A Limited Liability Partnership (LLP) is a relatively new form of business entity. It was introduced in the year 2008 through the Limited Liability Partnership Act. An LLP is a combination of a company and a partnership since it shares a lot of common traits with the two. In previous articles, we covered: the list of documents required for LLP registration and the process of LLP registration. In this article, we explain the process to close an LLP in India.

LLPs are relatively easy to incorporate and feature limited liability for their members. They offer various advantages as compared to other business entities. However, these advantages have little to do with the conduction of business. Smooth incorporation does not guarantee a great business. In times of economic uncertainty and other business-related problems, it is best to initiate closure. We explain the Strike Off method of closure in the article and give a glimpse of all the other types of closure.

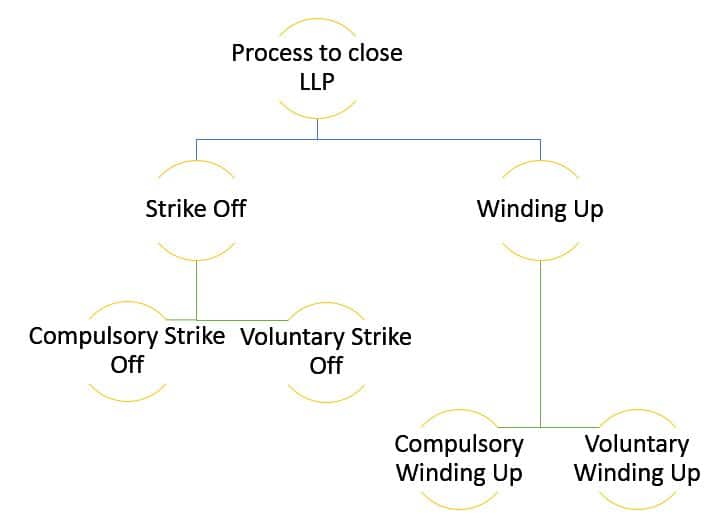

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

Strike off

a) Voluntary Strike Off

To opt for Strike Off method of closure, LLPs must meet the following grounds of eligibility:

- Not been in commercial operation for at least one year. To apply for voluntary strike off status, the LLP must file an application in Form 24 LLP and submit the same to the Registrar of LLPs.

- The LLP must have made all the compliance till the date of filing for closure. However it needs to file annual returns only until the end of the year it stopped commercial operation It must have obtained the consent of all the parties involved. Members, creditors and any or all regulatory authorities. (the domain of which the LLP lies under)

- The LLP must not have any assets or liabilities on the date of preparation of financial statements.

Process to close LLP through Strike Off method

- LLP schedules a meeting of all the partners. A resolution to strike off the name will be passed.

- The LLP will settle all debts it owes to its creditors. It has to extinguish all its liabilities.

- The meeting will also authorize a designated partner to file the application.

- The applicant has to file an application in e-Form 24. This has to be submitted to the Registrar. The application must have the consent of all the members.

- Attached with Form 24 are the following documents:

- Statement of Accounts – Prepared less than 30 days from date of application. It must be certified by a practicing CA.

- Copy of latest Income Tax return

- Certificate of bank account closure

- Copy of LLP’s resolution

- Affidavit by which the members claim the LLP has no creditors or Liability

- Indemnity Bond

- Affidavit by the designated partners

- Copy of detailed application

- Copy of the initial limited liability partnership agreement

- An NOC has to be filed if the LLP falls under the domain of any regulatory authority

- Following this, the registrar of Companies initiates the closure of the company.

b) Compulsory closure of a Defunct LLP through Strike Off method-

The Registrar of LLPs has the power to bring about the closure of any LLP. The former can strike off a defunct LLP: if it has not carried out any business for a period of 2 years and he has enough reason to do so.

Process of closure through Compulsory Strike Off method

- The Registrar will notify the members of the LLP of the same.

- They will be given the opportunity to state their side of the argument.

- If the LLP fails to get back to the Registrar within the stipulated time the process will be carried on.

- He shall then publish the notice of the LLP’s closure on its website for a period of one month.

- Receiving no objections, the name will be struck off.

- A notice will be published in the Official Gazette regarding the same and the LLP shall stand dissolved from the date of the notice.

Winding up

Winding up is done in cases where the LLP does not qualify as defunct. Sections 63 to 65 of the Limited Liability Partnership Act, 2008 govern the process of an LLP’s winding up. Under this form of closure, there are two possible instances: Voluntary Winding Up & Compulsory Winding Up.

a) Voluntary winding up

When the members of an LLP want to bring about its closure, it is known as voluntary winding up.

To initiate the closure through this method:

- The LLP needs to pass a resolution. At least three-fourths of the total partners must consent to it.

- A replica of the resolution passes shall be filed with the Registrar. It must be done through Form 1 within 30 days of the resolution’s passing.

- It should also file Form 2 which states that they do not have any debts or the debts that they do have will be made good within one year from the date of the passing of the resolution.

- Within 14 days of the resolution’s passing, the LLP must advertise in a newspaper the details of its closing.

- It should then appoint a liquidator for the purpose of liquidation of the assets and settlement of the liabilities.

Note: the creditors have the option to appoint a liquidator. If there isn’t any liquidator appointed by both the LLP and the creditors then the Tribunal shall appoint a liquidator.

- Another resolution should be passed which approves the report filed by the liquidator.

- The latter shall file this report through Form 9.

- The partners and the creditors of the LLP will then approve to closure.

b) Compulsory winding up

The Tribunal or the Registrar can initiate the closure of an LLP. Above in the article, we discussed how the Registrar initiates the closure of a defunct LLP through the Strike Off method. Here, we discuss the grounds on which the Registrar or the Tribunal closes a functioning LLP. Note that the LLP is not struck off rather it is wound up and liquidated. This is different from the Strike Off method as it is much simpler.

Grounds of compulsory LLP winding up-

- If the LLP decides to be wound up by the Tribunal

- Has only one member for more than 6 months

- Inability to pay debts

- If it acted against the State’s or the Nation’s interests

- Defaulted in filing the Statement of

- In case the Tribunal sees it fit to wind up the LLP

Conclusion

The closure of business is the last resort. Though the closure of LLP is simpler than the closure of companies, only after considering every alternative should the members initiate the process to close LLP. If the members are willing to cease operations for a while or take a hiatus, it is better to obtain defunct status than file for closure. However, if the decision is certain then the members can avail the services of Registration Arena. We help streamline the process of closure for our users. Reach out to us for any help.