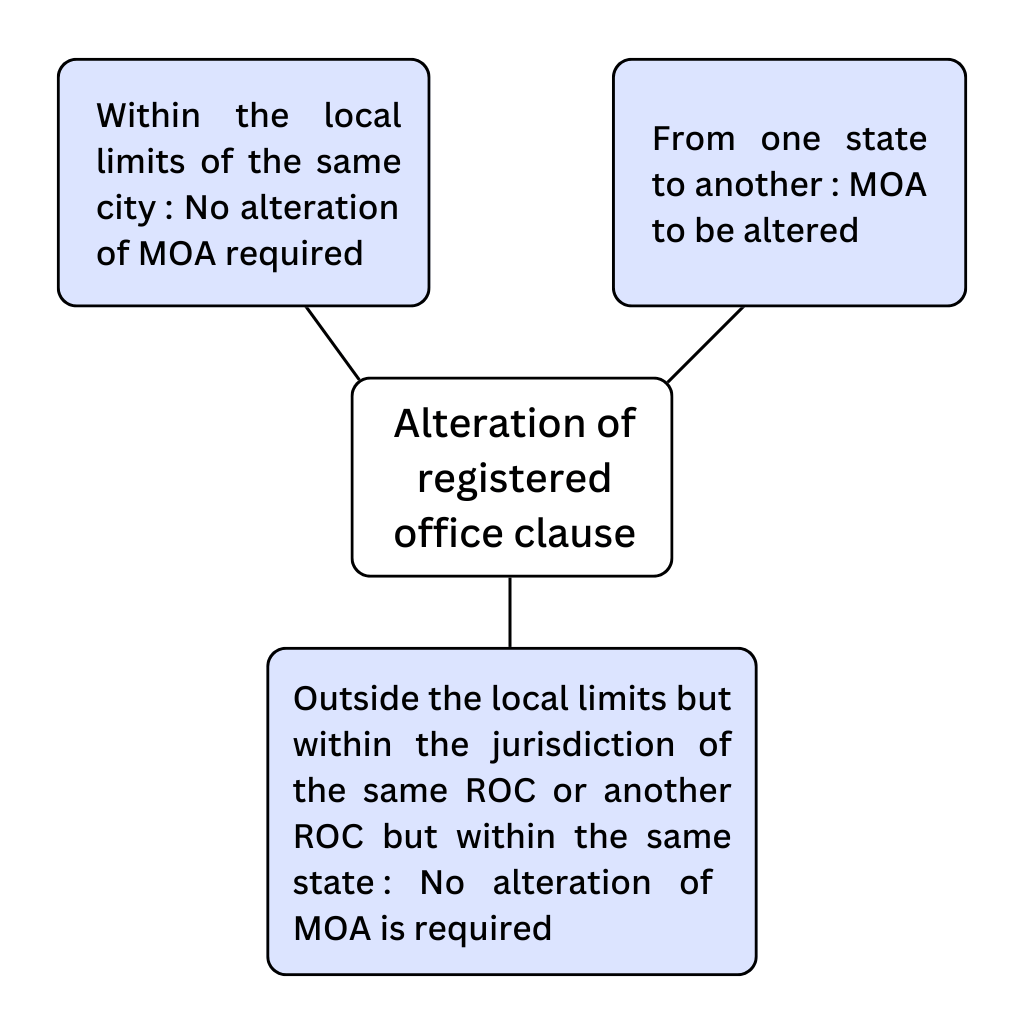

The Company may find it necessary to change the registered office of the from time to time due to several reasons. The Memorandum of Association contains the registered Office Clause which contains the State of India where the registered office of the company is situated. There are four modes/scenarios of shifting the registered office under the Companies Act, 2013:

| Sr. No | Modes of Changing the Registered Office | Effect on Registered Office Clause in the Memorandum of Association (MOA) |

| 1. | Changing the registered office from its current location in a city, town, or village to another place within the same city, town, or village. | MOA includes only the name of the state where the company is incorporated therefore it does not require alteration of MOA. |

