Introduction

The Ministry of Corporate Affairs (MCA) has made it obligatory for specific categories of companies to submit their financial statements in XBRL format, utilizing the XBRL taxonomy i.e. electronic dictionary of the reporting concepts.

XBRL is a short form for Extensible Business Reporting Language, XBRL is the globally preferred language for exchanging information via the Internet. XBRL is formed for businesses, analysts, investors, and regulators to easily share financial information in a common electronic format.

It does not change the content being reported; rather, it transforms how it’s reported It facilitates electronic communication of business and financial data, revolutionizing global business reporting. By providing a common language for financial reporting, XBRL facilitates better comparison and analysis of data, enabling investors, analysts, and regulators to make more informed decisions.

How does XBRL function?

XBRL helps make data easy to read with two key documents: the Taxonomy and the instance document.

An XBRL document has two main parts:

- Taxonomy: This is like a dictionary that describes and classifies business and financial terms.

- Instance Document: It’s where the real numbers and facts are written down.

Together, these two parts make up the XBRL document, helping to organize and present financial data in a standardized way.

It brings significant benefits such as cost savings, improved efficiency, and enhanced accuracy and reliability in preparing, analyzing, and sharing business information. One of the key advantages of XBRL is its ability to streamline the reporting process, making it more efficient and cost-effective for companies, regulatory bodies, and other stakeholders.

By providing a common language for financial reporting, XBRL facilitates better comparison and analysis of data, enabling investors, analysts, and regulators to make more informed decisions.

Features of XBRL

Standardized Format

XBRL provides a standardized language for reporting financial data.

Tagging

Financial data is tagged with unique identifiers, making it machine-readable.

Flexibility

XBRL can be customized to suit various reporting requirements.

Accessibility

It enables easy access to financial data for stakeholders.

Accuracy

Helps improve accuracy and reliability by reducing manual entry.

Efficiency

Streamlines the process of preparing, reviewing, and analyzing financial reports.

Regulatory Compliance

Many regulatory bodies including MCA (Ministry of Corporate Affairs) require XBRL filing for financial reporting.

Less Errors

By automating processes, XBRL reduces mistakes in financial reporting.

Global Use

It’s used worldwide by companies and regulators for consistent reporting.

