Introduction

In India, there are different forms of business organizations such as Sole proprietorship, Partnership, Company, Limited Liability Partnership (LLP), Private Limited Company, etc., and every form has its own advantages and disadvantages. Also, the process of Private Limited Company Registration has become simpler nowadays as most of the authorities offer the facility of online incorporation.

Although registration of some forms of business organization is not mandatory, it is always advisable to register a business with the respective authority as registration offers several benefits.

What is a Private Limited Company?

On the basis of the transferability of shares, companies are divided into two broad categories: Public Company and Private Company.

In general, private limited companies are formed by businesses that choose to operate at a small scale or are owned by members of the same family. In India, it is one of the most common types of business organizations. Such companies are governed by the Companies Act of 2013.

Section 2(68) of the Companies Act, 2013

Section 2(68) of the Companies Act, 2013 provides the definition of a Private Company. Accordingly, a Private Company is a company that has a minimum paid-up share capital as prescribed in rules and has the following restrictions/limitations/prohibitions in its articles of association –

Following are some points that must be kept in consideration in relation to the above restriction/ limitation/ prohibition –

1) The limit of a maximum number of members shall not apply in the case of One Person Company (OPC) as there is a single member in an OPC.

2) If shares of a private company are held jointly by two or more persons, then such person(s) shall be considered a single member.

3) Present and past employees of the company who are members of the company as well, shall not be counted while determining the total number of members.

Note: Currently, no minimum paid-up share capital is prescribed in the rules for companies.

Characteristics of a Private Limited Company

The following are the characteristics of a Private Limited Company –

Directors

A private limited company shall have at least 2 directors and a maximum of 15 directors.

Read more: Who can become a director in a company?

Members

A private limited company shall have at least 2 members and a maximum of 200 members.

Separate Legal Entity

A company, whether public or private, is considered a separate entity in the eyes of the law. It can enter into transactions on its own and can sue or be sued.

Perpetual Succession

It simply means that members may come and members may go, but the company goes on forever. The existence of a company is unaffected by situations like death, bankruptcy, insanity of a member, etc.

Limited Liability

The shareholders of a private limited company are not personally liable or responsible for losses of the company. They are only liable up to the extent of the unpaid amount on the shares held by them.

Requirements to Start a Private Limited Company

Prior to online registration of a private limited company, the following requirements shall be complied with –

Name

A private limited company must keep in mind the following things before selecting a name and sending it to the Registrar of Companies (ROC) for approval –

- The name shall contain the words ‘Private Limited’—for example XYZ Solutions Private Limited.

- It should not resemble the name of an existing company.

- It should reflect the activities to be carried out by the company. For example, if a company is formed for providing transportation services, then it can have ‘movers’, ‘distributors’, ‘carriers’, etc in its name.

DIN and DSC

Minimum 2 directors are required to start a private limited company out of which one director shall be a resident of India. However, all the directors shall have a valid Director Identification Number (DIN) and Digital Signature Certificate (DSC). DSC is required as a private limited company registration process is done through online mode.

Members

A minimum of 2 members are required to start a private limited company. Maximum, there can be 200 members.

Registered Office

It is necessary to have a registered office to start a private limited company where all the operations will be carried out and to which all the correspondence can be sent.

Advantages of Private Limited Companies

The following are the benefits of Private Limited Companies –

Lesser Compliances

Companies Act, 2013 provides several relaxations to private companies. Therefore, such companies enjoy the benefits of lesser compliance.

Taxation Benefits

Another benefit of starting a private limited company is that it gets various taxation benefits. For example, as per Section 80 IAC of the Income Tax Act, 1961, if a startup is registered as a Private Limited Company and is carrying out a qualified business then it can get a deduction of 100% of profits and gains from such qualified business for 3 consecutive years out of 10 assessment years starting with the year of incorporation.

Benefits of Company Structure

A private limited company gets all the benefits of a company form of business such as a Separate Legal Entity, Perpetual Succession, Limited Liability, etc.

Access to Funds

It is easier for a private limited company to raise funds as it is considered trustworthy and reliable by investors.

Read more: Private Ltd Company Vs LLP

Disadvantages of Private Limited Companies

Following are the disadvantages of Private Limited Companies –

Restrictions in Share Transfer

A private limited company restricts the free transfer of shares by its articles. It is permitted to do so, but there are various requirements that must be complied with before shares are transferred.

Increased Compliance Cost

Company form of business brings along several compliances and increased compliances means an increase in cost. Apart from the one-time cost of incorporation, it is mandatory for a company to file certain forms and get its accounts audited every year.

Limited Funds

As a private limited company cannot issue a prospectus and can have a maximum of 200 members, it has access to limited funds and therefore, limited chances of expansion.