| 2. | Changing the registered office from its current location within a city, town, or village to an area outside the local limits of that city, town, or village, but still within the same state, and under the jurisdiction of the same Registrar of Companies (ROC). | MOA includes only the name of the state where the company is incorporated therefore it does not require alteration of MOA. |

| 3. | Changing the registered office from its current location within a city, town, or village to an area outside the local limits of that city, town, or village within the same state but from the Jurisdiction of one Registrar of the Jurisdiction of another Registrar | MOA includes only the name of the state where the company is incorporated therefore it does not require alteration of MOA. |

| 4. | Change of the registered office from one State to another State in India. | MOA includes only the name of the state where the company is incorporated. therefore it requires alteration of MOA due to change in State. |

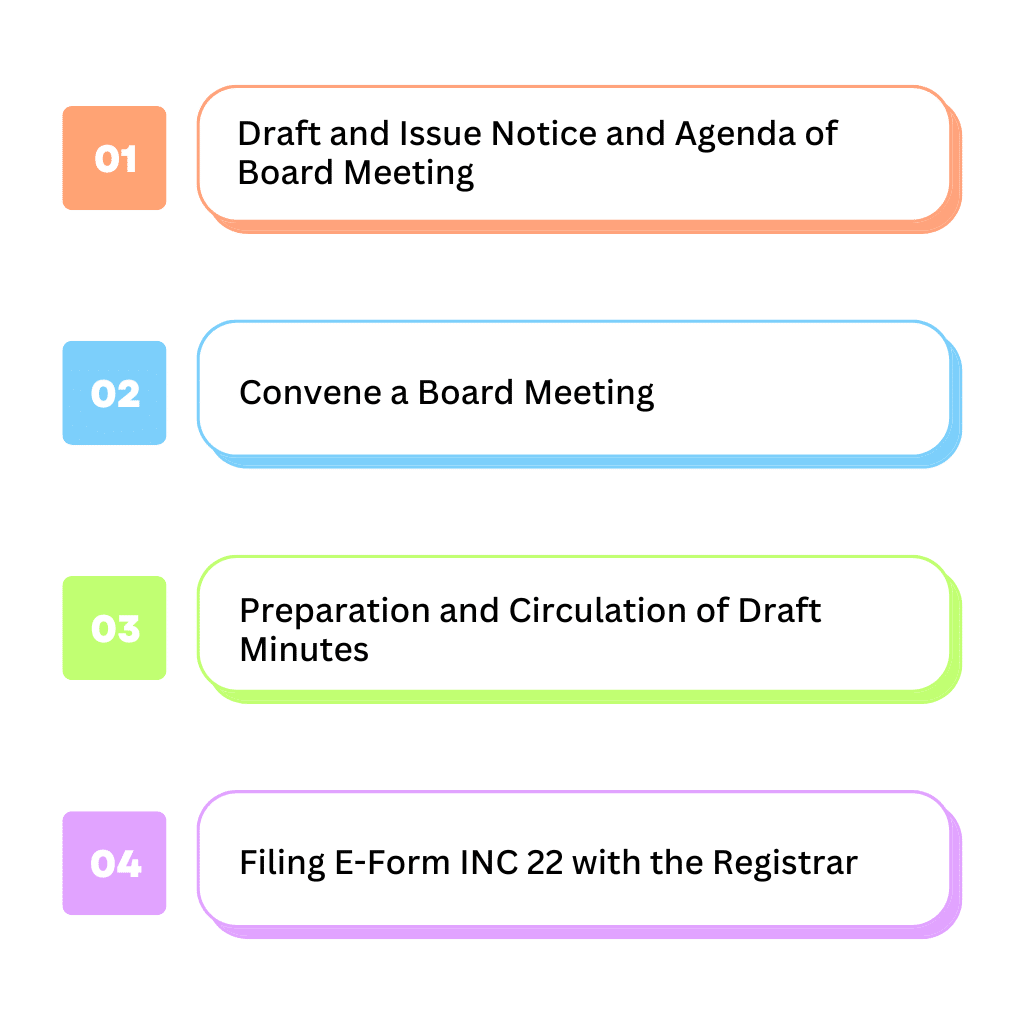

Procedure for shifting registered office within the local limits of the same city, town, or village

For shifting the registered office within the local limits of the same city, town, or village, approval of the Board of Directors is required.

