In the 21st century, where corporate governance is gaining momentum, it has become necessary for businesses to comply with applicable laws, rules, and regulations. In particular, a business must be well aware of Annual compliances and their respective due dates. Limited Liability Partnership, commonly known as LLP, is a popular form of business nowadays. It offers the benefits of the partnership while getting recognition similar to a company. Limited Liability Partnership Act, 2008 governs LLPs in India. An LLP has to comply with several rules and regulations. This blog throws light on LLP Annual Compliance and due dates.

What is Limited Liability Partnership (LLP)?

Limited Liability Partnership is a combination of a partnership firm and a company. It is a form of business organization that is governed by a written agreement between partners but their liability is limited to the amount of capital contributed by them.

Section 2 of Limited Liability Partnership Act, 2008

Section 2(n) provides the definition of LLP. According to it, an LLP means a partnership that is formed and registered under the Limited Liability Partnership Act, of 2008.

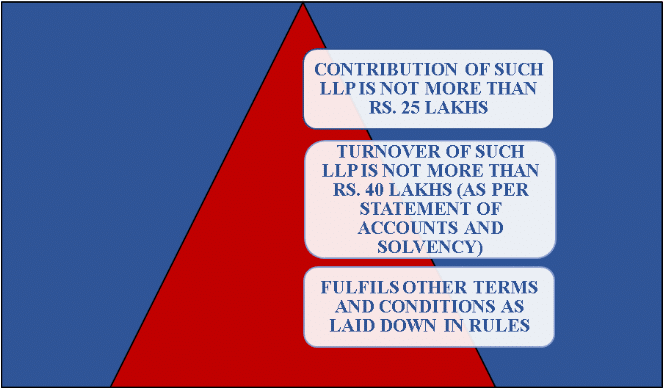

What is a Small LLP?

The Limited Liability Partnership (Amendment) Act, of 2021 introduced the concept of Small LLP. Accordingly, a Small LLP means an LLP that fulfills all the following requirements –

Mandatory Annual Compliance for LLP

An LLP is not only governed by LLP Act, 2008 and LLP Rules, 2009, but it shall also comply with Income Tax Act, 1961, and the Companies Act 2013. Therefore, an LLP has to file the following Annual Returns as a part of its compliance program.

LLP Rules, 2009

According to the provisions of LLP Rules, 2009, an LLP shall file the following Annual Returns –

| S. No | Form Type/ Purpose | Signature and Certification | Form No. | Due Date |

| 1. | Statement of Accounts and Solvency | Signed by a minimum of two designated partners. Certified by the auditor of the LLP only if the contribution exceeds Rs. 25 lakhs or the turnover exceeds Rs. 40 lakhs | LLP – 8 | 30th October of every year |

| 2. | Annual Return | Verified and certified by Designated Partners. But if contribution in LLP exceeds Rs. 50 lakhs or turnover of LLP exceeds Rs. 5 crores, then it must be certified by Company Secretary in Practice | LLP – 11 | 30th May of every year |

Filing Fees

Filing fees of Form-8 and Form-11 depend on the contribution of the LLP. The following table shows the filing fees according to the contribution.

| S. No. | Contribution | Fees |

| (a) | Up to Rs. 1 lakh | Rs. 50 |

| (b) | More than Rs.1 lakh but less than Rs.5 lakh | Rs. 100 |

| (c) | More than Rs.5 lakh but less than Rs.10 lakh | Rs. 150 |

| (d) | More than Rs.10 lakh but less than Rs.25 lakh | Rs. 200 |

| (e) | More than Rs.25 lakh but less than Rs.1 Crore | Rs. 400 |

| (f) | More than Rs. 1 Crore | Rs. 600 |

Note: Above forms shall be filed with the MCA (Registrar of Companies).

Worried about the approaching deadline for filing the Annual Return of your LLP? Connect with our experts now for guidance!

Income Tax Act, 1961

As per Section 2(31) of the Income Tax Act, 1961, a person includes a firm (including an LLP). Therefore, an LLP is subject to the provisions of the act. Also, as per Section 139(1) of the Income Tax Act, 1961, every LLP shall file a return of its income on an annual basis.

| S. No | Form Type/ Purpose | Form No. | Due Date |

| 1. | Income Tax Return | ITR 5 | If an audit of LLP is not required – 31st July If an audit of LLP is required – 31st October (Scroll down to know when an audit of LLP is mandatory) |

Companies Act, 2013

It is mandatory for every designated partner in the LLP to have DPIN i.e., Designated Partner Identification Number. According to the provisions of the Companies Act, 2013, every person who has been allotted a DIN/ DPIN prior to the end of the financial year i.e., 31st March, shall submit his KYC annually.

