India’s finance sector is burdened by vast amounts of unpaid loans. These unpaid loans are also known as Non-Performing Assets (NPAs). They tend to raise loan rates and in turn affect the lower and the middle class most notably. To ease this burden there is one such mechanism in place. This mechanism helps the lower and the middle class people in the country who are troubled by their inability to raise loans or do so at feasible rates. This mechanism is known as a Nidhi Company. Before we dive in with the Benefits of a Nidhi Company, it is important for us to understand it thoroughly.

A Nidhi Company comes across as a very attractive option for people to get into the habit of savings. It helps its members get access to loans at a much lower rate and with a lot less hassle involved.

What is a Nidhi Company?

It is a company operating in the non-banking finance sector recognized under Section 406 of the Companies Act, 2013. Since it facilitates borrowing and lending only amongst its members, it is different from NBFCs. It is also known as Mutual Benefit Society. Its primary aim is to foster the habit of savings and to provide financial aid to its members. It revolves around the principle of mutual benefit & cooperation. It can prove to be very advantageous to people of lower and middle class since it would yield them better interest and at the same time they could take loans at lower rates. Since we know what a Nidhi Company is, let us discuss its functioning and governance before discussing the benefits of a Nidhi Company.

Nidhi companies are characterized by trust. They borrow and lend exclusively among their members. Additionally, they follow the traditional norm of lending by securing their loans with collaterals.

Governance of Nidhi Company

The Ministry of Corporate Affairs (MCA) regulates Nidhi Companies while the RBI has the authority to direct them in issues regarding deposit acceptance. These companies are governed under Nidhi Rules, 2014. They fall under Section 406 of the Companies Act, 2013. Their business structure comes under Section 20A of the Companies Act, 2013. Companies operating/recognized under the provisions of Section 620A of the Companies Act, 1956 are also considered to be the same. These do not require a license of the RBI. Their registration process is simple and not complicated. These are widely prevalent in South India, with the latter accounting for almost 80% of all the Nidhi Companies in the country.

Functioning of Nidhi Company

A Nidhi Company grants loans only to its members. These loans are granted for various purposes. They are often secured. Its functions are only to accept deposits and lend money. It has to abide by a few guidelines with regard to its business activities. Owing to the small scale of their business activities, the RBI has exempted Nidhi companies from various provisions of the RBI Act.

Nidhi Companies are heavily reliant on their members. Since their entire business revolves around them. Here the shareholders are both the owners as well as the customers of the company

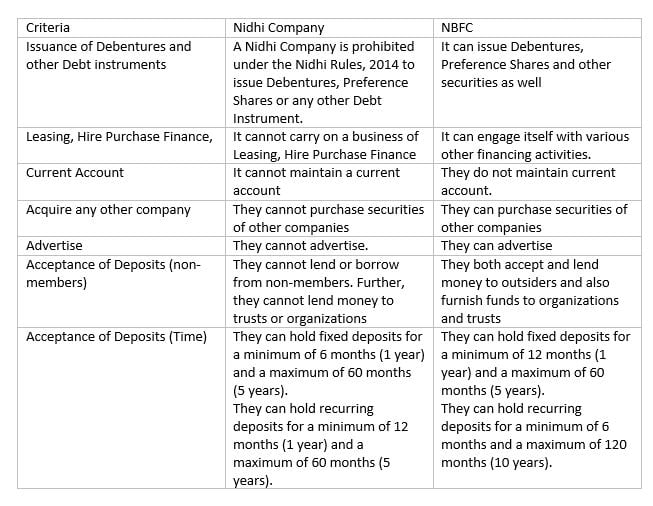

Difference between Nidhi Company and NBFC

A Nidhi Company is different from an NBFC owing to the differences between the two on grounds of registration, development of branches, etc. Moreover, the conversion of a Nidhi company into an NBFC is prohibited. This is due to the fact that a Nidhi Company cannot enter any other business other than those specified in Nidhi Rules, 2014. Take into account that while comparing with an NBFC, the benefits of a Nidhi Company may not seem very clear. However, from the standpoint of a small economic group it comes across as a very feasible option to cultivate the habit of saving.

Benefits of a Nidhi Company

Ease of incorporation:

It is easier to commence business in the NBFC sector as a Nidhi Company. A Nidhi company requires a paid-up equity share capital of 5 lakhs to begin with while an NBFC requires a net worth of 2 crores. Therefore it is easy to set up a Nidhi Company.

Ease of doing business:

A Nidhi Company elects 3 out of the minimum seven members as directors. Due to the small size of such companies and also. Their management is fairly easy.