Draft and Issue Notice and Agenda of Board Meeting

Prepare and issue notice calling Board Meeting to all the directors at least 7 days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means.

Convene a Board Meeting

Conduct a Board Meeting and pass a Board Resolution for changing the registered office address from its current location in a city, town, or village to another place within the same city, town, or village.

Preparation and Circulation of Draft Minutes

The draft minutes should be prepared and circulated to all directors for their review and comments within 15 days from the conclusion of a board meeting. Directors are required to provide their comments, if any, within 7 days from the date of circulation of the draft minutes.

Filing E-Form INC 22 with the Registrar

The company is required to submit a notice of change in registered office in E-Form INC-22 with the Registrar of Companies within 15 days of passing the Board Resolution by attaching necessary documents and requisite ROC fees.

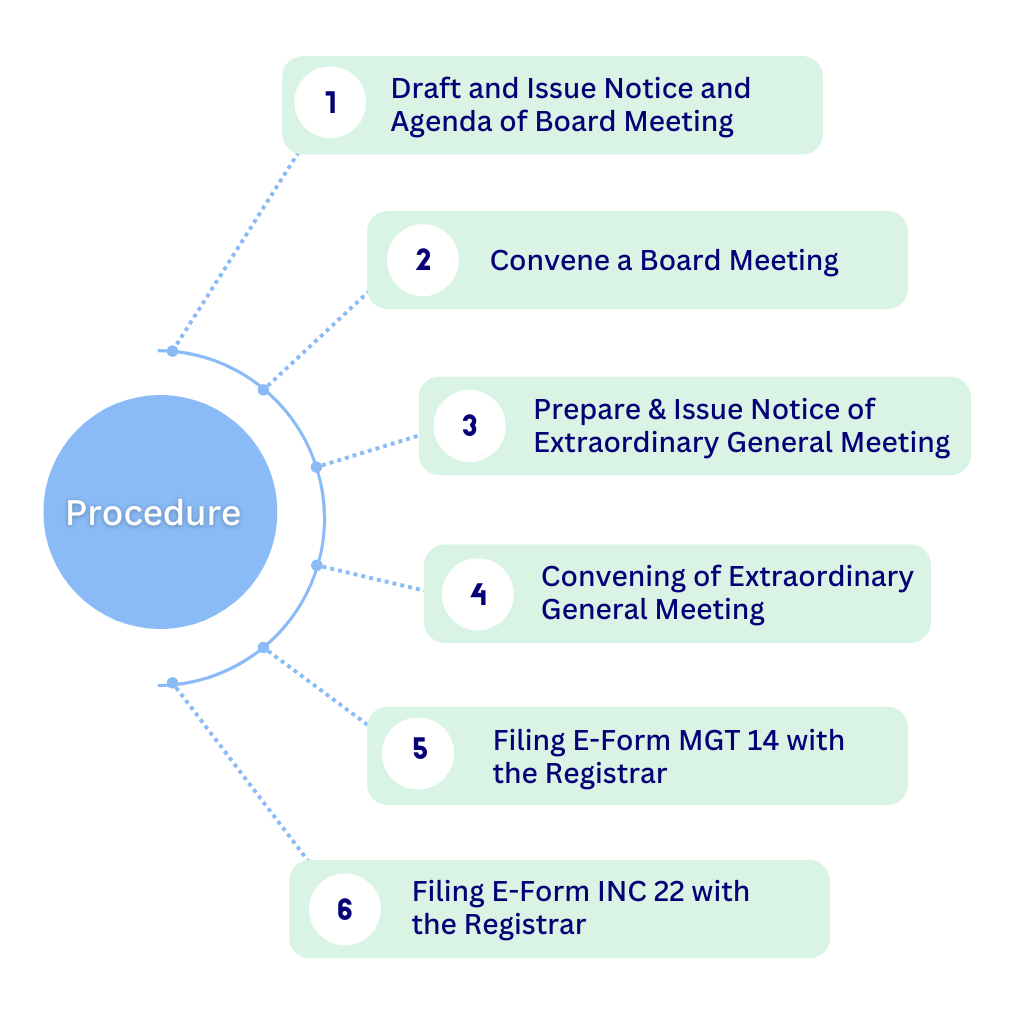

Procedure for shifting registered office outside the local limits of the same city, town, or village

