Introduction

The Articles of Association (AOA) is one of the crucial documents for forming a company and ensuring its ongoing operations. AOA are the bylaws or regulations that help to manage the company’s internal affairs and business conduct.

The Articles of Association serve a role subordinate to the Memorandum of Association and acknowledge the Memorandum of Association as the foundational document for the company’s incorporation. The term ‘articles’ refers to the articles of association of a company, whether they were originally drafted, modified over time, or adopted in compliance with previous company laws or the current Act.

This provision ensures that both the original articles drafted during the incorporation of the company and any subsequent alterations to those articles are considered equal.

Section 14 of the Companies Act, 2013 allows a company to alter its articles through a special resolution. Once altered, the updated articles must be filed with the Registrar of Companies within fifteen days, along with a printed copy. Any changes registered are legally binding as if they were originally part of the articles. Alteration of Articles can be done in the following ways:

- By adopting a new set of Articles

- By adding/inserting a New articles

- By deleting an Article

- By amending a specific Article

- By substituting a specific Article

- By entrenchment of Articles

Read more: Difference between MOA and AOA

Scenarios in which Alteration of Articles is required

Conversion of Private Company into Public Company

Subject to the provisions of the Companies Act, 2013 and conditions contained in its memorandum, if any a Company can alter its articles through a Special Resolution, resulting in conversion of Private Company into Public Company. If a private company alters its articles in such a manner that they no longer include the restrictions and limitations which are mandated to be included in the articles of a private company under the Companies Act, 2013 the company shall cease to be a private company from the date of such alteration,

Read more: Conversion of Private Company into Public Company

Conversion of Public Company into Private Company

Subject to the provisions of the Companies Act, 2013 and conditions contained in its memorandum, if any a Company may by a Special Resolution, alter its articles including alterations having the effect of conversion of a Public Company into a Private Company.

Any alteration that results in the conversion of a public company into a private company is not valid unless it is approved by an order of the Central Government. This requires an application to be made in E-Form INC-27.

Alteration in any of the existing Articles

Any Company which intends to make any change to the Article of Association of its company can alter its Article by way of addition, deletion, modification, substitution, or in any other way, only if it wants by taking approval of the shareholders through special resolution.

