It is decided by the Central Government to provide two types of limit for GST turnover for GST Registration for suppliers of goods, Rs. 40 lakhs and Rs. 20 lakh. Now, each of the individual State Governments must decide the limit of the GST Turnover as the State’s revenue is also tied to GST. This decision will differ from state to state as each of them have various different GST Acts.

Service providers will be required to register for GST once they cross the turnover of RS.20 lakh and in case of special category states at RS.10 lakh.

As mentioned above, there are two types of GST registration and types of entities like casual taxable persons, non-resident taxable persons or persons supplying through E-Commerce operators are required to mandatorily obtain GST registration irrespective of the turnover limit.

Q1. WHAT IS THE TURNOVER LIMIT FOR GST REGISTRATION FOR GOODS SUPPLIER, IS REVISED TURNOVER LIMIT OF 40 LAKHS APPLICABLE TO EVERY GOODS SUPPLIER ?

Goods Suppliers: A person who is engaged in exclusive supply of goods whose aggregate turnover crosses Rs.40 lakhs in a year is required to obtain GST registration. To be eligible for the Rs.40 lakhs turnover limit, the supplier must satisfy the following conditions:

- The supplier should not be providing any kind of services.

- The supplier should not be engaged in making intra-state (supplying goods within the same state) supplies in the States of Kerala and Telangana.

- The supplier should not be involved in the supply of ice-cream, pan masala or tobacco.

If the above given conditions do not meet, then the supplier of goods would be required to obtain GST registration when the GST turnover crosses Rs.20 lakhs and Rs.10 lakhs in special category states.

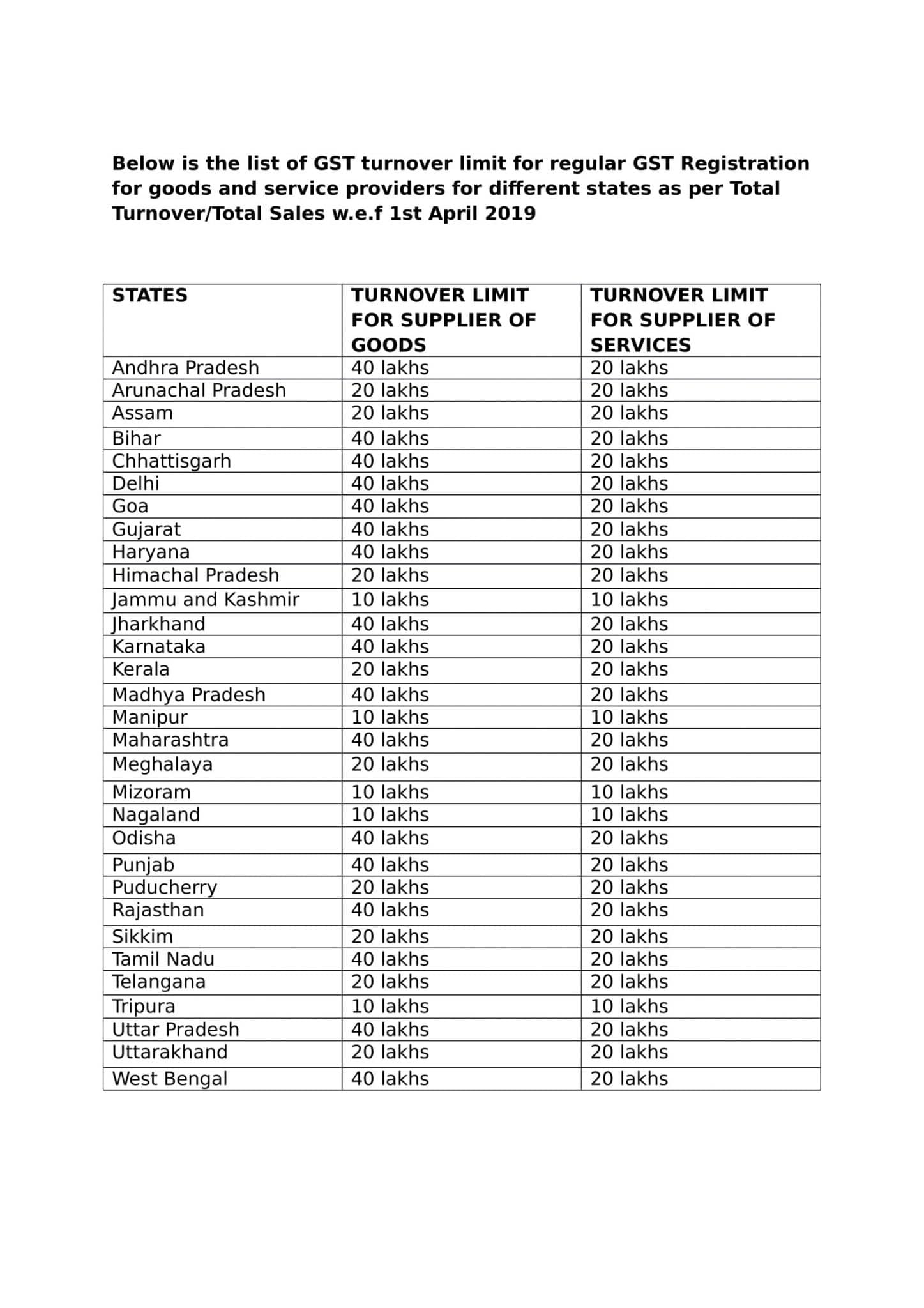

The list of turnover limit for regular GST registration for goods and service providers for different states as per Total Turnover/Total Sales is given below w.e.f 1st April 2019

Q2. WHAT IS THE TURNOVER LIMIT FOR SERVICE PROVIDER ?

Service Providers: An entity which provides services for more than Rs.20 lakhs in aggregate turnover in a year is required to obtain a GST registration. in case special category states, the turnover limit for service providers has been fixed at Rs. 10 lakhs.

The list of turnover limit for regular GST registration for goods and service providers for different states as per Total Turnover/Total Sales is given below w.e.f 1st April 2019

Q3. HOW TO CALCULATE GST TURNOVER ?

The aggregate turnover is calculated by taking together the value in respect of the activities carried by all the entities of the concerned person on a pan- India basis.

Below given charges should be excluded while calculating aggregate turnover:

- Taxes with respect to CGST, SGST or IGST Acts

- Value of taxes payable on reverse charge mechanism

- Value of inward supplies of goods and services

- Value of Non-taxable supplies of goods or services like Alcohol, Petrol etc

Q4. WHICH ARE THE SPECIAL CATEGORY STATES UNDER GST ACT ?

The status of Special Category is allotted to eleven states, by the Government. They are given below:

- Arunachal Pradesh

- Assam

- Jammu and Kashmir

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

- Uttarakhand

Let us assume that the turnover of the farmer Mr. Joesph living in Mizoram is Rs. 15 lakh from agriculture. His taxable turnover from the sale of plastic bags is only Rs. 50,000. Mr. Joesph will still have to register under GST as his aggregate turnover exceeds the threshold limit of Rs. 10 lakh for special category states.