For shifting the registered office outside the local limits of the same city, town, or village, approval of both Board of Directors and Shareholders is required.

Draft and Issue Notice and Agenda of Board Meeting

Prepare and issue notice calling Board Meeting to all the directors at least 7 days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means.

Convene a Board Meeting

Conduct a Board Meeting and pass a Board Resolution for the following:

- For changing the registered office address from its current location in a city, town, or village to another place outside the local limits of that city, town, or village subject to the approval of members

- Fix the time, date, and venue for holding the general meeting of the company for taking approval of members

- Approving the Notice of General Meeting and authorising the Company Secretary/Director to issue the notice on behalf of the Board of directors of the company.

Prepare and Issue Notice of Extraordinary General Meeting

Prepare and issue a notice in writing calling an Extraordinary General Meeting by giving at least 21 days clear notice to all the members by hand or by ordinary post or by speed post or by registered post or by courier or by facsimile or by e-mail or by any other electronic means. An explanatory statement must be annexed with the Notice of the meeting.

Convening of Extraordinary General Meeting

Convene an extraordinary general meeting and pass a Special resolution for changing the registered office of the Company outside the local limits.

Note: Other than OPCs and other companies with members up to 200, any change in the place of registered office outside the local limits of any city, town, or village shall be transacted solely through voting via a postal ballot.

Filing E-Form MGT 14 with the Registrar

The company is required to file E-Form MGT 14 with the Registrar of Companies along with a copy of special resolution along with a Notice and Explanatory Statement by paying requisite fees.

Filing E-Form INC 22 with the Registrar

The company is required to submit notice of change in registered office in E-Form INC-22 with the Registrar of Companies within 15 days of passing the Special Resolution by attaching necessary documents and requisite ROC fees.

Procedure for shifting registered office from one ROC to another within the same state

If a company shifts its registered office to a different place within the same state resulting into change of Registrar of Companies (ROC), it requires approval from the Regional Director after obtaining the approval from the directors and the shareholders in their respective meetings.

At present in India, we have two states with two ROCs i.e Maharashtra (Mumbai & Pune) and Tamil Nadu (Chennai & Coimbatore), therefore this scenario can take place only in case of these two states.

Draft and Issue Notice and Agenda of Board Meeting

Prepare and issue notice calling Board Meeting to all the directors at least 7 days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means.

Convene a Board Meeting

Conduct a Board Meeting and pass a Board Resolution for the following:

- For changing the registered office address from its current location in a city, town, or village to another place outside the local limits of that city, town, or village subject to the approval of members

- Fix the time, date, and venue for holding the general meeting of the company for taking approval of members

- Approving the Notice of General Meeting and authorizing the Company Secretary/Director to issue the notice on behalf of the Board of directors of the company.

Prepare and Issue Notice of Extraordinary General Meeting

Prepare and issue a notice in writing calling an Extraordinary General Meeting by giving at least 21 days clear notice to all the members by hand or by ordinary post or by speed post or by registered post or by courier or by facsimile or by e-mail or by any other electronic means. An explanatory statement must be annexed with the Notice of the meeting.

Convening of Extraordinary General Meeting

Convene an extraordinary general meeting and pass a Special resolution for changing the registered office of the Company outside the local limits. Other than OPC’s and other companies with members up to 200, any change in the place of registered office outside the local limits of any city, town, or village shall be transacted solely through voting via a postal ballot.