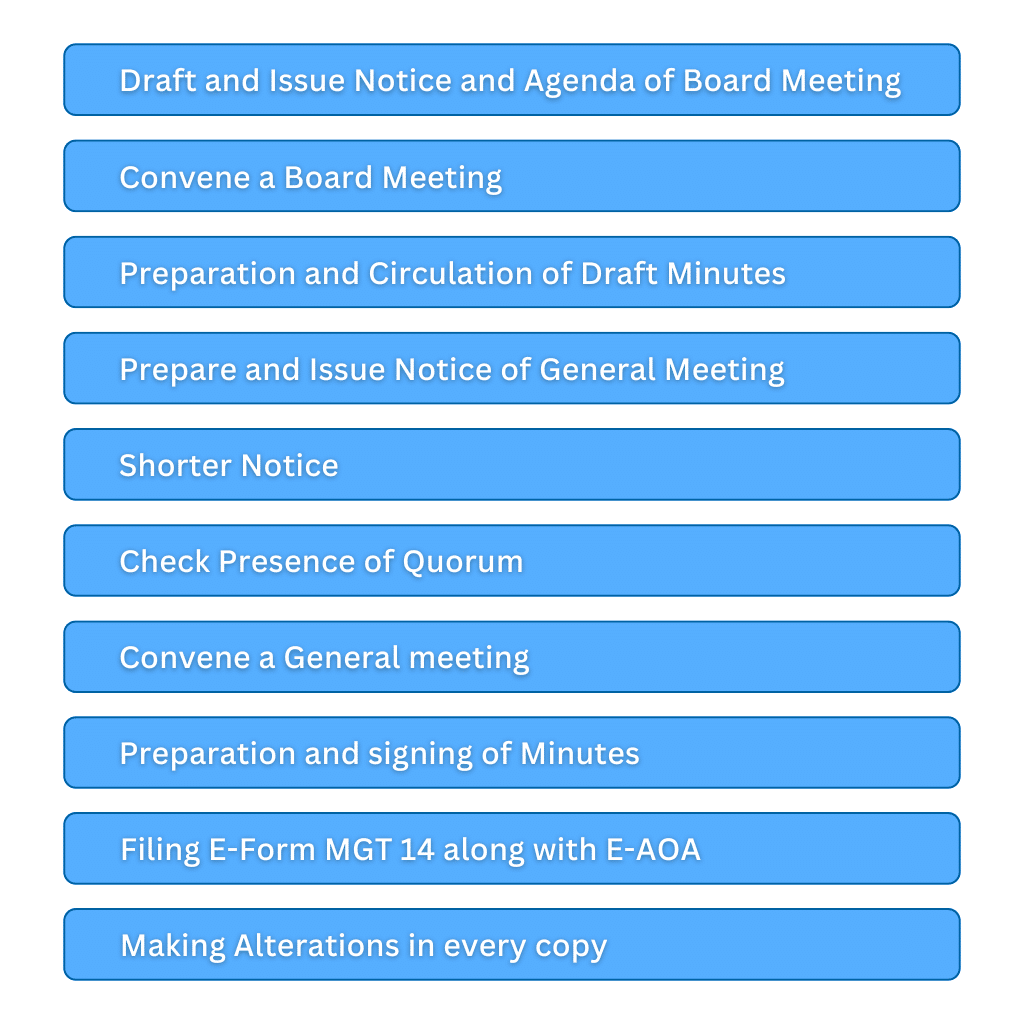

Procedure for Alteration of Articles

Draft and Issue Notice and Agenda of Board Meeting

Prepare and issue notice calling Board Meeting to all the directors at their addresses registered with the company at least 7 days before the date of the Meeting by hand or by speed post or by registered post or by facsimile or by e-mail or by any other electronic means. A Board Meeting can be called at shorter Notice to transact urgent business subject to certain conditions.

Convene a Board Meeting

Holding a Board Meeting and pass Board Resolutions for the following:

(i) Determine which articles need to be amended and formally resolve to proceed with the alterations.

(ii) Fix the time, day, date, and venue for convening a general meeting of the company to pass a special resolution in accordance with Section 14 of the Companies Act, 2013.

(iii) Approve the notice, agenda, and explanatory statement to be attached to the notice of the general meeting, as mandated by Section 102 of the Act.

(iv) Authorise any Director or any other person to issue the approved notice of the general meeting as authorized by the Board.

Preparation and Circulation of Draft Minutes

The draft minutes should be prepared and circulated to all directors for their review and comments within 15 days from the conclusion of a board meeting. Directors are required to provide their comments, if any, within 7 days from the date of circulation of the draft minutes.

Prepare and Issue Notice of General Meeting

Prepare and issue a notice in writing calling a General Meeting by giving at least 21 days clear notice to all the members, directors, and Auditors of the Company by hand or by ordinary post or by speed post or by registered post or by courier or by facsimile or by e-mail or by any other electronic means. The notice should clearly state the venue, date, day, and time of the meeting. An explanatory statement must be annexed with the Notice of the meeting.

Shorter Notice

The general meeting can be called at shorter notice subject to the following:

- In case of AGM, consent of not less than 95% of the members entitled to vote is required.

- In case of any other general meeting, consent of at least a majority in number and 95% of such part of the paid-up share capital of the company giving a right to vote at such a meeting is required.

Check Presence of Quorum

Requisite Quorum as per Section 103 of the Companies Act 2013 and Secretarial Standards 2 is required to be present not only at the commencement but throughout the meeting, Unless the Articles prescribe for a higher number, the Quorum for general meetings shall be as follows:

For Public Companies

| Number of Members as of the date of meeting | Quorum |

| Not more than 1000 | 5 members personally present |

| More than 1000 but upto 5000 | 15 members personally present |

| More than 5000 | 30 members personally present |

For Private Companies

| Number of Members as of the date of meeting | Quorum |

| In case of a private company | 2 members personally present |

Convene a General meeting

Hold a general meeting and pass a special resolution for alteration of Articles of Association.