Note: Financial year of an LLP shall be from 1st April – 31st March. In case an LLP is incorporated after 30th September, its financial year can end on 31st March of the financial year subsequent to the year of its incorporation.

| S. No. | Form Type/ Purpose | Form No. | Due Date |

| 1. | KYC | DIR – 3 KYC | 30th September of each year |

LLP Annual Compliance: Benefits

It is always said that the cost of non-compliance is more than the cost of compliance. In light of this, the following are the benefits of Annual Filing Compliance to an LLP –

Builds Credibility

If an LLP timely files its returns every year, it builds its credibility in the eyes of stakeholders and the general public. This is due to the reason that anyone can access the Master Data of an LLP on the MCA portal.

Stimulates Investment

Before making an investment, investors check the status of the organization. They do it in order to check whether it is complying with the applicable laws or not. Therefore, if an LLP complies with the law, it stimulates investment and it can get an opportunity to grow or expand.

Avoidance of Additional Cost

Payment of fines or penalties as a result of non-compliance with the law is like an additional cost for any business, that too without any benefit in return. Therefore, if an LLP files all the annual returns well before the due dates, it does not have to bear additional costs in the form of fines or penalties.

Conversion and Closure

If an LLP is to be converted into a company or for closure of LLP, it is mandatory that such LLP has filed the annual returns for the previous period(s). Therefore, conversion or closure becomes easier if an LLP does its annual filing timely and properly.

LLP Annual Filing Non-Compliance: Penalties

In case an LLP fails to file Annual Returns before the due date, the following penalties are levied-

Failure to file Form-8 or Form-11

If there is a delay in filing Form – 8 or Form – 11, the following penalties are levied –

| S. No. | Period of delay | Small LLPs | Other than Small LLPs |

| (a) | Upto 15 days | One time | One time |

| (b) | More than 15 days but less than 30 days | 2 times of normal filing fees | 4 times of normal filing fees |

| (c) | More than 30 days but less than 60 days | 4 times of normal filing fees | 8 times of normal filing fees |

| (d) | More than 60 days but less than 90 days | 6 times of normal filing fees | 12 times of normal filing fees |

| (e) | More than 90 days but less than 180 days | 10 times of normal filing fees | 20 times of normal filing fees |

| (f) | More than 180 days but less than 360 days | 15 times of normal filing fees | 30 times of normal filing fees |

| (g) | Beyond 360 days | 25 times of normal filing fees | 50 times of normal filing fees |

| for forms other than Form 8 and Form 11. For Form 8 and Form 11, 15 times the normal filing fees plus Rs. 10 per day for every day delay beyond 360 days | fees for forms other than Form 8 and Form 11. For Form 8 and Form 11, 30 times the normal filing fees plus Rs. 20 per day for everyday delay beyond 360 days. |

Failure to file ITR – 5 (Income Tax Return)

If the form is filed after the due date i.e.,31st July or 31st October, as the case may be, a penalty of Rs. 5000 is levied in case the income of LLP exceeds Rs. 5 lakhs. In case the income of an LLP does not exceed Rs, 5 lakhs, a penalty of Rs. 1000 is levied.

What is ITR-U?

If an LLP fails to file a return before the due date or a belated return, it can file an updated return in the ITR-U form. ITR-U can be filed within 2 years from the end of the relevant assessment year along with additional tax and interest.

Failure to file DIR-3 KYC

As a result of failure to file DIR-3 KYC on or before the due date, the DPIN of the partner is deactivated. It can be reactivated on payment of Rs. 5000 as late fees.

Is Audit Mandatory for an LLP?

Audit of the accounts of a business helps in maintaining the confidence of stakeholders, in particular, investors. Following are the rules governing the audit of an LLP.

LLP Rules, 2009

No, it is not mandatory for every LLP to get its accounts audited every year. However, if the contribution in an LLP exceeds Rs. 25 lakhs or the turnover of an LLP exceeds Rs. 40 lakhs, then audit is mandatory.

However, if the partners of an LLP decide that the accounts of the LLP shall be audited irrespective of the fact that audit is not mandatorily applicable for such LLP, then they can get the accounts audited as per the rules. In case they decide otherwise, they need to include a statement in Form-8 (Statement of Accounts and Solvency) that they acknowledge their responsibility with regard to compliance with the Act and the rules.

Income Tax Act, 1961

Section 44AB of the Income Tax Act, 1961 provides for a mandatory tax audit of an LLP in the following cases –

In the case of Business

If the LLP carries on a business and turnover exceeds Rs. 1 crores. However, if cash transactions are up to 5% of gross receipts or payments, then an audit is required only if the turnover exceeds Rs. 10 crores.

In the case of the Profession

If the LLP provides professional services and turnover exceeds Rs. 50 lakhs.

Further, if a tax audit is mandatory for an LLP, then it shall file an audit report on or before 30th September every year.

Conclusion

LLP is a form of business organization that has various benefits. Keeping in consideration several benefits of Annual Compliance and penalties for non-compliance, it is better for an LLP to timely file Annual Returns every year. We at Registration Arena are dedicated to assisting you in filing the Annual Returns of your LLP well on time by following the prescribed process. Our experts will ensure that your LLP is compliant with every law that is applicable!

For more information, connect with us.