Filing E-Form MGT 14 with the Registrar

The company is required to file E-Form MGT 14 with the Registrar of Companies along with a copy of special resolution along with Notice and Explanatory Statement by paying requisite fees.

Filing application with Regional Director

File E-Form INC-23 with the concerned Regional Director to seek confirmation for shifting the registered office within the same state from one Registrar of Companies jurisdiction to another ROC

- Certified True Copy of Board Resolution for shifting of registered office.

- Copy of notice of the Extra-Ordinary General Meeting along with an explanatory statement.

- Certified True Copy of Special Resolution approving the shifting of registered office.

- Minutes of the Extra-Ordinary General Meeting authorizing such alteration.

- Declaration by the Key Managerial Personnel or any two directors authorized by the Board stating that the company has not defaulted in payment of dues to its workmen and has either the consent of its creditors for the proposed shifting or has made necessary provision for the payment thereof.

- Declaration not to seek a change in the jurisdiction of the Court where cases for prosecution are pending.

- Acknowledged copy of intimation to the Chief Secretary of the state regarding the proposed shifting and assurance that employees’ interests are not adversely affected.

- Proof of service of the application to the Registrar, Chief Secretary of the state, SEBI, or any other regulatory authority.

- Copy of objections received, if any.

- Optional attachments, if any.

Review of Application by Regional Director

The Regional Director will review the application, and it may pass order for approval or rejection without a formal hearing. The decision to approve or reject the application must be made within 15 days of receiving the application. However, the changing of the registered office address will not be permitted if any inquiry, inspection, or investigation has been initiated, or if any prosecution is pending against the company.

Filing of E-Form INC 28 with the Registrar

The certified copy of the order issued by the Regional Director, confirming the approval for changing the registered office address, must be submitted using Form INC-28. This filing should be completed within 30 days from the date of receiving the certified copy of the order.

Filing E-Form INC 22 with the Registrar

The company is required to submit notice of change in registered office in E-Form INC-22 with the Registrar of Companies within 30 days of receiving the confirmation order by attaching necessary documents and requisite ROC fees.

Certificate from the Registrar

The registration and certification of the confirmation for the change of registered office shall be carried out by the Registrar of Companies (RoC) within thirty days from the date of filing of such confirmation. The certificate issued by the RoC serves as conclusive evidence that all the requirements of the Companies Act with respect to the change of registered office have been fulfilled . Consequently, the change of registered office shall take effect from the date mentioned on the certificate.

Procedure for shifting registered office from one ROC to another within the same state

Changing the registered office address of the company from one state to another involves alteration of the Memorandum which requires the consent of the shareholders by way of special resolution and a notice of the shifting of the registered office is required to be published through newspaper advertisements.

The alteration of memorandum for the changing of a company’s registered office from one state to another will only become effective after approval by the Central Government (through Regional Director) upon submission of an application in E-form 23 along with supporting documents.

Upon receiving the order from the Regional Director and filing the requisite forms with the Registrar of Companies (ROC), it will update its records to reflect the new premises and issue a new Certificate of Alteration of Registered Office for the company. This certificate serves as conclusive evidence of the relocation of the company’s registered office.

For detailed procedure, read more about Shifting of Registered Office from one State to Another

