What is a small company?

Small Company is introduced in Section 2(85) of the Companies Act, 2013. It was introduced so as to relieve small companies from the compliance of the larger ones. A company is considered to be a small company if it matches certain criteria (as discussed below). The qualification criteria is on grounds of paid-up share capital and the turnover according to the last year’s profit and loss account. They also have less norms to comply with owing to their small size. Below, we discuss the grounds for qualification and relaxations given to a Small Company as per Companies Act, 2013.

Grounds for qualification as a small company as per Companies Act, 2013:

- Paid up share capital should not exceed 50 lakh rupees or the higher limit prescribed for this ground.

(Provided that the higher limit shall not exceed 5 crore rupees)

- Turnover shall not exceed 2 crore rupees or the higher limit prescribed for this ground.

(Provided that the higher limit shall not exceed 20 crore rupees)

Both the above grounds were to be met for a company to qualify as a small company.

Earlier as per Companies Act, 2013, the limit prescribed for paid-up share capital was Rs.50 lakhs (which could be raised to Rs.5 crore) and turnover was Rs.2 crore (which could be raised to Rs.20 crore). In Companies Amendment Act, 2017 the limit prescribed for paid-up share capital has been increased to 10 crore Rupees and turnover was 100 crore Rupees respectively.

A gazette notification issued by the Ministry of Corporate Affairs dated 13th February, 2015, states: “in section 2, in clause (85), in sub-clause (i), for the word “or” occurring at the end, the word “and” shall be substituted”. This means that only a company which meets both the criteria for eligibility will be considered a small company and meeting only one condition would not suffice.

The difference is that a Company with Capital of 1 lakh and turnover of 100 Crores was previously considered to be a small company and a Company with Capital 50 Crores and Turnover of 5 lakhs was also considered to be one. But after amendment in 2015, only the companies meeting both the criteria were considered to be a small company.

Exceptions:

The following companies are not to be considered small companies-

- Holding or Subsidiary company

- Public Limited company

- Companies registered under Section 8 of the Companies Act. (Companies with Charitable Purpose)

- Any company or body corporate governed by any special Act (Such as Life Insurance Corporation (LIC) setup under LIC Act 1956 or State Bank of India (SBI) under SBI Act 1955)

An interpretation of the relaxations provided to small companies:

- Only private limited companies are eligible to fall under the domain of small companies. In the growth process, when a company crosses either of the two thresholds, it would no longer be considered a small company and would have to give up the relaxations of its previous status. This also means that the company has to meet the above requirements each year.

- However, the status of a company can fluctuate. For instance, the company can report revenue above the prescribed limit one year and report revenue below the limit the very next year (assuming that the paid-up share capital remains under the limit prescribed for it). With the changes, the company status would also change and it would have different compliance depending on the current status.

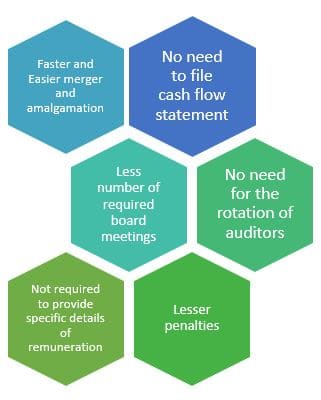

Benefits and Exemption for Small Companies:

- Small Companies can file the financial statements without filing Cash Flow Statements. (Exemption under Section 2(40))

- Their merger and amalgamation process is fast-track and does not go through the formalities of a traditional merger & amalgamation.

- In a small company, the board of directors can meet twice in a year (once in each half) instead of four times (as is the case of other companies). It has to make sure that the gap between the meetings is not less than 90 days.

- A small company need not rotate its auditors

- The annual return of a small company can be signed by a Company Secretary or by any one of its Directors.

- They are not required to provide the specific remuneration paid to their directors and other top level executives rather they are required to furnish only the aggregate amount paid.

- Under Section 446(B) of the Companies Act, 2013, they attract lesser penalties for putting on a disobeying conduct.

Strategic Importance of a Small Company for the Economy –

Small companies play an integral role in supporting the economy. They often act as troubleshooters for the society they are based out of. Since they tackle small-scale or local problems. These companies contribute taxes and at the same time offer employment to the region they operate in. They promote entrepreneurial spirit and often times aid the government in supplying necessities to the community.

Small companies can target problems of the consumers which the large companies just cannot. Due to their small size, they can adapt to the changing environment. and the changing habits of the consumers. They can easily adopt habits which are the most beneficial and profitable to them. They often handle certain business functions of the larger firms and thus contribute to their smooth functioning as well. The large firms can outsource some part of their work to small companies. As a result, they act as a catalyst for the growth and development of the community. Owing to these reasons, the government has given such exemptions to small companies.

Conclusion

Small companies play an important role in reducing unemployment and in the advancement of the economy. It is thereby important to ensure that the management of such an entity goes on smoothly without much intervention or outside hindrances. Keeping this in mind, the government’s relaxations come as a boon for such companies. However, it is also important for small business owners to know about the provision of a small company as per companies Act. to know about these relaxations so that they could make full use of them.