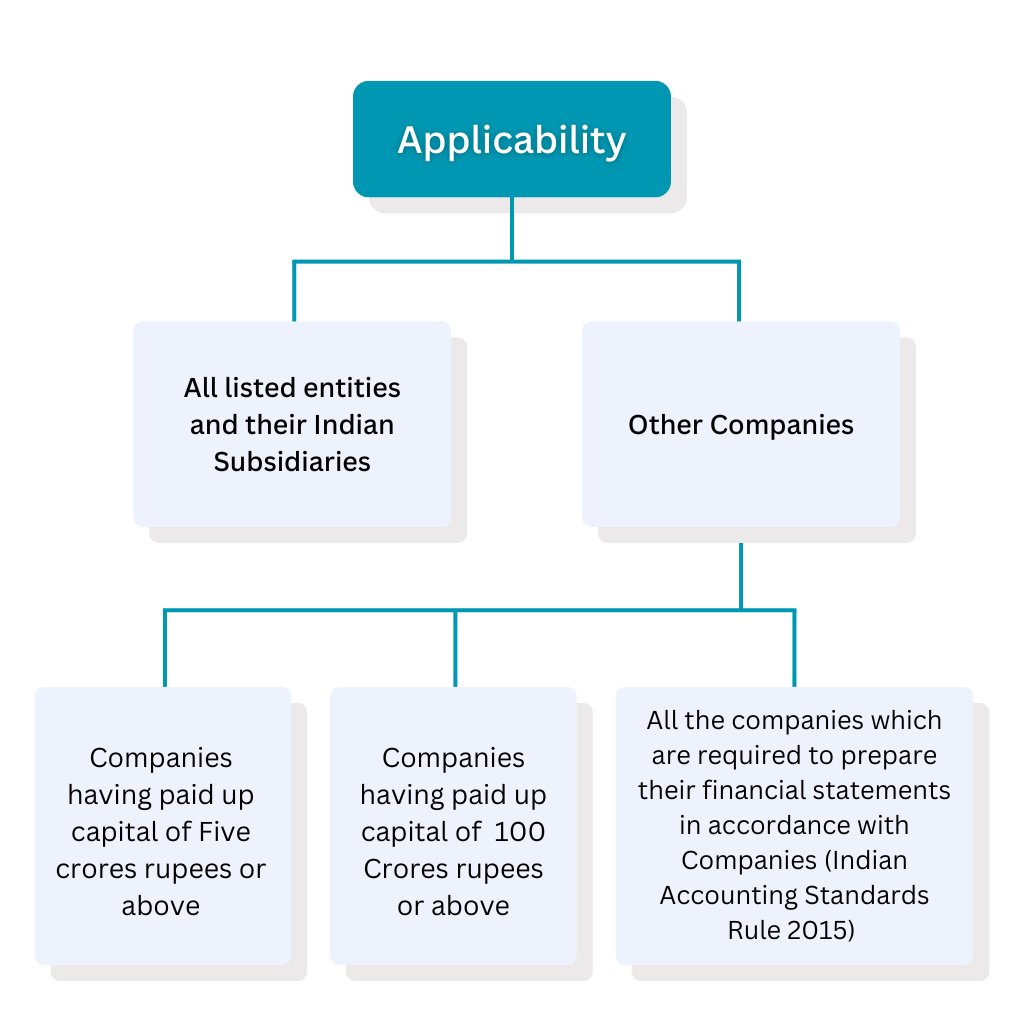

Applicability under the Companies Act,2013

Companies falling under the following categories are required to file their financial statements and other documents using the E-form AOC-4 XBRL:

- Companies listed on Indian stock exchanges and their Indian subsidiaries.

- Companies with a paid-up capital of Rs 5 Crores or more.

- Companies with a turnover of Rs 100 crores or more.

- All companies that are mandated to prepare their financial statements following the Companies (Indian Accounting Standards) Rules, 2015. (INDAS 2015)

Documents Checklist for XBRL Filing

Following is the list of documents required for XBRL filing:

- Board’s Report

- Standalone Balance Sheet, Profit & Loss Account, Cash Flow Statement, schedules related to the Balance Sheet and Profit & Loss Account, as well as Notes to Accounts.

- Consolidated Balance Sheet, Profit & Loss Account, Cash Flow Statement, schedules related to the Balance Sheet and Profit & Loss Account, as well as Notes to Accounts, if any

- Significant Accounting Policies

- Independent Audit Report along with CARO Report

- Secretarial Audit Report

- Corporate Governance Report for listed companies

- Any other necessary documents and information such as Company information such as contact no, email ID, PAN, Auditor’s information, Turnover bifurcation along with codes.

Procedure for XBRL Filing

Prepare Documents

Gather the Auditor’s Report, Financial Statements, and Board’s Report.

Tag Financial Elements

Match each financial element in the company’s financial statements with a corresponding element in a published taxonomy.

Create XBRL Instance Document

Use the tagged data to create an XBRL Instance Document.

Download XBRL Validation Tool

Get the XBRL Validation Tool from the MCA Portal.

Upload and Validate

Upload the Instance Document to the validation tool and check for any arithmetic errors.

Pre-Scrutinize

Perform pre-scrutiny of the Instance Document for accuracy and completeness.

Convert to PDF and Verify

Convert the Instance Document to PDF format and verify that all information is correct.

Attach to E-Form AOC-4 XBRL

Attach the Instance Document to the E-Form AOC-4 XBRL.

File on MCA Portal

Submit the E-Form AOC-4 XBRL on the MCA Portal for filing.

View Submitted Documents

After filing, check the Balance Sheet and Profit & Loss statements submitted in XBRL form on the MCA Portal.