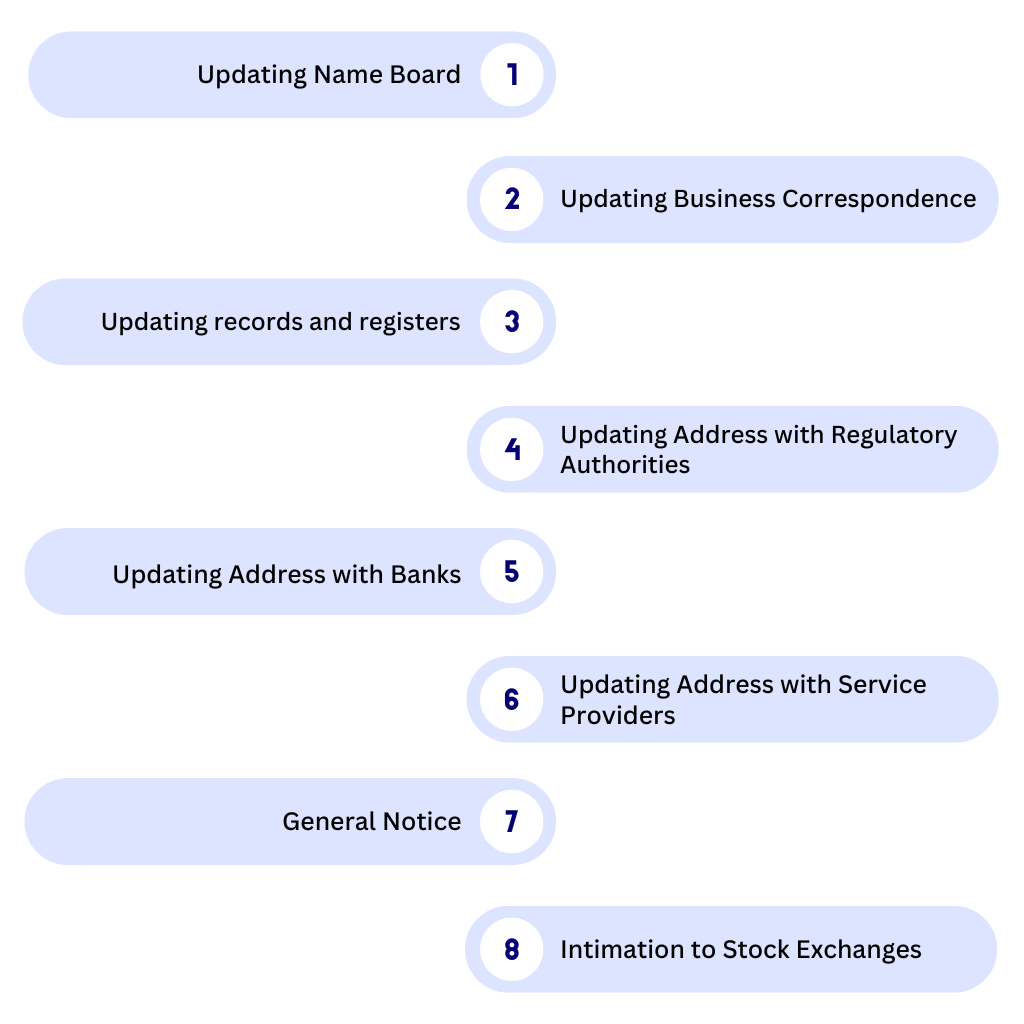

List of Compliances Post ROC Approval for Change in Registered Office

After receiving approval from the Registrar of Companies (RoC) for a change in the registered office address, the following compliances need to be carried out:

Updating Name Board

Display the new registered office address prominently on the name board outside every office and place where the company conducts business in visible and legible letters.

Updating Business Correspondence

Update the new registered office address in all business letters, billheads, letter papers, and official publications to ensure consistency and accuracy.

Updating records and registers

Update the new address of the registered office of the company on all records, registers, including the register of members, share certificates, etc

Updating Address with Regulatory Authorities

Notify and update the new address with all relevant regulatory authorities under various Acts such as Income Tax, GST, Provident Fund, Factories Act 1948, Gratuity, Shop and Establishments Act, Customs Act, Other Labour Laws, etc

Updating Address with Banks

Inform all banks where the company holds accounts about the change in registered office address to ensure smooth banking operations.

Updating Address with Service Providers

Notify and update the new address with service providers such as electricity, water, telephone, and internet connections to ensure uninterrupted services at the new registered office location.

General Notice

The company may optionally issue a general notice through advertisement in newspaper(s) to inform all members and concerned individuals about the change in the registered office address. This notice ensures that all future communications are directed to the company at its new address.

Intimation to Stock Exchanges

The listed companies should intimate change in registered office address promptly to the stock exchanges whether their securities are listed.