Less Accountability

Generally, private limited companies are formed by members of the same family or closely related persons, therefore, they show lesser accountability as compared to public companies.

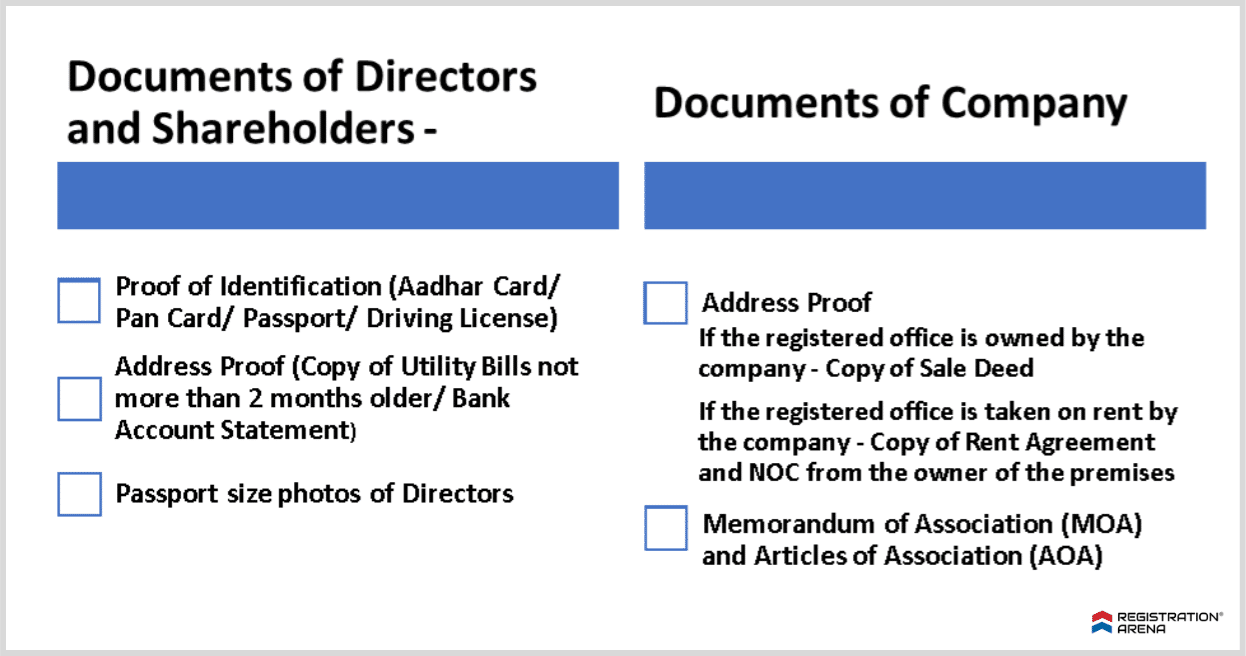

List of Documents Required for Private Limited Company Registration

Various documents are required for company registration in India. Following is a list of documents required for online registration of a private limited company –

Note: In case any of the directors of the company is a foreign national, then a passport is compulsorily required.

How to Register a Private Limited Company?

Looking for how to register a private company in India? Then you are at the right place!

Below is the procedure for Private Limited Company Registration Online –

Obtaining Digital Signature Certificate (DSC)

For online registration of private companies in India, Class 3 DSC of directors and subscribers of the memorandum is mandatorily required. It can be obtained from certifying authorities of the government.

Obtaining Director Identification Number (DIN)

All the proposed directors of the company shall have a DIN. DIN of a maximum of 3 directors can be obtained through SPICe+, an online form for company registration.

Filing of SPICe+ Form for Registration

For filing the SPICe+ form and online registration of the private company, the director of the company first needs to register on the MCA portal. After registration, the director can log in and file the SPICe+ form.

Part-A of the form is for name reservation. A company can submit 2 names in this part along with government fees. If the name is accepted, it is reserved for 20 days during which Part B of the form shall be filed along with the documents mentioned earlier and prescribed fees (registration fees depend on the authorized capital of the company).

If the name is rejected, another SPICe+ form needs to be filed along with the fees prescribed.

Issuance of Certificate of Incorporation (COI)

If the form is complete in all aspects along with the required documents, the ROC will issue the Certificate of Incorporation containing the CIN, PAN, and TAN of the company.

Professional Certification

Registration of a company in India requires certification from a Chartered Accountant, Company Secretary, or Cost Accountant.

Conclusion

The most common way to start a business is through a Private Limited Company. We at Registration Arena have experienced and competent specialists to assist you in the process of incorporation of your Private Limited Company Registration by carefully adhering to the Government’s required to process and criteria.

Our experts will plan meticulously and guarantee that the procedure is completed successfully.

Need help with registration? Connect with our experts now!