Easier to obtain loans:

The members can get loans at lower rates as compared to the market and at the same time involve themselves with less formalities. The members can get higher returns on their savings as well.

Less paperwork and compliance:

The RBI gives exemptions to them on matters relating to yearly compliance and tax assessments. It gets registered in a short span of time ranging from a few days to a maximum of a few weeks. It is the only form of a loan company that does not require a license from the RBI.

Perpetual Succession/ Going Concern:

It can continue business even after the death/retirement/departure of its members since it’s a legal entity and can only be dissolved.

Basic Preliminary formalities:

It can be started with a minimum of 7 members and a minimum paid up share capital of Rs. 5 lakh which needs to be extended to Minimum of 200 members and capital of Rs. 10 lakh within 1 year of incorporation. Further, the capital can be invested within six months of registration. It also does not require a license from the RBI as mentioned above and also there is no maximum cap limit on number of members.

No outsider interference:

When compared with other financial institutions or other companies of similar nature, Nidhi companies fare better. These companies are both owned as well as managed by their members. Hence, these are effectively managed. They have little to no interference from the RBI and absolutely no intervention from outsiders .

Channelizing small savings:

They help their members channelize their small savings and earn attractive interest on them as well.

Community growth:

Since the lending and borrowing occurs within the members of the company, this promotes the community by adding to the wealth of its members as well as funding their business development, personal needs etc.

Low risk of non-payment of loans:

Since these societies function on trust, the risk of defaulting by the members is very low. Additionally, there is a collateral attached to the loaned amount hence the loans are secured. A member can take loans on the basis of the amount deposited in the company. This is the concept of Net owned funds and we discuss this point below as well as under the Guidelines – After incorporation.

Net Owned Funds:

It is an accounting concept. Net owned fund implies the aggregate of paid up equity share capital and free reserves as reduced by accumulated losses and intangible assets appearing in the last audited balance sheet.

Guidelines for a Nidhi Company

Though relatively less comprehensive, Nidhi Companies do have guidelines that they have to abide by. They have less formalities to comply with. There are a set of guidelines they have to abide by to ensure that they sustain and grow and not default on their payments. It is important to remember that the benefits of a Nidhi Company outweigh the formalities they comply with. However for informative purposes, let us take a glimpse at those guidelines:

At incorporation:

- A Nidhi company shall not issue preference shares and if it has shared any prior to incorporation, they have to be redeemed.

- It should not state any other objective of operation apart from that of promoting the habit of thrift and savings amongst its members, in its Memorandum of Association. (MoA)

- The words Nidhi Limited have to be used after the name of the company.

- The company must have a minimum of 3 directors. They directors should compulsorily be the members of the company

- The company must have at least 7 shareholders

After incorporation:

- It should have a minimum of 200 members

- Net owned funds (inclusive of paid-up share equity capital of Rs. 5 lakhs) should be more than or equal to Rs. 10 lakhs

- Ratio of Net Owned Funds to Deposit– Every Nidhi Company must maintain a ratio of 1:20 implying for every 1 unit of net owned funds, the deposit should be maximum 20 units. The ratio should not exceed 1:20

- Every Nidhi company must compulsorily invest and continue to keep invested, in unencumbered term deposits with a scheduled commercial bank (other than a co-operative bank or a regional rural bank), or post office deposits in its own name. The amount of this deposit should not be less than 10% of the deposits outstanding at the close of business on the last working day of the second preceding month.

- It should limit dividend to 25%. It means that the company can declare a dividend equal to or less than 25% of the face value of the share.

- The company cannot charge interest on the loan more than 7.5% above the highest rate of interest offered on deposits by Nidhi Company (For Example, If Nidhi Company provides interest at the rate of 5% on deposits then it can charge a maximum interest at the rate 12.5% (5% + 7.5%) on the loans disbursed.

- It can open new branches only if it earned a net profit after deducting tax continually for the previous 3 years.

- After 3 years, it can open up to 3 branches in the district. For opening more than 3 branches inside or outside of the district, it has to approach the Regional Director for the permission.

- When it comes to loans, Nidhi companies cannot lend personal loans (loans without security/collateral)

Conclusion

The credit facilities in India are abundant. A few examples of the numerous banks out there suited to serve a single cause or a specific type of consumer are Gramin Sewa banks, Regional Rural Banks, Small Finance Banks. However Nidhi Companies are suited for every class of consumer. Their development could help solve a lot of credit issues in India keeping in mind the benefits of a Nidhi Company. Considering these companies operate under a comparatively easy environment, Nidhi Companies have a huge potential for growth and could very well prove to be the catalyst as well as an active player in the financial growth of the lower and middle classes in India.

Source: Rbi.org.in