Details and Documents Checklist

Following is the broad list of details and documents required for change in registered office address:

| Sr.No | Documents |

| 1. | Proof of Registered Office address (Conveyance/Index II/ Property Tax Receipt/Lease deed/Rent Agreement etc.) |

| 2. | Utility Bills such as telephone, gas, electricity, etc. depicting the address of the premises in the name of the owner/document as the case may be which is not older than 2 months. |

| 3. | Photograph of Registered Office showing the external building and inside office also showing therein at least one director/ KMP who has affixed his/her Digital Signature to this form. |

| 4. | No Objection Letter from the owner of the premises |

| 5. | Certified Copy of Board Resolution r |

| 6. | Copy of Notice of General Meeting along with Explanatory Statement |

| 7. | Certified Copy of Special Resolution |

| 8. | The list of all other companies with their CIN, having the same unit/tenement/premises as their registered office address. |

| 9 | Copy of order of competent authority |

| 10. | Any other documents as required |

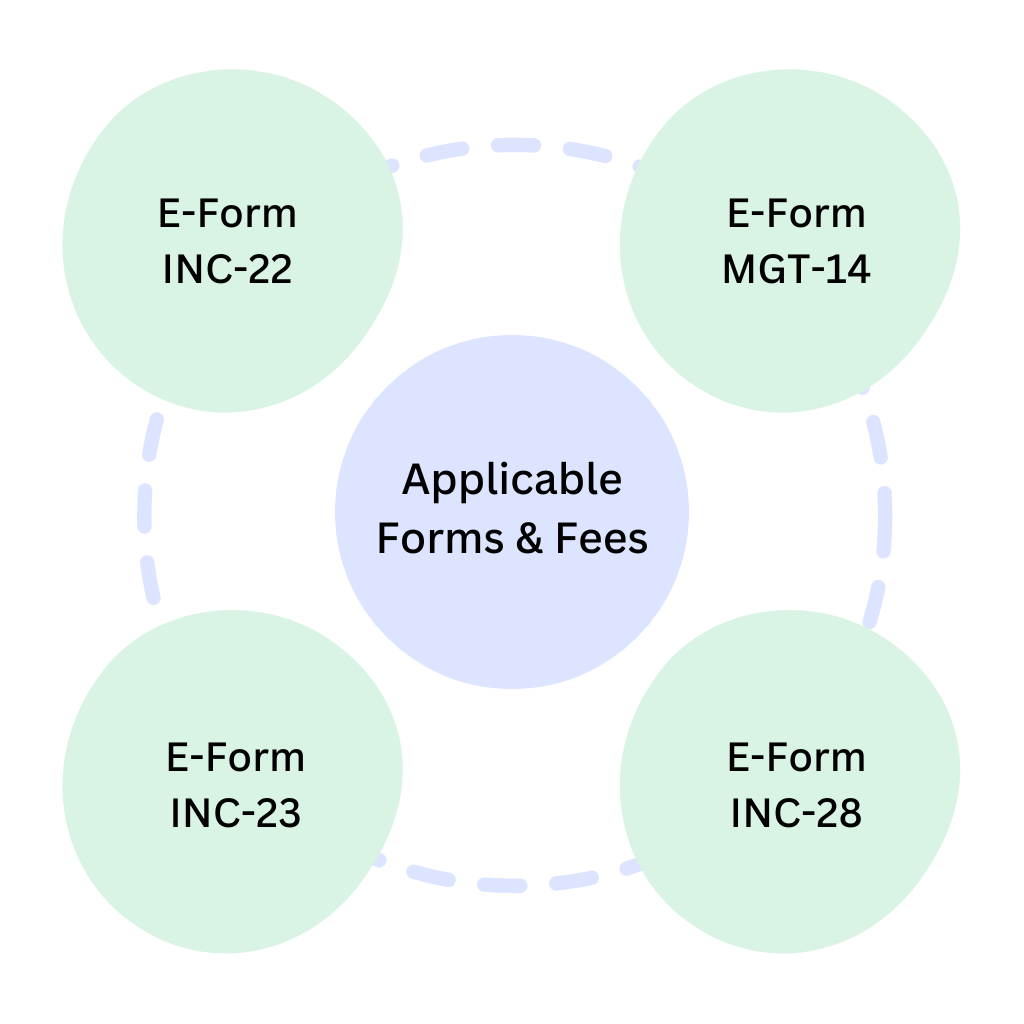

Applicable Forms and Fees

E-Form INC-22

E-Form INC-22 for intimation of change in registered office to the Registrar requires verification by a practicing professional, including the Company secretary (in full-time practice). Additionally, this professional must physically visit the new registered office address or premises of the company to verify its existence.