Timelines for E-Form AOC 4 XBRL Filing

| Particulars | Timeline |

| Financial statements, including consolidated financial statement, if any, along with all the documents adopted at AGM of the Company held within the due date i,e 30 September | Within 30 Days from the date of the AGM |

| When the AGM is adjourned | Within 30 days of the adjourned meeting |

| When the Financial statements are not adopted at the AGM | Within 30 days of the AGM. It is considered as provisional until the duly adopted financial statements are filed. |

| AGM is not held | Within 30 days from the date of the AGM on which it should have been held |

Fees for filing E-Form AOC-4 XBRL

| Nominal Share Capital | Fees Applicable (Rs) |

| Less than 1,00,000 | 200 |

| 1,00,000 to 4,99,999 | 300 |

| 5,00,000 to 24,99,999 | 400 |

| 25,00,000 to 99,99,999 | 500 |

| 1,00,00,000 or more | 600 |

In case a company is not having a share capital, a Fixed fee of Rupees (INR) 200 is applicable.

Additional fees:

| Period of Delay | Additional fee payable (in Rs.) |

| Delay beyond above-mentioned timelines as per Section 137 (1) of the Companies Act,2013 | Rs 100 per day |

Read more on penalty: Form AOC 4 – Applicability, Purpose, Due Date and Penalty

Exemptions for XBRL Filing

The following category of companies is exempted from filing financial statements in XBRL mode:

- Non-banking financial companies,

- Housing finance companies and

- Companies engaged in the business of the Banking and Insurance sector

XBRL for Cost Audit Report Filing

Companies that are required to submit cost audit reports and related documents to the Central Government under section 148(6) of the Act and Companies (Cost Records and Audit) Rules, 2014, must utilize the XBRL (Extensible Business Reporting Language) taxonomy outlined in Annexure-III for financial years starting from April 1, 2014, onwards in E-Form CRA-4 specified under the Companies (Cost Records and Audit) Rules, 2014.

Conclusion

Section 137 of the Companies Act,2013 and with Companies (Filing of documents and Forms in XBRL) Rules, 2015 has mandated XBRL filing for companies meeting the specified criteria.

Using XBRL for filing brings simplicity and efficiency to data management and reporting. It helps companies gather data easily from different divisions, create various reports quickly, and ensure accuracy through software checks. Ultimately, XBRL makes reporting smoother, more accurate, and compliant with regulations.

In case of any queries or doubts or for any assistance in XBRL Filing, you can Contact us. Registration Arena will be delighted to serve you in this process.

FAQs

How do companies create statements in XBRL?

Companies have the choice to generate their XBRL documents internally or appoint a third-party provider. Additionally, XBRL-aware accounting software solutions are available to support the export of data in XBRL format.

Which vendors offer services related to XBRL software?

Following are some of the popular vendors that provide services related to XBRL Software:

- Webtel Electrosoft Pvt. Ltd

- SAG Infotech Private Limited

- MicroVista Technologies

- IRIS Business Services Limited

- TAXMANN Allied Services Private Limited

Which taxonomies are designed for Indian reporting requirements?

Taxonomies for Indian companies are designed based on the requirements of

- Schedule III of the Companies Act

- Accounting Standards, issued by ICAI

- SEBI Listing requirements.

Taxonomies for the Manufacturing and service sector (referred as Commercial and Industrial, or C&I) and Taxonomies for INDAS (referred to as INDAS).

Does the company need to file financial statements using the XBRL taxonomy for the current financial year if it hasn’t fulfilled any conditions outlined in Section 137 of the Companies Act, 2013?

A company previously filing its financial statements in XBRL format under either the Companies Act 1956 (23AC/23ACA/Other XBRL documents) or the Companies Act 2013 (AOC-4 XBRL or Other XBRL documents) must continue to file its financial statements and other documents in XBRL format, regardless of whether it meets the criteria in subsequent years.