Preparation and signing of Minutes

Minutes of General Meeting shall be prepared, entered, and signed in the Minutes Book within thirty days from the date of conclusion of the Meeting as per Section 118 of the Companies Act 2013 and Secretarial Standards 2.

Filing E-Form MGT 14 along with E-AOA

The company is required to file E-Form MGT 14 on the MCA Portal along with E-AOA and necessary attachments by paying requisite fees. Alteration in the Articles are required to be made in E-AOA.

Making Alterations in every copy

Make necessary alteration in all the copies of the articles of association of the company lying in the office of the company.

Note: If a company fails to comply with the above requirement, both the company and the officer in default shall be levied a penalty of Rs 1000 for each copy of the memorandum or articles issued without the necessary alteration.

Entrenchment of Articles

The term “entrenchment” is not explicitly defined in the Companies Act, 2013, although it was introduced in this legislation. In the absence of a statutory definition, we can refer to the Oxford Dictionary, which defines entrenchment as “the fact of something being strongly established.”In legal terms, entrenchment refers to the inclusion of provisions that make amendments to the articles of association either more difficult or nearly impossible.

Entrenchment involves including provisions that can only be altered if conditions more restrictive than those applicable to a special resolution are met. Entrenchment makes certain articles more rigid and harder to change, providing greater stability for those provisions.

The provisions for entrenchment shall only be made either on the formation of a company or by an amendment in the AoA agreed to by all the members of the company in the case of a private company and by a special resolution in the case of a public company.

Entrenchment provisions can be beneficial for various types of companies or parties seeking to safeguard their interests which are as follows:

- Joint Venture Companies

- Companies that have received private equity investment, angel investment, or venture capitalist funding

- Start-ups

Details and Documents Checklist

Following is the broad list of details and documents required for change in registered office address:

| Sr.No | Documents |

| 1. | Copy of Notice of General Meeting along with Explanatory Statement |

| 2. | Certified Copy of Special Resolution |

| 3. | Copy of Altered Articles of Association (E-AOA) |

| 4. | Shorter Notice Consent, if any |

Applicable Forms and Fees

E-Form MGT-14 :

Form MGT–14 is required to be filed with a certified true copy of the special resolution passed at the general meeting, the explanatory statement annexed to the notice of the general meeting, and E-AOA. E-Form No.MGT-14 for Alteration of Articles is an approval-based form. Following are the Government (ROC) Fees for filing E-Form MGT-14 with the Registrar :

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

In case a company is not having share capital, a Fixed fee of Rupees (INR) 200 is applicable.

Conclusion

The articles of association serve as the by-laws or rules and regulations governing the internal management and business conduct of a company. They are designed to implement the objectives outlined in the Memorandum of Association.

A company intending to change its Articles of Association (AOA) must adhere to Section 14 of the Companies Act, 2013, along with other relevant provisions of the Act and applicable rules. Changes to the AOA can be made through addition, deletion, modification, substitution, or any other method, if desired.

Additionally, every alteration made to the articles must be recorded in every copy of the articles.

To get assistance with drafting altered clauses of your Articles of Association and ensuring compliance with the Companies Act 2013, Contact our team at Registration Arena today!

FAQs

What is the legal effect of registering alterations to the articles of association under the Companies Act, 2013?

Any alteration registered shall be deemed valid, subject to the provisions of the Companies Act, as if it were originally part of the articles of association.

What flexibility do companies have in setting provisions in their articles of association?

Companies have the flexibility to set provisions in their articles of association as long as they comply with the provisions of the Act. For instance, if the Act specifies that a particular business can be transacted with an ordinary resolution, the articles may require a special resolution instead. Similarly, if a public company is mandated to provide 21 days’ notice for a general meeting by the Act, its articles can stipulate 30 days’ notice. However, the articles cannot permit less than 21 days’ notice for such meetings.

Is stamp duty required for alterations made to the Articles of Association (AOA)?

Stamp duty is not required for alterations to the Articles of Association. The Act mentions that alteration in the AOA can be made by passing a special resolution and therefore does not necessitate stamping.