They are also required to certify that they have personally visited the new registered office address and confirm that the premises are indeed available for the applicant company’s use. E-Form No. INC-22 is an approval-based form.

The Government (ROC) Fees for filing E-Form INC-22 with the Registrar are as follows:

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

A fixed fee of Rupees (INR) 200 to be charged in case company is not having share capital.

E-Form MGT-14

Form MGT–14 is to required be filed with a certified true copy of the special resolution passed at the general meeting and the explanatory statement annexed to the notice of the general meeting. E-Form No.MGT-14 for change in registered office is a non- approval based form. The Government (ROC) Fees for filing E-Form MGT-14 with the Registrar are as follows:

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

A fixed fee of Rupees (INR) 200 to be charged in case company is not having share capital.

E-Form INC-23

Application in E-Form INC 23 (Approval based form) along with the supporting documents is required to be filed with the Regional Director by affixing DSC OF any Director/Manager/Company Secretary/CEO/ CFO of the Company by paying the following the government fees. The Government (ROC) Fees for filing E-Form INC-23 with the Regional Director are as follows:

| Application made | Other than OPC and Small Company | OPC and Small Company |

| ||

| Upto Rs 25,00,000 | 2000 | 1000 |

| Above Rs 25,00,000 but upto Rs 50,00,000 | 5000 | 2500 |

| Above Rs 50,00,000 but upto Rs 5,00,00,000 | 10,000 | N/A |

| Above Rs 5,00,00,000 but upto Rs 10,00,00,000 | 15,000 | N/A |

| Above Rs 10,00,00,000 | 20,000 | N/A |

| 2. By a company limited by guarantee but not having a share capital | 2000 | N/A |

| 3. By a company having a valid license issued under section 8 of the Act (Section 8 Company) | 2000 | N/A |

E-Form INC-28

A certified copy of the order of the competent authority in E-Form INC 28 (Non-approval based form for change in registered office) is required to be filed with the Registrar of Companies by affixing the DSC of any Director/Manager/Company Secretary/CEO/ CFO of the Company and certification by any practicing professional i.e., any whole-time practicing CA, CS or CWA. The Government (ROC) Fees for filing E-Form INC-28 with the Registrar are as follows:

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

Penal Provisions

- If there’s any failure to comply with the provisions of Section 12 of the Companies Act, 2013, both the company and any officer found in default will incur a penalty of Rs. 1000 per day for the duration of the default, with the total penalty not exceeding Rs 1,00,000.

- Additional government (ROC) fees in case of delay in filing E-Form INC-22, E-Form MGT 14, and E-Form INC 28:

| Period of delays | Additional fees as a multiple of normal fees |

| Up To 15 days | One time |

| More than 15 days and up to 30 days | 2 times of normal filing fees |

| More than 30 days and up to 60 days | 4 times of normal filing fees |

| More than 60 days and up to 90 days | 6 times of normal filing fees |

| More than 90 days and up to 180 days | 10 times of normal filing fees |

| Beyond 180 days | 12 times of normal filing fees |

Conclusion

The registered office of a company in India plays a crucial role in determining its domicile, which refers to the state of incorporation or its legal home. It is important for companies to maintain an accurate and up-to-date registered office address to ensure that they receive important correspondence and comply with legal requirements.

Changing the registered office address of the Company requires compliance to legal procedures and regulatory requirements. For expert guidance on changing the company’s registered office address in line with the Companies Act 2013, reach out to our team at the Registration Arena.

To get in touch with us, Please contact us